- Home

- »

- Advanced Interior Materials

- »

-

Middle East Waste Management Market Size Report, 2033GVR Report cover

![Middle East Waste Management Market Size, Share & Trends Report]()

Middle East Waste Management Market (2025 - 2033) Size, Share & Trends Analysis Report By Service Type (Collection, Transportation, Disposal), By Waste Type (Municipal Waste, Medical Waste, Industrial Waste, E-waste), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-715-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Middle East Waste Management Market Summary

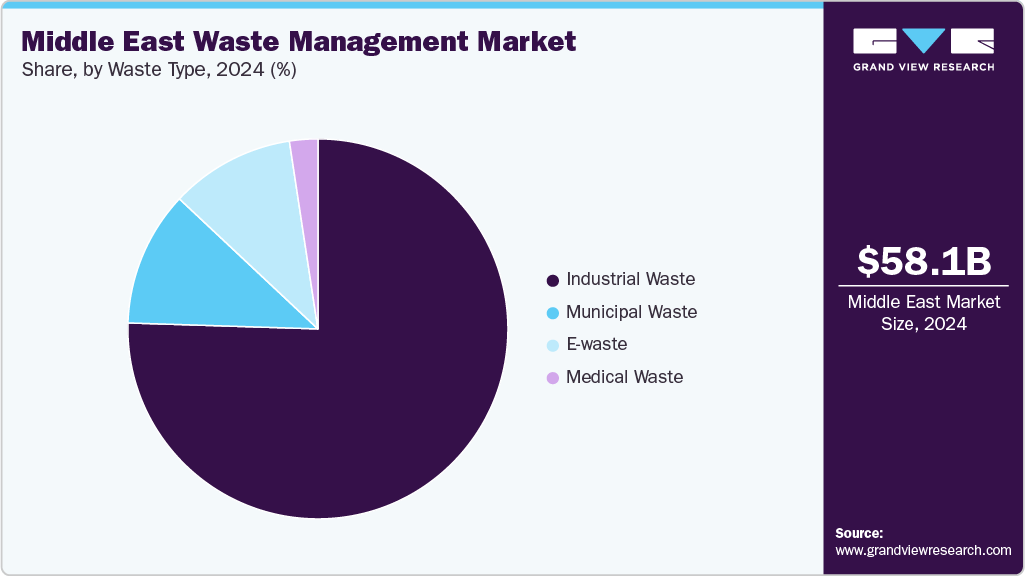

The Middle East waste management market size was estimated at USD 58.06 billion in 2024 and is projected to reach USD 104.05 billion by 2033, growing at a CAGR of 6.8% from 2025 to 2033. The market is growing due to rapid urbanization and population growth, which are increasing waste generation across countries.

Key Market Trends & Insights

- The Kuwait waste management industry is expected to grow at a substantial CAGR of 9.6% from 2025 to 2033.

- By service type, the disposal service segment is expected to grow at a considerable CAGR of 7.2% from 2025 to 2033.

- By waste type, the municipal waste segment is expected to grow at a considerable CAGR of 7.4% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 58.06 Billion

- 2033 Projected Market Size: USD 104.05 Billion

- CAGR (2025-2033): 6.8%

Rising environmental concerns and government regulations promoting recycling and sustainable disposal methods are further driving demand. Another major factor driving the growth of the Middle East waste management industry is the adoption of circular economy initiatives by governments to reduce landfill dependency. Public-private partnerships are enhancing waste collection efficiency and recycling capabilities across the region. Increased awareness among citizens about responsible waste disposal is also fueling market growth. Additionally, tourism-driven economies in countries like the UAE and Saudi Arabia are implementing stricter waste management policies to maintain environmental standards.

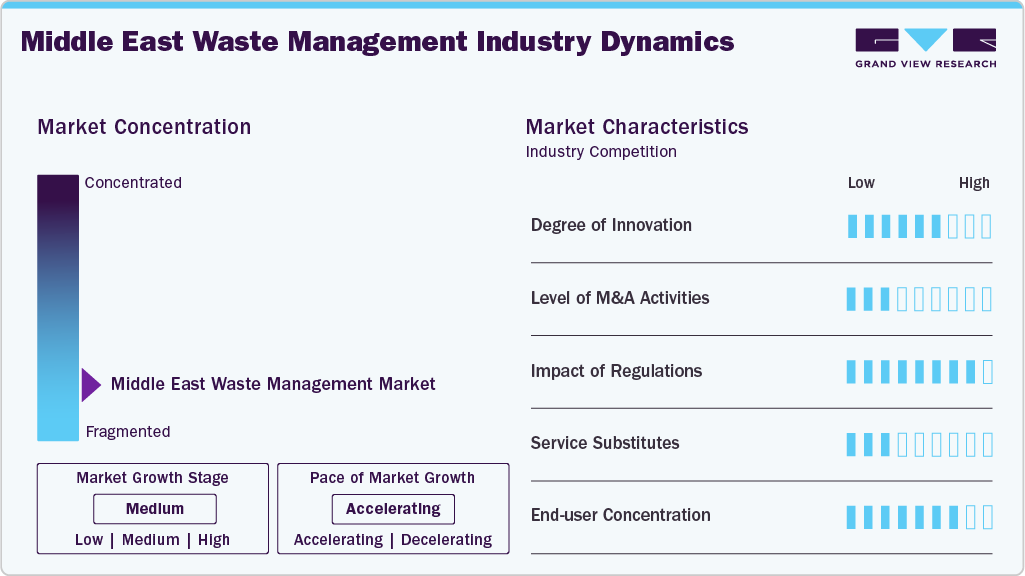

Market Concentration & Characteristics

The Middle East waste management market is fragmented, with a few major players dominating large-scale contracts and infrastructure projects, along with emerging small and medium size companies. Countries like the UAE, Saudi Arabia, and Qatar have centralized waste management systems led by government-backed entities and select private firms. However, smaller local companies still operate in niche segments such as recycling and waste collection. Ongoing privatization and public-private partnerships are gradually opening the market to more competition while maintaining dominance by established operators.

The market is witnessing steady innovation, particularly in recycling technologies, waste-to-energy solutions, and smart waste collection systems. Governments in the UAE and Saudi Arabia are investing in AI-based sorting facilities and digital tracking platforms to improve efficiency. Startups and technology providers are introducing solutions tailored to desert climates and high-density urban areas. These innovations are aimed at reducing landfill use and meeting ambitious sustainability targets.

Mergers and acquisitions in the region are moderate, driven by the need to consolidate resources, expand service portfolios, and integrate advanced technologies. Large players are acquiring specialized recycling and treatment companies to enhance capabilities in hazardous waste, e-waste, and organics processing. Cross-border acquisitions, especially involving GCC nations, are also increasing to create regional waste management networks. This trend supports the scaling up of infrastructure and improves operational efficiency.

Regulations have a significant impact on the Middle East waste management market, with governments implementing strict landfill restrictions and mandatory recycling targets. Policies like Saudi Arabia’s National Waste Management Strategy and the UAE’s zero-waste goals are shaping industry practices. Compliance requirements are pushing companies to adopt advanced treatment methods and sustainable disposal solutions. These regulations also create opportunities for private sector participation through tenders and public-private partnerships.

Drivers, Opportunities & Restraints

The Middle East waste management market’s growth is driven by rapid urbanization, population growth, and rising waste generation in major cities. Government sustainability initiatives, such as the UAE’s Zero Waste 2030 and Saudi Arabia’s Vision 2030, are accelerating investments in modern waste treatment facilities. Tourism and mega-events, including Expo 2020 Dubai and the upcoming Saudi projects, have heightened the demand for efficient waste management solutions. Additionally, growing public awareness about environmental protection is encouraging recycling and segregation practices at the source.

There are significant opportunities in waste-to-energy projects, advanced recycling technologies, and digital waste tracking systems. Public-private partnerships are creating openings for international and local companies to expand their operations. The circular economy model is gaining traction, promoting resource recovery and industrial symbiosis. Infrastructure gaps in hazardous and electronic waste management also present untapped potential for specialized service providers.

The market faces challenges due to limited recycling infrastructure in some Middle Eastern countries and high reliance on landfills. Cultural and behavioral barriers, such as low segregation rates at the household level, can lead to slow adoption of the sustainable practices. Budget constraints in certain economies can delay large-scale waste treatment investments. Additionally, varying regulatory frameworks across countries make it difficult for companies to operate uniformly across the region.

Service Type Insights

The collection segment leads the Middle East waste management industry in 2024 with a 51.3% share, due to strong municipal frameworks and government-led initiatives ensuring regular waste pickup. Rapid urbanization and population growth in cities like Dubai, Riyadh, and Doha have increased demand for organized collection systems. Public awareness campaigns are also encouraging households and businesses to participate in structured waste collection.

The disposal services is the fastest-growing segment, driven by the development of engineered landfills and advanced waste-to-energy facilities. Governments in Saudi Arabia, the UAE, and Oman are investing heavily in sustainable disposal methods to reduce environmental impact. Stricter regulations on open dumping are pushing municipalities toward modern disposal infrastructure. The shift toward eco-friendly landfill management and incineration with energy recovery is accelerating this growth.

Waste Type Insights

The industrial waste segment dominated the Middle East waste management industry with a revenue share of 75.5% in 2024, due to the dominance of oil & gas, petrochemical, and heavy manufacturing industries. High volumes of hazardous and non-hazardous waste from refineries, construction, and industrial zones require specialized treatment. Regulatory enforcement in countries like Saudi Arabia and the UAE ensures proper disposal and recycling processes. Ongoing industrial expansion and mega-project developments continue to strengthen this segment’s lead.

Municipal waste is the fastest-growing segment in the Middle East due to rapid urbanization, rising populations, and increasing consumption in major cities. Governments are expanding infrastructure with sanitary landfills, recycling plants, and waste-to-energy projects to handle growing volumes. Insufficient legacy systems have accelerated the shift toward modern collection and disposal methods. Large-scale developments like NEOM and Masdar City are also adopting advanced municipal waste solutions from inception.

Country Insights

Saudi Arabia leads the Middle East waste management market and accounted for a 30.8% share, due to its large population, rapid urbanization, and extensive industrial base, especially in oil, gas, and manufacturing. Government initiatives under Vision 2030 aim to divert 82% of waste from landfills through recycling and waste-to-energy projects. Major developments like NEOM and the Red Sea Project are integrating advanced waste solutions from the start. Strong regulatory support and public-private partnerships are further driving the sector’s growth.

The Kuwait waste management market is supported by high waste generation per capita and strong government initiatives for recycling and landfill reduction. The country is investing in waste-to-energy plants and modern landfill infrastructure. Industrial growth, coupled with urban expansion, is increasing demand for advanced treatment solutions. Policies promoting private sector involvement are also accelerating market development.

Key Middle East Waste Management Company Insights

Some of the key players operating in the market include Veolia, Averda, and BioMedical Waste Solutions.

-

Veolia operates through three main verticals, namely, water management, waste management, and energy services; each supported by integrated technological solutions. In water management, the company covers the full cycle, from producing and distributing drinking and industrial water to wastewater treatment, reuse, and smart monitoring. Its waste management vertical includes collection, sorting, recycling, and treatment of hazardous and non-hazardous waste, along with energy recovery solutions for municipal and industrial clients. The energy services vertical focuses on producing and distributing energy, optimizing industrial and building energy efficiency, and managing low-carbon thermal networks.

-

Averda is an integrated waste management company headquartered in Dubai, operating across the Middle East, Africa, and South Asia. It provides services including general waste collection, recycling, hazardous waste handling, and medical waste disposal. The company serves over 60,000 clients, including municipalities, healthcare facilities, industrial sectors, and commercial enterprises. Averda played a key role in the Red Sea Development Project in Saudi Arabia by implementing a comprehensive waste management system during construction. It also collaborates with the International Finance Corporation (IFC) to advance sustainable waste management and promote circular economy practices in emerging markets.

Key Middle East Waste Management Companies:

- Averda

- BioMedical Waste Solutions

- Veolia

- FCC Environmental Services.

- REMONDIS

- Stericycle Inc.

- Waste Connections Inc.

- DAISEKI CO.,Ltd.

- Hitachi Zosen Corp.

- Clean Harbors Inc.

Recent Developments

-

In January 2025, BEEAH and Masdar announced the second phase of the Sharjah Waste-to-Energy plant, doubling its capacity from 30 MW to nearly 60 MW. The expansion will increase annual waste processing from 300,000 to 600,000 tonnes and cut CO₂ emissions by up to 1 million tonnes. This project supports Sharjah’s zero-waste goals and contributes to the UAE’s Net Zero by 2050 target. The expansion project was officially unveiled at the World Future Energy Summit in January 2025.

-

In February 2025, TWMA began construction of a modern drilling waste management facility in Habshan, Abu Dhabi, UAE. The facility will process up to 300 tonnes of drill cuttings daily and recover about one barrel of diesel or oil per tonne. Using RotoMill and XLink technologies, it will support up to 100 rigs while meeting strict HSEQ standards. The project will also create around 60 local jobs, promoting regional sustainability and economic growth.

-

In December 2024, Veolia plans to grow its Middle East operations by 50% by 2030, building on USD 1.19 billion in regional sales in 2023. The expansion will focus on water treatment, hazardous waste management, and energy decarbonization. With over 11,000 employees in the region, Veolia has operated there for more than 50 years. This strategy supports its GreenUp plan, emphasizing sustainable development and innovation.

Middle East Waste Management Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 61.51 billion

Revenue forecast in 2033

USD 104.05 billion

Growth rate

CAGR of 6.8% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service type, waste type, and country

Regional scope

Middle East

Country scope

UAE; Saudi Arabia; Oman; Qatar; Israel; Kuwait.

Key companies profiled

Averda; BioMedical Waste Solutions; Veolia; FCC Environmental Services; REMONDIS; Stericycle Inc.; Waste Connections Inc.; DAISEKI CO.Ltd.; Hitachi Zosen Corp.; Clean Harbors Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Waste Management Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Middle East waste management market report based on service type, waste type, and region:

-

Service Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Collection

-

Transportation

-

Disposal

-

-

Waste Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Municipal Waste

-

Medical Waste

-

Industrial Waste

-

E-waste

-

-

Country Outlook (Revenue, USD Billion, 2021 - 2033)

-

UAE

-

Saudi Arabia

-

Oman

-

Qatar

-

Israel

-

Kuwait

-

Frequently Asked Questions About This Report

b. The Middle East waste management market size was estimated at USD 58.06 billion in 2024 and is expected to be USD 61.51 billion in 2025.

b. The Middle East waste management market, in terms of revenue, is expected to grow at a compound annual growth rate of 6.8% from 2025 to 2033 to reach USD 104.05 billion by 2033.

b. The industrial waste segment dominated the waste management industry with a revenue share of 75.5% in 2024, due to the dominance of oil & gas, petrochemical, and heavy manufacturing industries. High volumes of hazardous and non-hazardous waste from refineries, construction, and industrial zones require specialized treatment.

b. Some of the key players operating in the Middle East waste management market include Averda; BioMedical Waste Solutions; Veolia; FCC Environmental Services.; REMONDIS; Stericycle Inc.; Waste Connections Inc; DAISEKI CO.,Ltd.; Hitachi Zosen Corp.; Clean Harbors Inc.

b. The Middle East waste management market is fueled by urban growth, rising waste volumes, and government-led sustainability goals. Expanding industries and mega projects boost demand for modern waste solutions. Stricter regulations are also driving recycling and waste-to-energy adoption.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.