- Home

- »

- Plastics, Polymers & Resins

- »

-

Modified Atmosphere Packaging Market Size Report, 2030GVR Report cover

![Modified Atmosphere Packaging Market Size, Share & Trends Report]()

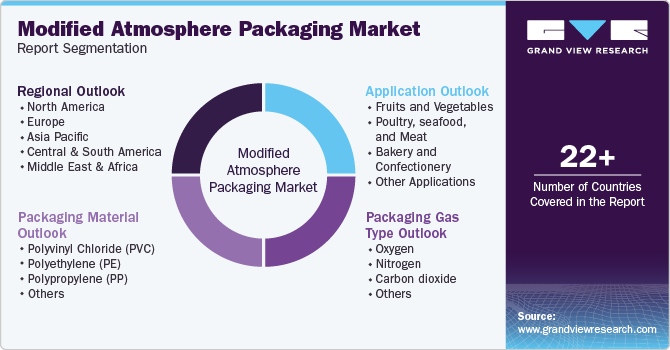

Modified Atmosphere Packaging Market (2025 - 2030) Size, Share & Trends Analysis Report By Packaging Material (Polyethylene, Polypropylene), By Packaging Gas Type (Nitrogen, Carbon Dioxide), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-531-0

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Modified Atmosphere Packaging Market Summary

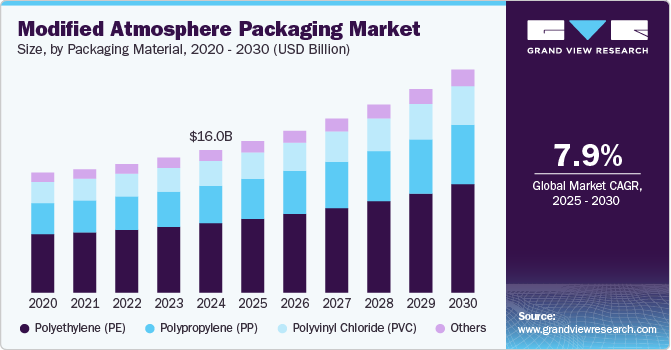

The global modified atmosphere packaging market size was estimated at USD 16.03 billion in 2024 and is anticipated to reach USD 26.18 billion by 2030, growing at a CAGR of 7.94% from 2025 to 2030. The growth of global cold chain logistics is driving the market, as better temperature-controlled storage and transportation help maintain the effectiveness of MAP in extending shelf-life.

Key Market Trends & Insights

- Asia Pacific modified atmosphere packaging market dominated the global market and accounted for the largest revenue share of 36.80% in 2024.

- In the U.S., the rising demand for convenience and ready-to-eat food products is significantly driving the modified atmosphere packaging market.

- By packaging material, polyethylene (PE) dominated the market with a revenue share of 48.72% in 2024.

- By packaging gas type, carbon dioxide dominated the market with a revenue share of 44.17% in 2024.

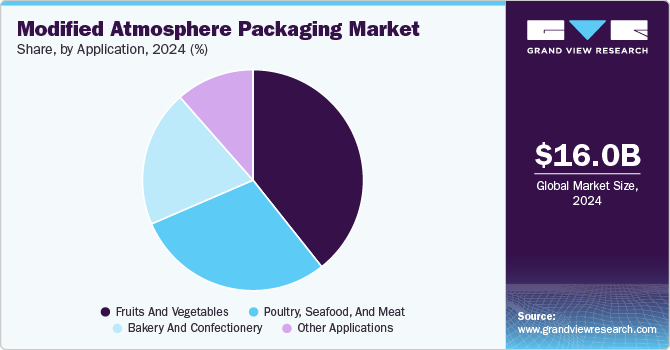

- By application, fruits and vegetables dominated the market with a revenue share of 39.33% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 16.03 Billion

- 2030 Projected Market Size: USD 26.18 Billion

- CAGR (2025-2030): 7.94%

- Asia Pacific: Largest market in 2024

The integration of smart sensors in modified atmosphere packaging (MAP) is a key trend driving innovation in the industry. As consumer demand for fresh and safe food increases, companies are adopting intelligent packaging solutions that monitor real-time gas composition, temperature, and humidity inside the packaging. These sensors help optimize shelf-life by ensuring the correct atmospheric balance and reducing spoilage. This trend is particularly significant in perishable food categories such as meat, seafood, and fresh produce, where maintaining ideal gas levels is crucial. Additionally, regulatory bodies and retailers are emphasizing transparency in food safety, further accelerating the adoption of smart packaging technologies in MAP.

Drivers, Opportunities & Restraints

The rising global demand for minimally processed and longer shelf-life food products is a primary driver for the modified atmosphere packaging market. Consumers increasingly prefer fresh, preservative-free food options while expecting longer storage durations. MAP technology addresses this by replacing oxygen with a controlled gas mixture, reducing oxidation and microbial growth without the need for chemical preservatives. The rapid expansion of the ready-to-eat meals and convenience food segment, driven by urbanization and changing consumer lifestyles, is further fueling demand. Additionally, stringent food safety regulations and the push for waste reduction in the food supply chain are prompting food manufacturers to invest in modified atmosphere packaging (MAP) solutions to ensure compliance and sustainability.

The growing demand for sustainable and biodegradable MAP solutions presents a significant opportunity for market expansion. With increasing environmental concerns, governments and consumers are pressuring companies to reduce plastic waste and adopt eco-friendly packaging materials. This has led to research and development in biodegradable films, bio-based polymers, and recyclable MAP solutions that maintain gas barrier properties while reducing carbon footprints. Companies that successfully develop and commercialize sustainable MAP solutions will gain a competitive edge, particularly in markets with strict regulations on single-use plastics, such as the European Union. The intersection of sustainability and food preservation offers untapped potential for innovation and growth in the industry.

The high initial investment and operational costs of modified atmosphere packaging technology act as a major restraint for market expansion, especially for small and medium-sized food producers. Modified atmosphere packaging requires specialized equipment, gas mixtures, and advanced sealing technologies, all of which contribute to elevated costs. Additionally, maintaining consistent gas ratios across large-scale production can be complex, requiring sophisticated quality control measures. For cost-sensitive markets, the affordability of MAP solutions remains a challenge, often leading food producers to opt for conventional packaging alternatives. Without cost-effective solutions, the widespread adoption of MAP technology may remain limited to premium food segments and large-scale manufacturers with substantial capital investment capabilities.

Packaging Material Insights

Polyethylene (PE) dominated the modified atmosphere packaging market across the packaging material segmentation with a revenue share of 48.72% in 2024. The increasing demand for lightweight, cost-effective, and recyclable packaging is driving the use of PE in modified atmosphere packaging. PE offers excellent moisture resistance and flexibility, making it ideal for perishable food products that require extended shelf life. With sustainability concerns rising, manufacturers are developing recyclable and bio-based PE films that maintain gas barrier properties while reducing environmental impact. Additionally, the growth of e-commerce in the food sector has further fueled demand for durable yet lightweight MAP solutions, where PE remains a preferred material due to its balance of performance, affordability, and ease of processing.

The high clarity and strong gas barrier properties of polyvinyl chloride (PVC) make it a key material in modified atmosphere packaging, particularly for fresh meat, poultry, and seafood. Consumers and retailers prioritize product visibility, and PVC’s transparency enhances shelf appeal while allowing for effective quality inspection. Additionally, advancements in plasticizer-free and food-grade PVC formulations have improved safety standards, addressing previous concerns about chemical migration. As regulatory frameworks tighten around food packaging safety, demand for high-performance PVC films that comply with food-grade standards continues to grow, particularly in regions with stringent quality control measures.

Packaging Gas Type Insights

Carbon dioxide dominated the modified atmosphere packaging market across the packaging gas type segmentation with a revenue share of 44.17% in 2024. The critical role of carbon dioxide in inhibiting microbial growth is a key factor driving its demand for modified atmosphere packaging. Carbon dioxide is particularly effective in slowing the spoilage of perishable foods such as meat, dairy, and seafood by suppressing bacterial and fungal growth. With global concerns over food waste rising, manufacturers are optimizing carbon dioxide concentrations in packaging to maximize shelf-life without compromising product freshness. The expansion of global cold chain logistics has supported the use of carbon dioxide-based MAP, ensuring food quality is preserved throughout extended distribution networks. The growing preference for minimally processed and chemical-free preservation methods further strengthens the role of carbon dioxide in this market.

The growing need for oxidation prevention in packaged food is driving the increased use of nitrogen in modified atmosphere packaging. Nitrogen is an inert gas that displaces oxygen inside the package, preventing lipid oxidation and maintaining product texture and color, making it essential for snacks, coffee, and processed food items. As the demand for clean-label and preservative-free food increases, nitrogen’s role in maintaining freshness without chemical additives has gained prominence. Furthermore, technological advancements in gas flushing and on-site nitrogen generation have made MAP more cost-effective for manufacturers, further supporting market growth.

Application Insights

Fruits and vegetables dominated the modified atmosphere packaging market across the application segmentation with a revenue share of 39.33% in 2024. The growing consumer preference for fresh, minimally processed produce is driving demand for modified atmosphere packaging in the fruits and vegetables segment. With increasing awareness of food safety and nutritional value, consumers expect longer shelf-life without preservatives, making MAP a crucial solution for reducing spoilage. Advances in breathable packaging films, which allow optimal gas exchange to slow respiration rates, have further enhanced MAP adoption in this category. Additionally, the global expansion of organic farming and farm-to-table supply chains has increased the need for protective packaging solutions that maintain freshness during extended transportation and storage.

The rising demand for extended shelf-life in artisanal and packaged baked goods is driving the adoption of modified atmosphere packaging in the bakery and confectionery segment. MAP helps prevent staleness, mold growth, and moisture loss, ensuring that bread, pastries, and chocolates maintain their quality over time. With the increasing globalization of food distribution, manufacturers are utilizing MAP to expand product reach while reducing dependency on artificial preservatives. Furthermore, premium and gluten-free bakery segments are witnessing significant growth, necessitating advanced packaging solutions that preserve texture, flavor, and appearance without compromising ingredient integrity.

Regional Insights

Asia Pacific modified atmosphere packaging market dominated the global market and accounted for the largest revenue share of 36.80% in 2024. The growing middle-class population and rising disposable income levels in Asia Pacific are accelerating the demand for high-quality packaged food, driving the modified atmosphere packaging market. As consumers in emerging economies like India, Indonesia, and Vietnam shift toward modern retail and premium food products, food manufacturers are adopting MAP to meet expectations for freshness and safety.

North America Modified Atmosphere Packaging Market Trends

The increasing focus on reducing food waste and ensuring supply chain efficiency is a key driver for the modified atmosphere packaging market in North America. With rising concerns over sustainability, government agencies, retailers, and food manufacturers are adopting advanced packaging solutions to extend product shelf-life and minimize losses. The expansion of the cold chain infrastructure, particularly for fresh produce, seafood, and dairy products, has further fueled demand for MAP technologies that help maintain product integrity during long-distance transportation.

U.S. Modified Atmosphere Packaging Market Trends

In the U.S. modified atmosphere packaging market, the rising demand for convenience and ready-to-eat food products is significantly driving the modified atmosphere packaging market. With fast-paced lifestyles and increasing urbanization, consumers are opting for pre-packaged, fresh-cut produce, deli meats, and bakery items that require extended shelf life. This has led food manufacturers to invest in advanced MAP solutions that maintain freshness while complying with stringent FDA regulations on food safety. Additionally, the premiumization of organic and clean-label food products has encouraged the adoption of MAP to reduce oxidation and microbial spoilage, ensuring that high-quality, preservative-free foods remain fresh for longer periods.

Europe Modified Atmosphere Packaging Market Trends

The strict environmental and food safety regulations imposed by the European Union are driving the adoption of modified atmosphere packaging in Europe. With stringent restrictions on food preservatives and synthetic additives, manufacturers are turning to MAP as a natural method to extend shelf-life while maintaining food quality. Additionally, the EU’s strong push towards sustainable packaging solutions has led to innovations in biodegradable and recyclable MAP films, aligning with circular economy goals. The region’s highly developed supermarket and private-label food industry further supports the growth of MAP, as retailers seek high-quality packaging solutions to reduce food waste and enhance product appeal.

In China modified atmosphere packaging market, the rapid expansion of the fresh food e-commerce sector is a key factor driving demand for modified atmosphere packaging. The rise of online grocery platforms such as JD Fresh and Alibaba’s Freshippo has increased the need for packaging solutions that can preserve perishable food products during extended logistics cycles. Additionally, urban consumers are demanding higher food quality and safety standards, prompting food manufacturers to invest in advanced MAP technologies. The Chinese government’s push for reducing food waste and improving cold chain logistics is further encouraging the adoption of MAP, particularly in sectors such as fresh produce, seafood, and dairy.

Key Modified Atmosphere Packaging Company Insights

The modified atmosphere packaging industry is highly competitive, with several key players dominating the landscape. Major companies include Air Products and Chemicals, Inc., Linde plc, Praxair, Inc., Amcor plc, Berry Global, Inc., Sealed Air Corporation, MULTIVAC Group, Multisorb Technologies Inc., and Colpac Limited. The modified atmosphere packaging market is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their types.

Key Modified Atmosphere Packaging Companies:

The following are the leading companies in the modified atmosphere packaging market. Thesecompanies collectively hold the largest market share and dictate industry trends.

- Air Products and Chemicals, Inc.

- Linde plc

- Praxair, Inc.

- Amcor plc

- Berry Global, Inc.

- Sealed Air Corporation

- MULTIVAC Group

- Multisorb Technologies Inc.

- Colpac Limited

Recent Developments

-

In February 2025, StePacPPC partnered with Windham Packaging to create modified atmosphere packaging (MAP) to extend the shelf life of fresh produce for foodservice, reducing waste. The resealable packaging has controlled water vapor transmission, minimized moisture and preserving produce quality. Designed for various form-fill and seal operations, the films reduce plastic use and are available with chemically recycled content.

-

In January 2025, Cirkla launched the world's first molded fiber Modified Atmosphere Packaging (MAP) trays, offering a sustainable alternative to traditional plastic MAP trays. These trays reduce plastic content by approximately 85% and are made from renewable plant fibers.

Modified Atmosphere Packaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 17.87 billion

Revenue forecast in 2030

USD 26.18 billion

Growth rate

CAGR of 7.94% from 2024 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors and trends

Segments covered

Packaging material, packaging gas type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S., Canada; Mexico; Germany; UK; France; Italy, China; India; Japan; Brazil; Argentina, GCC Countries, South Africa

Key companies profiled

Air Products and Chemicals, Inc.; Linde plc; Praxair, Inc.; Amcor plc; Berry Global, Inc.; Sealed Air Corporation; MULTIVAC Group; Multisorb Technologies Inc.; Colpac Limited

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Modified Atmosphere Packaging Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global modified atmosphere packaging market report based on the packaging material, packaging gas type, application, and region:

-

Packaging Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Polyvinyl Chloride (PVC)

-

Polyethylene (PE)

-

Polypropylene (PP)

-

Others

-

-

Packaging Gas Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Oxygen

-

Nitrogen

-

Carbon dioxide

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Fruits and vegetables

-

Poultry, seafood, and meat

-

Bakery and confectionery

-

Other Applications

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

GCC Countries

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global modified atmosphere packaging market size was estimated at USD 16.03 billion in 2024 and is expected to reach USD 17.87 billion in 2025.

b. The global modified atmosphere packaging market is expected to grow at a compound annual growth rate of 7.94% from 2025 to 2030 to reach USD 26.18 billion by 2030.

b. Polyethylene (PE) dominated the modified atmosphere packaging market across the packaging material segmentation in terms of revenue, accounting for a market share of 48.72% in 2024. The increasing demand for lightweight, cost-effective, and recyclable packaging is driving the use of PE in Modified Atmosphere Packaging.

b. Some key players operating in the modified atmosphere packaging market include Air Products and Chemicals, Inc., Linde plc, Praxair, Inc., Amcor plc, Berry Global, Inc., Sealed Air Corporation, MULTIVAC Group, Multisorb Technologies Inc., and Colpac Limited.

b. The growth of global cold chain logistics is driving the Modified Atmosphere Packaging market, as better temperature-controlled storage and transportation help maintain the effectiveness of MAP in extending shelf-life.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.