- Home

- »

- Communications Infrastructure

- »

-

Mobile POS Terminals Market Size & Share Report, 2030GVR Report cover

![Mobile POS Terminals Market Size, Share & Trends Report]()

Mobile POS Terminals Market (2023 - 2030) Size, Share & Trends Analysis Report By Component (Hardware, Software, Service), By Type (Tablets, Others), By Application (Restaurants, Hospitality, Healthcare, Retail), By Region, And Segment Forecasts

- Report ID: 978-1-68038-452-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Mobile POS Terminals Market Summary

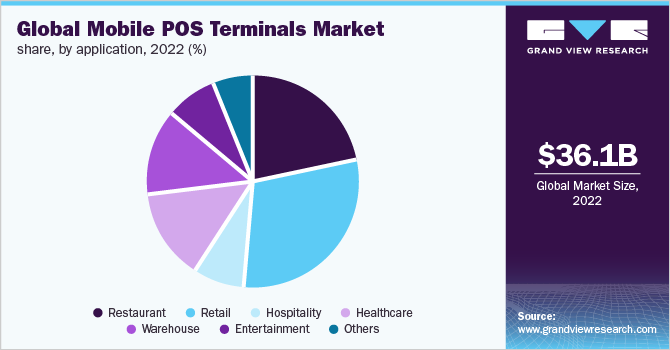

The global mobile POS terminals market size was estimated at USD 36.07 billion in 2022 and is anticipated to reach USD 85.11 billion by 2030, growing at a CAGR of 11.1% from 2023 to 2030. A mobile POS terminals device is a smartphone, tablet, or wireless device which wirelessly executes the functions such as cash registers or electronic POS terminals.

Key Market Trends & Insights

- North America is expected to dominate the market, due to increasing demand from the retail and restaurant industries in the region.

- Asia Pacific mPOS terminals market is anticipated to exhibit high growth on account of the low cost of manufacturing in the region.

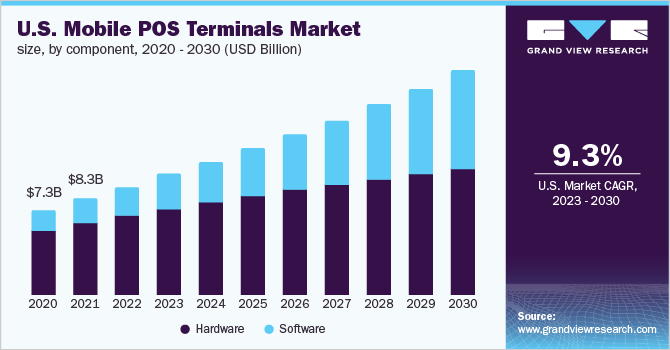

- By component, the hardware segment is expected to dominate the market over the forecast period with a CAGR of 9.6 %.

- By type, the others sub-segment is estimated to dominate the market over the forecast period with a CAGR of 10.4%.

- By application, the healthcare sector is expected to remain the dominant segment over the forecast period.

Market Size & Forecast

- 2022 Market Size: USD 36.07 Billion

- 2030 Projected Market Size: USD 85.11 Billion

- CAGR (2023-2030): 11.1%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

The mobile POS terminals market has grown in recent years due to improved deployments in large retailers across a wide range of store formats in regional markets. The convergence of mobile and online payment channels at a time of significant growth in the mobile app and smartphone industry is being one of the driving factors for mPOS terminal adoption. A major factor driving the mobile POS terminals market is the increasing emphasis of businesses on improving the customer experience. Mobile POS solutions are adopted because of check-out lines at markets and large stores frequently waste customers' time. However, customers can make the sale directly from the main product area in a store, paying for the products digitally and avoiding long lines. These solutions increase customer satisfaction, which increases brand loyalty and trust, hence businesses are rapidly shifting from traditional systems to smartphone and tablet POS.

Escalating demand for mPOS terminals across industries is one of the major factors driving the overall market. The affordable price of installing mPOS in the store along with security and intuitive interface has encouraged small and mid-size businesses (SMBs) to adopt the solution for their stores. Although SMBs are struggling to navigate the impact of business disruptions and lost traffic during the COVID-19 outbreak, the demand for mPOS is expected to increase as more people use digital payment to shop from their homes. Moreover, a reduction in Total Cost of Ownership (TCO) and improved return on investments offered by mPOS terminals have considerably increased their demand in SMBs.

However, there are some factors that impede the growth of the market. The prevailing cash payment system in many countries coupled with the stringent government regulation for payment processing is expected to restrain the mPOS terminal market growth. Cash payment at small vendors, fairs, and countries with poor economic conditions will slow down the growth in the forecast period. While adhering to PCI and other payments and data collection compliance ensure secure payment, the complexity of adhering to them hinders the adoption of mPOS terminal.

Moreover, new emerging market players are introducing new strategic initiatives and partnerships among others that leverage the growth of the market. These strategies include mobile discounts, loyalty programs, gift cards, vouchers, and cash-back offers among others. Key trends such as increasing technological advancements such as cloud-based mPOS increase the growth of the market. Hence, emerging market players and technological trends provide lucrative opportunities for market growth.

COVID-19 had a positive impact on the mobile POS terminals market. Digitization accelerated in the hospitality and retail sectors owing to increased emphasis on social distancing and the mandatory use of masks to avoid COVID-19 contraction. Many financial service providers increased the limits for contactless payments, allowing for simpler and more streamlined cashless transactions. As a result, mobile POS terminals gained popularity because they provided a quicker and more seamless payment option.

Component Insights

The mPOS terminals market segmentation based on the component includes hardware and software. The hardware segment is expected to dominate the market over the forecast period with a CAGR of 9.6 %. The demand for hardware is attributed to the need for a portable payment device that reduces the overall checkout time. The mPOS terminal hardware manufacturers include VeriFone and Ingenico devices such as handheld terminals, tablets, and mobile computers. These devices are dedicated to operating untethered with functions supported by apps and contactless card readers.

The software segment is expected to grow rapidly owing to its application in running the required functions such as inventory, billing, and collecting customer information for handling a retail store, restaurant, or healthcare sector. For instance, QVS Software, the mPOS terminal software developer focuses on creating software, apps, and storage mechanisms that provide functionalities such as managing customer data, inventory control, reporting capabilities, and sales transaction update. Some providers also offer analytics tools that identify file I/O usage, PLU response times, network traffic, load balancing, and bottlenecks in the system to improve system performance. Moreover, the solution provides a secure environment for payment with PCI compliance to allow encrypted payments such as chip cards and NFC payments like Apple Pay.

Type Insights

On the basis of mobile, the mPOS terminals market is segmented into tablets and others. The other sub-segment includes handled terminals, and smartphones, among others. The others sub-segment is estimated to dominate the market over the forecast period with a CAGR of 10.4%. This is due to the improved security features which reduce the risk of data breaches. Furthermore, it makes the use of mobile POS more effective and efficient. It also enables all online payment modes options to come in a single application which also includes Europay, Mastercard, and Visa (EMV) cards, Unified Payments Interface (UPI), and wallet among others.

The tablet sub-segment is anticipated to grow rapidly over the forecast period with the CAGR exceeding 12.0%. Owing to the enhanced system integration tablet POS to gain lucrative opportunities over the forecast period. This includes accounting analysis, sales, and customer relationship management, among others. Additionally, tablets deliver transparency and flexibility to the POS system. Hence, tablets are estimated to grow in the mobile POS terminals market in forthcoming years.

Application Insights

On the basis of application, the mPOS terminals market is segmented into restaurants, hospitality, healthcare, warehouse, retail, entertainment, and others. The healthcare sector is expected to remain the dominant segment over the forecast period. The healthcare industry is rapidly deploying mobile point-of-sale terminals to streamline the payment process for treatments and medications provided by hospitals and clinics. As healthcare facilities become more digital, operators are being encouraged to integrate these payment terminals.

The retail sector is expected to lead the segment over the forecast period. The changing payment scenario has led to the penetration of digital payment in both brick & mortar and eCommerce retail platforms creating seamless shopping experiences across all channels. Additionally, the mobile payment wallets comprising Apple Pay, Android Pay, and Samsung Pay have further increased the demand for mPOS terminals in the retail sector. Moreover, retailers are benefiting by engaging customers in omnichannel shopping experiences where mPOS keeps their sales associates more informed for real-time assistance.

The adoption of technology in various sectors such as healthcare, hospitality, and entertainment is expected to positively impact market growth. The restaurants face huge customer crowds which need to be attended to over the course of their dining from taking orders to bill payment, while the mPOS allows the customer to order without waiting for the waiter and expedite checkout at the table itself. For instance, Agilysys, Inc. offers InfoGenesis Flex mPOS to help the hospitality and gaming sector to connect easily with guests and increase their profitability. Moreover, the availability of wireless connectivity has significantly increased the demand for mPOS owing to the need for remote monitoring and access to information. The need for expediting the checkout process and line bursting across the application area is expected to significantly drive the mPOS terminals industry.

Regional Insights

North America is expected to dominate the market, due to increasing demand from the retail and restaurant industries in the region. According to NPD Group, Inc.; the U.S. restaurant count including both QSRs and casual, and fine dining restaurants reached 647,288 in the fall of 2017. A large number of retail and restaurants in the U.S. engage in accepting digital payment and are gradually shifting towards mPOS terminals for quick and secure payment. The Lilly Pulitzer fashion chain in the U.S. reported increased sales with the implementation of an mPOS terminal for its “The Pink stores”. The large retailers are slowly adopting mPOS in addition to their existing fixed POS terminal, the SMBs are more likely to opt for only mPOS in their stores.

Asia Pacific mPOS terminals market is anticipated to exhibit high growth on account of the low cost of manufacturing in the region. The Asia Pacific mobile POS terminals market is estimated to gain traction over the forecast period due to increased demand from SMBs and a reduction in TCO. The booming smartphones and tablet in Asia-Pacific, particularly in India and China, is anticipated to favorably impact the mPOS terminals in the region. Furthermore, the initiative for encouraging digital payment in other developing countries is further contributing to the growth of the mPOS terminal market.

Key Companies & Market Share Insights

Companies operating in the mPOS terminals market focus on strategic partnerships and acquisitions for business expansion. The market is expected to witness consolidation over the coming years due to increased M&A activities by market players. For instance, in February 2020, Worldline announced its plan to acquire Ingenico with the aim to provide a "one-stop-shop" for both global and small merchants.

For instance, in March 2022, Ingenico announced a partnership with Bharatpe. This partnership aimed to provide advanced payment and commerce services to Indian enterprises and accelerate the adoption of point-of-sale devices in India. In January 2022, Adyen introduced mobile Android Point-Of-Sale (POS) terminals for the U.S., U.K., and E.U. The Android mobile POS device functions as an all-in-one payment platform and includes an app management system. It allows merchants to upload and manage apps such as loyalty programs and inventory management that they require on a regular basis. Some of the prominent players in the global mobile POS terminals market include

-

Fiserv, Inc.

-

Hewlett Packard Enterprise Development LP

-

Ingenico

-

NEC Corporation

-

Oracle

-

Panasonic Holdings Corporation

-

PAX Technology

-

Posiflex Technology, Inc.

-

QVS Software

-

SAMSUNG

-

SPECTRA Technologies

-

TOSHIBA CORPORATION

-

VeriFone, Inc.

-

Zebra Technologies Corp.

Mobile POS Terminals Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 40.80 billion

Revenue forecast in 2030

USD 85.11 billion

Growth Rate

CAGR of 11.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; China; India; Japan; Brazil; Mexico

Key companies profiled

Fiserv, Inc.; Hewlett Packard Enterprise Development LP; Ingenico; NEC Corporation; Oracle; Panasonic Holdings Corporation; PAX Technology; Posiflex Technology, Inc.; QVS Software; SAMSUNG; SPECTRA Technologies; TOSHIBA CORPORATION; VeriFone, Inc.; Zebra Technologies Corp.

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

Global Mobile POS Terminals Market Segmentation

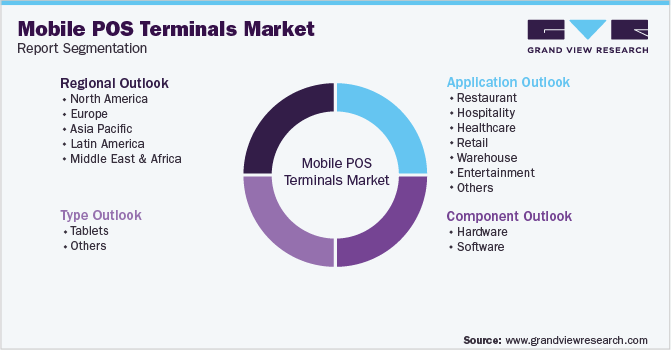

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global mobile POS terminals market report on the basis of component, type, application, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

-

Type Outlook (Revenue; USD Million; 2018 - 2030)

-

Tablets

-

Others

-

-

Application Outlook (Revenue; USD Million; 2018 - 2030)

-

Restaurant

-

Hospitality

-

Healthcare

-

Retail

-

Warehouse

-

Entertainment

-

Others

-

-

Regional Outlook (Revenue; USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Rest of Europe

-

-

Asia Pacific

-

India

-

China

-

Japan

-

Rest of Asia Pacific

-

-

Latin America

-

Brazil

-

Mexico

-

Rest of Latin America

-

-

Middle East & Africa (MEA)

-

Frequently Asked Questions About This Report

b. North America dominated the mobile POS terminals market with a share of 30.94% in 2022. This is attributable to increased demand from SMBs, reduction in Total Cost of Ownership (TCO), and booming smartphones and tablet market in the country such as China and India.

b. Key factors that are driving the market growth include the advent of affordable wireless communication technologies and increased deployments in large retail chains across a wide number of store formats and regional markets.

b. The global mobile POS terminals market size was estimated at USD 36,074.3 million in 2022 and is expected to reach USD 40,809.2 million in 2023.

b. The global mobile POS terminals market is expected to grow at a compound annual growth rate of 11.1 % from 2023 to 2030 to reach USD 85,111.4 million by 2030.

b. Some key players operating in the mobile POS terminals market include Ingenico, Verifone, Zebra Technologies (Motorola Enterprise Solutions), Oracle (MICROS Systems), and First Data Corporation.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.