- Home

- »

- Advanced Interior Materials

- »

-

Mining Equipment Rental Market Size, Industry Report, 2030GVR Report cover

![Mining Equipment Rental Market Size, Share & Trends Report]()

Mining Equipment Rental Market (2025 - 2030) Size, Share & Trends Analysis Report By Equipment (Underground Mining Equipment, Surface Mining Equipment), By Power Output (<500 HP, 500-2000 HP), By Rent Type, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-518-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Mining Equipment Rental Market Summary

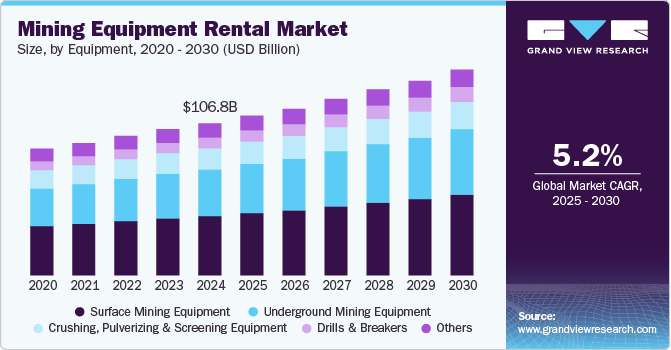

The global mining equipment rental market size was estimated at USD 106.79 billion in 2024 and is projected to reach USD 144.49 billion by 2030, growing at a CAGR of 5.2% from 2025 to 2030. The industry is experiencing significant growth driven by various factors such as cost-effective solutions, technological advancements, and increasing mining activities globally.

Key Market Trends & Insights

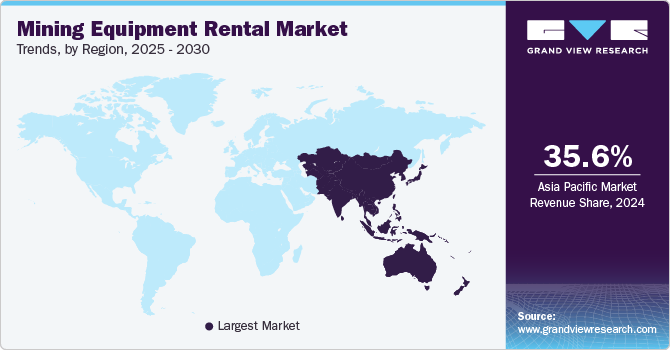

- In terms of region, Asia Pacific was the largest revenue generating market in 2024.

- Country-wise, Australia is expected to register the highest CAGR from 2025 to 2030.

- Based on equipment, the surface mining equipment segment accounted for the largest revenue share of 38.9% of the overall market in 2024.

- Based on power output, the <500 HP segment led the market and accounted for 41.7% of the overall revenue share in 2024.

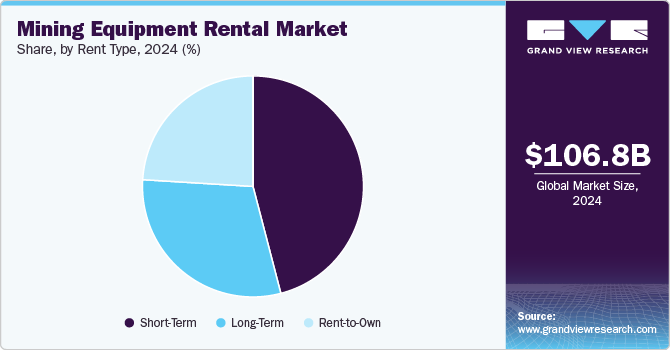

- Based on rent type, the long-term segment dominated the market in 2024, accounting for the largest revenue share of 45.9%

Market Size & Forecast

- 2024 Market Size: USD 106.79 Billion

- 2030 Projected Market Size: USD 144.49 Billion

- CAGR (2025-2030): 5.2%

- Asia Pacific: Largest market in 2024

One of the primary drivers of the mining equipment rental market is the cost savings that come with renting rather than purchasing equipment. Renting allows mining companies to avoid large capital expenditures on expensive machinery, which can be especially beneficial in regions with fluctuating commodity prices. Additionally, rental options provide operational flexibility, allowing companies to scale up or down based on the demand for mining operations.

Growing mining activities in emerging economies like India, China, and Latin America have created opportunities for rental companies to expand their operations. These regions are rich in mineral deposits and are increasing investments in mining infrastructure, boosting demand for equipment rental services.

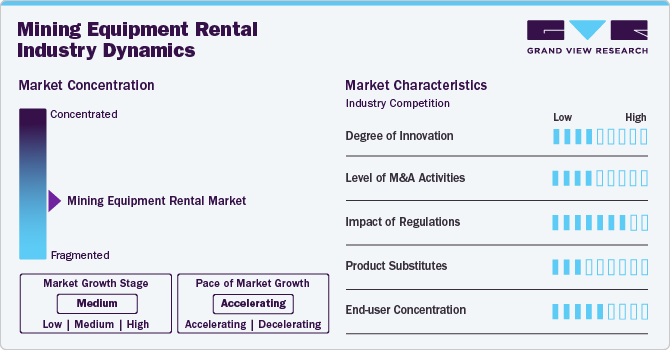

Market Concentration & Characteristics

Environmental regulations and sustainability goals are becoming stricter across the mining industry. Many mining companies are adopting more eco-friendly and energy-efficient equipment to reduce their environmental footprint. Renting these newer, sustainable machines is often a more viable solution than investing in new machinery, especially for short-term projects or projects that require specialized equipment.

The mining industry is gradually shifting toward more sustainable equipment options, including electric and hybrid-powered machinery. Rental companies are investing in electric mining trucks, battery-powered loaders, and other eco-friendly equipment to meet growing demand from mining operations seeking to reduce their carbon emissions.

The integration of digital technologies such as GPS tracking, remote monitoring, and automated machinery is increasingly being seen in mining equipment rentals. Rental companies are leveraging these technologies to enhance machine efficiency, improve fleet management, and provide value-added services to mining clients. Digitalization is also improving maintenance schedules and reducing operational downtimes.

Drivers, Opportunities & Restraints

The rise of EVs is directly tied to the growing demand for key battery metals, such as lithium, cobalt, and nickel, which are predominantly sourced through mining. As demand for these materials surges, mining companies are scaling up their operations to meet the need. To support this, the demand for specialized mining equipment, including drills, loaders, haul trucks, and processing equipment, has increased. Mining equipment rental services are benefiting from this demand, as companies seek to access the necessary machinery without the heavy capital investment of purchasing.

Mining companies are increasingly seeking equipment that offers enhanced safety features and automation capabilities. Autonomous mining trucks, automated drilling rigs, and remote-controlled loaders are gaining traction. As these technologies become more mainstream, rental companies are offering equipment with advanced safety and automation features to attract mining clients.

Increasing global focus on sustainability and green energy is pushing mining companies to adopt environmentally friendly practices. As part of this shift, there is an emphasis on reducing energy consumption and carbon emissions. Rental companies are responding by offering more fuel-efficient and low-emission equipment, ensuring they align with the industry’s sustainability goals.

Equipment Insights

The surface mining equipment segment accounted for the largest revenue share of 38.9% of the overall market in 2024. Surface mining involves the extraction of minerals and ores located close to the earth’s surface. This method includes open-pit mining, strip mining, and mountaintop removal, where large volumes of earth are removed to access the underlying resources.

The underground mining equipment segment is significantly driven by the increasing demand for the extraction of valuable minerals or ores located deep within the earth. Underground mining is benefiting from automation, advanced safety features, and green technologies that cater to the growing demand for precious metals and compliance with stringent environmental regulations.

Power Output Insights

The <500 HP segment led the market and accounted for 41.7% of the overall revenue share in 2024. The segment includes smaller mining machines that are often used for light-duty tasks or operations in confined spaces. These equipment pieces are typically compact, more fuel-efficient, and ideal for operations where less power is needed. The segment growth is attributed to small-scale mining operations or niche sectors, such as gemstone mining or artisanal mining, where only limited resources and lower power are required.

The >2000 HP segment is likely to have opportunistic growth over the forecast period. This equipment encompasses the largest and most powerful mining equipment, typically used for large-scale mining operations in open-pit mines or major extraction projects. These machines are designed for maximum performance, capable of handling high-volume operations and heavy-duty tasks.

Rent Type Insights

The long-term segment dominated the market in 2024, accounting for the largest revenue share of 45.9% of the overall market. Long-term rentals typically involve leasing equipment for extended periods, from several months to several years. This model is common for large-scale mining operations or ongoing projects where equipment is required for continuous use over a longer period.

Short term segment is expected to witness the fastest growth potential over the forecast period. Short-term rentals typically involve leasing mining equipment for a period of a few days to a few months. These rentals are ideal for temporary projects or when mining companies need additional equipment to support specific tasks or seasonal operations. Rent-to-own segment refers to the agreements that allow mining companies to rent equipment with the option to purchase it at the end of the rental period.

Application Insights

The coal mining segment dominated the market in 2024 accounting for the largest revenue share of 40.1% of the overall market. Coal mining involves the extraction of coal for energy production and industrial applications. The equipment used in coal mining ranges from surface mining machinery (for open-pit mining) to underground mining equipment (for deep coal seams).

Metal mining focuses on the extraction of valuable metals such as gold, copper, aluminum, zinc, and other precious and base metals. The equipment required in metal mining is specialized to handle the unique demands of extracting metals from ore, processing them, and ensuring efficiency in the operation.

Regional Insights

North America mining equipment rental market is driven by significant advancements in mining technologies, including autonomous vehicles, smart equipment, and IoT-enabled systems. As mining companies adopt these innovations to improve productivity, safety, and efficiency, they often prefer renting the latest technology instead of purchasing expensive equipment.

U.S. Mining Equipment Rental Market Trends

The mining equipment rental industry in the U.S. is projected to expand at a CAGR of 3.8% over the forecast period. In the U.S., public land leases and resource extraction agreements are common for mining companies. These policies are helping to facilitate access to mineral-rich regions, which in turn drives demand for mining equipment rentals for exploration, drilling, and development work.

Asia Pacific Mining Equipment Rental Market Trends

The mining equipment rental industry in Asia Pacific dominated the global market in 2024, accounting for a global revenue share of 35.6%. The Asia Pacific mining equipment rental market is expected to see continued growth, driven by the region's expanding mining industry and the increasing demand for mining machinery across both traditional and emerging sectors.Australia is likely to remain a strong market for mining equipment rentals due to its robust mining industry, especially in coal, iron ore, and precious metals.

China mining equipment rental industry is projected to expand at a CAGR of 6.3% over the forecast period. China is the world’s largest producer and consumer of coal, as well as a major player in the mining of other critical resources such as gold, copper, iron ore, and rare earth metals. The country’s vast mining operations, coupled with ongoing infrastructure development and technological advancements, have driven the growth of the mining equipment rental market in China.

The mining equipment rental industry in India is expected to grow at a CAGR of 6.4% over the forecast period, fueled by the country’s initiatives. The mining equipment rental market in India is poised for steady growth driven by cost efficiency, regulatory compliance, and the increasing demand for technological advancements.

Europe Mining Equipment Rental Market Trends

The mining equipment rental industry in Europe plays a critical role in the global mining value chain, with the region being home to several major producers of metallic minerals, industrial minerals, and energy resources. The mining equipment rental market in Europe has been growing steadily, driven by technological innovations, the push for sustainability, and increasing demand for cost-effective, flexible equipment solutions.

Germany mining equipment rental industry is projected to expand at a CAGR of 4.4% over the forecast period. Germany remains one of the top producers of coal, salt, and potash in Europe. Despite a growing transition to renewable energy sources, the mining of minerals and aggregates remains vital to the industrial sector. The need for specialized equipment, including excavators, haul trucks, drills, and conveyors, continues to drive demand for equipment rental in Germany.

The mining equipment rental industry in UK is projected to expand at a CAGR of 3.9% over the forecast period. The UK mining equipment rental market is evolving due to a variety of factors, including regulatory pressures, growing demand for technological advancements, and the shift toward sustainability in the mining sector.

Middle East & Africa Mining Equipment Rental Market Trends

The mining equipment rental market in the Middle East and Africa is witnessing significant growth, fueled by increasing demand for minerals, government infrastructure initiatives, and the adoption of sustainable practices.

Saudi Arabia mining equipment rental industry is expected to grow at a CAGR of 6.0% over the forecast period. Saudi Arabia, a leading economic powerhouse in the Middle East, has substantial mineral reserves, including gold, copper, phosphates, and other base metals. The mining sector in the country is undergoing significant transformation as part of the Vision 2030 initiative, which aims to diversify the economy away from oil dependency.

Latin America Mining Equipment Rental Market Trends

The mining equipment rental market in Latin America has witnessed significant growth, fueled by increasing mining activities, the adoption of cost-effective practices, and a focus on sustainability and environmental compliance. Latin America is one of the world’s most resource-rich regions, boasting vast mineral deposits, including copper, gold, silver, lithium, and iron ore. The mining sector plays a vital role in the region’s economic growth, and as such, the demand for mining equipment is a significant contributor to its industrial development.

Brazil mining equipment rental industry is projected to expand at a CAGR of 5.3% over the forecast period. Brazil is home to some of the world's largest mineral deposits, particularly in iron ore, gold, nickel, and bauxite, making the mining sector a key pillar of the economy. With the increasing global demand for these minerals, Brazil’s mining industry is poised for continued growth, which in turn drives the need for specialized mining equipment.

Key Mining Equipment Rental Company Insights

Some of the key players operating in the market include Komatsu Rentals and Caterpillar among others.

-

Komatsu Rental provides a vital service to the mining industry by offering high-quality, reliable, and flexible rental options for mining equipment. With access to Komatsu's extensive fleet of machinery, mining companies can enhance their operational efficiency without the burden of owning large equipment. The rental division ensures that mining businesses can meet the growing demands of their operations while maintaining cost-efficiency and minimizing downtime.

-

Caterpillar’s mining equipment rental services are designed to help mining companies reduce costs while gaining access to the latest and most reliable machinery available. With a wide variety of machines suited for every aspect of mining, from exploration to extraction, Caterpillar provides flexible, high-quality rental options that enable companies to meet the demands of their projects without the capital investment required for purchasing equipment.

Key Mining Equipment Rental Companies:

The following are the leading companies in the mining equipment rental market. These companies collectively hold the largest market share and dictate industry trends.

- United Rentals

- Hertz Equipment Rental

- Caterpillar

- Loxam

- MacAllister Machinery

- Barton & Sons

- Trident Equipment

- Ritchie Bros.

- Epiroc

- Komatsu Rental

- SANY Group

- BOMAG

- Doosan Infracore

- XCMG

- Liebherr

Recent Developments

-

In October 2023, Lou-Tec, a Quebec-based rental company, acquired Torcan Lift Equipment, an Ontario-based provider of aerial lift rentals. This strategic acquisition is part of Lou-Tec's efforts to strengthen and expand its footprint in Ontario.

-

In December 2024, Sumitomo Corporation, via its subsidiary Aver Asia, acquired 100% of the shares of PT. Resource Equipment Indonesia (REL), a company specializing in the rental of large pumps for mining operations in Indonesia.

Mining Equipment Rental Market Report Scope

Report Attribute

Details

Market size in 2025

USD 112.15 billion

Revenue forecast in 2030

USD 144.49 billion

Growth Rate

CAGR of 5.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Equipment, power output, rent type, application, and region

Regional scope

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa

Country Scope

U.S., Canada, Mexico, Germany, UK, Poland, Finland, Sweden

China, India, Japan, South Korea, Australia, Brazil, Argentina, Saudi Arabia, and UAE

Key companies profiled

United Rentals,Hertz Equipment Rental, Caterpillar, Loxam, MacAllister Machinery,Barton & Sons,Trident Equipment, Ritchie Bros., Epiroc, Komatsu Rental, SANY Group, BOMAG, Doosan Infracore, XCMG, and Liebherr

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Mining Equipment Rental Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global mining equipment rental market on the basis of equipment, power output, rent type, application, and region:

-

Equipment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Underground Mining Equipment

-

Surface Mining Equipment

-

Crushing, Pulverizing & Screening Equipment

-

Drills & Breakers

-

Others

-

-

Power Output Outlook (Revenue, USD Billion, 2018 - 2030)

-

<500 HP

-

500-2000 HP

-

>2000 HP

-

-

Rent Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Short-Term

-

Long-Term

-

Rent-to-Own

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Metal Mining

-

Non-metal Mining

-

Coal Mining

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Poland

-

Finland

-

Sweden

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global mining equipment rental market size was estimated at USD 106.79 billion in 2024 and is expected to reach USD 112.15 billion in 2025.

b. The mining equipment rental market, in terms of revenue, is expected to grow at a compound annual growth rate of 5.2% from 2025 to 2030 to reach USD 144.49 billion by 2030.

b. The Asia Pacific dominated the market in 2024 accounting for a global revenue share of 35.6%. The market sees substantial growth due to the increasing mining activities to fulfill the rising demand for minerals, rare earth substances, fossil fuels, etc.

b. Some of the key players operating in the mining equipment rental market are United Rentals, Hertz Equipment Rental, Caterpillar, Loxam, MacAllister Machinery, Barton & Sons, Trident Equipment, Ritchie Bros., Epiroc, Komatsu Rental, SANY Group, BOMAG, Doosan Infracore, XCMG, and Liebherr.

b. Key factors driving the mining equipment rental market include the increasing demand for minerals, technological advancements, the expansion of mining operations, and the push for greater efficiency and sustainability.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.