Report Overview

The global milling machine market size was valued at USD 63,156.5 million in 2018 and is expected to register a CAGR of 7.0% from 2019 to 2025. Milling machines are some of the most important machines used in metal cutting applications across several industries. The promising expansion of the global metalworking industry and a notable rise in metalworking facilities globally have triggered the demand for these machines in recent years.

Milling machines are highly versatile and can perform a plethora of functions including fillet making, turning, chamfering, drilling, facing, gear cutting, and slot cutting. These machines can also be used for performing multiple cuts simultaneously by installing multiple cutters. Various other tools, such as rounding mills, fluted mills, and ball end mills, can also be integrated into these machines. These advantages make milling machines ideal for machining metal parts required in industries such as automotive and defense & aerospace.

Milling machines are widely used to drill, bore, cut gears, and produce slots. Various milling machine manufacturers are adopting the CNC technology to enhance the productivity and quality of the work performed by milling machines by using the same tools and program to produce multiple parts. Automation and multi-axis machining are some of the most prominent trends in the market. Moreover, companies are using software programs to control the axis, spindle speeds, and tool changes in milling machines, thereby reducing the need for manual intervention.

Integration of CAM and CAD software into CNC machines provides additional benefits such as reducing the machining time and enabling a smooth workflow. The inception of compact machine tools that occupy minimum floor space is particularly gaining traction within the industrial manufacturing sector.

Adoption of five-sided machining with the aim of reducing set-up time is another major trend in the market.However, the significant costs associated with the installation and maintenance of advanced machine tools and a looming lack of adequately skilled workforce holding expertise in operating complex machine tools are expected to restrain the growth of the market over the forecast period. To overcome these challenges, numerous companies are spending on R&D to minimize the maintenance cost by implementing automated diagnostic solutions.

Type Insights

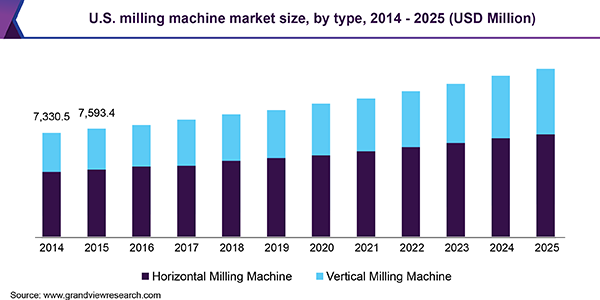

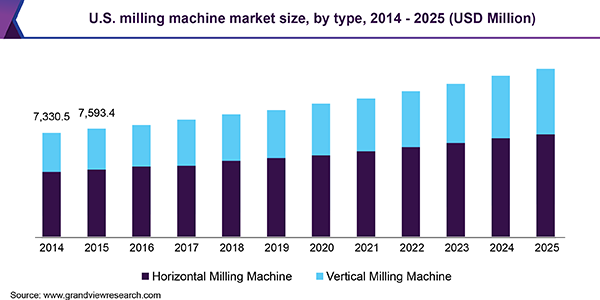

On the basis of type, the milling machine market has been segmented into horizontal milling machines and vertical milling machines. The horizontal milling machines segment dominated the market in 2018 owing to the growing popularity and users’ preference for horizontal milling machines. Horizontal mills offer better chip evacuation, thereby delivering a more refined surface finish and an extended tool life. They can also execute more complicated parts with fewer operations. In a horizontal mill, the spindle points horizontally, thereby helping in ensuring a greater spindle uptime. Moreover, horizontal milling machines are particularly preferred owing to their ability to perform the work of three or more vertical mills.

Nevertheless, the vertical milling machines segment accounted for a considerable share of the market in the said year, owing to features such as high visibility, affordable costs, ease of use, and high accuracy. These mills are mainly used for drilling and plunging cuts and are available in a wide range of specifications depending on different end uses.

End-Use Insights

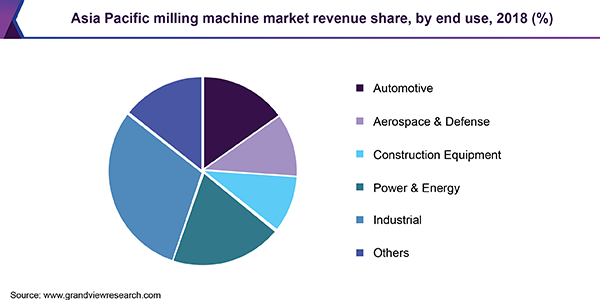

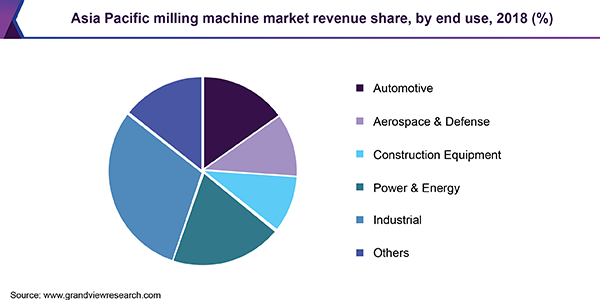

On the basis of end-use, the market has been segmented into automotive, aerospace & defense, construction equipment, power & energy, industrial, and others. The industrial segment dominated the market in 2018 owing to the extensive use of horizontal milling machines for result-driven operations. The growing demand for the mass production of a variety of goods such as consumer electronics, automobiles, and household appliances is also expected to drive the growth of the industrial segment.

The automotive segment is expected to register the highest CAGR over the forecast period in line with the rising preference of OEMs to metal parts with precise cuts. The power & energy segment also accounted for a significant share in 2018. The demand for drilling rigs continues to increase as oil & gas exploration companies across the globe embark upon new drilling projects. At the same time, power companies continue to invest in new technologies such as wind power in line with the growing emphasis on renewable energy. The specific components required for these steadily expanding application areas are machined using high-precision machine tools, which is expected to drive the demand for milling machines in the power sector in the near future.

Regional Insights

Asia Pacific dominated the market in 2018 owing to the rising adoption of metal cutting processes in the region. Given that Asia Pacific is home to some of the key market companies in the milling machine industry, it is anticipated to continue dominating the global market over the forecast period. Government initiatives such as the Government of India’s ‘Make in India’ and ‘Skill India’ are also expected to drive the demand for machine tools in the region.

Europe accounted for a substantial share in 2018 owing to an aggressive adoption of milling machines by the automotive manufacturers in the region. While Europe is home to several automotive manufacturers, multi-tasking machines are also being adopted by companies in the rail industry in some European countries, such as Germany, France, and the U.K. The growth of the regional market can also be attributed to the growing energy sector and the subsequent growth in demand for parts such as turbines and motors, which need to be machined with using high-precision tools.

Key Companies & Market Share Insights

Some of the key vendors active in the market are AMADA CO., LTD.; Amera Seiki; DATRON Dynamics, Inc.; DMG MORI CO., LTD.; Haas Automation, Inc.; FANUC CORPORATION; Okuma Corporation; Shenyang Machine Tool Co., Ltd.; Hurco Companies, Inc.; Dalian Machine Tool Group Corporation (DMTG); and Yamazaki Mazak Corporation; among others. These industry participants are trying to gain a competitive edge over their rivals by launching innovative products. For instance, Okuma Corporation of Japan introduced MU-8000V LASER EX, a new multitasking machining center that employs the laser metal deposition technology to deliver unique cutting abilities in many different shapes and sizes.

Market players are also adopting different strategies such as mergers & acquisitions, partnerships, and collaborations to expand their product portfolios. Prominent players are particularly emphasizing on collaborating with companies offering advanced systems and components in order to integrate cutting-edge technologies into their products. For instance, in April 2017, Dalian Machine Tool Group Corporation of China and Gazdevice of Russia established a joint venture in Russia in Moskovskaya Oblast for manufacturing high-precision machine tools.

Milling Machine Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2020

|

USD 71.6 billion

|

|

Revenue forecast in 2025

|

USD 100.9 billion

|

|

Growth Rate

|

CAGR of 7.0% from 2019 to 2025

|

|

Base year for estimation

|

2018

|

|

Historical data

|

2014 - 2017

|

|

Forecast period

|

2019 - 2025

|

|

Quantitative units

|

Revenue in USD billion and CAGR from 2019 to 2025

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Type, end use, and region.

|

|

Regional scope

|

North America; Europe; Asia Pacific; South America; Middle East & Africa

|

|

Country scope

|

U.S.; Canada; Germany; Italy; France; India; Japan; China; Brazil; Mexico.

|

|

Key companies profiled

|

AMADA CO., LTD.; Amera Seiki; DATRON Dynamics, Inc.; DMG MORI CO., LTD.; Haas Automation, Inc.; FANUC CORPORATION; Okuma Corporation; Shenyang Machine Tool Co., Ltd.; Hurco Companies, Inc.; Dalian Machine Tool Group Corporation (DMTG); and Yamazaki Mazak Corporation..

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

Segments covered in the report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the global milling machine market report based on type, end-use, and region.

-

Type Outlook (Revenue, USD Million, 2014 - 2025)

-

End-Use Outlook (Revenue, USD Million, 2014 - 2025)

-

Automotive

-

Aerospace & Defense

-

Construction Equipment

-

Power & Energy

-

Industrial

-

Others

-

Region Outlook (Revenue, USD Million, 2014 - 2025)

-

North America

-

Europe

-

Asia Pacific

-

Latin America

-

MEA