- Home

- »

- Next Generation Technologies

- »

-

Mixed Reality Headset Market Size & Share Report, 2030GVR Report cover

![Mixed Reality Headset Market Size, Share & Trends Report]()

Mixed Reality Headset Market (2023 - 2030) Size, Share & Trends Analysis Report By Component, By Operating System, By Storage, By Charging Technology, By End-user, By Industry, By Resolution, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-100-3

- Number of Report Pages: 171

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global mixed reality headset market size was estimated at USD 2.89 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 29.1% from 2023 to 2030. The demand for mixed reality headset devices is expected to reach 13.2 million units by 2030. The growth can be credited to the increasing prominence of immersive experiences not only in the entertainment domain but also in several other industrial applications. Mixed reality brings the digital world close to the real one allowing users to interact as well as manipulate the physical and virtual environments through next-generation imaging and sensing technologies. Ongoing technological developments, such as advancements in display technology, sensors, and processing power are significantly driving the growth of the mixed reality headset industry. Higher resolution displays, wider field-of-view, enhanced tracking, and improved graphics contribute to a more immersive and realistic mixed-reality experience.

Moreover, the enhanced user experiences offered by this technology are driving the growth of the mixed reality industry. The mixed-reality headsets offer engaging user experiences combining virtual content and the real world, creating entertainment, gaming, training, education, design, and collaboration opportunities.

The inclination of consumers toward mixed reality is urging the leading tech companies to enhance their offerings and deliver innovative solutions that will strengthen the overall outlook of the mixed reality headset industry in the coming years. In June 2023, Apple Inc. launched Vision Pro, the highly anticipated virtual reality headset. Its latest solution will allow users to overlay digital apps, personal photos, movies, and other content onto the real world. The users can control the device through hand gestures and experience TV shows, movies, and games in a highly interactive way.

In addition, Apple, Inc. also partnered with Disney to enable users to experience immersive shows and sporting events through Vision Pro. Moreover, a digital version of the Disneyland theme park could also be projected into the user’s physical environment. Mixed reality is now going mainstream for consumers and businesses. It liberates users from screen-bound experiences by providing instinctual interactions with data in the users’ living spaces. For instance, Windows mixed reality provides next-level user experiences through high-end holographic representations, high-fidelity holographic 3D models, and the real world surrounding the users.

The players operating in the mixed reality headset market are focusing on improving the accessibility and portability of their offerings. Wireless and standalone options including the VR-3 by Varjo offer a convenient and untethered experience, making mixed reality more appealing to a broader audience. The Varjo VR-3 headset is a good fit for human heads of all shapes and sizes with a 3-point precision fit headband and active cooling system to facilitate more immersive and longer sessions. Its ultra-wide non-Fresnel lenses, automatic interpupillary distance adjustment, and frame rate of 90 Hz reduce eye strain and simulator sickness by making the overall experience sharp and smooth for the users.

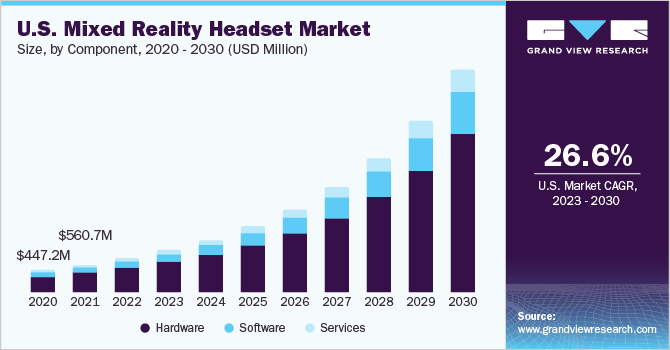

Component Insights

The hardware segment held over 72.3% revenue share in 2022 owing to increasing demand for immersive experiences in various enterprise applications. The hardware components, such as high-resolution displays, cameras, and motion sensors are key in delivering precise tracking, realistic visuals, and accurate spatial mapping. In addition, increasing product demand in the gaming industry is also driving segmental growth. The mixed reality headsets equipped with powerful processors and graphics cards provide a realistic audio, smooth rendering of complex 3D graphics and an enhanced gaming experience. One of the popular mixed reality hardware is Magic Leap 2, launched in September 2022, which comes with an unprecedented AR field of view and the ability to dim the display, allowing improved focus on virtual objects by blocking out external light.

The software segment is estimated to record a CAGR of approximately 30% from 2023 to 2030. The software component in mixed reality headsets is crucial in delivering immersive experiences when combined with the hardware. Several technology companies, such as Microsoft Corporation, Apple Inc, Unity Technologies, and Unreal Engine (Epic Games, Inc.), are developing enhanced mixed reality software platforms. Combined with the hardware manufacturers, these companies also provide the development tools to build immersive and interactive mixed-reality experiences. The mixed reality software is expected to transform various sectors, including healthcare, education, retail, manufacturing, etc., by enabling effective collaboration, training and simulations, enhanced visualization, and data analysis.

Operating System Insights

The Android segment accounted for a significant revenue share of 55% in 2022. This can be ascribed to the wide adoption of the Android operating system across various devices. The Android-based mixed reality headsets offer seamless integration with existing Android devices, such as smartphones and tablets. This allows users to connect their devices to the headset, facilitating content sharing and interaction with mobile as a remote control, etc. Android is an open-source platform, which provides flexibility and customization options for manufacturers. Mixed reality companies can design software according to their hardware with Android-based headsets.

The Windows segment is expected to record a CAGR of over 27.6% over the forecast period owing to increasing demand. Windows is among the most widely used operating system across the globe, with a large user base. Windows-based mixed reality headsets offer seamless compatibility with Windows PCs, allowing users to easily connect and operate headsets without additional software installations or configurations. Moreover, Windows has a highly efficient development environment. Microsoft Corporation provides developers with the Windows Mixed Reality SDK and documentation, facilitating the development of mixed reality applications specific to Windows-based headsets.

Storage Insights

The <128 GB segment held a revenue share of approximately 60% in 2022 because of the significant demand for headsets in this storage range. Several users prefer these mixed reality headsets as they are portable, more compact, and with lightweight designs. Moreover, headsets with smaller storage capacities tend to be more affordable as compared to those with capacities. They also benefit users who may only require a small amount of local storage for their mixed reality experiences. Smaller capacities are sufficient for the primary use of browsing, productivity allocations, or light gaming.

The >128 GB segment is expected to witness a substantial CAGR of over 30.6% from 2023 to 2030 owing to the increasing need for expanded storage spaces to deliver mixed reality experiences with highly immersive content, such as 3D models, videos, textures, and interactive applications. Higher storage capacities allow users to store a larger library of content and applications on their headsets, gaining more diverse and extensive experience without constantly managing the storage space. With more advanced mixed reality experiences, applications are becoming more sophisticated and richer in features, requiring large storage capacity to ensure their smooth functioning.

Charging Technology Insights

The wired segment captured a revenue share of approximately 52% in 2022 as it was a preferred choice for certain users. Wired charging enables faster charging and can be advantageous when users need to charge their mixed reality headsets during time-sensitive situations quickly. In addition, it is more reliable and consistent as users can rely on stable connections and consistent power delivery. Moreover, they are more cost-effective than wireless options, expected to drive product demand over the coming years.

Due to several advantages of the charging technology, the wireless segment is expected to witness a substantial CAGR of over 30% over the forecast period. Wireless charging offers greater convenience by eliminating physical cables and connectors, allowing users to place their headsets on a charging dock simply. Moreover, it is more durable as it eliminates the need to plug or unplug regularly. It also offers universal compatibility, therefore multiple devices can be charged using the same charging pad.

End-user Insights

Based on end-user, the commercial segment captured a revenue share of approximately 35% in 2022 owing to the increasing adoption of mixed reality solutions in various applications. Several businesses are now recognizing the potential mixed reality offers for enhancing their services and customer experience. Mixed reality headsets are being increasingly adopted by retail and Ecommerce companies to provide improved product visualization and create immersive shopping experiences. They also offer unique opportunities for marketing and advertising as companies can create immersive branding and product promotions. Apart from commercial uses, they are also used in remote collaboration, architecture, design, training, simulation, manufacturing, assembly, etc.

The consumer segment is expected to witness a substantial CAGR of over 29% over the forecast period. The versatility and immersive nature of the technology have instigated the demand for mixed reality headsets in this segment. The largest consumer application of these headsets is for gaming and entertainment, as they allow users to experience the games as they are a part of it. In addition, they are also used for educational purposes as they allow students to visualize complex concepts and make learning more interactive. Mixed reality headsets can also support the personal productivity goals of an individual by offering virtual workspaces, creative and artistic tools, workout programs for fitness, etc.

Industry Insights

The media & entertainment segment captured a revenue share of approximately 16% in 2022 owing to significant applications of mixed reality headsets in this industry. They enable virtual cinematic and theatrical experiences, allowing viewers to feel like they are a part of the action. The users can watch concerts, movies, or live performances in a virtual environment. Moreover, they also enhance content consumption by allowing users to access media content in a virtual environment. Another important application in this domain is virtual tours and travel experiences, allowing viewers to explore historical sites or distant locations from the comfort of their homes. The ongoing technological advancements and the possibility for more applications are expected to open new growth opportunities for the segment.

The retail and e-commerce segment is expected to witness a substantial CAGR of over 30.7% during the forecast period owing to virtual shopping events and experiences offered by the mixed reality headsets. Users can participate the interactive sales events, product launches, or exclusive promotions, thereby driving customer engagement and sales. They can improve the overall product visualization, reduce buyer uncertainty, and help customers in making informed purchasing decisions. Their ability to provide remote assistance, product demonstrations, personalized recommendations, and virtual shopping experiences is expected to open new growth opportunities in the retail and eCommerce segment.

Resolution Insights

The HD resolution segment captured a significant revenue share of approximately 52% in 2022 as this resolution is commonly used in mixed reality headsets to provide more detailed and immersive experiences. Moreover, it offers a clearer and more defined image, improving the visibility of small details, particularly in mixed reality, where users interact with virtual objects and need to perceive them accurately. As mixed reality applications and content are becoming more advanced and demanding, HD resolution can ensure that headsets can handle the visual requirements of future applications.

The 4K and above segment is estimated to record a CAGR of over 31% from 2023 to 2030, with increasing advancements in mixed reality requiring displays with higher resolution, such as 4K and above. With this resolution, virtual objects, environments, and textures appear incredibly lifelike, providing a highly immersive and realistic experience. Moreover, higher resolutions offer an expanded field-of-view, ensuring a high level of visual quality and clarity. It also ensures a high level of fidelity, making it useful for various professional and industrial applications, such as architecture, design, medical training, etc.

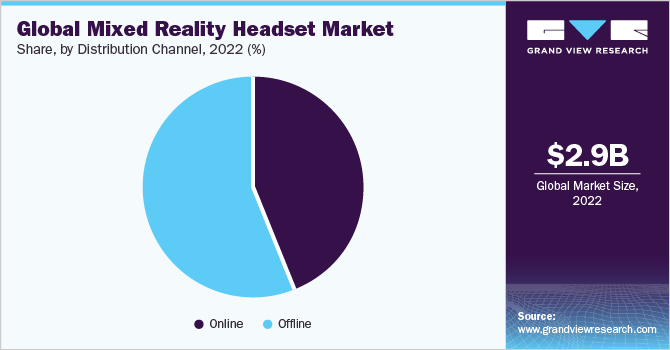

Distribution Channel Insights

The online segment witnessed a substantial revenue share of over 43% in 2022 with the increasing consumer preference to buy electronic products from e-commerce channels due to the availability of a wide range of offerings, affordable price points, attractive offers, discounts, etc. Several players now distribute their products either through their own online portals or third-party e-commerce websites. It allows them to reach a wider customer base globally. Moreover, social media advertising and online market strategies also help them reach the target audiences, thereby favoring segmental growth.

The offline segment captured a revenue share of approximately 56% in 2022. This can be credited to many customers opting for brick & mortar stores to buy electronic items. They prefer checking the products independently and then making a purchase decision. In addition, several stores provide special discounts similar to online portals to attract customers to buy from stores. In addition, they also provide better return policies when it comes to returning defective or unwanted merchandise without any additional costs.

Regional Insights

North America accounted for a revenue share of approximately 32% in 2022, owing to the greater proclivity of consumers toward technologically advanced solutions and high purchasing power. In addition, the region is a hub for various leading technology companies, including Microsoft Corporation, Apple Inc, Magic Leap Inc., and Meta, that are at the forefront of developing mixed reality solutions. Moreover, the thriving gaming and entertainment industry in the region offers remunerative opportunities for the market. Several U.S. industries have embraced mixed reality for their specific applications, such as design visualization, training, remote collaboration, etc.

Asia Pacific is estimated to record a CAGR of over 31% from 2023 to 2030 due to rapid technological adoption and digital transformation across various regional countries. Moreover, the rising middle-class population, rising disposable income, and growing demand for immersive experiences are enhancing the regional mixed reality headsets market outlook. Besides, higher interest in gaming and the availability of large gaming communities in Asia Pacific offer greater potential for mixed reality to enable immersive experiences.

Key Companies & Market Share Insights

The key market players operating in the mixed reality headset market are focusing on delivering technologically advanced solutions. They are also implementing various strategic initiatives, such as collaborations, mergers, acquisitions, and partnerships to gain a competitive edge in the market. In June 2023, Meta announced to launch its high-end virtual and mixed reality headset- Meta Quest 3, later this year. The latest offering features cutting-edge Meta Reality technology, stronger performance, higher resolution, and a slimmer, more comfortable form factor. Quest 3 is the supercharged and wireless all-in-one headset, which will also offer an additional storage option for the users requiring some extra space. Some prominent players in the global mixed reality headset market include:

-

Acer Inc.

-

Amber Garage (Holokit)

-

Apple Inc

-

Asus Tek Computer Inc

-

Dell Technologies Inc

-

Hewlett Packard Enterprise

-

HTC Corporation

-

Magic Leap, Inc.

-

Meta Platform Inc

-

Microsoft Corporation

-

Occipital Inc.

-

Pico Technology Co. Ltd.

-

Samsung Electronics Company Limited

-

Valve Corporation

-

Varjo

-

Vuzix

Mixed Reality Headset Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 3.62 billion

Revenue forecast in 2030

USD 21.68 billion

Growth rate

CAGR of 29.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion, volume in thousand units, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, operating system, storage, charging technology, end-user, industry, resolution, distribution channel, region

Regional Scope

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Mexico; Saudi Arabia

Key companies profiled

Acer Inc; Amber Garage (Holokit); Apple Inc; Asus Tek Computer Inc; Dell Technologies Inc; Hewlett Packard Enterprise; HTC Corporation; Magic Leap, Inc.; Meta Platform Inc; Microsoft Corporation; Occipital Inc.; Pico Technology Co. Ltd.; Samsung Electronics Company Limited; Valve Corporation; Varjo

Pricing and purchase options

Free re Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Mixed Reality Headset Market Report Segmentation

This report forecasts revenue growth at the global, country, and regional levels, and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global mixed reality headset market report based on component, operating system, storage, charging technology, end-user, industry, resolution, distribution channel, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Headset

-

Microphone

-

Sensors

-

Depth Sensor

-

G-Sensor

-

Gyroscope

-

Proximity Sensor

-

Others

-

-

Display

-

LED Technology

-

LCD Technology

-

-

Battery

-

Processor

-

Camera

-

Speakers

-

Others

-

-

Controller

-

Sensor

-

G-Sensor

-

Gyroscope

-

Others

-

-

Battery

-

Others

-

-

Accessories

-

Casing & Covers

-

Wrist Wearable

-

Cables

-

Power Adapter

-

External Battery

-

Gloves

-

Full Body Trackers

-

Lenses

-

Strap Belts

-

Others

-

-

Software

-

Services

-

-

-

Operating System Outlook (Revenue, USD Million, 2018 - 2030)

-

Android

-

Windows

-

Others (Linux, xrOS)

-

-

Storage Outlook (Revenue, USD Million, 2018 - 2030)

-

<128 GB

-

>128 GB

-

-

Charging Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Wired

-

Wireless

-

-

End-user Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial

-

Consumer

-

Military & Government

-

-

Industry Outlook (Revenue, USD Million, 2018 - 2030)

-

Education

-

Gaming

-

Media & Entertainment

-

Healthcare

-

Retail & E-Commerce

-

IT & Telecom

-

Energy & Renewables

-

Oil & Gas

-

Automotive

-

Manufacturing

-

Sports

-

Others

-

-

Resolution Outlook (Revenue, USD Million, 2018 - 2030)

-

HD

-

4K and Above

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global mixed reality headset market size was estimated at USD 2.89 billion in 2022 and is expected to reach USD 3.62 billion in 2023.

b. The global mixed reality headset market is expected to grow at a compound annual growth rate of 29.1% from 2023 to 2030 to reach USD 21.68 billion by 2030.

b. Based on component, the hardware segment dominated the market in 2022 with a share of over 70.0%. The segment growth is attributed to the increasing product demand in the gaming industry

b. The key players in this industry are Acer Inc., Samsung Electronics Company Limited, Meta Platform Inc., Valve Corporation, Microsoft Corporation, Apple Inc. and among others.

b. Key factors driving the mixed reality headset market growth include rapid urbanization, the growing prominence of immersive experiences, and ongoing technological developments, such as advancements in display technology, sensors, and processing power.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.