- Home

- »

- Communication Services

- »

-

Mobile VoIP Market Size, Share And Growth Report, 2030GVR Report cover

![Mobile VoIP Market Size, Share & Trends Report]()

Mobile VoIP Market (2024 - 2030 ) Size, Share & Trends Analysis Report By Service (Video And Voice Calls, Video Conferencing), By Platform (Android OS, iOS), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-019-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Mobile VoIP Market Size & Trends

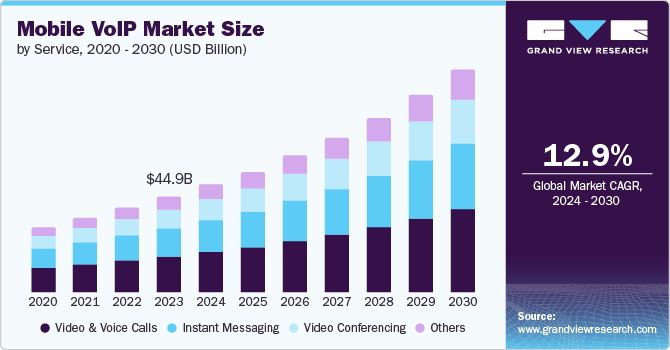

The global mobile VoIP market size was valued at USD 44.99 billion in 2023 and is projected to grow at a CAGR of 12.9% from 2024 to 2030. A rise in the use of smart devices, the introduction of the 5G network in multiple countries across the globe, increased accessibility and availability of high-speed internet, and overwhelming adoption of messaging platforms provided by technology companies are the major growth drivers for the mobile VoIP market.

Mobile VoIP services eliminate the need for voice plans and additional charges for messaging while offering flexibility to make voice calls. Moreover, the growth of advanced consumer devices is positively influencing the expansion of the mobile VoIP market. In addition, service providers use competitive pricing strategies to make VoIP calls more affordable, which helps in generating a more significant customer base. As the cost of the internet decreases, more people are encouraged to use VoIP services. Ease of use and higher scalability of meeting the needs of individuals and businesses are driving the market's growth.

Moreover, the market growth is fueled by significant expansion in the corporate sector and the growing embracement of trends such as Bring Your Own Device (BYOD). Due to the rise in startup ventures and small & medium enterprises (SMEs), the market is expected to experience exponential demand in the approaching years.

In recent years, concepts such as working from home and remote work profiles have become common owing to technological advancements and changing trends in business operations. Consequently, the need for mobile VoIP services is growing as organizations increasingly adopt video conferencing and virtual connectivity to uphold operational workflows.

Service Insights & Trends

Video and voice calls dominated the market and accounted for a share of 38.5% in 2023. Businesses are increasingly using video calls for corporate meetings, candidate interviews, client conversations, and team discussions. Due to a shift in consumer behavior, internet-based video and voice calls are increasingly used across companies, educational institutes, healthcare facilities, and even by families staying or working in different locations. These consumer preferences are expected to drive growth for this segment.

Instant messaging is anticipated to register the fastest CAGR during the forecast period. Corporate and individual users use instant messaging as a quick, easy, and adaptable email alternative. The growing use of smartphones and increased internet accessibility has made instant messaging apps more readily available to a wider range of users. Increasing dependability on instant communication and collaboration tools in personal and professional environments, factors relating to the economy, including GDP per capita, consumer spending per capita, and internet users, play a crucial role in driving the market's growth.

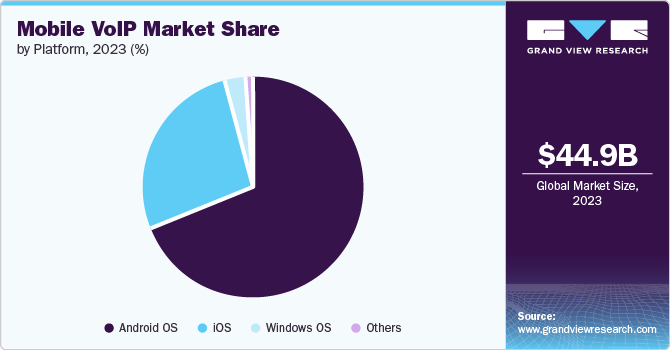

Platform Insights & Trends

The Android operating system (OS) segment dominated the market in 2023. Advanced features in Android OS smartphones, such as augmented reality, flexible screens, and holographic displays, are driving market growth in this segment. Android OS provides an open platform for content and app creators, which contributes to its impact on the mobile VoIP market. Open sourcing and customizations are widely distributed with the help of Android OS.

The iOS segment is projected to grow at the fastest CAGR from 2024 to 2030. Engineering excellence, a combination of art & aesthetics with technology, and innovations associated with the iOS segment are the key drivers for the growth of this market. The security offered by iOS is the major factor influencing consumer behavior. The intuitive and responsive interface of iOS devices and services like digital assistants, face recognition, and digital payment platforms offer convenience and personalization to consumers. Launching updated iOS device versions in regular intervals has driven demand for the segment.

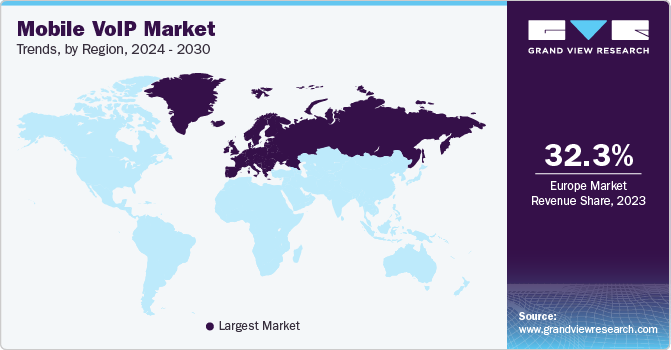

Regional Insights & Trends

The mobile VoIP market in North America held a significant revenue share of the global industry in 2023. This market is primarily driven by the unceasing use of mobile VoIP services by businesses in the region, technology advancements embraced by numerous organizations and multiple service providers, and the overwhelming response to different online platforms and mobile applications offering services such as instant messaging and video calls. In addition, early adoption of changes in business operations such as remote work profiles, working from home, video conferencing, and the adoption of innovative technologies have been driving the growth of this regional market.

U.S. Mobile VoIP Market Trends

The U.S. mobile VoIP market dominated the regional market with a revenue share of 68.3% in 2023. It can be attributed to technological developments that led to the growth of innovative mobile VoIP solutions in the U.S. catering to diverse consumer demands. Additionally, the growing awareness among consumers about the benefits of mobile VoIP products has increased demand across various industries. Government initiatives to promote sustainability have also accelerated the growth of the market.

Europe Mobile VoIP Market Trends

Europe dominated the global mobile VoIP market in 2023 with a revenue share of 32.3%. A rise in the accessibility and availability of the Internet in the region, the growing dependency of businesses on the Internet, improved mobile data speeds, and widespread availability of Wi-Fi hotspots are the factors influencing the growth of the mobile VoIP market in Europe.

The UK mobile VoIP market is expected to grow rapidly in the coming years due to the growth of mobile computing devices and high operational flexibility. Easy access and low internet costs are leading to increased usage among consumers.

Asia Pacific Mobile VoIP Market Trends

Asia Pacific mobile VoIP market is anticipated to witness noteworthy growth during the forecast period. A rapid increase in the number of smartphones used in the region, the constantly growing network of internet accessibility in countries such as India, and the growing adoption of mobile VoIP services by businesses are generating budding demand for the industry in this region. The continuous inflow of investments from North America & Europe and the operational presence of global organizations operating in different industries also market growth in the region.

China mobile VoIP market holds a significant revenue share of the regional market. It is attributed to a large population with widespread smartphone adoption, enhancements in telecom infrastructure in the country, the presence of multiple businesses with global operations, and increasing accessibility to the Internet.

Key Mobile VoIP Company Insights

Some of the key companies operating in the global mobile VoIP market ar Microsoft, RingCentral, Inc., Meta, Grasshopper, Cisco Systems, Inc., Aircall, Mitel Networks Corp and others. Market participants are concentrating on expanding their customer base to enhance their competitive advantage in the industry. Therefore, major players are implementing numerous strategic initiatives, including mergers and acquisitions, and forming partnerships with other leading firms.

-

Apple Inc., a prominent technology company, designs, develops and delivers smartphones, personal computers, tablets, wearables, accessories, and associated technologies. The company also provides solutions related to digital payment, digital content, cloud, and advertising. It specializes in computers and consumer electronics.

-

Microsoft is a global technology and computing solutions company that offers a variety of software products, hardware products, and additional services. Its mobile VoIP app provides low or no-cost calling services.

Key Mobile VoIP Companies:

The following are the leading companies in the mobile VoIP market. These companies collectively hold the largest market share and dictate industry trends.

- Apple Inc.

- Google LLC

- Microsoft

- RingCentral, Inc.

- Nextiva

- Grasshopper

- Cisco Systems, Inc.

- Aircall

- Mitel Networks Corp.

- Meta

- Zoom Video Communications, Inc.

- 3CX

- 8x8, Inc.

- GoTo group

Recent Developments

-

In March 2024, WhatsApp voice calls started appearing in regular phone call history. According to WhatsApp’s help center, users cannot unsubscribe from this feature; however, they can delete the calls from history records instead.

Mobile VoIP Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 50.78 billion

Revenue forecast in 2030

USD 104.92 billion

Growth Rate

CAGR of 12.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, platform

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, South Korea, Brazil, Saudi Arabia, and South Africa

Key companies profiled

Apple Inc., Google LLC, Microsoft, RingCentral, Inc., Nextiva., Grasshopper., Cisco Systems, Inc., Aircall, Mitel Networks Corp., Meta, Zoom Video Communications, Inc., 3CX , 8x8, Inc., GoTo group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Mobile VoIP Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global mobile VoIP market report based on service and platform.

-

Service Outlook (Revenue, USD Billion, 2018 - 2030)

-

Video and Voice Calls

-

Video Conferencing

-

Instant Messaging

-

Others

-

-

Platform Outlook (Revenue, USD Billion, 2018 - 2030)

-

Android OS

-

iOS

-

Windows OS

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.