- Home

- »

- Advanced Interior Materials

- »

-

Middle East Timber Construction Market Size Report, 2033GVR Report cover

![Middle East Timber Construction Market Size, Share & Trends Report]()

Middle East Timber Construction Market (2025 - 2033) Size, Share & Trends Analysis Report By End Use (Residential, Non-residential), By Timber Type (Softwood, Hardwood, Engineered Wood), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-744-2

- Number of Report Pages: 107

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Middle East Timber Construction Market Summary

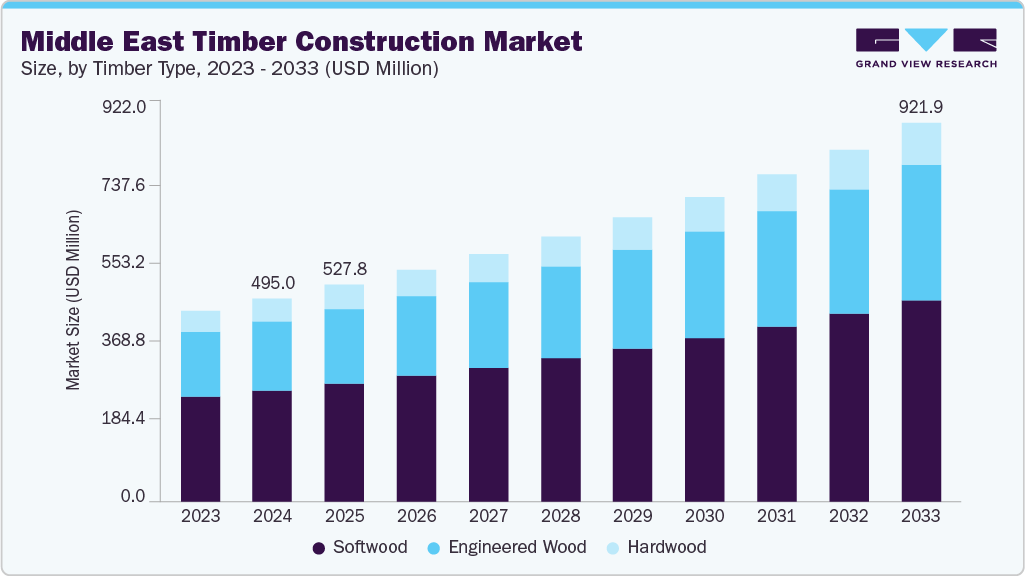

The Middle East timber construction market size was estimated at USD 495.0 million in 2024 and is projected to reach USD 921.9 million by 2033, growing at a CAGR of 7.2% from 2025 to 2033. The demand for timber construction in the Middle East is rising due to the growing focus on sustainable and eco-friendly building practices.

Key Market Trends & Insights

- Saudi Arabia dominated the Middle East timber construction market with the largest revenue share of 17.1% in 2024.

- By timber type, the engineered wood segment is expected to grow at the fastest CAGR of 7.8% over the forecast period.

- By end use, the non-residential segment is expected to grow at the fastest CAGR of 7.6% over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 495.0 Million

- 2033 Projected Market Size: USD 921.9 Million

- CAGR (2025-2033): 7.2%

- Saudi Arabia: Largest market in 2024

- Egypt: Fastest market in 2024

With increasing concerns over carbon emissions from concrete and steel, timber offers a renewable and lower-impact alternative. The shift towards green buildings and LEED-certified projects is creating opportunities for timber in residential, commercial, and hospitality sectors. In addition, consumer preferences for modern, aesthetic, and natural finishes are boosting adoption. The region’s real estate recovery and mega-projects in the UAE, Saudi Arabia, and Qatar are further driving interest in timber-based solutions.

Key drivers include government-led sustainability programs, rising investment in luxury resorts and villas, and international collaborations introducing advanced timber engineering. Urbanization and population growth are pushing demand for faster, lighter, and energy-efficient building materials, where timber plays a significant role. Growing acceptance of prefabricated and modular timber construction is also helping adoption, especially in cost-sensitive housing projects. Furthermore, the region’s exposure to global design trends and adoption of hybrid construction techniques blending timber with steel and concrete are expanding applications.

Trends include the use of Cross-Laminated Timber (CLT), Glulam, and laminated veneer lumber (LVL) for large-scale projects such as schools, offices, and mixed-use developments. Advanced timber engineering technologies allow high-rise structures, enhancing timber’s reputation beyond traditional housing. Hybrid construction models integrating timber with concrete and steel are gaining traction, improving structural stability in hot climates. Prefabrication and modular timber solutions are streamlining construction timelines, reducing costs, and aligning with labor efficiency goals. The introduction of fire-resistant timber treatments and digital design tools like BIM is further enabling wider acceptance in the region.

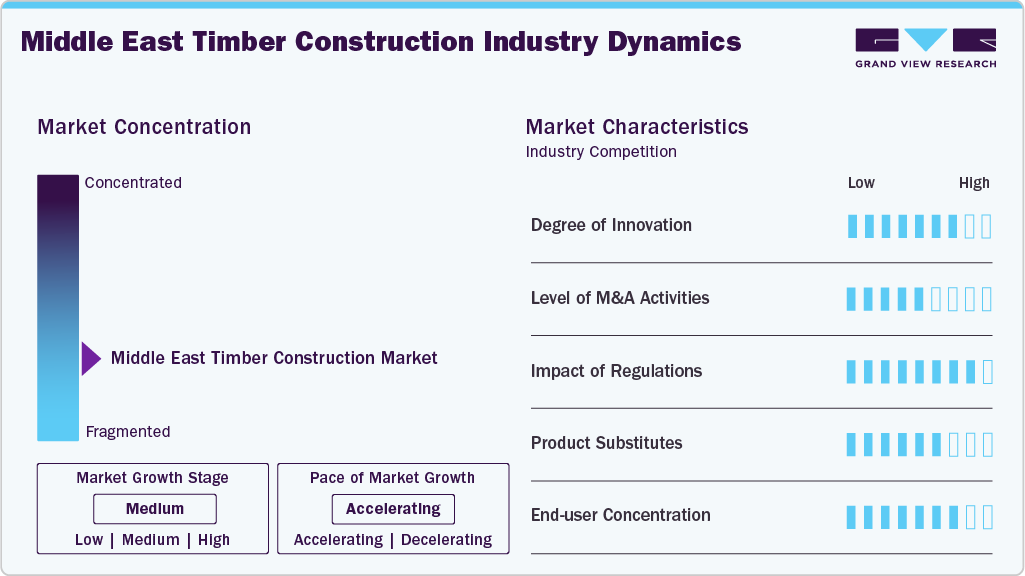

Market Concentration & Characteristics

The Middle East timber construction industry is moderately fragmented, with both regional timber suppliers and international players contributing. The presence of European timber exporters is strong, given the limited regional timber resources. However, local companies are increasingly focusing on engineered wood and prefabricated systems to capture niche demand. Large construction firms are forming partnerships with timber solution providers to incorporate sustainability targets into mega-projects. Market consolidation is expected as international brands collaborate with local distributors and contractors to strengthen their regional presence.

Timber construction faces competition from steel, concrete, and aluminum, which dominate the Middle East due to availability, durability, and fire resistance in high-temperature environments. Precast concrete remains a strong substitute in large-scale infrastructure projects, while aluminum cladding is often favored in façade applications. However, increasing environmental regulations and demand for low-carbon materials are reducing the competitive edge of substitutes. Timber’s lightweight properties, recyclability, and advanced treatments are helping mitigate the threat of alternatives, although widespread acceptance still depends on awareness and regulatory support.

Timber Type Insights

The softwood segment led the market with the largest revenue share of 54.7% in 2024, due to its wide availability, cost-effectiveness, and versatility across structural and decorative applications. Its lightweight nature makes transporting and handling large construction projects easier, while species like pine and spruce are favored for framing, flooring, and paneling. Softwood’s compatibility with engineered wood technologies such as CLT and Glulam further strengthens its adoption. The growing demand for sustainable and renewable building materials also supports its dominance, as softwood can be sourced from certified forests with lower environmental impact.

The engineered wood segment is expected to grow at the fastest CAGR of 7.8% over the forecast period, driven by increasing use of Cross-Laminated Timber (CLT), Laminated Veneer Lumber (LVL), and Glulam in modern construction projects. These products provide higher strength, dimensional stability, and resistance to warping compared to traditional timber, making them ideal for high-rise buildings, commercial complexes, and modular homes. With government sustainability mandates and the push for innovative construction methods, engineered wood is gaining strong traction in the region. Its ability to combine structural performance with eco-friendliness positions it as the preferred choice for upcoming large-scale projects.

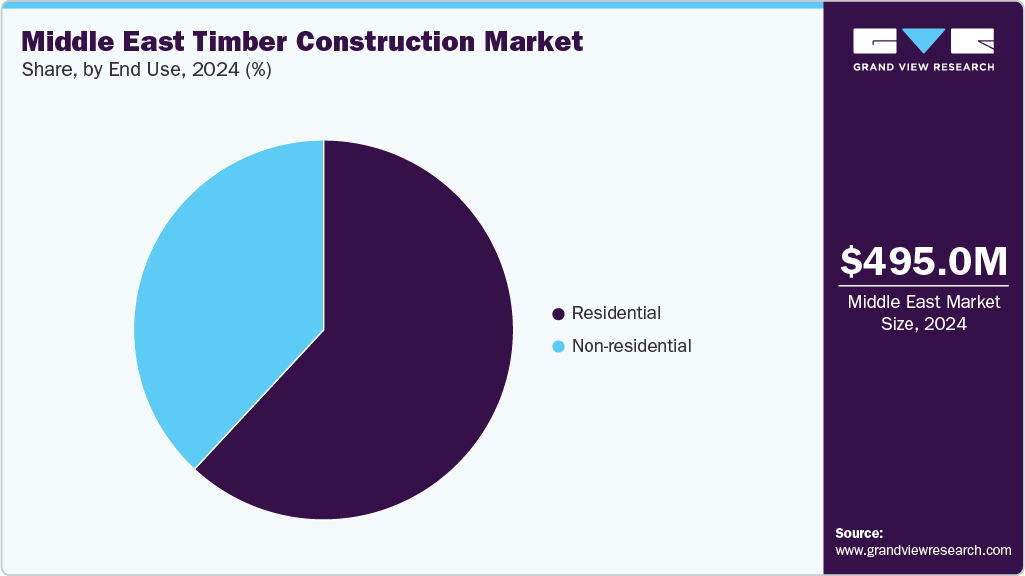

End Use Insights

The residential segment led the market with the largest revenue share of 61.9% in 2024, supported by rising demand for villas, luxury homes, and sustainable housing solutions. Timber’s natural aesthetics, insulation properties, and adaptability to modular construction methods make it attractive for developers and homeowners alike. Growing urbanization and population expansion in countries like Saudi Arabia, the UAE, and Egypt are fueling residential projects where timber is increasingly being used for interiors, flooring, and prefabricated homes. With real estate developers focusing on sustainability and premium design features, timber continues to find its strongest foothold in the residential sector.

The non-residential segment is expected to grow at the fastest CAGR of 7.6% over the forecast period, fueled by the rapid expansion of commercial, hospitality, and institutional projects across the region. Governments and private developers are incorporating timber in office buildings, schools, resorts, and mixed-use complexes to meet green building standards and enhance design appeal. Engineered wood solutions like CLT and Glulam are increasingly being used in large-span structures, reducing construction timelines while achieving sustainability targets. Mega projects under Saudi Vision 2030 and the UAE’s urban master plans are further driving adoption in the non-residential space, making it a high-growth segment in the coming years.

Regional Insights

The Middle East timber construction market is witnessing gradual growth, driven by sustainability mandates and global design influences. Mega-projects in the Gulf Cooperation Council (GCC) countries are increasingly incorporating timber for aesthetic appeal and eco-certifications. While reliance on imports is high, regional prefabrication units are emerging to address cost and availability challenges. Adoption is strongest in luxury villas, resorts, and commercial buildings. Awareness campaigns and technical collaborations are helping overcome resistance due to durability and fire safety concerns, making timber a credible alternative to conventional construction.

Saudi Arabia dominated the Middle East timber construction market with the largest revenue share of 17.1% in 2024. Projects such as NEOM and Red Sea Global are integrating timber in luxury and eco-tourism infrastructure. The government’s push for renewable and low-carbon materials is encouraging architects and contractors to explore CLT and Glulam solutions. Partnerships with European timber firms are growing, while local players are exploring prefabricated modular homes to meet housing demand. Despite challenges from extreme climatic conditions, demand is expected to rise significantly in premium and tourism-driven developments.

The timber construction market in the UAE is a frontrunner in sustainable construction adoption, with Dubai and Abu Dhabi actively integrating timber solutions in green buildings. Tourism and luxury hospitality projects are key contributors to timber demand, alongside modern residential developments. Dubai’s 2040 Urban Master Plan emphasizes sustainability, creating opportunities for timber-based architectural solutions. The presence of international architectural firms and exposure to global best practices are accelerating adoption. Prefabrication and modular construction methods are gaining momentum, with timber being increasingly integrated into hybrid designs for hotels, resorts, and mixed-use buildings.

The Egypt timber construction market is anticipated to grow at the fastest CAGR during the forecast period. Egypt’s construction sector is expanding with government-backed housing programs and urban renewal projects. Timber adoption is relatively limited but growing in niche applications such as luxury residential and interior design. Sustainability discussions in Cairo’s new capital city project are gradually opening opportunities for eco-friendly building materials, including timber. Growing collaboration with international firms is likely to introduce advanced timber technologies. The cost-sensitive nature of Egypt’s market may initially limit adoption to high-end and tourism-related projects before broader expansion takes place.

The timber construction market in Qatar is growing rapidly. Qatar’construction industry, post-World Cup, is diversifying into hospitality, commercial, and luxury housing projects where timber is gaining ground. The country’s Green Building Council is actively promoting sustainable materials, giving timber a role in certification-focused developments. Demand is concentrated in high-end real estate and tourism infrastructure, particularly in eco-resorts and luxury villas. CLT and hybrid solutions are being introduced in pilot projects, paving the way for broader adoption. While reliance on imports remains high, local contractors are showing interest in modular timber systems to reduce project timelines.

The Kuwait timber construction market is gradually adopting timber construction, mainly in luxury residential projects and upscale commercial developments. Government housing initiatives are focused on affordability, but private developers are integrating timber in high-value projects targeting expatriates and wealthy residents. The construction sector’s increasing awareness of sustainability is opening niche opportunities for timber-based solutions. Partnerships with international players are expected to drive knowledge transfer and technical expertise in engineered wood systems. While not a dominant market, Kuwait’s timber construction adoption is forecast to accelerate as sustainability and aesthetics become stronger purchase drivers.

Key Middle East Timber Construction Company Insight

Some of the key players operating in the market include Al Masaood Bergum, Katerra Middle East.

-

Al Masaood Bergum specializes in sustainable modular building systems, including cross-laminated timber (CLT) and hybrid construction solutions for residential, commercial, and industrial projects.

-

Katerra Middle East is known for advanced prefabricated and modular construction technologies, including engineered timber solutions, applied in large-scale housing and mixed-use projects before its restructuring.

Premier Composite Technologies and Timberwolf Middle East Contracting LLC are some of the emerging market participants in the Middle East timber construction industry.

-

Premier Composite Technologies is a global construction and manufacturing firm that incorporates innovative materials, including hybrid timber-composite solutions, for architectural façades, interiors, and structural applications.

-

Timberwolf Middle East Contracting LLC focuses on timber-based contracting projects, delivering mass timber, engineered wood structures, and custom timber construction across residential and commercial developments.

Key Middle East Timber Construction Companies:

- Al Masaood Bergum

- Pine Wood Building Materials Trading LLC

- Premier Composite Technologies

- Katerra Middle East

- Al Bawardi Building Materials & Timber Structures

- Al Fanar Timber Construction

- Timberwolf Middle East Contracting LLC

- Eco Timber House

- Modular Timber Solutions

- WoodLife Timber Construction LLC

Recent Developments

-

In February 2025, Premier Composite Technologies collaborated with Sicomin for the Mataf Ceiling extension project at the Holy Mosque of Mecca. The ceiling spans about 216,800 m². Quadriaxial-stitched glass fabric, carbon reinforcements, and Sicomin epoxy resins were used.

Middle East Timber Construction Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 527.8 million

Revenue forecast in 2033

USD 921.9 million

Growth rate

CAGR of 7.2% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

End use, timber type, region

Regional scope

Middle East

Country scope

Saudi Arabia; UAE; Egypt; Qatar; Kuwait

Key companies profiled

Al Masaood Bergum; Pine Wood Building Materials Trading LLC; Premier Composite Technologies; Katerra Middle East; Al Bawardi Building Materials & Timber Structures; Al Fanar Timber Construction; Timberwolf Middle East Contracting LLC; Eco Timber House; Modular Timber Solutions; WoodLife Timber Construction LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Timber Construction Market Report Segmentation

This report forecasts revenue growth at the regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2021 to 2033. For this purpose, Grand View Research has segmented the Middle East timber construction market report based on the timber type, end use, and region:

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Residential

-

Non-residential

-

-

Timber Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Softwood

-

Hardwood

-

Engineered Wood

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

Egypt

-

Qatar

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The Middle East timber construction market size was estimated at USD 495.0 million in 2024 and is expected to reach USD 527.8 million in 2025.

b. The Middle East timber construction market is expected to grow at a compound annual growth rate of 7.2% from 2025 to 2033 to reach USD 921.9 million by 2033.

b. The softwood segment held the highest revenue market share of 54.7% in 2024, due to its wide availability, cost-effectiveness, and versatility across structural and decorative applications.

b. Some of the key players operating in the timber construction market include Al Masaood Bergum, Pine Wood Building Materials Trading LLC, Premier Composite Technologies, Katerra Middle East, Al Bawardi Building Materials & Timber Structures, Al Fanar Timber Construction, Timberwolf Middle East Contracting LLC, Eco Timber House, Modular Timber Solutions, and WoodLife Timber Construction LLC

b. The key factors driving the Middle East timber construction market are the sustainability mandates, government green building initiatives, growing demand for eco-friendly materials, adoption of prefabricated timber solutions, and rising luxury real estate and tourism projects.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.