- Home

- »

- Pharmaceuticals

- »

-

Migraine Drugs Market Size, Share & Trends Report, 2030GVR Report cover

![Migraine Drugs Market Size, Share & Trends Report]()

Migraine Drugs Market Size, Share & Trends Analysis Report By Therapeutic Class (Ditans, NSAIDs), By Route Of Administration (Oral, Injectable), By Treatment, By Age Group, By Availability, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-559-5

- Number of Report Pages: 159

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Migraine Drugs Market Size & Trends

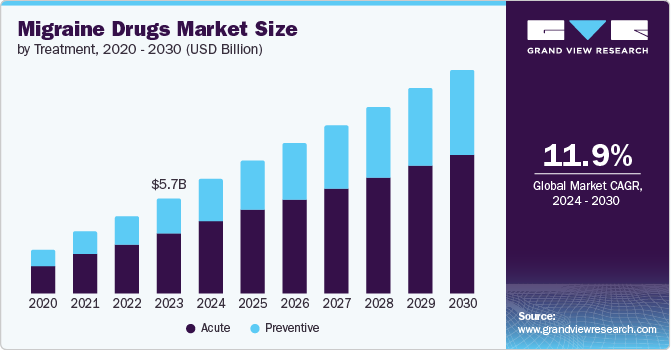

The global migraine drugs market size was estimated at USD 5.64 billion in 2023 and is projected to grow at a CAGR of 11.9% from 2024 to 2030. The market growth is attributed to the increasing prevalence of migraines and the global approval of new drugs for their treatment. According to the WHO article published in March 2024, approximately 40% of the global population, equating to around 3.1 billion individuals, were affected by migraine and other headache disorders in 2021. This condition exhibits a higher prevalence among females compared to males, possibly because of hormonal imbalance. Headache disorders consistently rank among the top three most frequent neurological conditions across various age groups, beginning as early as age 5 and maintaining this status until the age of 80. Thus, raising awareness about the disorder and its diagnosis and treatment measures among global population is anticipated to drive market growth.

According to an American Migraine Foundation article published in June 2023, during Migraine and Headache Awareness Month, the foundation launched the "GET HEADUCATED" campaign, which underscores the significance of educating oneself and others about the disorder. This initiative is geared towards rallying the community to combat stigma surrounding the condition and to promote understanding of the disease, thereby boosting adoption of drugs.

Moreover, the wide availability of migraine drugs is expected to positively impact adoption worldwide. For instance, calcitonin gene-related peptide (CGRP) monoclonal antibodies, such as fremanezumab (Ajovy), erenumab (Aimovig), and galcanezumab (Emgality), are among the latest preventative drug therapies available to treat the disorder. According to the WebMD article published in February 2023, every month, CGRP drugs are administered via self-injection by the patient, providing a targeted approach to treating migraines by blocking the release of CGRP, a neuropeptide implicated in migraine pain. Another drug in this class, eptinezumab (Vyepti), is given via intravenous injection every three months. Furthermore, the U.S. FDA has granted approval for small-molecule CGRP antagonists, such as rimegepant (Nurtec) and atogepant (Qulipta), marking significant advancements in migraine treatment. These advancements in drug development to treat the disorder are anticipated to fuel market growth.

In addition, high consumer base and unmet need for medicines worldwide push big pharmaceutical giants to develop and commercialize new drugs. For instance, in February 2023, Pfizer Inc. published the Phase 3 pivotal clinical trial results of zavegepant in The Lancet Neurology. This is an investigational CGRP receptor antagonist nasal spray to treat patients with acute migraine. The clinical study achieved its co-primary endpoints, demonstrating that a single 10 mg dose of zavegepant was more effective than a placebo for both freedom from the most bothersome symptom (MBS) and pain at two hours post-dose. This positive result is anticipated to boost market growth during the forecast period.

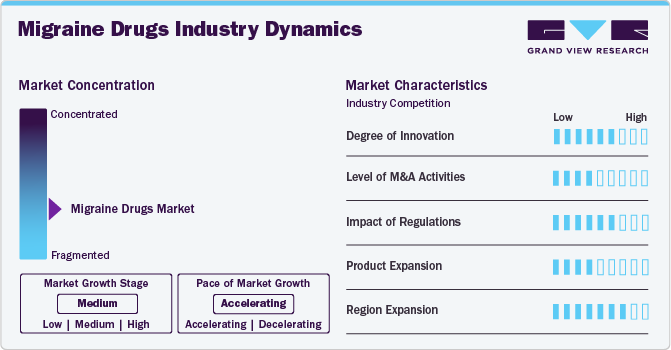

Industry Dnynamics

The degree of innovation is high in the market and is characterized by a growing level of research and development. For instance, in January 2023, Innovations in migraine drug development have evolved beyond traditional triptans, such as introducing new medication classes targeting specific migraine triggers. One such advancement is eptinezumab, a humanized IgG1 monoclonal antibody that targets both α and β isoforms of CGRP. Eptinezumab has demonstrated efficacy in reducing days and improving functionality in chronic patients. This drug is administered quarterly via intravenous infusion to patients.

Several players engage in mergers & acquisitions to strengthen their market position. This strategy enables companies to increase their capabilities, expand their product portfolios, and improve competency. For instance, in May 2022, Pfizer acquired Biohaven Pharmaceuticals for USD 11.6 billion, securing access to Nurtec, a CGRP inhibitor used to treat acute pain, and zavegepant, a nasal spray migraine drug candidate. This acquisition aligns with Pfizer's strategy to enhance its commercialization capabilities and broaden the availability of treatments.

Regulations in the market set standards for safety, efficacy, and accessibility. They govern approval processes, manufacturing standards, labeling, and surveillance. Compliance is vital for companies to introduce and sustain their drugs. Thus, it protects patients by minimizing risks and ensuring accurate information.

Product substitutes include non-pharmacological treatments, alternative therapies, and lifestyle modifications. These substitutes offer relief without relying solely on medication. For instance, biofeedback therapy teaches relaxation techniques to manage symptoms, serving as a substitute for traditional drug treatments.

Regional expansion for migraine drugs involves expanding market reach to new geographical areas beyond current operations. This expansion strategy aims to tap into previously untapped markets and increase treatment accessibility. For instance, a pharmaceutical company may expand its distribution network to include regions in Asia or South America where the prevalence is high, but access to effective treatments may be limited.

Treatment Insights

The acute segment dominated the market and accounted for 63.31% of the global revenue in 2023 and is anticipated to grow significantly over the forecast period. Acute treatment encompasses various medications and strategies designed to alleviate the symptoms experienced during a migraine attack by the patient. Some of these drugs include Rimegepant, Ubrogepant, and Zavegepant. Companies are undertaking various initiatives to support patients suffering from acute migraine by offering drugs free of cost. For instance, AbbVie Inc. offers UBRELVY (ubrogepant) prescription fill free of cost to commercially insured patients through its UBRELVY Complete Savings Card. This offer is not valid for patients enrolled in Medicaid, Medicare, and other state insurance programs. Such initiatives are expected to boost demand for drugs used to treat acute migraine and drive segment growth.

The preventive segment is anticipated to grow at the fastest CAGR over the forecast period. Preventive treatment involves medications and strategies to reduce attacks' frequency, severity, and duration.Recent drug approvals for treatment have highlighted advancements in preventive therapies, offering new options for patients suffering from the disorder. For instance, in April 2023, QULIPTA (atogepant), an oral medication taken daily, was approved by the U.S. FDA in 2021 to prevent episodic migraines. It marks a novel class of preventive therapy for the disorder, presenting an alternative to traditional preventive treatments and driving market growth.

Route Of Administration Insights

The injectable segment held the largest revenue market share in 2023 and registered the highest CAGR of 14.0% during the forecast period. Injectable migraine drugs often provide rapid and effective relief from migraine symptoms, making them a preferred choice for individuals experiencing severe or acute attacks.Furthermore, it is a convenient option for treatment, particularly for individuals who have difficulty swallowing pills or experience nausea and vomiting during attacks. These advantages encourage physicians to prescribe this drug to patients, thereby boosting prescription rate during the forecast period. For instance, physicians prescribe Sumatriptan injections to patients for immediate relief from migraines and cluster headache attacks as it serves as a beneficial alternative for individuals who encounter difficulty swallowing pills and can demonstrate its effectiveness in as little as 10 minutes. Thus, high safety and efficacy associated with injectables boost its adoption worldwide and drive segment growth.

The oral segment is projected to witness a significant growth rate over the forecast period. Oral medications are widely accessible and convenient for patients, contributing to their popularity as a preferred treatment option.Oral drugs have been shown to effectively relieve symptoms for many individuals, providing relief from pain, nausea, and other associated symptoms.A wide variety of oral drugs are available, including over-the-counter medications such as ibuprofen or acetaminophen, prescription medications such as triptans, and preventive medications like beta-blockers or anticonvulsants. For instance, in February 2023, Rimegepant (Nurtec) and ubrogepant (Ubrelvy) were CGRP receptor antagonists approved for acute treatment with or without aura. These medications block the CGRP receptor, which plays a role in the sensory nerves supplying the head and neck, thereby preventing these attacks.

Age Group Insights

Adult led the market, accounting for 52.92% of the global revenue in 2023, and is anticipated to grow significantly over the forecast period. Modern lifestyles characterized by stress, irregular sleep patterns, poor dietary habits, and sedentary behavior contribute to the exacerbation of migraine symptoms in adults. The need for effective treatment options to manage these symptoms drives the market's growth. According to the NCBI article published in February 2024, a meta-analysis involving 23 case-control studies revealed that adults with migraine exhibited higher PSQI scores compared to control groups, indicating poorer sleep quality among migraine sufferers. Furthermore, findings from a randomized controlled trial (RCT) involving 31 adults in the U.S. with chronic migraine and insomnia demonstrated that participants who underwent insomnia cognitive-behavioral therapy experienced a lower frequency of headache events compared to the control group. These results suggest a potential correlation between improving sleep quality and reducing the frequency and intensity of attacks in affected individuals.

The geriatric segment is anticipated to grow at the fastest CAGR over the forecast period. There is growing recognition of migraine in the geriatric population, fueled by improved awareness among healthcare providers and older adults themselves. For instance, according to The American Headache Society (AHS) report in April 2021, migraines in older individuals can manifest differently than in younger people. Headaches associated with migraines are more likely to occur bilaterally and may exhibit less sensitivity to light and sound. In addition, migraine aura, which includes visual disturbances, can occur without the typical headache pain, necessitating careful assessment to rule out stroke, transient ischemic attack, and seizure. Aura, not including headache, can increase from 6% to 16% in individuals after age 55. Moreover, migraine attacks in the elderly tend to start more often at night or in the early morning, with up to 60% of cases initiated during these times.

Availability Insights

Prescription drugs led the market and accounted for 78.10% of the global revenue in 2023 and is anticipated to grow significantly over the forecast period. The rising prevalence of migraines globally is a significant driver for the growth of prescription drugs. As more people are diagnosed with migraines, there is a higher demand for effective medications. For instance, in February 2023, FDA-approved prophylactic agents for migraine include divalproex sodium, propranolol, topiramate, and timolol. These medications are prescribed to prevent these attacks and are taken daily. Treatment is usually initiated in patients experiencing four or more headaches per month and should be continued for at least two to three months consistently. The primary drug classes for prophylaxis are beta-blockers, calcium channel blockers, and anticonvulsants.

Over-the-counter (OTC) drugs is anticipated to grow at the fastest CAGR over the forecast period. OTC drugs are readily available without a prescription, making them convenient for consumers to purchase and use without needing to visit a healthcare provider. This accessibility encourages more people to try OTC options for managing their migraines. For instance, according to a report in August 2023, OTC medications were effective, particularly when taken early during a moderate migraine attack without nausea. Studies indicate that NSAIDs (Nonsteroidal Anti-Inflammatory Drugs) are widely used for headache and migraine relief without a prescription. Among them, naproxen, ibuprofen, and acetaminophen have strong evidence supporting their effectiveness in treating acute migraine attacks, especially when taken promptly after onset. In addition, a combination of acetaminophen, aspirin, and caffeine is recognized as highly effective for treating these attacks. These OTC options provide accessible and reliable relief for individuals experiencing symptoms.

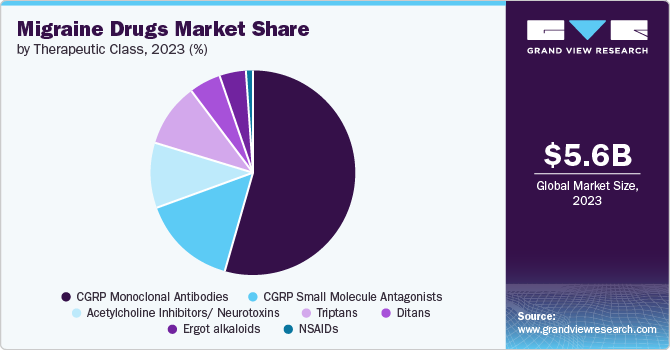

Therapeutic Class Insights

CGRP monoclonal antibodies segment dominated the market with a market share of 57.27% in 2023. CGRP monoclonal antibodies (mAbs) have proven highly effective in preventing migraine attacks, often demonstrating efficacy rates comparable to or even higher than those of currently used preventive drugs. In addition, their excellent tolerability and emerging long-term safety data highlight a remarkable balance between efficacy and adverse effects. In January 2023, CGRP monoclonal antibodies (mAbs) were associated with higher costs, yet they offer substantial benefits in terms of more migraine-free days and increased health-related quality of life compared to treatment with other drug classes. Estimates suggest that each migraine-free day achieved with CGRP mAbs can result in savings ranging from approximately USD 130 to USD 340. Thus, mAbs lead to reductions in both direct and indirect migraine-related costs. Currently approved CGRP includes Rimegepant, Ubrogepant, Zavegepant, and Atogepant. These abovementioned factors are expected to drive segment growth during the forecast period.

The CGRP small molecule antagonists segment is anticipated to grow at the fastest CAGR over the forecast period. CGRP small molecule antagonists are a class of drugs used in migraine treatment. Unlike CGRP monoclonal antibodies, which are large protein molecules administered via injections, small molecule antagonists are orally administered medications. The development and commercialization of pants and titans for treatment have been remarkable achievements in the field that open new opportunities for market growth. Furthermore, multiple approvals of new CGRP small molecule antagonists enhance patients' drug accessibility. For instance, in June 2023, the National Institute for Health and Care Excellence (NICE), for the first time, recommended Rimegepant (Vydura) as an oral treatment for preventing migraines. This approval marks significant progress in preventive treatment in Europe, offering new options for managing disease across regions and driving segment growth.

Regional Insights

North America migraine drugs market accounted for 40.91% share in 2023 owing to the high prevalence of migraine in North America, affecting millions of people. The rising incidence of these cases in the region contributes to the market's growth. For instance, in January 2024, about 1 in every 4 American households has a member in the family who suffers from the disorder. However, despite the widespread prevalence, only half of Americans experiencing these sought medical attention for headache-related issues in the previous 12 months due to a lack of awareness. This highlights a gap in healthcare access and emphasizes the need for increased awareness and treatment options.

U.S. Migraine Drugs Market Trends

The migraine drugs market in the U.S. is expected to grow over the forecast period due to the huge opportunity for migraine drugs owing to the large consumption base and improved quality of life associated with treatment, prompting more individuals to seek medical treatment.

Europe Migraine Drugs Market Trends

The migraine drugs market in Europe was identified as a lucrative region in this industry. This region’s market growth can be attributed to a significant population affected by migraines and the approval of new drugs for treatment, contributing to a substantial market size for these drugs.

The UK migraine drugs market is expected to grow over the forecast period due to its well-developed healthcare infrastructure and wide range of medical services associated with treatment. This facilitates the distribution and availability of migraine drugs effectively across the UK and supports market expansion.

The migraine drugs market in France is expected to grow over the forecast period, which is attributed to supportive regulatory and reimbursement policies related to migraine drugs, driving the entry of new players in the country, and the market growth.

Germany migraine drugs market is expected to grow over the forecast period due to the rising number of aging people and the general population's increased susceptibility to headache conditions like migraines. As the population ages, the demand for drugs is expected to increase, driving market growth.

Asia Pacific Migraine Drugs Market Trends

The migraine drugs market in Asia Pacific is anticipated to witness the fastest growth. The growing prevalence of migraine disease contributes to the region’s market growth. For instance, in October 2023, across all countries, South Asia reported the highest incidence of migraine, with 12,041,286 cases, along with the highest migraine-associated Disability-Adjusted Life Years (DALYs) at 5,570,590.8. Overall, countries with higher Socio-demographic Index (SDI) values exhibited a greater disease burden of both migraine and Tension-Type Headaches (TTH).

China migraine drugs market is expected to grow over the forecast period. For instance, in August 2023, migraine became a significant public health concern in China due to changing lifestyles and a huge population base, impacting approximately 65 million individuals, which constitutes the largest migraine population in the world. This high prevalence highlights the substantial burden on the population's health, well-being, and opportunity in the market.

The migraine market in Japan is expected to grow over the forecast period due to the presence of one of the world's most rapidly aging populations. Migraines are more prevalent among older adults due to increased tension on mental and physical levels and sensory distractions. Thus, the rising geriatric population drives demand for migraine drugs over the forecast period in Japan.

Latin America Migraine Drugs Market Trends

The migraine drugs market in Latin America was identified as a lucrative region in this industry. Advancements in healthcare technology and pharmaceutical innovation have led to the introduction of new and improved migraine drugs, meeting the evolving needs of patients and driving market expansion.

Brazil migraine drugs market is expected to grow over the forecast period. This can be attributed to high awareness about migraine and its available treatment options among the Brazilian population. According to the International Association for the Study of Pain (IASP) report published in 2023, more than 30 million population in Brazil suffer from migraine in the country. However, yet large population in Brazil is underdiagnosed and untreated due to lack of access to treatment. Thus, increasing government focus on providing safe and effective treatment to migraine patients drives market growth in Brazil.

MEA Migraine Drugs Market Trends

The migraine drugs market in MEA is identified as a lucrative region in this industry. The prevalence of migraines is increasing in the MEA region, driven by various factors such as lifestyle changes, stress, and genetic predisposition.

Saudi Arabia migraine drugs market is expected to grow over the forecast period owing to the availability of health insurance coverage in Saudi Arabia for treatment.

Key Migraine Drugs Company Insights

Key players are using existing customer bases in the region to prioritize maintaining high-quality standards and gain high market size access. This strategy is useful for brands that have already built a strong position in the market. In addition, companies are heavily investing in the advanced development of a new therapeutic class of drugs for migraine treatment.

Impel Pharmaceuticals Inc., Tonix Medicines, Inc., Currax Pharmaceuticals LLC., and Lundbeck are some of the emerging market participants. These companies focus on achieving funding support from government bodies and healthcare organizations aided by novel product launches to capitalize on untapped avenues.

Key Migraine Drugs Companies:

The following are the leading companies in the migraine drugs market. These companies collectively hold the largest market share and dictate industry trends.

- AbbVie Inc.

- Amgen Inc.

- Teva Pharmaceutical Industries Ltd.

- GSK plc

- Eli Lilly and Company

- Pfizer Inc.

- Bausch Health Companies Inc.

- Gensco Pharma

- Impel Pharmaceuticals Inc.

- Tonix Medicines, Inc.

- Currax Pharmaceuticals LLC.

- Lundbeck

Recent Developments

-

In April 2024, the National Institute of Health and Care Excellence (NICE) recommended using Atogepant to treat migraine patients who cannot tolerate other drugs available on the market. This recommendation is anticipated to boost demand for Atogepant during the forecast period and drive market growth.

-

In March 2024, Amazon Pharmacy announced that Lilly had selected it for online delivery of its medications to treat different health conditions, such as obesity, diabetes, and migraine, to patient homes. This facility is available for 24/7 access to clinical pharmacists.

-

In December 2023, Organon, a global healthcare company specializing in women's health, entered into an agreement with Eli Lilly and Company (Lilly) to exclusively distribute and promote the migraine medications Emgality (galcanezumab) and RAYVOW (lasmiditan) in Europe.

-

In August 2023, Ajanta Pharma Ltd obtained final approval from the U.S. Food and Drug Administration (USFDA) to sell topiramate extended-issue capsules in strengths of 25 mg, 50 mg, 100 mg, and 200 mg.

-

In July 2023, the American Heart Association allocated USD 2.1 million in funding to support seven new scientific research studies focused on investigating the potential link between migraines and the risk of stroke and cardiovascular disease.

Migraine Drugs Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 6.80 billion

Revenue forecast in 2030

USD 13.34 billion

Growth rate

CAGR of 11.9% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Treatment, therapeutic class, route of administration, age group, availability,region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

AbbVie Inc.; Amgen Inc.; Teva Pharmaceutical Industries Ltd.; GSK plc; Eli Lilly and Company; Pfizer Inc.; Bausch Health Companies Inc.; Gensco Pharma; Impel Pharmaceuticals Inc.; Tonix Medicines, Inc.; Currax Pharmaceuticals LLC.; Lundbeck

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Migraine Drugs Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 - 2030. For this study, Grand View Research has segmented the global migraine drugs market report based on treatment, therapeutic class, route of administration,age group, availability, and region:

-

Treatment Outlook (Revenue, USD Million, 2018 - 2030)

-

Acute

-

Preventive

-

-

Therapeutic Class Outlook (Revenue, USD Million, 2018 - 2030)

-

CGRP monoclonal antibodies

-

CGRP small molecule antagonists

-

Acetylcholine inhibitors/ neurotoxins

-

Triptans

-

Ditans

-

Ergot alkaloids

-

NSAIDs

-

Others

-

-

Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Oral

-

Injectable

-

Others

-

-

Age Group Outlook (Revenue, USD Million, 2018 - 2030)

-

Pediatric

-

Adult

-

Geriatric

-

-

Availability Outlook (Revenue, USD Million, 2018 - 2030)

-

Prescription Drugs

-

Over-the-Counter (OTC) Drugs

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

Kuwait

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global migraine drugs market size was estimated at USD 5.64 billion in 2023 and is expected to reach USD 6.80 billion in 2024.

b. The global migraine drugs market is expected to grow at a compound annual growth rate of 11.9% from 2024 to 2030 to reach USD 13.34 billion by 2030.

b. OTC dominated the migraine drugs market with a share of 78.10% in 2023. This is attributable to ease of use, patient preference, and economic aspects. A research study published in the U.S. Pharmacist, in 2016, stated that nearly 57% of migraine patients self-medicate using OTC products

b. Some key players operating in the migraine drugs market include Allergan; Amgen Inc.; Bayer AG; Eli Lilly and Company; GlaxoSmithKline plc; Johnson & Johnson Services, Inc.; Novartis AG; Pfizer Inc.; and Teva Pharmaceutical Industries Ltd.

b. Key factors that are driving the market growth include increasing disease prevalence, strong developmental pipeline, rising consumer awareness, and high unmet needs.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."