- Home

- »

- Advanced Interior Materials

- »

-

Middle East Waste Recycling Services Market Report, 2033GVR Report cover

![Middle East Waste Recycling Services Market Size, Share & Trends Report]()

Middle East Waste Recycling Services Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Paper & Paperboard, Metals, Plastics, Glass, Food, Batteries & Electronics, Yard Trimmings), By Application (Municipal, Industrial), By Country, And Segment Forecasts

- Report ID: GVR-4-68040-716-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Middle East Waste Recycling Services Market Summary

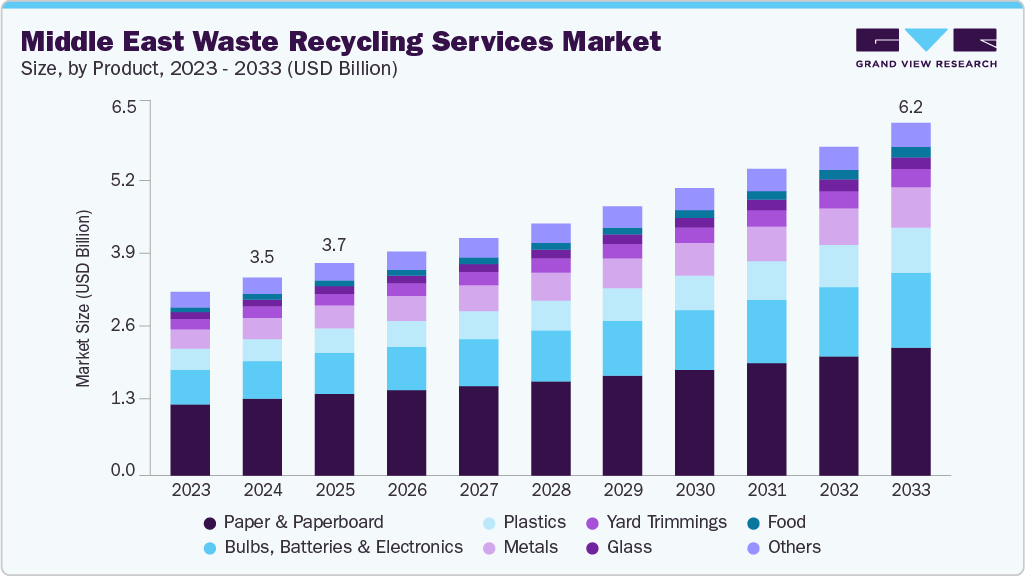

The Middle East waste recycling services market size was estimated at USD 3,462.8 million in 2024 and is expected to reach USD 6,176.3 million by 2033, growing at a CAGR of 6.6% from 2025 to 2033. The market growth is driven by rapid urbanization and population growth, leading to higher volumes of municipal and industrial waste.

Key Market Trends & Insights

- The waste recycling services market in Israel is expected to grow at a substantial CAGR of 8.0% from 2025 to 2033.

- By product, the plastics segment is expected to grow at a considerable CAGR of 8.1% from 2025 to 2033 in terms of revenue.

- By application, the industrial segment is expected to grow at a considerable CAGR of 7.3% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 3,462.8 Million

- 2033 Projected Market Size: USD 6,176.3 Million

- CAGR (2025-2033): 6.6%

Governments across the region are introducing strict landfill diversion targets and sustainability goals, pushing investments in advanced recycling infrastructure. Rising public awareness about environmental conservation is increasing demand for efficient waste management solutions.

Another key driver is the region’s shift towards circular economy practices, supported by economic diversification agendas such as Saudi Vision 2030 and the UAE’s Waste-to-Resource strategies. Industrial sectors are adopting recycling to cut costs, meet ESG commitments, and enhance resource efficiency. Technological advancements, including AI-driven sorting systems and automated MRFs, are boosting recycling rates and operational efficiency. Partnerships between governments and private operators are further expanding capacity and improving service quality across the Middle East waste recycling services industry.

Market Concentration & Characteristics

The Middle East waste recycling services market is moderately concentrated, with a few large regional players such as Veolia, Averda, BEEAH Group, and Tadweer dominating operations. These companies hold significant market share through extensive infrastructure, government contracts, and cross-border projects. However, smaller local operators also compete in niche segments like e-waste, metal recovery, and organic waste processing.

The Middle East waste recycling services industry is witnessing steady innovation, driven by the adoption of automated sorting technologies, AI-based waste classification, and waste-to-energy solutions. Companies are investing in advanced Material Recovery Facilities to improve recycling efficiency and material purity. Digital platforms for waste tracking and smart bin systems are being introduced in urban centers to enhance collection efficiency.

Mergers and acquisitions in the Middle East waste recycling sector are increasing as companies seek to expand service portfolios and geographic reach. Regional players are acquiring specialized firms in e-waste, hazardous waste, and alternative fuel production to strengthen market positioning. Strategic partnerships and joint ventures between multinational corporations and local operators are common to secure government contracts.

Government regulations play a central role in shaping the waste recycling industry in the Middle East, with strict landfill diversion targets and recycling quotas being enforced. National sustainability agendas, such as Saudi Vision 2030 and the UAE’s Zero Waste strategies, are pushing companies to invest in advanced recycling infrastructure. Regulatory frameworks also require adherence to environmental compliance standards and extended producer responsibility programs.

Drivers, Opportunities & Restraints

The Middle East waste recycling services market is propelled by rapid urbanization, rising waste volumes, and increasing government investment in sustainable infrastructure. National strategies such as Saudi Vision 2030 and the UAE’s Waste-to-Resource initiatives are encouraging recycling adoption. Growing corporate ESG commitments are pushing industries to integrate circular economy practices. Additionally, public awareness and environmental advocacy are boosting demand for recycling services across municipalities and industries.

Expanding waste-to-energy projects and the development of advanced Material Recovery Facilities present significant growth potential in the region. Emerging sectors like e-waste recycling, organic waste composting, and alternative fuel production offer lucrative business prospects. Public-private partnerships are opening opportunities for technology transfer and infrastructure expansion. Furthermore, regional trade in recycled materials is expected to grow, driven by demand from the manufacturing and construction industries.

The market faces challenges from high capital requirements for modern recycling infrastructure and advanced technology deployment. Inconsistent waste segregation practices and low source-level recycling rates reduce operational efficiency. Regulatory enforcement varies across countries, creating uneven market development. Additionally, fluctuating prices for recycled materials can impact profitability and discourage private sector investment.

Product Insights

The plastics segment is expected to grow at a considerable CAGR of 8.1% from 2025 to 2033 in terms of revenue. The paper & paperboard segment dominated the Middle East waste recycling services industry in 2024 with a revenue share of 38.5%, due to high collection rates from commercial, industrial, and packaging sectors. Large-scale demand from paper mills and packaging manufacturers drives steady consumption of recovered fiber. Government initiatives to reduce deforestation and promote sustainable packaging further support this segment. Additionally, well-established collection networks make paper and paperboard recycling more efficient compared to other materials.

Plastics recycling is the fastest-growing segment, fueled by rising environmental concerns over plastic pollution and regulatory bans on single-use plastics. Demand for recycled PET, HDPE, and other polymers is increasing from the packaging, textiles, and construction industries. Technological advancements in sorting and chemical recycling are improving material recovery and quality. Regional sustainability targets and corporate commitments to use recycled content are accelerating growth in plastic recycling capacity.

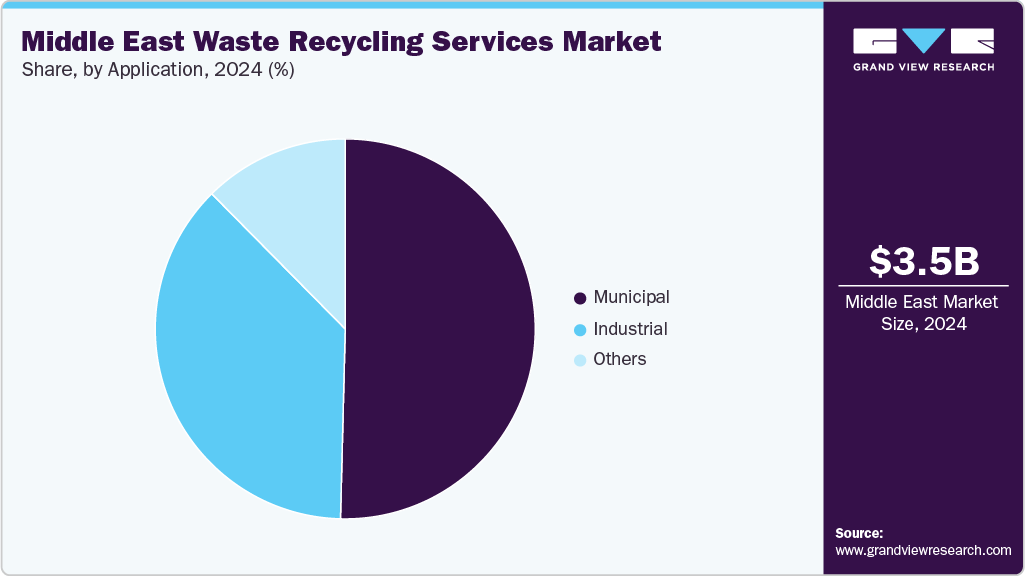

Application Insights

The industrial segment is expected to grow at a considerable CAGR of 7.3% from 2025 to 2033 in terms of revenue. Municipal waste recycling dominates the Middle East waste recycling services market and accounted for a 50.4% share in 2024, due to the large volumes generated by rapidly growing urban populations. Government contracts and public sector investments prioritize municipal waste collection, sorting, and material recovery. Established infrastructure, such as large MRFs and landfill diversion programs, supports this dominance. Additionally, public awareness campaigns and city-level recycling targets strengthen municipal sector performance.

Industrial waste recycling is the fastest-growing segment, driven by manufacturing, construction, and oil & gas sector sustainability commitments. Rising environmental regulations are pushing industries to adopt advanced recycling solutions for metals, plastics, and hazardous waste. Companies are investing in on-site waste management systems and partnering with specialized recyclers. This growth is further fueled by the circular economy’s emphasis on resource efficiency and waste reduction in production processes.

Country Insights

Saudi Arabia Waste Recycling Services Market Trends

Saudi Arabia dominates the Middle East waste recycling services market and accounted for a 33.5% share in 2024, due to large-scale government investments under Saudi Vision 2030 and the National Waste Management Strategy. The Saudi Investment Recycling Company (SIRC) is leading nationwide projects in plastics, metals, and waste-to-energy. Industrial growth and urban expansion are generating substantial waste volumes, creating strong recycling demand. Strategic partnerships with global firms are enhancing technology transfer and operational capacity.

Israel Waste Recycling Services Market Trends

Israel’s waste recycling services market is growing rapidly, fueled by technological advancements, supportive government policies, and increasing environmental awareness among its population. The nation has developed a strong presence in clean technology and green innovation, with significant exports in this field. Government initiatives focused on sustainability have further encouraged the adoption of recycling solutions.

Key Middle East Waste Recycling Services Company Insights

Some of the key players operating in the market include Veolia, REMONDIS, and BEEAH Group.

-

Veolia operates in the Middle East through integrated waste recycling services, focusing on material recovery and circular economy solutions. The company manages advanced Material Recovery Facilities (MRFs) that sort and process plastics, metals, and paper for re-entry into manufacturing. It offers specialized recycling for hazardous and industrial waste, ensuring compliance with regional environmental regulations. Veolia also develops waste-to-energy projects, converting non-recyclable waste into alternative fuels or electricity. Its operations in the region span the UAE, Qatar, Oman, and Saudi Arabia, often in partnership with municipalities and industrial clients.

-

Averda is an integrated waste management company headquartered in Dubai, operating across the Middle East, Africa, and South Asia. It provides services including general waste collection, recycling, hazardous waste handling, and medical waste disposal. The company serves over 60,000 clients, including municipalities, healthcare facilities, industrial sectors, and commercial enterprises. Averda played a key role in the Red Sea Development Project in Saudi Arabia by implementing a comprehensive waste management system during construction. It also collaborates with the International Finance Corporation (IFC) to advance sustainable waste management and promote circular economy practices in emerging markets.

Key Middle East Waste Recycling Services Companies:

- Veolia

- REMONDIS

- BEEAH Group

- Tadweer.

- SIRC.

- Averda

- Dulsco.

- Basel Convention

- Seashore Group.

- Imdaad LLC.

Recent Developments

-

In July 2025, Tadweer Group acquired Masdar’s stake in the Sharjah Waste-to-Energy plant and formed a joint venture with BEEAH to manage operations. Opened in 2022, the facility transforms non-recyclable waste into electricity, with plans to double capacity from 30 MW to 60 MW and expand processing capabilities. The initiative is designed to increase landfill diversion and reduce emissions.

-

In July 2025, Dubai aims to eliminate landfill use by 2027, with Dulsco Environment leading the effort through advanced recycling and waste-to-energy solutions. The company operates modern MRFs, RDF plants, and C&D waste facilities to maximize material recovery. These operations produce alternative fuels and recycled aggregates, cutting emissions and supporting the emirate’s zero-waste targets.

-

In January 2025, BEEAH and Masdar are expanding the Sharjah Waste-to-Energy plant, increasing capacity from 30 MW to nearly 60 MW. The upgraded facility will process around 600,000 tonnes of non-recyclable waste each year, generating power for roughly 60,000 homes and reducing annual CO₂ emissions by about one million tonnes.

Middle East Waste Recycling Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3,716.8 million

Revenue forecast in 2033

USD 6,176.3 million

Growth rate

CAGR of 6.6% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region.

Regional scope

Middle East

Country scope

Saudi Arabia; Oman; UAE; Israel; Qatar; Kuwait

Key companies profiled

Veolia; REMONDIS; BEEAH Group; Tadweer.; SIRC.; Averda; Dulsco.; Basel Convention; Seashore Group.; Imdaad LLC.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Waste Recycling Services Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Middle East waste recycling services market report based on product, application, and country:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Paper & Paperboard

-

Metals

-

Plastics

-

Glass

-

Food

-

Bulbs, Batteries & Electronics

-

Yard Trimmings

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Municipal

-

Industrial

-

Others

-

-

Country Outlook (Revenue, USD Million, 2021 - 2033)

-

Saudi Arabia

-

UAE

-

Oman

-

Israel

-

Qatar

-

Kuwait

-

Frequently Asked Questions About This Report

b. The Middle East stand-up pouches market size was estimated at USD 427.3 million in 2024 and is expected to reach USD 457.2 million in 2025.

b. The Middle East stand-up pouches market is expected to grow at a compound annual growth rate of 7.0% from 2025 to 2033 to reach USD 785.5 million by 2033.

b. Plastic dominated the Middle East stand-up pouches market across the product segmentation in terms of revenue, accounting for a market share of 58.8% in 2024 owing to its cost-effectiveness, versatility, and superior barrier properties, making it suitable for food, beverage, and personal care applications.

b. Some key players operating in the Middle East stand-up pouches market include Sahl Industries, Smart Pack., Takamul Industries., Knack Flexipack LLP., Flexico, ASPCO,, Advanced Flexible Packaging Co., Emirates Printing Press (L.L.C), Rotopacking Materials Ind. Co. LLC,Artsan Ambalaj, and INTER PLASTIK AMBALAJ VE GIDA SAN. TIC. A.S.

b. The Middle East stand-up pouches market is driven by several factors, including rapid urbanization and evolving lifestyles, which have increased the demand for portable, convenient, and visually appealing packaging, particularly in the food, beverage, and personal care segments.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.