- Home

- »

- Pharmaceuticals

- »

-

Over The Counter Drug Market Size & Share Report, 2030GVR Report cover

![Over The Counter (OTC) Drug Market Size, Share & Trends Report]()

Over The Counter (OTC) Drug Market Size, Share & Trends Analysis Report By Product Type, By Formulation Type, By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-194-7

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Over The Counter (OTC) Drug Market Trends

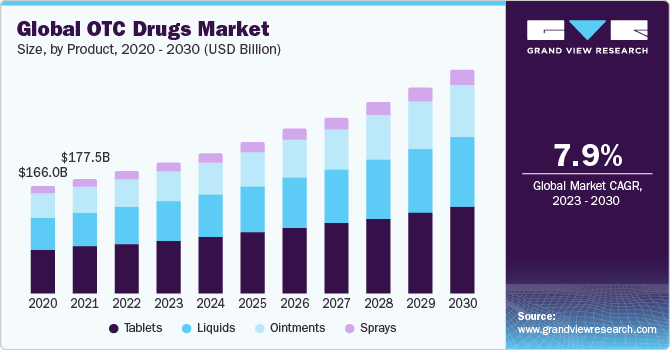

The global over the counter (OTC) drugs market size was estimated at USD 189.3 million in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 7.92 from 2024- 2030. The growth can be attributed to factors such as increasing consumer willingness to spend on OTC medication, growing consumer awareness, increasing prevalence of lifestyle diseases, such as obesity & diabetes, and a rise in the geriatric population. In addition, increasing disposable income, a rising number of distribution channels for OTC drugs, and improved accessibility further drive the market.

Despite significant impacts on healthcare systems, the COVID-19 pandemic boosted the OTC drugs market. For instance, according to an article published in June 2022, commonly used OTC drugs during the pandemic included antihistamines, antipyretics, and cough suppressants. Moreover, according to the National Library of Medical article published in May 2022, the inclination toward self-medication was prominent in both developed and developing nations, with a global prevalence reaching nearly 80% and approximately 78.6% in India. The surge of online misinformation during the COVID-19 era has further fueled the prevalence of self-medication, consequently boosting the OTC drugs market.

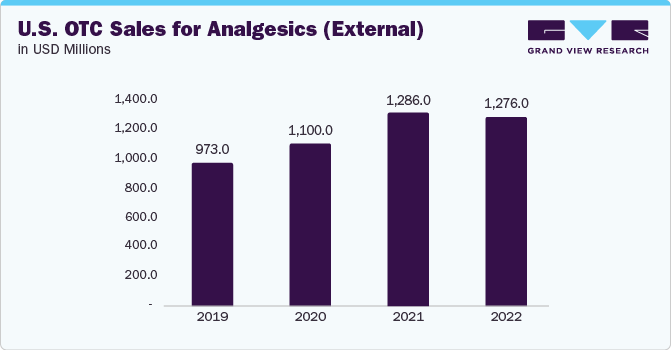

According to the WHO, in 2019, osteoarthritis affected approximately 528 million people globally. It serves as a driver for the demand and utilization of OTC analgesics. Osteoarthritis, characterized by joint pain and stiffness, prompts individuals to seek effective pain relief solutions. OTC analgesics, including pain relievers like acetaminophen and nonsteroidal anti-inflammatory drugs (NSAIDs), become go-to options for individuals managing osteoarthritis symptoms. The widespread availability of these medications without the need for a prescription makes them accessible to a large population, contributing to their role as a driver in the OTC drugs market.

Formulation Type Insights

The OTC tablets segment gained a maximum market share in the OTC drugs market in 2023. The growth is attributed to tablets offering a convenient and familiar form of medication, making them user-friendly for consumers. The ease of administration, accurate dosage, and portability make tablets a preferred choice. Additionally, tablets are suitable for many therapeutic areas, from pain relief to cold and flu symptoms. The availability of diverse formulations and the possibility of incorporating various active ingredients contribute to the popularity of OTC tablets, making them a dominant market segment.

Product Type Insights

Based on product type, the OTC drugs market is segmented into dermatology products, cough, cold and flu products, vitamins, mineral and supplements(vms), gastrointestinal products, ophthalmic products, weight loss/dietary products, analgesics, sleeping aids, and other product types. Cough, cold and flu products dominated the market in 2023. The prevalence of colds, primarily caused by the rhinovirus, acts as a significant driver for the OTC drugs market. According to the CDC, with the rhinovirus accounting for at least 50% of cold cases, the impact is substantial, leading to approximately 22 million lost school days annually in the U.S., as reported by the CDC. The occurrence of cold is estimated at 1 billion cases each year among Americans, emphasizes the widespread demand for OTC drugs to alleviate symptoms and manage the effects of common colds.

Distribution Channel Insights

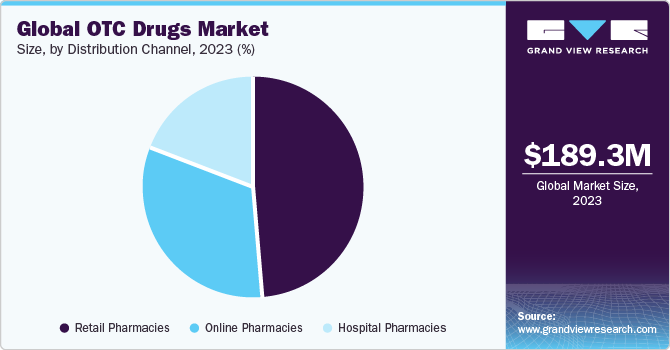

The OTC drugs market is segmented based on distribution channels into hospitals, retail, and online pharmacies. The retail pharmacies segment dominated the market in 2023. The growth is attributed to advancements in the telehealth infrastructure. For instance, in May 2023, AmerisourceBergen (AB) announced a strategic partnership with SteadyMD, a B2B telehealth infrastructure facilitator offering advanced telehealth patient experiences in healthcare. Their collaborative efforts are initiated by co-creating a telehealth solution concentrated on Test to Treat possibilities. The pilot program is underway, involving a cluster of 130 independent retail pharmacies, encompassing Good Neighbor Pharmacy network members.

Regional Insights

North America dominated the market in 2023. The accessibility of the emergency contraceptive pill, Plan B One-Step, without age restrictions, and its availability on pharmacy shelves without a prescription is contributing to the OTC drugs market in the North America region. Furthermore, the approval of various medications for OTC use in 2023, such as Narcan and RiVive (naloxone nasal sprays for emergency opioid overdose treatment) and Opill (a progestin-only oral birth control pill, the first of its kind available without a prescription in the U.S.), serves as a driving factor for the OTC drugs market in North America. On the other hand, Asia Pacific is expected to grow at the CAGR over the forecast period.

Key Over The Counter Drug Company Insights

Key players operating in the market are Pfizer, Johnson & Johnson Services Inc., Bayer AG, Takeda Pharmaceutical Company Ltd., Reckitt Benckiser Group PLC, Sanofi S.A., Novartis AG, GlaxoSmithKline PLC, Boehringer Ingelheim International GmbH, and Mylan. The market participants are constantly working towards new product development, M&A activities, and other strategic alliances to gain new market avenues. The following are some instances of such initiatives.

-

In June 2022, AFT Pharmaceuticals and RooLife Group entered into a partnership and officially introduced a selection of AFT's OTC pharmaceutical products through their storefront on the China Cross Border E-Commerce (CBEC) platform, Tmall Global.

-

In March 2022, Perrigo Company plc, a prominent provider of Affordable and Quality Self-Care Products, obtained final approval from the U.S. Food and Drug Administration for the OTC utilization of 24HR Allergy Nasonex (mometasone furoate monohydrate 50mcg).

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."