- Home

- »

- Clothing, Footwear & Accessories

- »

-

Mobile Phone Protective Covers Market Size Report, 2033GVR Report cover

![Mobile Phone Protective Covers Market Size, Share & Trends Report]()

Mobile Phone Protective Covers Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Body Gloves, Pouch, Phone Skin, Hybrid Cases), By Distribution Channel (Online, Offline), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-714-8

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Mobile Phone Protective Covers Market Summary

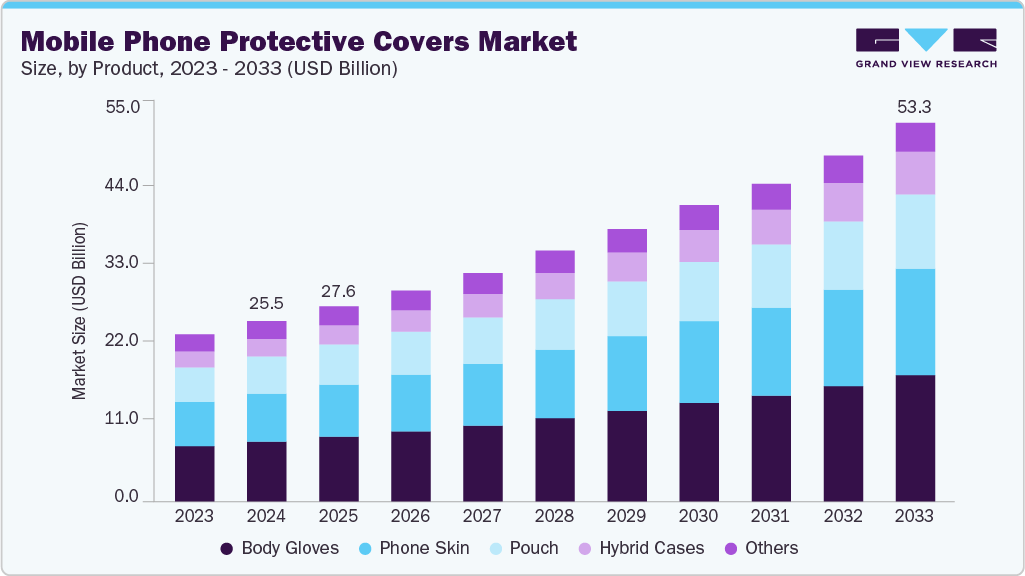

The global mobile phone protective covers market size was valued at USD 25.51 billion in 2024 and is expected to reach USD 53.33 billion by 2033, growing at a CAGR of 8.6% from 2025 to 2033. The growth is primarily supported by rising demand for higher-value protective solutions as device lifecycles lengthen and repair costs escalate, alongside sustained smartphone adoption and the expanding efficiency of global e-commerce distribution.

Key Market Trends & Insights

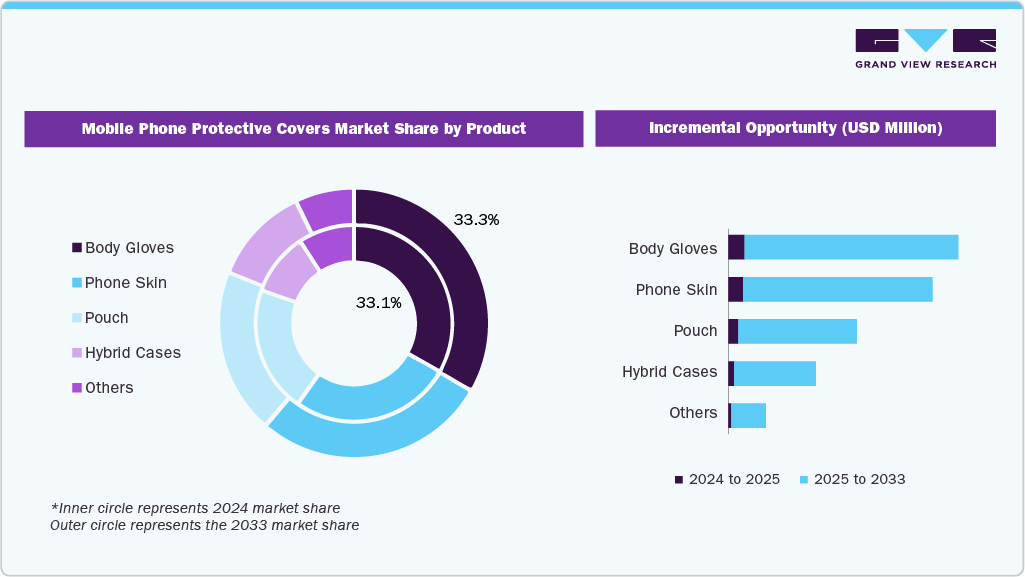

- By product, body gloves led the market with a share of 33.13% in 2024.

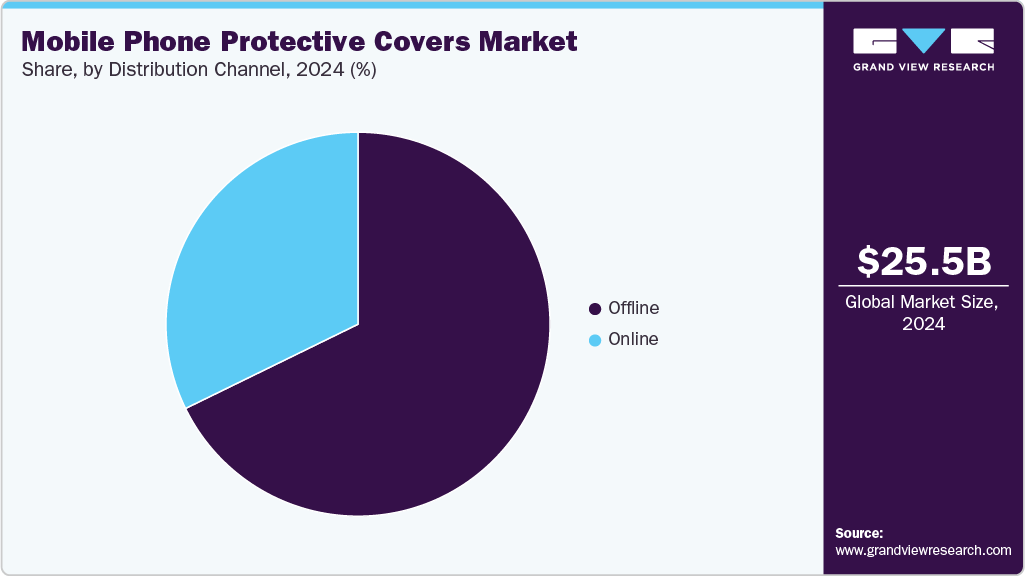

- By distribution channel, the offline sales accounted for a market share of 67.77% in 2024.

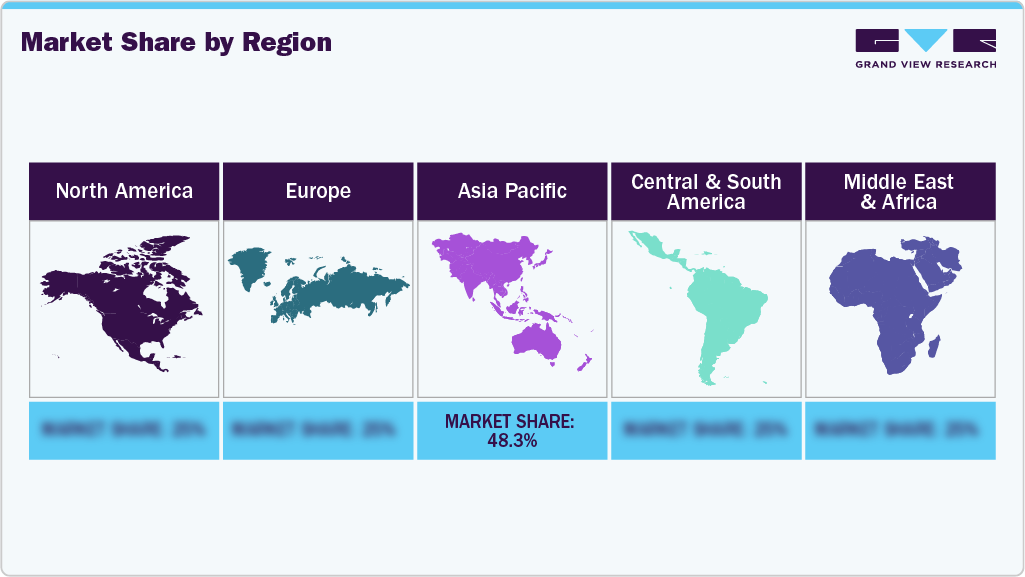

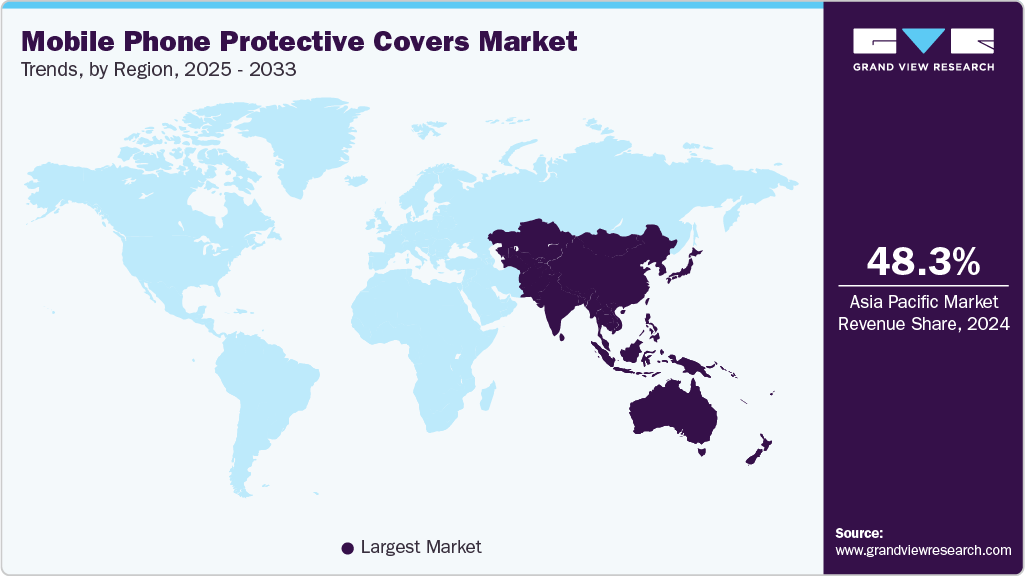

- By region, Asia Pacific held a market share of 48.32% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 25.51 Billion

- 2033 Projected Market Size: USD 53.33 Billion

- CAGR (2025-2033): 8.6%

- Asia Pacific: Largest market in 2024

A key ongoing trend is the shift toward ecosystem-integrated protective covers, especially MagSafe- and ring-mount-compatible modular cases, which allow users to attach wallets, battery packs, grips, and car mounts-turning the case into a functional hub rather than a passive protector.

Global market growth is strongly driven by the rising fragility and higher repair costs of modern smartphones, which feature glass backs, multi-camera arrays, and curved OLED displays. These design choices make devices more vulnerable to damage, prompting consumers to invest in robust, shock-resistant covers. For instance, the launches of premium flagships from Apple and Samsung routinely trigger surges in demand for military-grade and multilayer protective cases.

Another major factor is the shift toward multifunctional and ecosystem-integrated covers that offer more than physical protection. MagSafe-enabled wallets, battery-pack-ready cases, and modular grip or stand systems-such as collaborations between OtterBox and PopSockets-have expanded the premium segment by transforming cases into utility accessories. These innovations raise average selling prices and encourage accessory upgrades alongside new device cycles.

Growth is further reinforced by rapid digital expansion in emerging markets, where rising smartphone adoption meets highly active e-commerce ecosystems. Countries such as India, Indonesia, and Brazil display strong demand for affordable yet stylistically differentiated covers, with platforms like Amazon, Flipkart, and Shopee accelerating purchase frequency. The combination of high-volume fashion-led buying in these markets and premiumization in developed regions sustains overall global market momentum.

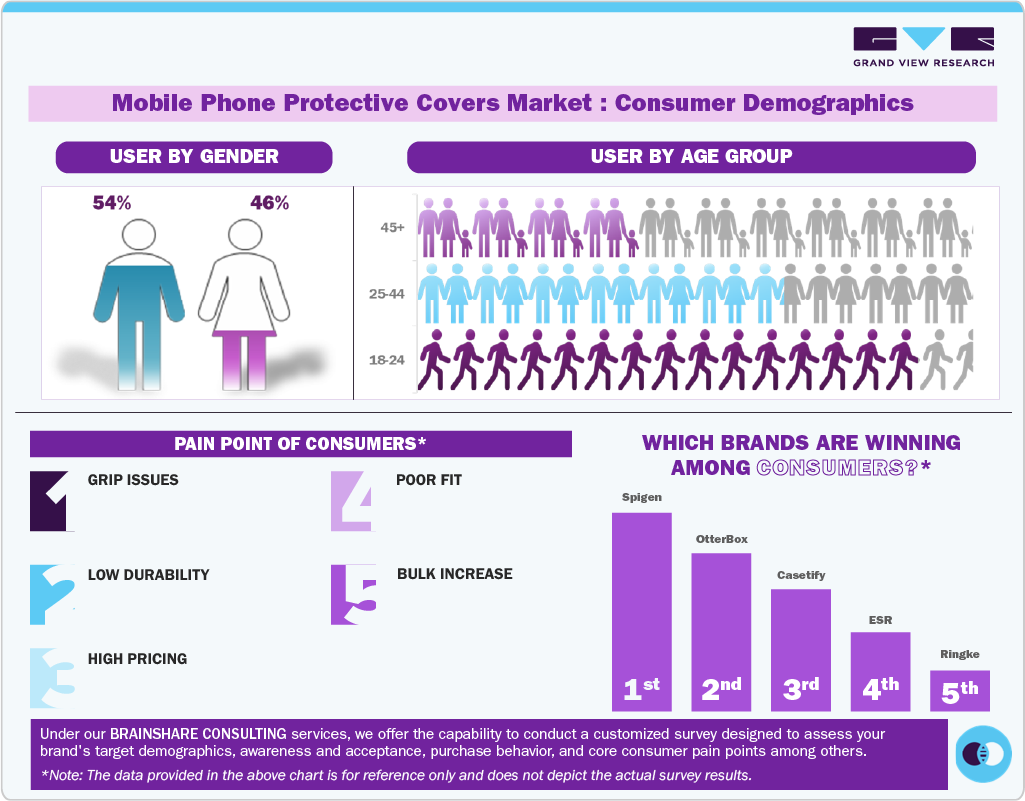

Consumer Insights

Male users slightly outnumber female users in this market because they over-index in rugged and performance-oriented case purchases, while women play a strong role in design- and style-led segments. This creates a balanced but mildly male-skewed demographic profile.

The 25-44 age group dominates usage as they have the highest smartphone dependence for work and daily tasks, followed by 18-24 users who drive trend-led and frequent case switching. Consumers aged 45+ form a smaller but stable base focused mainly on practicality and durability.

Key frustrations across demographics include cases feeling bulky, offering poor grip, lacking durability, not fitting well, or being priced too high. These pain points reflect the ongoing tension between protection, comfort, and cost.

Brands like Spigen, OtterBox, Casetify, Ringke, and ESR lead globally due to strong protection performance, design customization, and competitive pricing, allowing them to appeal across both premium and mass-market segments.

Product Insights

Body gloves held a market share of 33.13% in 2024, as consumers prefer cases that combine durability and style at an accessible price point. High demand is driven by shock protection, slim form factor, and wide compatibility with popular smartphone models, making Body Glove cases a preferred choice in both online and offline retail channels.

Hybrid cases are anticipated to witness a CAGR of 10.4% from 2025 to 2033. The growth is fueled by demand for versatile protection that combines hard-shell durability with flexible TPU edges, offering shock absorption without compromising style. Rising smartphone prices, especially for flagship devices, push consumers toward premium protective solutions, while increasing e-commerce penetration and awareness of functional, aesthetic designs further accelerate adoption.

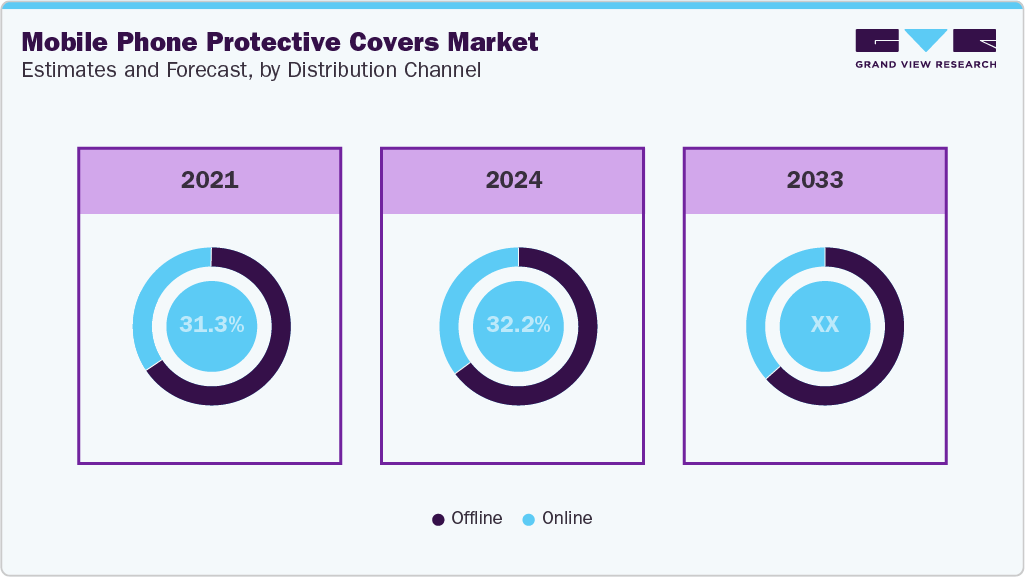

Distribution Channel Insights

The sale of mobile phone protective covers through offline channels accounted for 67.77% of the market. Offline dominance is driven by factors such as immediate product access, ability to physically assess quality and fit, and strong retailer influence in mobile stores and multi-brand electronics outlets. Consumers often prefer in-store purchases for cases because protection, grip, texture, and color accuracy are easier to judge physically, making offline retail a trusted and convenient channel-especially in regions with high mall and mobile-store penetration.

The sale of mobile phone protective covers through the online channel is expected to grow at a CAGR of 10.2% from 2025 to 2033. Online growth is driven by factors like expanding e-commerce penetration, broader assortment availability, and aggressive pricing and promotions on digital platforms. Faster delivery, easy returns, and rising adoption of design-led, customizable, and MagSafe-compatible covers online further accelerate demand. Younger consumers increasingly rely on digital marketplaces for accessory purchases, making online the fastest-growing channel.

Regional Insights

The Asia Pacific mobile phone protective covers market held a revenue share of 48.32%, as it combines massive smartphone user bases with high upgrade and replacement frequency, making cases a recurring purchase across price tiers. Strong growth in countries like India, China, and Indonesia-where mid-range phones dominate-drives very high volume demand for affordable protective covers, while markets like Japan and South Korea fuel the premium segment with MagSafe-compatible, shockproof, and branded cases. The region’s dense e-commerce ecosystems (e.g., Flipkart, Shopee, Lazada) and rapid expansion of offline mobile retail chains further amplify both reach and purchase frequency.

North America Mobile Phone Protective Covers Market Trends

The mobile phone protective covers market in North America is anticipated to witness a CAGR of 8.3% from 2025 to 2033. Growth is driven by high adoption of premium smartphones, rising demand for MagSafe-compatible and rugged protective cases, and strong consumer preference for frequent case upgrades tied to fashion, functionality, and new device launches. Well-developed retail ecosystems, Best Buy, carrier stores, and Amazon, combined with a willingness to spend on high-ASP accessories, support sustained expansion across both premium and mass segments.

The mobile phone protective covers market in the U.S. is expected to see a CAGR of 8.2% from 2025 to 2033. The market continues to expand through premiumization, personalization, and ecosystem-integrated accessories. Frequent flagship upgrades from Apple and Samsung drive recurring demand for new cases, while trends such as MagSafe attachments, impact-resistant materials, and influencer-led design collaborations push consumers toward higher-value purchases, maintaining steady growth.

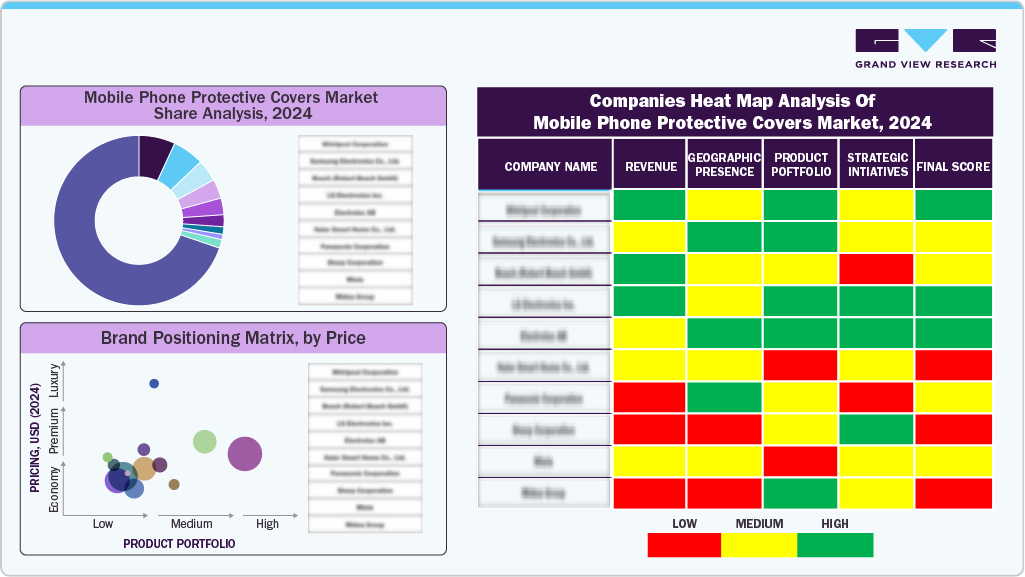

Key Mobile Phone Protective Covers Companies Insights

Key players operating in the mobile phone protective covers market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Established companies like OtterBox, Spigen, Tech21, and UAG lead the mid to premium segment through strong durability credentials, broad compatibility with flagship models, and deep retail distribution across carriers and electronics chains.

Premium, design-oriented brands such as Casetify, Mous, and Pela appeal to style-driven and sustainability-focused consumers with customizable, MagSafe-ready, and eco-material cases.

Meanwhile, regional players including Ringke, ESR, and Nillkin are expanding quickly in Asia Pacific and the Middle East by offering affordable, reliable products tailored to popular mid-range smartphones and driven heavily by e-commerce marketplaces. This tiered structure-spanning rugged protection, aesthetic personalization, and budget accessibility-continues to define the market’s competitive dynamics globally.

Key Mobile Phone Protective Covers Companies:

The following are the leading companies in the mobile phone protective covers market. These companies collectively hold the largest market share and dictate industry trends.

- OtterBox

- Spigen

- UAG (Urban Armor Gear)

- Tech21

- Casetify

- Mous

- ESR

- Ringke

- Nillkin

- Speck

Recent Developments

-

In October 2025, Spigen launched its new case lineup for the iPhone 17 and iPhone 17 Pro series, introducing color-matched clear models designed to complement the new Pro finishes and offering enhanced protection that covers the redesigned camera bar, incorporates full MagSafe compatibility, and uses a polycarbonate back with TPU bumper for improved drop resistance.

-

In April 2024, dbrand launched a “Touch Grass” skin and grip kit for Samsung phones including the S25 series - a textured accessory made of tiny polyethylene “grass” strands embedded on adhesive vinyl, designed to bring a novelty tactile feel (“touch grass”) to the device while maintaining compatibility with a wide range of models.

Global Mobile Phone Protective Covers Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 27.57 billion

Revenue forecast in 2033

USD 53.33 billion

Growth rate

CAGR of 8.6% from 2025 to 2033

Actuals

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; Australia & New Zealand ; South Korea; ; Brazil; South Africa

Key companies profiled

OtterBox; Spigen; UAG (Urban Armor Gear); Tech21; Casetify; Mous; ESR; Ringke; Nillkin; Speck

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Mobile Phone Protective Covers Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global mobile phone protective covers market report on the basis of product, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Body gloves

-

Pouch

-

Phone skin

-

Hybrid cases

-

Others

-

-

Distribution Channel (Revenue, USD Million, 2021 - 2033)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Million; 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global mobile phone protective covers market size was estimated at USD 25.51 billion in 2024 and is expected to reach USD 27.57 billion in 2025.

b. The global mobile phone protective cover market is expected to grow at a compound annual growth rate of 8.6% from 2025 to 2033 to reach USD 53.58 billion by 2033.

b. Asia Pacific dominated the mobile phone protective covers market with a share of 49.32% in 2024. This is attributable to the rising penetration of smartphones in countries such as India and China.

b. Some key players operating in the mobile phone protective cover market include OtterBox; Spigen; UAG (Urban Armor Gear); Tech21; Casetify; Mous; ESR; Ringke; Nillkin; Speck

b. Key factors that are driving the mobile phone protective cover market growth include growing penetration of e-commerce vendors in tier II and tier III cities worldwide and the Introduction of innovative delivery options by vendors, including same-day delivery.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.