- Home

- »

- Communications Infrastructure

- »

-

Mobile Phone Insurance Market Size & Share Report, 2030GVR Report cover

![Mobile Phone Insurance Market Size, Share & Trends Report]()

Mobile Phone Insurance Market Size, Share & Trends Analysis Report By Coverage (Physical Damage, Internal Component Failure, Theft & Loss Protection), By Phone Type (Budget Phones, Premium Smartphones), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-3-68038-807-7

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Mobile Phone Insurance Market Trends

The global mobile phone insurance market size was valued at USD 28.74 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 12.5% from 2023 to 2030. Increasing incidents of accidental damage, phone thefts, virus infection, and device malfunction are expected to drive market growth over the forecast period. These incidents have urged customers to look for ways to safeguard their mobile phones and, thereby, adopt mobile phone coverage policies. Mobile phone insurance helps consumers avoid high replacement costs in case their mobile phone is lost or faces a breakdown. A mobile phone insurance policy typically covers physical damage, internal coverage failure, theft & loss protection, and virus & data protection.

Mobile phones serve as a platform for entertainment and education and an effective platform for conducting digital transactions. Increasing the use of smartphones for storing personal information and digital transactions has led to the increasing need for safeguarding mobile devices. This trend is expected to escalate market growth over the forecast period. According to GSMA, approximately 75% of internet users are expected to access the internet through smartphones by 2025. Mobile phone insurance service providers are collaborating with smartphone manufacturers to experiment with the success rate of insurance policies/schemes offered when purchasing a mobile phone.

Mobile phones are highly susceptible to physical and technical damages, such as damaged casing and excessive dust and dirt, which may harm the Printed Circuit Board (PCB) and coverages. Such damages may also incur enormous losses for users and are expected to increase the demand for mobile phone insurance over the forecast period. The increasing costs of smartphones are also compelling consumers to opt for mobile phone coverage policies. Furthermore, the growing collaborations among mobile phone manufacturers and insurance providers are also anticipated to drive market growth over the forecast period. Moreover, direct-to-consumer insurance assistance is expected to create substantial growth opportunities for market players over the forecast period. The direct-to-consumer insurance assistance model provides improved customer experience instead of insurance selling through traditional distribution channels.

The increasing adoption of Business Intelligence (BI) tools by market players is anticipated to propel the market growth over the forecast period. BI tools help market players to identify negative trends in the costs and performance of their products. Business Intelligence is used either strategically or tactically. Strategic business intelligence is used for monitoring Key Performance Indicators (KPIs) about policy growth, incurred claims ratio, the average time to settle a claim, and so on.

KPIs also help evaluate the development of insurance companies and enable potential investors to determine the effectiveness of a company’s operational strategies. Furthermore, implementing BI tools helps companies track data about customer buying behavior and gain insights into consumer trends, thereby helping them make informed decisions regarding the services that can be introduced in the mobile phone insurance market.

The complexities associated with the terms and conditions make it difficult for consumers to opt for appropriate claim procedures, which is subsequently expected to hinder market growth. Some market players offer coverage plans with a fixed premium and coverage amount, thus leading to reluctance from customers to buy such policies. Such policies also mandate users to pay enormous premium amounts for damage repair, irrespective of the nature of the damages covered. However, in recent years, insurance providers have worked toward identifying such issues and have introduced policies with varying monthly premium amounts. They are also offering coverage based on customer requirements. The simplification of terms and conditions and claiming procedures is expected to increase the adoption of mobile insurance plans among customers across the globe.

The COVID-19 pandemic highly affected the mobile phone/smartphone market. While most of the companies operating in the market reported revenue decline from the mobile phone insurance domain, the sales of smartphones also witnessed a significant dip in the market. However, with the growing initiatives taken by governments across the globe to revive the economy, the market is anticipated to recover over the coming years. Additionally, the average life span of a smartphone is expected to rise, which, in turn, will positively impact the market over the forecast period.

The ease of availability and portability of a smartphone has made it one of the most preferred devices across the globe. Smartphones offer a wide range of applications and, therefore, have a high penetration level. Mobile phones were initially used for making calls and sending messages. However, with the introduction of smartphones, the capabilities of phones have extended to video calling, social media browsing, banking, and high-resolution gaming, among others.

Mobile phone owners often express concerns about the safety of their phones after the expiration of their warranty. The costs associated with repairing and maintaining damaged smartphones prove to be expensive after the warranty expires. Providing insurance coverage for smartphones saves a lot of money for consumers as the burden of repair costs is delegated to insurance providers. This is expected to boost the growth of the market over the forecast period.

Mobile phones often come with a warranty to cover the costs of repairing mechanical breakdowns, internal disk crashes, or damages caused by touch sensors, among others. Manufacturers or retailers usually offer a one-year limited warranty, which an additional fee can extend. However, since the terms and conditions associated with the warranty coverage are stringent and limited, many a time, customers end up bearing the cost of replacing damaged parts.

For instance, any liquid damage caused to a cell phone is usually not covered under the manufacturer’s warranty. As a result, customers favor insurance over warranty, as mobile phone insurance offers various customer-friendly insurance plans with a broader scope. The increasing number of mobile phone manufacturers and users has unfolded numerous opportunities for insurance companies to lure customers into opting for cell phone insurance plans. Moreover, as the lifecycle of cell phones is increasing with time, warranties with limited coverage would not be able to satiate the growing customer needs, thereby paving the way for mobile phone insurers to lead the market.

Phone Type Insights

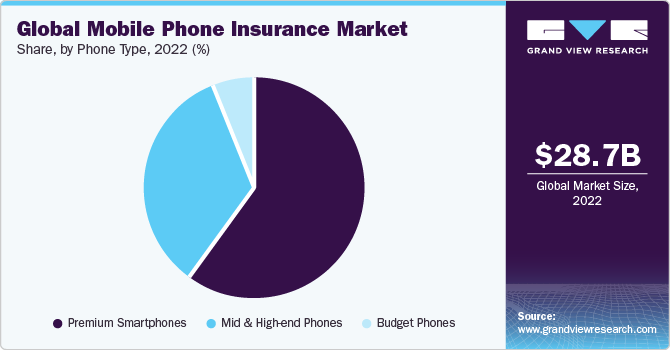

Mobile phone insurance companies offer several insurance policies depending on the type of mobile phone, such as budget phones, mid and high-end smartphones, and premium smartphones. Premium smartphones are prone to technical and physical damages, which lead to huge losses. Users opt for mobile phone insurance to protect their smartphones from these losses. The premium smartphone segment held a market share of 59.8% in 2022. Technical damages such as malfunction of software are common in premium smartphones. In addition to technical damages, theft, and hardware damages incur enormous user losses. The users pay high amounts for repairing such damages and maintaining these phones. All the above factors are expected to increase mobile phone insurance adoption by premium smartphone users.

The mid and high-end phones segment is expected to expand at the fastest CAGR of 16.2% during the forecast period owing to the growing penetration of mid-end smartphones globally. The rapid advancements in technology and decreasing costs of mid-end smartphones encourage users to opt for mid-end rather than premium smartphones. Thus, mobile phone insurance companies are now heavily capitalizing on insurance plans specific to mid and high-end smartphones. This is expected to drive the segment's growth over the forecast period.

Coverage Insights

The physical damage segment accounted for the highest market share of 38.2% in 2022 and is expected to expand at the fastest CAGR during the forecast period. Physical damage protection is the most prominent damage protection plan insured by most users since mobile phone devices are highly prone to physical damages such as cracks in the circuit board, screen damage, and so on. Therefore, in recent years, several mobile phone insurance companies have started offering insurance coverage for such damages under physical damage plans, which help users avoid paying huge amounts for repair and maintenance.

Loss and theft protection is expected to emerge as the second fastest-growing segment over the forecast period, owing to the rapidly increasing incidences of smartphone theft. According to the International Telecommunication Union (ITU), around 4,700 to 6,000 smartphones are stolen daily in Argentina and Peru, respectively. Furthermore, approximately 70 million smartphone theft cases are reported annually. The plans under this segment offer protection against replacement costs, high repair costs, accidental damage, liquid damage, malfunctioning, and display/camera issues.

The internal coverage failure segment is anticipated to expand considerably over the forecast period. The electronic damages are caused by overcharging and voltage fluctuations, among others. The plans in this segment also offer protection against the gradual deterioration of electronic coverages, parts, and accessories. Potential cyberattack threats, such as trojans and botnets, are compelling users to secure their devices, leading to considerable growth in the virus and protection segment.

Regional Insights

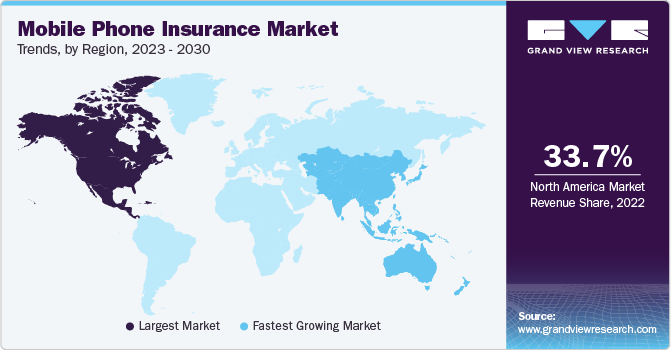

North America is anticipated to account for a market share of 33.7% by 2030. The regional market growth can be attributed to the presence of a large number of mobile phone insurance providers and the rising incidences of crimes committed using smartphones in Canada and the U.S. According to the Bureau of Justice Assistance, on average, more than one million smartphones are stolen in the U.S. every year. Furthermore, the availability of insurance plans that offer additional protection for software malfunctioning and replacement of stolen devices is expected to fuel the regional market growth over the forecast period.

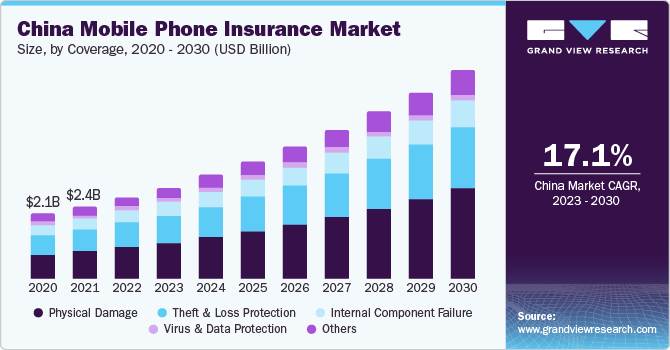

Asia Pacific is expected to expand at the fastest CAGR of 15.0% during the forecast period. E-tailors such as Flipkart are collaborating with insurance service providers such as Bajaj Allianz to offer mobile phone insurance coverage to customers. These initiatives are projected to substantially drive the growth of the Asia Pacific market over the forecast period. Furthermore, China, India, Singapore, and Japan are projected to witness lucrative market growth over the coming years. This regional growth can be attributed to the substantial increase in disposable income. In 2022, China accounted for the highest market share in the Asia Pacific region.

The rising preference of consumer in China to have their mobile phones insured is due to the cheaper pricing and quality of glass provided for the screen of mobile phones. For instance, the iPhone X series had a glass back for aesthetic effects, which were not durable enough. Thus, companies such as Sinosafe launched special iPhone screen insurance in China.

Key Companies & Market Share Insights

Market players are focusing on inorganic growth strategies, such as acquisitions & mergers, and collaborations to augment their market share. For instance, in January 2023, Cox Mobile, a Cox Communications mobile phone service, collaborated with Asurion to provide device protection and trade-in services to its wireless customers. Customers of Cox Mobile can now protect their smartphones from accidental damage, theft, and loss.

Key Mobile Phone Insurance Companies:

- Apple Inc.

- American International Group, Inc.

- Assurant, Inc

- Asurion

- AT&T Intellectual Property.

- AmTrust Financial

- Brightstar Corp.

- GoCare Warranty Group

- SquareTrade, Inc.

- Taurus Insurance Services Limited

Recent Developments

-

In July 2023, Apple Inc. announced AppleCare+, an extended warranty plan that includes accidental damage coverage and 24/7 technical help. AppleCare+ can be purchased within 60 days of buying an iPhone in most nations and locations.

-

In May 2022, Amazon announced customers can now protect all of their eligible tech purchases from Amazon with a single plan due to a new partnership with Asurion, a device insurance provider. Asurion Tech Unlimited provides coverage for accidental damage, theft, and loss and 24/7 tech support.

Mobile Phone Insurance Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 32.38 billion

Revenue forecast in 2030

USD 73.86 billion

Growth rate

CAGR of 12.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Phone type, coverage, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; China; Japan; India; Australia; South Korea; Brazil; Mexico; Saudi Arabia; South Africa; UAE

Key companies profiled

Apple Inc.; American International Group, Inc.; Assurant, Inc.; Asurion; AT&T Intellectual Property.; AmTrust Financial; Brightstar Corp.; GoCare Warranty Group; SquareTrade, Inc.; Taurus Insurance Services Limited

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Mobile Phone Insurance Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global mobile phone insurance market report based on phone type, coverage, and region:

-

Phone Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Budget phones

-

Mid & high-end phones

-

Premium smartphones

-

-

Coverage Outlook (Revenue, USD Billion, 2017 - 2030)

-

Physical damage

-

Internal component failure

-

Theft & loss protection

-

Virus & data protection

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global mobile phone insurance market size was estimated at USD 28.74 billion in 2022 and is expected to reach USD 32.38 billion in 2023.

b. The global mobile phone insurance market is expected to grow at a compound annual growth rate of 12.5% from 2023 to 2030 to reach USD 73.86 billion by 2030.

b. The physical damage segment dominated the global mobile phone insurance market and accounted for the highest market share of more than 38% in 2022.

b. The premium smartphone segment led the global mobile phone insurance market with a market share of over 59% in 2022.

b. North America dominated the mobile phone insurance market with a share of 33.69% in 2022. This is attributable to the presence of a large number of mobile phone insurance providers and the rising incidences of crimes committed using smartphones in Canada & the U.S.

b. Some key players operating in the mobile phone insurance market include AmTrust International; Assurant, Inc.; Asurion; AT&T Inc.; Brightstar Corp.; GoCare Warranty Group; Revolut Ltd.; SquareTrade, Inc.; Taurus Insurance Services Limited; and Vodafone Limited.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."