- Home

- »

- Clinical Diagnostics

- »

-

Minimal Residual Disease Testing Market Size Report, 2030GVR Report cover

![Minimal Residual Disease Testing Market Size, Share & Trends Report]()

Minimal Residual Disease Testing Market (2025 - 2030) Size, Share & Trends Analysis Report By Technology (NGS, PCR), By Cancer Type (Hematological Malignancy, Solid Tumors), By End-use (Hospitals, Diagnostic Laboratories), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-016-3

- Number of Report Pages: 320

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Minimal Residual Disease Testing Market

The global minimal residual disease testing market size was estimated at USD 2.50 billion in 2024 and is projected to reach USD 4.50 billion by 2030, growing at a CAGR of 10.1% from 2025 to 2030. The market for minimal residual disease (MRD) is driven by rising cancer incidence and prevalence, technological advancements in diagnostic tools, and integration with personalized medicines.

Key Market Trends & Insights

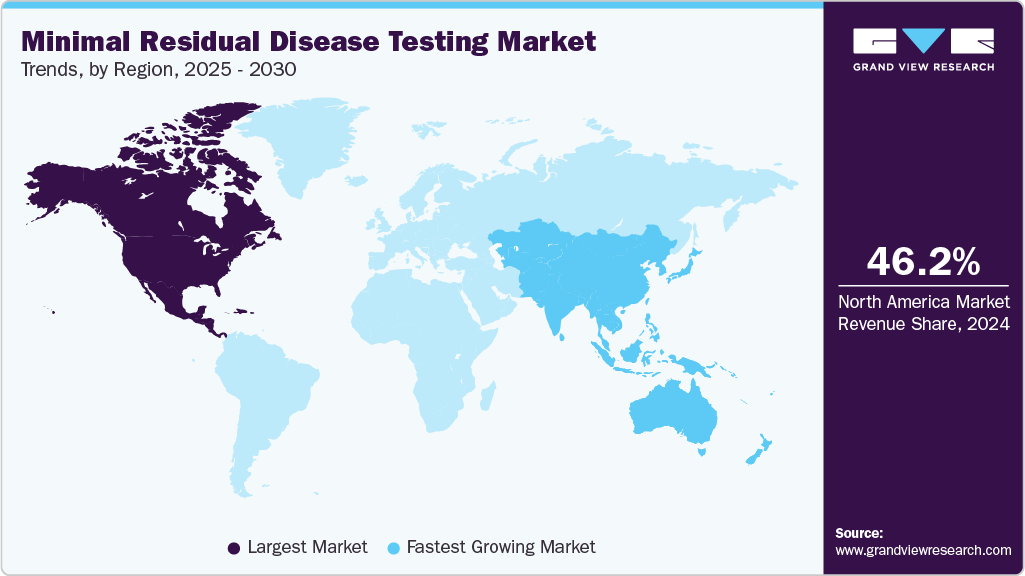

- North America dominated the global market and accounted for a 46.15% revenue share in 2024.

- The U.S. minimal residual disease testing market is expected to grow at a significant CAGR over the forecast period.

- By technology, the flow cytometry segment accounted for the largest revenue share of 41.07% in 2024.

- By cancer type, the hematological malignancy cancer segment held a revenue share of 68.58% in 2024.

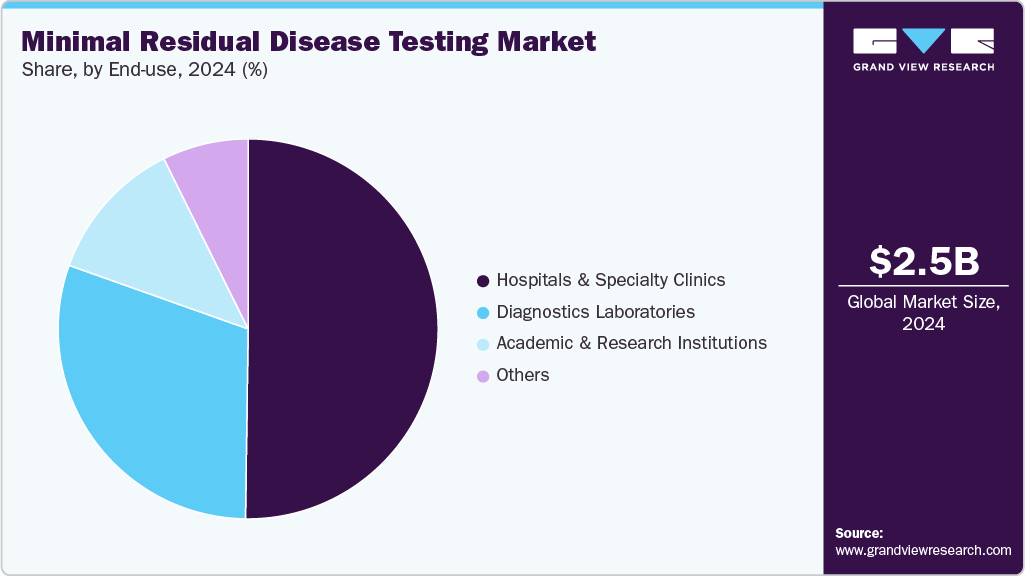

- By end-use, the hospitals and specialty clinics segment accounted for the largest share of 50.23% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.50 Billion

- 2030 Projected Market Size: USD 4.50 Billion

- CAGR (2025-2030): 10.1%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

For instance, according to the National Cancer Institute, approximately 2,041,910 new cancer cases will be diagnosed in the United States in 2025, and 618,120 people are expected to die from the disease. The increasing global burden of cancer, particularly hematological malignancies such as leukemia, lymphoma, and multiple myeloma, is a critical driver for the MRD testing market growth. Rising cancer cases due to aging populations, lifestyle factors, and improved diagnostic rates, the demand for sensitive monitoring tools has intensified. The chart below illustrates the projected number of cancer cases and deaths in the United States for the year 2025.

MRD testing plays a crucial role in detecting residual cancer cells after treatment, allowing for early intervention before a complete relapse occurs. This capability enhances patient outcomes and survival rates. As awareness of cancer prevalence grows among healthcare providers and patients, the adoption of MRD testing in clinical practice expands, driving market growth globally.

Fig.1 Projected Cancer Cases and Deaths in the U.S for 2025

Cancer Type

Cases

Deaths

All sites

2,041,910

618,120

Breast

319,750

42,680

Digestive system

362,200

174,520

Genital system

444,610

71,510

Leukemia

66,890

23,540

Respiratory system

245,700

130,200

Leukemia

66,890

23,540

Lymphoma

89,070

20,540

Myeloma

36,110

12,030

Other and unspecified primary sites

37,370

53,220

Source: American Cancer Society, United States.

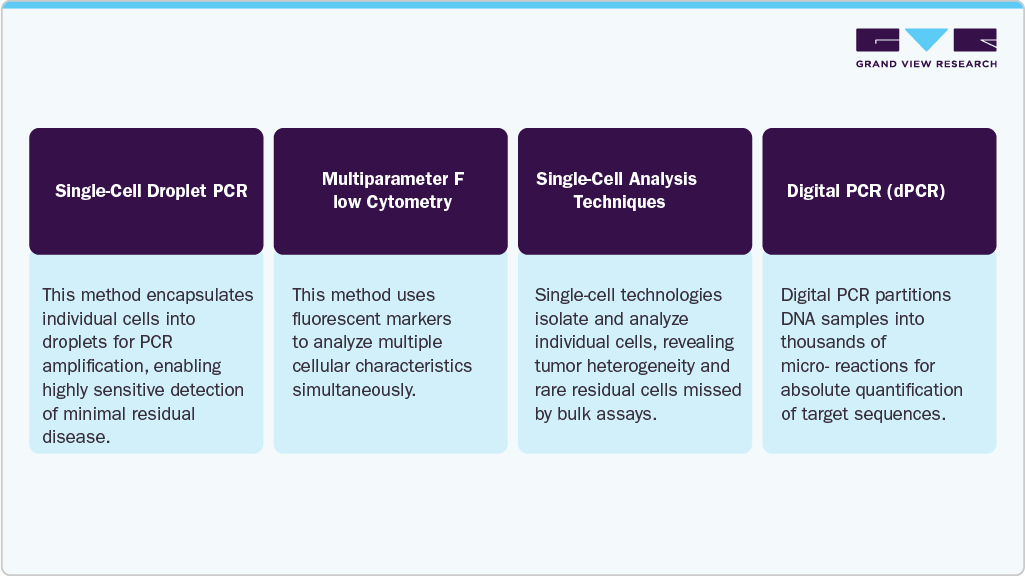

Rapid technological innovations significantly drive the minimal residual disease testing industry. Advanced molecular diagnostic techniques such as Next-Generation Sequencing (NGS), digital PCR, and multiparameter flow cytometry have dramatically enhanced the sensitivity and accuracy of detecting minimal residual disease. Some of the technological advancements are illustrated in the figure below:

Enhanced precision in MRD testing facilitates better patient monitoring and treatment adjustments. Continuous improvements in automation and data analysis further streamline testing processes, making MRD assays more reliable and accessible, which drives global market adoption.

Personalized medicine is transforming cancer care by tailoring treatments according to individual molecular profiles. MRD testing integrates seamlessly into this approach by offering precise information about unique residual disease levels for each patient. This enables clinicians to customize the intensity of therapy, switch treatments promptly, or avoid overtreatment, optimizing outcomes while minimizing side effects. The growing focus on precision oncology is increasing the use of MRD assays to guide decision-making throughout treatment and remission monitoring. As healthcare systems prioritize personalized care, the demand for MRD testing continues to rise, driving market growth and innovation.

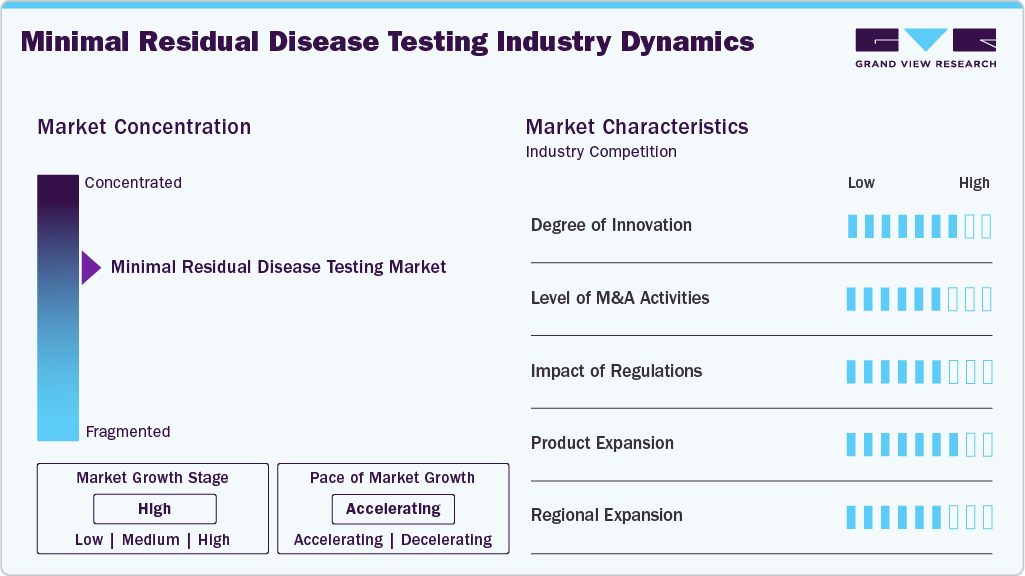

Market Concentration & Characteristics

The minimal residual disease testing market benefits from continuous innovation, including advanced techniques like Next-Generation Sequencing, digital PCR, and single-cell analysis. Ongoing R&D efforts focus on automation and AI integration for enhanced diagnostic capabilities. For instance, in January 2025, Datar Cancer Genetics (DCG) announced the launch of Target-MRD, an advanced minimal residual disease (MRD) monitoring blood test for solid organ cancers. Target-MRD was developed as a blood test based on tumor-agnostic next-generation sequencing (NGS) and a customized, tumor-informed droplet digital PCR (dd-PCR) assay.

The MDR testing market is characterized by significant mergers and acquisitions (M&A), as companies seek to expand their product portfolios and technological capabilities. Strategic partnerships and acquisitions facilitate rapid access to innovative platforms, increase market reach, and enhance competitiveness. For instance, in April 2025, Hartwig and Ultima Genomics teamed up to reduce costs for whole-genome cancer profiling, minimal residual disease testing, and large-scale genetic data generation. Their partnership aimed to make advanced genomic technologies more affordable and accessible, with the goal of improving cancer diagnostics and personalized treatment through enhanced genetic analysis.

Regulatory approvals play a crucial role in shaping the minimal residual disease testing market. Authorities like the FDA impose rigorous standards to ensure test accuracy and patient safety. Minimal Residual Disease (MRD) has emerged as an important endpoint for accelerated drug approvals, particularly in hematologic cancers such as multiple myeloma and acute lymphoblastic leukemia (ALL). The FDA's Oncologic Drug Advisory Committee (ODAC) has recognized minimal residual disease (MRD) as a legitimate surrogate endpoint for the accelerated approval of multiple myeloma, as stated in a May 2025 article. Expanding regulatory recognition of MRD assays in treatment protocols enhances market adoption and reimbursement opportunities.

Manufacturers continuously expand their MRD testing offerings by developing assays for various hematologic malignancies and solid tumors. Innovations focus on enhancing test sensitivity, reducing turnaround time, and enabling multiplexing. For example, in May 2024, Tempus announced the clinical launch of its MRD testing portfolio, including the xM MRD and NeXT Personal Dx tests. These tests are designed to detect residual disease or early cancer recurrence and to monitor responses to immunotherapy, providing critical insights to guide patient management.

Market players are increasingly targeting emerging regions such as Asia Pacific and Latin America, where rising cancer prevalence and improving healthcare infrastructure create growth opportunities. Localization of products, collaborations with regional healthcare providers, and awareness programs are key strategies to drive MRD testing adoption and expand the global market footprint.

Technology Insights

The flow cytometry segment accounted for the largest revenue share of 41.07% in 2024, driven by its rapid and precise detection capabilities. This technology identifies abnormal cells by analyzing multiple cellular markers simultaneously, enabling clinicians to detect residual cancer cells even at very low levels. Its high sensitivity and specificity make it particularly valuable in monitoring hematological malignancies such as leukemia and lymphoma. Moreover, flow cytometry is widely available in clinical laboratories, providing cost-effective and standardized testing. The ability to deliver quick results supports timely treatment decisions, contributing to improved patient outcomes and fostering strong demand for flow cytometry-based MRD testing globally.

The polymerase chain reaction (PCR) technology is the fastest-growing segment in the minimal residual disease (MRD) testing market. PCR offers exceptional sensitivity and specificity by amplifying targeted DNA or RNA sequences, enabling the detection of even minute amounts of residual cancer cells. Techniques such as quantitative PCR (qPCR) and droplet digital PCR (ddPCR) provide precise quantification of disease markers, making them essential for monitoring treatment response and detecting early relapse. PCR-based MRD testing is widely adopted due to its rapid turnaround time and ability to deliver accurate results, which support timely clinical decisions and personalized treatment strategies in hematologic cancers.

Cancer Type Insights

Hematological malignancy cancer dominated the market with a revenue share of 68.58% in 2024 and is the fastest-growing segment, driven by the high prevalence of blood cancers such as leukemia, lymphoma, and multiple myeloma. MRD testing plays a critical role in these cancers by detecting residual malignant cells. Advancements in technologies like next-generation sequencing (NGS) and droplet digital PCR (ddPCR) have improved the sensitivity and accuracy of MRD detection, enabling earlier identification of residual disease and enhanced monitoring of treatment responses. At the 2025 American Association for Cancer Research (AACR) Annual Meeting, experts highlighted significant advancements in minimal residual disease (MRD) testing for hematologic malignancies, underscoring the need for standardized methodologies and the integration of novel technologies.

Detecting minimal residual disease (MRD), the small number of cancer cells that remain after treatment, is crucial for assessing relapse risk and guiding further therapy. MRD detection enables personalized treatment decisions, including therapy intensification or de-escalation, improving patient outcomes. As MRD becomes an essential biomarker in hematological cancers, its integration into clinical practice supports early intervention and long-term disease monitoring.

End-use Insights

The hospitals and specialty clinics segment accounted for the largest share of 50.23% in 2024, due to their advanced diagnostic capabilities and access to specialized healthcare professionals. These facilities are equipped with cutting-edge technologies such as flow cytometry, PCR, and next-generation sequencing, enabling precise MRD detection. Moreover, hospitals and specialty clinics offer integrated patient care, combining MRD testing with treatment and monitoring, which is essential for managing hematologic malignancies. Their capacity to provide comprehensive services and timely results makes them the preferred choice for MRD testing, driving their dominance and sustained growth in the market.

The diagnostic laboratories is emerging as the fastest-growing segment in the minimal residual disease (MRD) testing market. This growth is driven by an increasing demand for high-sensitivity testing, advanced molecular diagnostics, and early relapse detection in hematological malignancies. Diagnostic labs are well-equipped with next-generation sequencing (NGS), digital PCR, and flow cytometry platforms, enabling them to offer precise and standardized MRD assessments. Their scalability, cost-effectiveness, and capacity to handle high testing volumes make them ideal partners for hospitals and oncology centers. As precision medicine gains momentum, diagnostic labs play a pivotal role in delivering reliable MRD insights for treatment planning.

Regional Insights

North America dominated the minimal residual disease testing market and accounted for a 46.15% revenue share in 2024. This dominance is attributed to advanced healthcare infrastructure, high adoption of MRD testing technologies, and a strong presence of key industry players. Strategic collaborations, such as in December 2024, Personalis and Tempus expanded their collaboration to include the biopharmaceutical sector, enabling Tempus to offer Personalis' ultra-sensitive tumor-informed minimal residual disease (MRD) test, NeXT Personal Dx, to pharmaceutical and biotech companies.

U.S. Minimal Residual Disease Testing Market Trends

The U.S. leads the minimal residual disease testing industry, which is growing significantly due to rising cancer incidences and an increase in partnerships and collaborations. For example, in January 2025, Adaptive Biotechnologies and NeoGenomics partnered to integrate Adaptive's FDA-cleared clonoSEQ MRD test with NeoGenomics' COMPASS and CHART services, enabling comprehensive tracking of minimal residual disease (MRD) in cancers such as multiple myeloma, chronic lymphocytic leukemia, B-cell acute lymphoblastic leukemia, and diffuse large B-cell lymphoma.

Europe Minimal Residual Disease Testing Market Trends

The Europe minimal residual disease testing industry is expanding, fueled by increased awareness, advancements in diagnostic technologies, and the growing adoption of MRD testing in clinical settings. Countries such as Germany, France, and the UK are at the forefront of the regional market, with Germany anticipated to maintain its leading position. Collaborations and partnerships are increasing in these regions.

The UK minimal residual disease testing market is expanding, driven by advancements in next-generation sequencing (NGS), polymerase chain reaction (PCR), and flow cytometry technologies. These innovations enhance detection sensitivity and monitoring capabilities. The increasing adoption of precision medicine and early cancer detection further accelerates market growth. As the demand for personalized oncology care rises, the UK's MRD testing market is positioned for continued expansion.

The minimal residual disease testing market in Germany is experiencing significant growth, driven by advancements in next-generation sequencing (NGS), polymerase chain reaction (PCR), and flow cytometry technologies. Collaborations, such as in August 2022, Exact Sciences Corp. announced that it has entered into a collaboration agreement with the West German Study Group (WSG), an international research organization specializing in practice-changing clinical studies in breast cancer, to streamline clinical workflows.

Asia Pacific Minimal Residual Disease Testing Market Trends

Asia Pacific is expected to be the fastest-growing segment in the minimal residual testing industry at a CAGR of 11.4% over the forecast period. The market is anticipated to witness significant growth driven by increasing cancer incidence and technological advancements. Some players include Illumina, Roche, Sysmex, and Natera. Technological innovations, such as multi-parameter flow cytometry and digital PCR, are enhancing test sensitivity and early detection capabilities. Collaborations and strategic partnerships are further accelerating the adoption of MRD testing across the region.

The China minimal residual disease testing market held a substantial revenue share in 2024. The market is advancing due to government support for precision medicine. Companies such as Genetron Health, Hotgen Biotech, and Prenetics have a presence in China. Innovations in liquid biopsy and digital PCR are enhancing test sensitivity and accessibility. Strategic collaborations and infrastructure development further propel market growth.

The minimal residual disease testing market in Japan is progressing moderately, reflecting a preference for high-precision diagnostic solutions. Innovations in liquid biopsy and digital PCR are improving test sensitivity and accessibility. The Japan Society of Clinical Oncology has established guidelines to standardize MRD testing, promoting its integration into clinical practice.

Latin America Minimal Residual Disease Testing Market Trends

Latin America's minimal residual disease testing industry is experiencing significant growth, driven by rising healthcare investments and improving technologies. Technological advancements such as next-generation sequencing (NGS) and polymerase chain reaction (PCR) are enhancing test sensitivity and early detection capabilities. However, challenges like limited reimbursement and access to advanced diagnostics in certain areas may impact market expansion.

The minimal residual disease testing market in Brazil is growing rapidly over the forecast period. Major global players active in Brazil include Roche, Illumina, Exact Sciences, and Qiagen, contributing to a competitive market landscape driven by innovation and personalized medicine trends.

Middle East & Africa Minimal Residual Disease Testing Market Trends

The Middle East and Africa (MEA) minimal residual disease testing industry is poised for growth over the forecast period. Advancements in diagnostic technologies and increasing cancer awareness are driving market expansion.

The Saudi Arabia minimal residual disease testing market is experiencing robust growth. Some of the players include Exact Sciences, Illumina, Natera, Guardant Health, Roche, Foundation Medicine, Qiagen, Veracyte, MDxHealth, and Bio-Techne. Technological innovations such as digital PCR and liquid biopsy are enhancing test sensitivity and early detection capabilities. Collaborations and strategic partnerships are further accelerating the adoption of MRD testing in the region.

Key Minimal Residual Disease Testing Company Insights

The minimal residual disease testing market is led by key companies such as Exact Sciences Corporation and GRAIL, LLC. Adaptive Biotechnologies dominates with its FDA-approved ClonoSEQ assay, widely used in hematologic cancers. Roche and Thermo Fisher leverage advanced NGS and PCR technologies to maintain significant market shares, supported by their global reach and strong R&D. The market is fragmented but rapidly growing, with NGS-based testing gaining prominence due to higher sensitivity.

Key Minimal Residual Disease Testing Companies:

The following are the leading companies in the minimal residual disease testing market. These companies collectively hold the largest market share and dictate industry trends.

- Exact Sciences Corporation

- GRAIL, LLC

- Veracyte, Inc.

- Natera, Inc.

- Guardant Health

- F. Hoffmann-La Roche Ltd

- FOUNDATION MEDICINE, INC.

- QIAGEN

- mdxhealth

- Bio-Techne

Recent Developments

-

In January 2025, NeoGenomics disclosed a multi-year exclusive strategic commercial collaboration with Adaptive Biotechnologies to advance MRD monitoring options for patients with select blood cancers.

-

In January 2025, Foresight Diagnostics announced the inclusion of its ctDNA-MRD testing in the National Comprehensive Cancer Network (NCCN) Guidelines for diffuse large B-cell lymphoma, marking the first-ever inclusion of ctDNA-MRD testing in these guidelines.

-

In January 2024, Allogene Therapeutics and Foresight Diagnostics announced a strategic alliance to develop an in vitro diagnostic for MRD, aimed at evaluating eligibility for the ALPHA3 study in large B-cell lymphoma.

Minimal Residual Disease Testing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.77 billion

Revenue forecast in 2030

USD 4.50 billion

Growth rate

CAGR of 10.1% from 2025 to 2030

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, cancer type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Spain; Italy; Sweden; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Exact Sciences Corporation; GRAIL, LLC; Veracyte, Inc.; Natera, Inc.; Guardant Health; F. Hoffmann-La Roche Ltd; FOUNDATION MEDICINE, INC.; QIAGEN; mdxhealth; Bio-Techne

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Minimal Residual Disease Testing Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global minimal residual disease testing market report based on technology, cancer, end-use, and region:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Flow Cytometry

-

Polymerase Chain Reaction (PCR)

-

Next Generation Sequencing (NGS)

-

-

Others

-

-

Cancer Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Hematological Malignancy

-

Leukemia

-

Lymphoma

-

Solid Tumors

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals and Specialty Clinics

-

Diagnostic Laboratories

-

Academic and Research Institutes

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Spain

-

Italy

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global minimal residual disease testing market size was estimated at USD 2,501.24 million in 2024 and is expected to reach USD 2,773.63 million in 2025.

b. The global minimal residual disease testing market is expected to grow at a compound annual growth rate of 10.1% from 2025 to 2030 to reach USD 4.50 billion by 2030.

b. North America dominated the minimal residual disease testing market with a share of 46.15% in 2024. This is attributable to advanced healthcare infrastructure, high adoption of MRD testing technologies, and a strong presence of key industry players.

b. Some key players operating in the minimal residual disease testing market include Exact Sciences Corporation, GRAIL, LLC, Veracyte, Inc., Natera, Inc., Guardant Health, F. Hoffmann-La Roche Ltd, FOUNDATION MEDICINE, INC., QIAGEN, mdxhealth., and Bio-Techne.

b. Key factors that are driving the market growth include the increasing prevalence of cancer, increasing consumer awareness for therapy, increasing funding for research with an increasing disposable income in emerging economies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.