- Home

- »

- Consumer F&B

- »

-

Milkfish Market Size, Share & Trends Report, 2028GVR Report cover

![Milkfish Market Size, Share & Trends Report]()

Milkfish Market (2022 - 2028) Size, Share & Trends Analysis Report By Form (Frozen, Canned), By Distribution Channel (Offline, Online), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-936-1

- Number of Report Pages: 75

- Format: PDF

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2028

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global milkfish market size was valued at USD 1.15 billion in 2021 and is expected to expand at a CAGR of 5.2% during the forecast period from 2022 to 2028. Factors such as easy availability of the products, growing consumption of fish due to its nutritional content, and increasing smart fishing with innovative equipment are expected to promote the milkfish market. Moreover, expansion a development of distribution channels and increasing investment in research and development activities of aquaculture are expected to positively impact the milkfish market in the forecast timeline.

Lockdown and curfew were announced by the governments during the COVID-19 pandemic in 2020. Citizens preferred to stay at home as a precautionary measure. Due to this, overall production and supply chains of the industry were disturbed. Trading activities of supply chains from manufacturing to retail store were affected and the market experienced short fall in sales due to the disruption of services and reduced demand. Thus, with a short slack in market revenue, the industry is expected to witness a healthy growth rate in the upcoming years after COVID restrictions.

The biological name of milkfish is Chanos which belongs to the Family Chanidae. The body of fish has silvery color on the belly whereas on sides, grading to olive green or blue on the back. It is a bony fish with white meat with a mild flavor used for a variety of cooking preparations. This fish originates in Southeast Asia and is one of the oldest fish farmed in the Southeast Asia.

Milkfish is a combined source of animal nutrition, which helps in supplying protein needs especially for humans. Based on the protein content the demand for milkfish is increasing among the health-conscious population across the globe. The milkfish is loaded with high omega-3 fatty acids and protein which are quite essential for appropriate body functioning. With the regular consumption of milkfish, it develops the memory and brain in children, prevents heart disease, nourishes the eyes, controls cholesterol levels, and is also helpful in reducing depression. Therefore, these nutrient-loaded factors are responsible for the growing milkfish demand.

Manufacturers or shrimp farmers are investing heavily to increase the milkfish production to recover the losses by going back to milkfish and cultivating it for the export market. Hence, the ongoing trend is likely to create more opportunities for the producers of milkfish during the forecast period. The milkfish can be easily cultivated irrespective of any season, as they are very tolerant of environmental changes and are also resistant to disease, which allows farmers to easily produce milkfish.

The demand for milkfish was relatively stagnated over the past decade due to the boom of shrimp and the low price of milkfish in the market. As a result, the low-price structure is limiting the milkfish market growth. The farmers and manufacturers are using the improved technologies for increasing the volumes of milkfish production thereby resulting in increased sales during the forecast period.

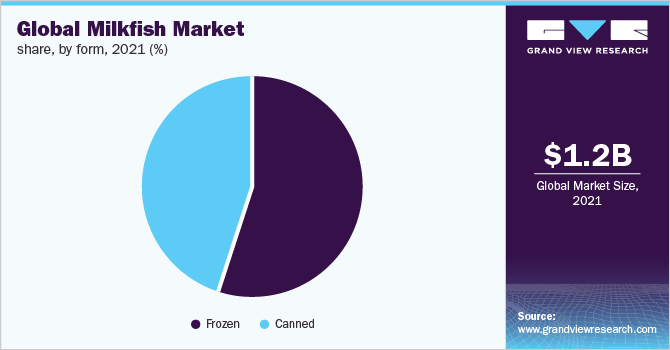

Form Insights

Frozen segment contributed around 55% to the global market share in 2021. The frozen segment consists of packed salted milkfish products. The rise in consumer’s demand for frozen milkfish is a major factor to drive the segmental growth. The changing food habits of the citizens and the growing demand for fish proteins to fulfill the daily need of nutritional value are expected to boost the market growth during the forecast period.

Canned segment is projected to register a faster CAGR of 5.6% from 2022 to 2028. This growth is due to the increased focus of consumers to adopt organic and clean-labeled seafood products. The market growth is due to the increasing demand for ready-to-cook food products. The supportive government guidelines and regulations to accomplish the demand of ready-to-cook milkfish products is refueling the market growth.

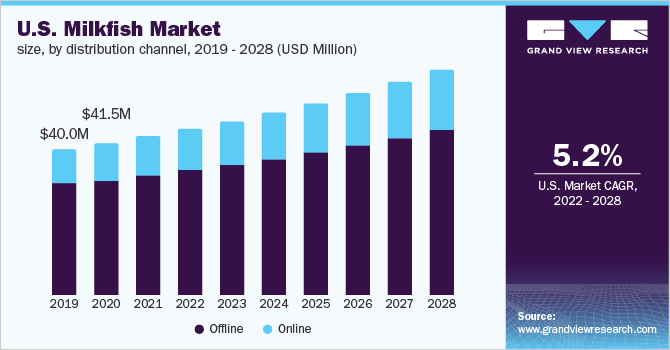

Distribution Channel Insights

Offline distribution channels contributed a larger market share of more than 75% in 2021. Manufacturers use the retail channels for product sales with the help of advertising and marketing. Offline channels include various retail store type such as hypermarkets, supermarkets, convenience stores, specialty stores, and department stores, which are contributing to the market revenue. Thus, the channel is expected to continue its dominance in the market. Moreover, this retail channel provides a choice of physical verification of products to the buyers. Thus, contributing more to the market revenue.

Online distribution channel is forecast to expand at a higher CAGR of 6.4% from 2022 to 2028. Consumers prefer using online portals and mobile apps for shopping and are getting popular due to their simplicity and convenience. Products are available at economic rates via online channel compared to offline. End-users prefer authentic shopping portals or mobile apps to purchase therein leading to the growth of online segment.

Regional Insights

Asia Pacific contributed largest market share of more than 65% in 2021 and is forecast to expand at a CAGR of 5.0% from 2022 to 2028. The product has been originated in this region and has a huge production capacity. Since the ancient era, fishing is one of the prime businesses in these regions. The countries such as China, India, and Indonesia are majorly contributing to the production of fish products. The consumption rate of fish products in the countries China and India is increasing due to high demand in the population. Moreover, the governments are taking initiative by offering funds for developing aquaculture. Thus, this region contributes to the largest market revenue.

Central and South America is forecast to expand grow with a CAGR of 6.6% from 2022 to 2028. Country like Brazil is positively contributing to the market revenue. Rapid adoption of aquaculture for increasing production has resulted in the market growth in this region. The favorable environmental conditions are good for aquaculture in this region. An increasing number of food processing units and rising consumption by population are expected to contribute to the market revenue.

Europe is forecast to grow with a 2nd fastest CAGR of 5.4% from 2022 to 2028. This can be credited to the increasing production of milkfish. People are highly health-conscious and thus the demand for milkfish is surging in the European market. Moreover, the growing milkfish production from aquaculture constitutes the strategy for securing fish food supply which contributes to the revenue generation of the milkfish market. Additionally, the growing demands from low to middle-income group households are attributing the milkfish market in Europe. Thus, the region is expected to expand at a 2nd fastest CAGR in the forecast period.

Key Companies & Market Share Insights

The milkfish market is characterized by the presence of various well-established players and several small and medium players. Vendors are focusing on the launch the products to reach consumers expectations from the milkfish. Additionally, vendors are trying to innovate new preservative techniques to increase durability of the product. Moreover, vendors are expanding their reach across geographies. Such initiatives are expected to boost the adoption rate of the products among consumers. The Milkfish extractors are aggressively following the organic as well as inorganic strategies to expand the footprints across the geography. For instance, Nireus Aquaculture S.A. uses the sustainable and cost-effective strategy to feed the fish. The company use legumes that are produced in the EU and especially, on Greek soil an alternate proteins replacement to marine creatures. The use of legumes in fish feed is increasing steadily, as pulses have become unavoidable in fish feed formulations.

Some of the prominent players in the Milkfish market include:

-

Komira Group

-

LAND & SEA INTERNATIONAL FOOD SUPPLY

-

Nireus Aquaculture S.A.

-

Siam Canadian Group Limited

-

Stehr Group

-

Kaysaint International Co. Ltd

-

PT. Fishnesia Mitra Bersama

-

Liang Shing Frozen Seafoods Co., LTD.

-

W Fresh Supply

Milkfish Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 1.20 billion

Revenue forecast in 2028

USD 1.65 billion

Growth Rate

CAGR of 5.2% from 2022 to 2028

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2028

Quantitative units

Revenue in USD million/billion and CAGR from 2022 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Form, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Germany; France, U.K.; China, India, Indonesia; Brazil; South Africa

Key companies profiled

Komira Group, LAND & SEA INTERNATIONAL FOOD SUPPLY, Nireus Aquaculture S.A., Siam Canadian Group Limited, Stehr Group, Kaysaint International Co. Ltd, PT. Fishnesia Mitra Bersama, Liang Shing Frozen Seafoods Co.,LTD., and W Fresh Supply

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segment from 2017 to 2028. For this study, Grand View Research has segmented the global milkfish market report based on form, distribution channel, and region:

-

Form Outlook (Revenue, USD Million, 2017 - 2028)

-

Frozen

-

Canned

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2028)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2028)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

France

-

U.K.

-

-

Asia Pacific

-

China

-

India

-

Indonesia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global milkfish market size was estimated at USD 1.15 billion in 2021 and is expected to reach USD 1.20 billion in 2022.

b. The global milkfish market is expected to grow at a compound annual growth rate of 5.2% from 2022 to 2028 to reach USD 1.65 billion by 2028.

b. Asia Pacific dominated the milkfish market with a share of 67.6% in 2021. This is attributable to rising consumption of aquaculture products among China, India, and Japan.

b. Some key players operating in the milkfish market include Komira Group; LAND & SEA INTERNATIONAL FOOD SUPPLY; Nireus Aquaculture S.A.; Siam Canadian Group Limited; Stehr Group; Kaysaint International Co. Ltd, PT; Fishnesia Mitra Bersama; Liang Shing Frozen Seafoods Co., LTD.; and W Fresh Supply.

b. Key factors that are driving the milkfish market growth include easy availability of the products, growing consumption of fish due to its nutritional content, and increasing smart fishing with innovative equipment.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.