- Home

- »

- Pharmaceuticals

- »

-

Mineral Supplements Market Size And Share Report, 2030GVR Report cover

![Mineral Supplements Market Size, Share & Trends Report]()

Mineral Supplements Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Calcium, Magnesium), By End-use, By Formulation, By Application, By Sales Channel, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-202-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Mineral Supplements Market Size & Trends

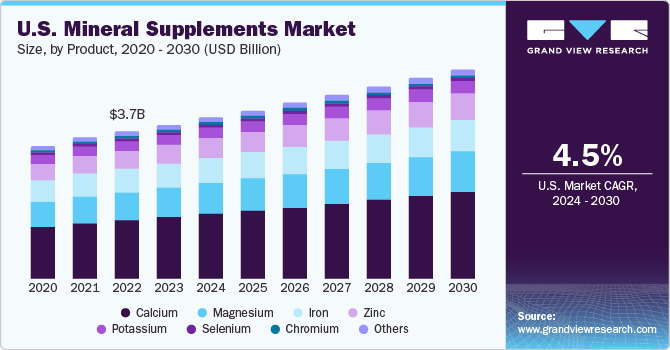

The global mineral supplements market size was estimated at USD 16.08 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 5.9% from 2024 to 2030. The growing adoption of mineral supplements to manage chronic conditions cancer, osteoporosis, anemia, and osteoporosis is anticipated to drive the market. Pharmaceutical giants are conducting public campaigns to encourage people to adopt healthy habits and increase their intake of supplements.

For instance, in February 2023, Torrent Pharmaceuticals Ltd revealed its television campaign named #BeShelcalStrong. The program focuses on increasing awareness regarding calcium deficiencies and their effects on daily life.

The growing geriatric population worldwide has sparked a notable surge in the market. With longer life expectancies, the elderly population is seeking ways to maintain optimal health and combat age-related deficiencies. This demographic shift has increased the awareness and adoption of mineral supplements, driving market expansion. Ageing individuals experience reduced absorption and utilization of essential minerals due to age-related physiological changes. As a result, there's a higher demand for calcium, magnesium, zinc, and other vital minerals crucial for bone health, cognitive function, and immune support. In additional, age-related conditions like osteoporosis, arthritis, and cognitive decline have prompted a proactive approach toward preventive healthcare among seniors. Mineral supplements, recommended by healthcare professionals, play a pivotal role in managing these conditions, further propelling market growth.

Moreover, advancements in formulation technologies have led to the development of specialized mineral supplements tailored to meet the unique nutritional needs of the aging population. This targeted approach has resonated well, boosting consumer confidence and fueling market expansion. The combination of a burgeoning elderly population seeking improved health outcomes and an increasing focus on preventive healthcare has created a conducive environment for the continual growth of the mineral supplements. As the demographic trend persists, the market is expected to show sustained expansion, catering to the evolving needs of the aging population.

The COVID-19 pandemic brought substantial shifts to the mineral supplements. Initially, panic buying, and heightened health concerns led to a surge in supplement purchases which are believed to support immune health. Consumers sought preventive measures, triggering a rapid uptick in sales during the pandemic's onset. However, the market experienced fluctuations as the pandemic evolved. Disruptions in supply chains, production, and distribution posed challenges. Lockdowns, restrictions, and economic uncertainties affected consumer spending habits. Despite initial spikes, some segments saw a decline in sales due to financial constraints and shifts in priorities. Moreover, shifting consumer behaviors impacted sales patterns. With increased focus on overall wellness, there was a sustained interest in supplements supporting immunity, energy, and stress relief. Consequently, mineral supplements addressing these needs remained resilient in the market.

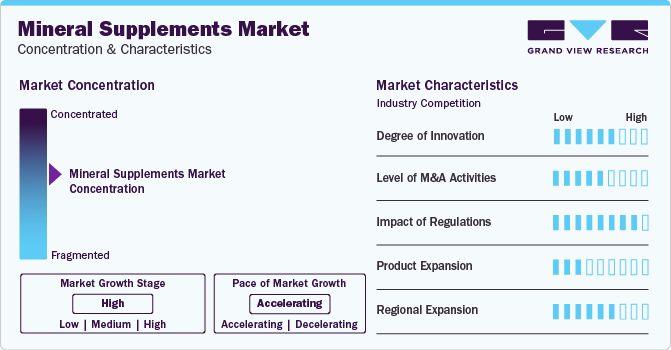

Market Concentration & Characteristics

The market has seen steady growth over the years; with the growing competition in the market, there is a need for innovation to stand out among the competitors. One of the innovative approaches to this market is personalized supplements. With advancements in technology, companies can create personalized supplements based on an individual's genetic makeup, lifestyle, and health goals. This approach ensures that consumers get the specific minerals they need in the right dosage, which can lead to better health outcomes.

Mergers and acquisitions in the market are transformative circumstances that shape the industry's revolution—the impacts influencing market structure, innovation, competition, and global market reach. Companies engaged in M&A activities must navigate these changes strategically to capitalize and create a sustainable and competitive presence in the evolving landscape of the market.

Regulations play a crucial role in shaping the market. Governments implement regulations to ensure that the products sold in the market are safe for consumption, accurately labeled, and meet specific quality standards. Compliance with these regulations can have a significant impact on the market, affecting the demand for products and the profitability of companies.

Several natural food sources can provide the necessary minerals instead of relying on supplements. Foods such as leafy greens, nuts, seeds, fish, and lean meats are all great sources of minerals. In additional, some fortified foods like cereals and dairy products can also help meet daily mineral needs. The availability of these natural sources of minerals can affect the mineral supplements as consumers choose natural sources instead of supplements. This can result in a decrease in demand for mineral supplements.

The regional expansion in the global market presents opportunities and challenges for players in the market. While established players have a significant advantage over new entrants, the market remains open for innovative and agile companies to capture a share of the growing demand for mineral supplements.

Product Insights

Based on the product, the calcium segment led the market in 2023 with the largest revenue share of 41.9%. The demand for calcium supplements is growing in the fitness industry due to various factors. Consumption of calcium supplements on regular basis helps maintain bone strength which is essential for heavy weightlifting. Regular exercise and physical activity put pressure on the skeletal system. Calcium plays a critical role in maintaining strong bones and preventing conditions, such as stress fractures, that are common among athletes and fitness enthusiasts. As individuals are gaining awareness about the importance of bone health in supporting their fitness goals, the demand for calcium supplements is expected to increase.

Zinc segment is expected to grow at significant CAGR over the forecast period. The zinc supplement demand has experienced significant growth in the past few years. Zinc is an essential mineral that plays a crucial role in immune function, protein synthesis, and cell growth. As people are becoming more health conscious, there is a growing recognition of the importance of zinc in supporting overall well-being and immune system health. Moreover, research has shown the potential benefits of zinc supplementation in supporting immune function and reducing the duration & severity of common cold symptoms. These findings are expected to fuel the demand for zinc, contributing to market growth.

Formulation Insights

Based on the formulation, the tablet segment led the market in 2023 with a largest revenue share of 35.4%. The tablets are preferred owing to their extended shelf-life and easy packaging. These formulations are gaining traction owing to their cost-effectiveness and easy packaging techniques. In addition, the availability of tablets in various forms, such as enteric coated, chewable, sublingual & buccal, effervescent, and sustained release, is further driving the segment's growth.

The liquid/gel segment is expected to grow a lucrative CAGR over the forecast period. The increasing number of product launches of mineral liquids along with ease of administration of liquid forms in children is expected to drive the segment growth in the forecast period. For instance, in March 2023, Vestige launched Concentrated Mineral Drops which is a sea mineral supplement. The product has been approved by American Vegetarian Association for consumption.

Application Insights

Based on the application, the general health segment led the market in 2023 with the largest revenue share of 40.4%, and it expected to grow at fastest CAGR over the forecast period. Growing interest in proactive health management and preventive care is the prime reason for the segment growth. Mineral supplements are in high demand for general health due to their essential roles in various bodily functions. Minerals are vital for enzyme function, bone health, immune support, energy production, and overall well-being. Despite efforts to obtain minerals from diet alone, modern lifestyles, dietary restrictions, soil depletion, and specific health conditions can lead to deficiencies.

The bone & joint health segment is expected to grow at significant CAGR over the forecast period owing to increase in personalized cancer treatments. Rising calcium deficiencies among teenagers and women are the major reason for the increased consumption of mineral supplements for bone & joint health. With the global population aging, there is a growing concern for maintaining good bone and joint health. Older people are more susceptible to conditions like arthritis and osteoporosis, which can result in weakened bones and joint discomfort. As a result, supplements that aid in bone density and joint function have become popular in tackling these issues.

End-use Insights

Based on the end-use, the adult segment led the market with the largest revenue share of 47.8% in 2023. Increasing mineral deficiencies along with a high prevalence of calcium deficiency in working women is the major reason for the segment growth. Adults follow specific dietary patterns such as veganism, vegetarianism, or gluten-free diets, which can pose challenges in meeting certain mineral requirements. In such cases, mineral supplements can help ensure an adequate intake. Moreover, as people age, the body’s ability to absorb and utilize minerals decrease, leading to a greater need for supplementation to maintain optimal health. Chronic stress, environmental pollutants, and hectic schedules further deplete nutrient stores, prompting adults to seek supplements for immune support, energy, and overall well-being.

The geriatric segment is expected to grow significant CAGR over the forecast period. The population aged 65 and above is growing rapidly. This demographic shift represents more individuals entering age groups with higher demand for mineral supplements due to decreased absorption and utilization and increased prevalence of chronic diseases. These factors are expected to support market growth.

Sales Channel Insights

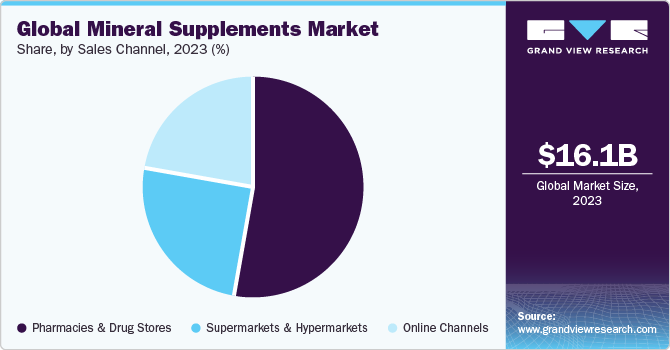

Based on the sales channel, the pharmacies & drug stores segment led the market in 2023 with a largest revenue share of 53.0%, due to the accessibility, trust, and healthcare integration offered by these outlets. With diverse offerings, these stores cater to various health needs and preferences, accommodating specific formulations or combinations tailored to individual requirements. Moreover, as preventive health measures gain traction, consumers actively seek supplements to support their well-being, finding these stores reliable sources for their nutritional needs. Through marketing strategies and loyalty programs, pharmacies and drug stores effectively attract and retain consumers, contributing to the escalating sales of mineral supplements through this retail channel.

The online channels segment is expected to grow at the fastest CAGR over the forecast period. The advent of online pharmacies, along with an increasing number of mobile platforms supplying OTC supplements, is the major reason for the segment growth. Online platforms provide access to various supplement brands and products, often more extensive than what is available in local stores. This allows customers to find specific supplements or explore new options that may not be readily accessible offline. Over time, consumers have become more comfortable with online shopping and have developed trust in reputable online retailers. Secure payment gateways, reliable customer reviews, and return policies have helped build confidence in purchasing supplements online.

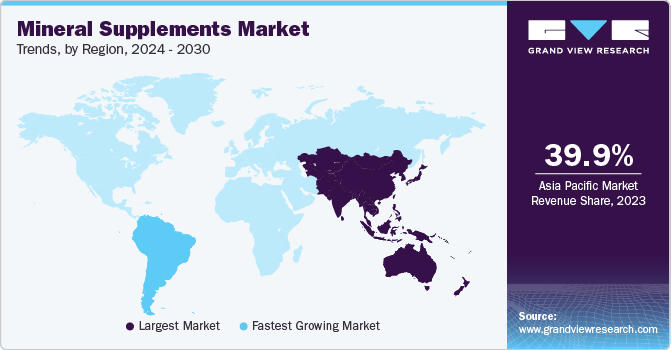

Regional Insights

Asia Pacific dominated the market with the revenue share of 39.96% share in 2023. The key factors that contributed to the growth are the high prevalence of chronic diseases, the growing geriatric population, the presence of a large number of market players, and emerging contract manufacturing hubs, in countries like the Philippines, India, and China. China is one of major country with highest market share in 2023. Due to its large population, increasing health awareness, and a growing middle class with higher disposable income. In addition, Chinese government has implemented policies to promote the development of the mineral supplement industry, providing additional support for the growth of this market. Moreover, e-commerce platforms revolutionized the distribution & sales of supplements in China, providing a convenient and accessible platform for consumers and offering brand opportunities to reach a wide customer base.

Latin America is expected to grow with fastest CAGR during the forecast period. Brazil holds market share in 2023. Brazil holds a major share in the region. Brazil is rich in natural resources, which has helped to promote the production of mineral supplements in the country. The country invests in research and development in the agricultural and pharmaceutical sectors, leading to innovations in the formulation and production of mineral supplements. This contributes to the competitiveness of Brazilian products in the market. As per the WHO, Brazil allocates 8.2% of its Gross Domestic Product (GDP) towards health expenditure, with private spending accounting for 4.4% and public spending accounting for 3.8%.

Key Companies & Market Share Insights

Some of the leading players in the market include Sanofi, Glanbia, plc, Abbott, Nestle, Amway, Bayer AG. Different strategies are taken by the players to strengthen their market positions. Companies are involved in expanding their market presence by signing agreements with other players in emerging economies. Product launch is another strategy adopted by these companies to grow their business.

Emerging players such as Biovea, Herbalife International of America, Inc., Omega Protein Corporation, Bio Botanica, Inc., Pharmavite LLC are taking different strategic initiatives such as collaborations & partnerships with key participants and other players in the industry to enhance their presence. Capturing niche areas of supply chain, such as distribution and delivery of products & solutions, to establish themselves.

Key Mineral Supplements Companies:

- Glanbia, plc.

- Abbott

- Nestle

- Biovea

- Herbalife International of America, Inc.

- Sanofi

- Amway

- Bayer AG

- Omega Protein Corporation

- Bio Botanica, Inc.

- Pharmavite LLC

- DSM

- Nu Skin

Recent Developments

-

In September 2023, Sanofi acquired the U.S.-based health & wellness brand Qunol. Qunol offers mineral supplements. This acquisition is intended to support Sanofi's consumer healthcare segment business

-

In April 2023, Pharmavite announced the opening of a new 225,000-square-foot manufacturing facility in the U.S. This facility is expected to support two brands of the company: Nature Made and MegaFood. Nature Made offers mineral supplements

-

In March 2023, Optimum Nutrition, a Glanbia PLC sports nutrition brand, partnered with the Gaelic Players Association for a 3-year period. Through this collaboration, the brand is offering its nutritional products to adult players. Optimum Nutrition offers mineral supplements. Thus, such collaboration can boost the demand for mineral supplements

Mineral Supplements Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 17.02 billion

Revenue forecast in 2030

USD 23.99 billion

Growth rate

CAGR of 5.9% from 2024 to 2030

Actual Data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, formulation, application, end-use, sales channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Germany; U.K.; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico, Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

Glanbia, plc.; Abbott; Nestle; Biovea; Herbalife International of America, Inc.; Sanofi; Amway; Bayer AG; Omega Protein Corporation; Bio Botanica, Inc.; Pharmavite LLC; DSM; Nu Skin

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Mineral Supplements Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global mineral supplements market report based on product, disease, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Calcium

-

Magnesium

-

Iron

-

Potassium

-

Zinc

-

Chromium

-

Selenium

-

Others

-

-

Formulation Outlook (Revenue, USD Billion, 2018 - 2030)

-

Capsule

-

Tablet

-

Powder

-

Liquid/Gel

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

General Health

-

Bone & Joint health

-

Gastrointestinal Health

-

Immunity

-

Others

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Adults

-

Geriatric

-

Pregnant Women

-

Children

-

Infants

-

-

Sales Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Pharmacies & Drug Stores

-

Supermarkets & Hypermarkets

-

Online Channels

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

Kuwait

-

UAE

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global mineral supplements market size was estimated at USD 16.08 billion in 2023 and is expected to reach USD 17.02 billion in 2024.

b. The global mineral supplements market is expected to grow at a compound annual growth rate of 5.9 % from 2024 to 2030 to reach USD 23.99 billion by 2030.

b. The calcium segment dominated the mineral supplements market with a share of 41.9% in 2023. This is attributable to the growing prevalence of osteoporosis is one of the significant factors that boost the segment growth.

b. Some key players operating in the mineral supplements market include Abbott; Nestle SA; Amway; Herbalife International of America, Inc.; Glanbia plc; Omega Protein Corporation; Bio Botanica, Inc.; Pharmavite LLC; DSM; Nu Skin.

b. Key factors that are driving the mineral supplements market growth include the rising prevalence of mineral deficiencies, especially calcium, zinc, and iron, and growing awareness regarding health and fitness.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.