- Home

- »

- Green Building Materials

- »

-

Modular Construction Market Size, Industry Report, 2033GVR Report cover

![Modular Construction Market Size, Share & Trends Report]()

Modular Construction Market (2026 - 2033) Size, Share & Trends Analysis Report By Type (Relocatable, Permanent), By Material (Wood, Steel Concrete, Other), By Application (Residential, Commercial), By Module, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-561-8

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Modular Construction Market Summary

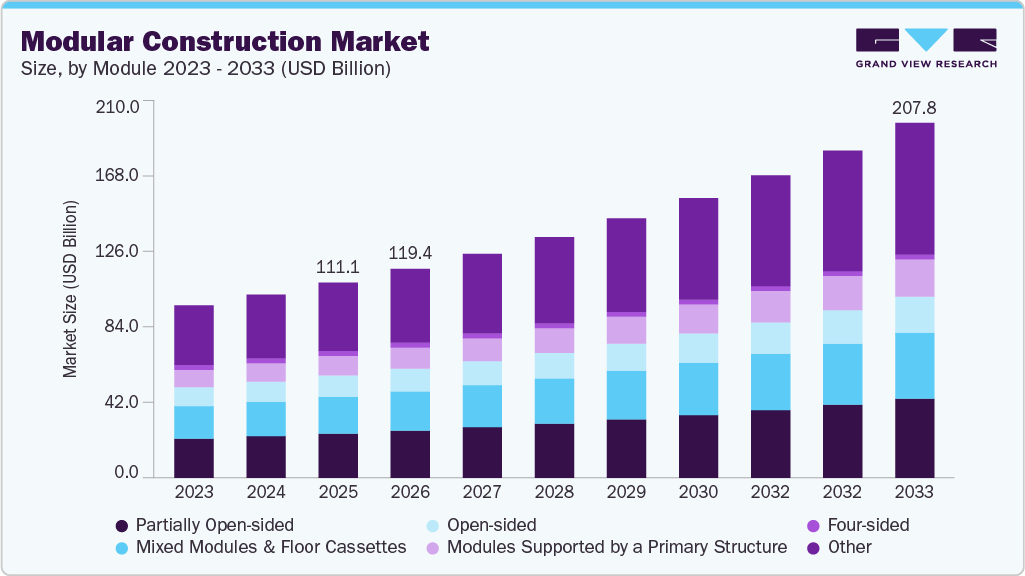

The global modular construction market size was valued at USD 111.07 billion in 2025 and is projected to reach USD 207.82 billion by 2033, growing at a CAGR of 8.2% from 2026 to 2033. This growth is attributed to growing demand for affordable housing, coupled with increasing investment in the development of healthcare and commercial infrastructure around the globe.

Key Market Trends & Insights

- Europe dominated the modular construction market with the largest revenue share of 45.0% in 2025.

- By type, the permanent segment is expected to grow at the fastest CAGR of 8.5% over the forecast period.

- By application, the residential segment is expected to grow at the fastest CAGR of 8.9% over the forecast period.

- By material, the concrete segment is expected to grow at the fastest CAGR of 8.4% over the forecast period.

- By modules, the open-sided segment is expected to grow at the fastest CAGR of 9.3% over the forecast period.

Market Size & Forecast

- 2025 Market Size: USD 111.07 Billion

- 2033 Projected Market Size: USD 207.82 Billion

- CAGR (2026-2033): 8.2%

- Europe: Largest market in 2025

- Asia Pacific: Fastest market in 2025

Off-site building activities in urban regions are also growing, which is further driving the growth of the modular building market. Off-site building is not affected by weather conditions, as it is manufactured within closed factories using advanced machinery, thereby optimizing construction time and providing high-quality Types. The benefits of off-site building make modular building cost-effective and contribute to less site-generated waste. The steady rise in urbanization and industrial expansion is anticipated to spur a greater number of upcoming commercial and industrial projects, thereby supporting global construction sector growth. Ongoing technological progress in the building industry, along with the benefits offered by modular methods such as faster project delivery, cost efficiency, improved adaptability, reusability, and lower material wastage, continues to strengthen overall demand. These strengths are becoming increasingly relevant in the modular construction for high rise buildings market, where rapid and efficient construction solutions are essential.

Modular building enables industries to customize designs and leverage the latest innovations in style and functionality. Before the development of the modular prefabricated construction market, industries were compelled to spend countless man-hours on planning and designing, while actual construction took months or even years to complete. The evolution of modular methods takes the guesswork out of the planning stage and simplifies construction to a large extent, reducing the time from conception to completion by months or more.

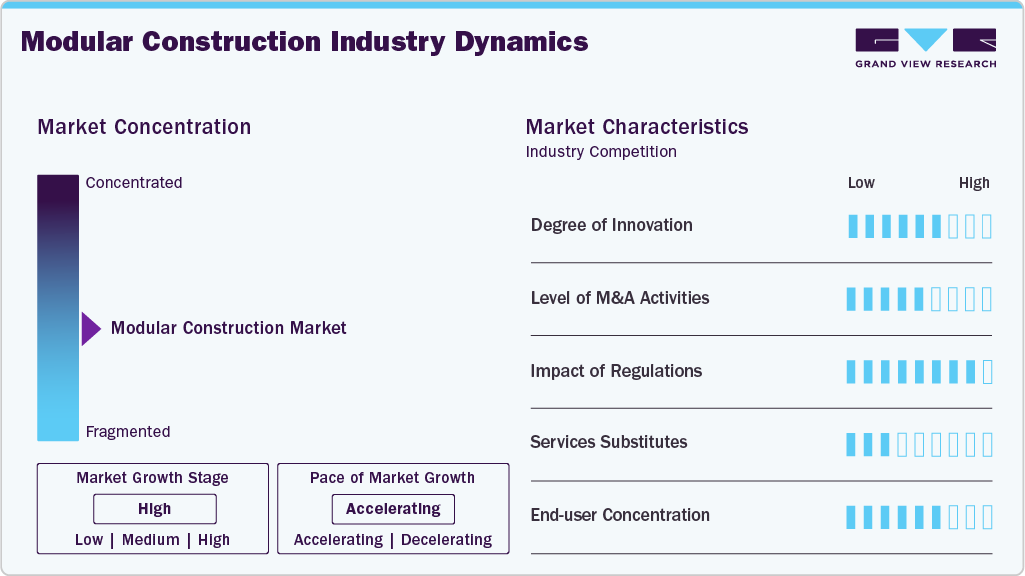

Market Concentration & Characteristics

The market growth stage is high, and the pace of this industry's growth is accelerating. Modular construction industry is characterized by a high degree of innovation owing to rapid technological advancements. This industry is characterized by technological advancements that enable the production of advanced products for various applications. Advancements in extended 3D analysis of building systems (ETABS) and revit software/3D max have resulted in development of increased penetration of modular building in different applications. Extended 3D Analysis of Building Systems (ETABS) is an engineering software that carries out the design and structural analysis of buildings. It offers 3D object modeling and visualizing tools. This software also offers insightful reports, graphic displays, and schematic drawings to enable users to decipher design results and understand the building structure analysis easily. ETABS has sophisticated and comprehensive design capabilities for a broad range of materials and possesses fast linear and nonlinear analytical power.

Modular construction industry is also characterized by a high level of merger and acquisition (M&A) activity by leading players. This is due to several factors, including shifting focus towards expansion of production capabilities and strengthening their position in this industry.

Various associations and regulatory bodies across the globe have set regulations with regard to the designing, manufacturing, transportation, and erection of pre-engineered and modular buildings. ASTM standards define various parameters such as dimensions and tolerance level of components used in pre-engineered buildings. Manufacturing companies have to adhere to the standards set by various associations such as MBMA, AISC, AISI, and AWS for modular construction structures during their entire manufacturing process.

End-user concentration is a significant factor in this industry as there are a number of end-user industries that are driving demand for modular construction. The demand for modular building is growing among the end-user industries on account of growing awareness regarding benefits of offsite construction. The manufacturers of modular construction offer final Types to end users in the residential, industrial, commercial, educational, and healthcare sectors. The demand for modular construction is rising from end users as it helps reduce the building time, cost, and material waste generated. As modular construction building units are manufactured at the worksites and simply assembled & installed by the end-users at the project site, this further helps to speed up the building process, there preference among the end-users is largely increasing.

Type Insights

The permanent segment led the modular construction market and accounted for a revenue share of 64.6% in 2025. Permanent modular construction offers enhanced design flexibility and customization, enabling the creation of visually appealing and architecturally diverse buildings. Its robust quality control ensures consistent safety, durability, and high standards, making it a preferred option for developers, architects, and clients seeking reliable, long-lasting solutions. These advantages position permanent modular construction as a leader in the modular construction market, catering to permanent and relocatable building needs with a growing demand for efficiency and resilience.

The relocatable modular construction segment is expected to grow significantly at a CAGR of 7.7% over the forecast period. Temporary housing for emergency and relief efforts has become increasingly popular. These structures are designed to be easily relocated and adapted to different sites. During the urgent need for housing for disadvantaged communities, relocatable construction models offer an ideal solution, helping to address both time and budget limitations efficiently. The demand for temporary office spaces, storage, and housing in large construction projects has driven their increased need. These structures offer a practical and flexible solution to meet the short-term needs of such projects.

Material Insights

The steel segment dominated the market, accounting for a revenue share of 41.2% in 2025. The material comes in various forms, including H-type beams, columns, angles, I-beams, and T-shapes. It boasts remarkable mechanical and chemical properties such as high strength, durability, ductility, ease of fabrication, resistance to seismic forces, and rapid assembly. It is commonly used as a reinforcing agent in concrete to offset its lower tensile strength. Pre-engineered steel structures are frequently employed in large, open spaces, particularly for commercial and industrial applications. Steel frames are lighter than many other wall materials, making it easier to crane and transport building components efficiently, which minimizes disruption to the surrounding area and helps lower costs.

The concrete segment in the modular construction market is estimated to grow at the fastest CAGR of 8.4% over the forecast period. Concrete’s durability and strength make it ideal for modular buildings, ensuring long-term structural integrity and resistance to weather conditions. Its natural fire resistance enhances safety, benefiting both residential and commercial projects. Concrete also improves energy efficiency by providing better insulation and lowering heating and cooling costs. Minimal maintenance requirements further reduce long-term expenses. With its wide availability and cost-effectiveness, concrete is preferred in modular construction, enabling faster, more affordable project completions while meeting the growing demand for sustainable building solutions.

Module Insights

The four-sided segment dominated the market and accounted for a revenue share of 37.3% in 2025. The growing demand for affordable and prefabricated housing solutions plays a crucial role in the expansion of the four-sided module segment. With rapid urbanization and housing shortages in various regions, governments and private developers are increasingly turning to modular construction to meet demand. The ability to construct multi-story residential buildings quickly and efficiently makes four-sided modules a preferred choice in the industry.

The open-sided segment in the modular construction market is estimated to grow at the fastest CAGR of 9.3% over the forecast period, driven by increasing demand for flexible and customizable building solutions. Open-sided modules provide enhanced design adaptability, allowing for larger open spaces without internal load-bearing walls. This makes them particularly suitable for applications such as hotels, commercial buildings, and healthcare facilities, where spacious interiors and seamless connectivity between modules are essential. The ability to integrate multiple open-sided modules enables architects and developers to achieve more complex designs while maintaining the benefits of off-site construction.

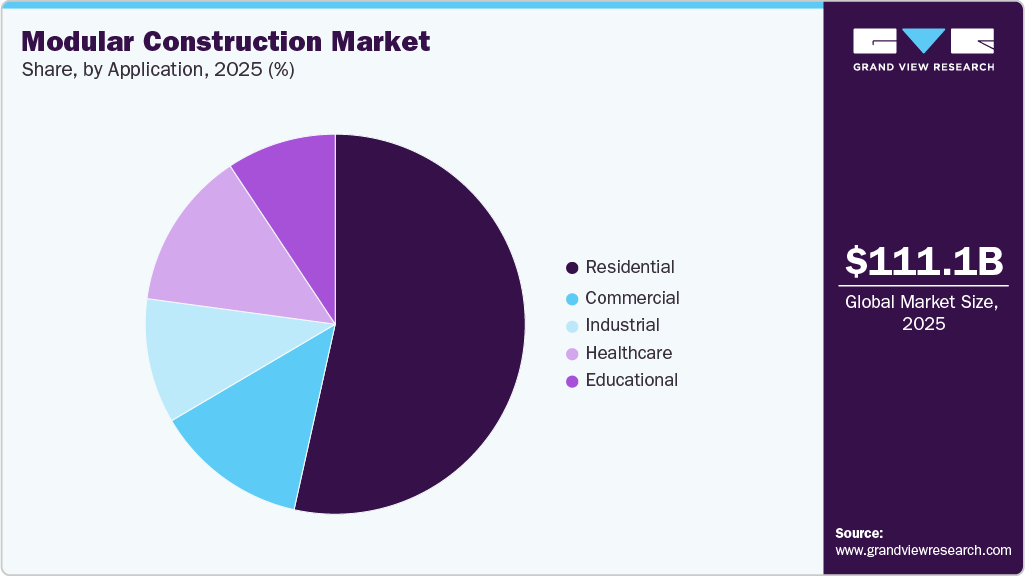

Application Insights

Residential modular construction dominated the market and accounted for a revenue share of 53.5% in 2025. Modular construction offers an innovative approach to creating visually appealing buildings with an emphasis on sustainability and design. It enables quick construction, accommodates complex design challenges, and allows for the creation of distinctive, customizable homes that meet the specific needs of communities. Rising global population and urbanization have heightened the need for housing, especially in crowded urban areas. Modular construction provides an efficient, cost-effective solution, reducing build times and costs. Its versatility offers various customizable residential designs, meeting diverse housing needs and preferences in rapidly growing cities.

The commercial sector in the modular construction market is expected to grow significantly at a CAGR of 8.1% over the forecast period. The recovering economic situations in key markets such as the UK, the U.S., and Asia are expected to generate robust demand for commercial spaces such as offices, showrooms, and hotels, thus leading to increased commercial building activities. From portable commercial buildings to modular retail stores, modular construction holds the potential to disrupt the industry. These buildings are constructed by the International Building Code (IBC). The dynamism of modular construction makes it an ideal option for use across different commercial sectors such as offices, public restrooms & bathrooms, restaurants, and diners.

Regional Insights

Europe dominated the market and accounted for a 45.0% share in 2025 and is expected to continue its dominance over the forecast period. The strong adoption of modular solutions in Germany, Finland, the UK, and Sweden continues to reinforce regional growth. One of the major factors supporting this expansion is the rising influx of migrants, which is increasing the need for both temporary and long-term housing infrastructure. At the same time, sustained investments and the rapid integration of advanced building technologies are accelerating modular construction activities across various sectors, including the Europe modular construction for healthcare market, which is benefiting from the broader shift toward faster, flexible, and cost-efficient building methods.

UK Modular Construction Market Trends

In UK, modular construction is gaining popularity as a viable method of constructing affordable homes owing to various factors such as population growth and shortages in housing. The number of modular homes in UK is increasing, and the country's top construction companies, investors, and developers are exploring modular housing solutions. As UK government plans to construct approximately 300,000 new homes per year to address the challenges in the housing market, modular building sector is expected to play a significant role.

North America Modular Construction Market Trends

The North America modular construction market held a substantial market share of 14.3% in 2025. Technological advancements such as Building Information Modeling (BIM), 3D printing, and automation have improved modular construction's efficiency, precision, and quality, making it more attractive to developers and investors. In urban centers such as New York and San Francisco, rising demand for affordable housing drives the adoption of modular solutions, offering faster, cost-effective alternatives. Modular buildings are also gaining popularity for disaster relief, providing scalable, quick solutions for housing and essential facilities.

Growth of modular construction market in Canada is driven by increase in new education start-ups, office constructions, and new multifamily construction projects. Industrial workforce housing sector is one of the most important end-use market for modular building sector in Canada. The modular industry provides temporary workforce housing solutions in remote areas where energy sector is active.

Asia Pacific Modular Construction Market Trends

The Asia Pacific modular construction market is expected to grow at the fastest CAGR of 9.2% over the forecast period due to rising international investments in the region's infrastructural sector. The increasing demand for sustainable structures owing to growing environmental concerns and rising pollution rates is propelling the deployment of modular construction and contributing significantly to its growth. Asia-Pacific is a rapidly developing region, home to major emerging economies such as India and China, further driving the growth of modular construction.

The China modular construction market has gained traction in the last two decades owing to rapid economic development, rising labor costs, quality & affordability of homes, innovations in construction technologies, and promotion of national policies. Several electronic companies in China are working on advanced robotics and automation technologies that are being used in modular building industry.

The Singapore modular construction market is growing as the demand for modular building is growing rapidly in Singapore due to government policies of promoting construction sector, which is in line with the country’s vision of continuous increase of Typeivity in the construction industry. In Singapore, modular building technique is well-suited for implementation in urban and congested areas. As these construction process is delocalized off-site, it generates almost no nuisance in terms of sound, dust, or traffic. The installation process on-site takes only a few weeks, as compared to a few months for a conventional in-site construction.

Saudi Arabia Modular Construction Market Trends

Saudi Arabia, which is one major contributors to Middle East and African economy, is adding more rail lines, investing in workforce, expanding shipping ports, and providing other incentives to gain attention of global and domestic suppliers. Thus, investment in infrastructure sector of this region is likely to positively influence modular construction market over the forecast period. For the development of megaprojects, adoption of advanced technologies to speed up this building process and reduce labor costs is increasing; therefore, modular construction market is expected to grow over the forecast period.

Various new players entering the modular construction industry in Brazil are focusing on adopting advanced technology in this field to improve the speed and quality of construction. Rising adoption of advanced technologies by new players in the construction industry is expected to boost the modular construction market over the forecast period.

Key Modular Construction Company Insights

Some of the key players operating in this industry include Sekisui House Ltd., Skanska and Lendlease Corporation

-

Sekisui House Ltd. designs, contracts, constructs, and supervises landscaping and exterior construction activities, along with cultivation, purchase, and sales of plants. This company operates through four business segments, namely, Built-to-order business, Supplied housing business, Development business, and Overseas business

-

Skanska is a construction and project development company focused on selected home markets in Nordic region, Poland, Czech Republic, Hungary, Europe, and the U.S. It operates through three business segments, namely construction, residential development, and commercial property development

-

Lendlease Corporation is a globally integrated real estate and investment group with core expertise in shaping cities and creating strong and connected communities. It operates through three business segments, namely development, construction, and investments.

Guerdon, LLC and Riko Hiše d.o.o are some of the emerging industry participants in this market.

-

Guerdon, LLC is engaged in the development of medium to large scale multi-story modular construction projects with a primary focus of using modular construction methods. It is specialized in modular experience building multifamily, hospitality, assisted living, student housing, and remote workforce housing projects.

-

Riko Hiše d.o.o develops wooden, eco-friendly, energy-efficient, and prefabricated buildings. The company designs each building exclusively according to the expectations and requirements of customers to meet their requests, needs, and lifestyles.

Key Modular Construction Companies:

The following are the leading companies in the modular construction market. These companies collectively hold the largest market share and dictate industry trends.

- Sekisui House Ltd.

- LAING O'ROURKE

- Red Sea International

- Skanska

- Bouygues Construction

- Premier Modular Limited

- LEUSBERG GmbH & Co KG

- DuBox

- Wernick Group

- CIMC Modular Building Systems Holdings Co., Ltd. (CIMC-MBS)

- Riko Hiše d.o.o

- Lendlease Corporation

- Modulaire Group

- Guerdon, LLC

- Hickory Group

Recent Developments

-

In January 2025, Sunbelt Modular Inc. acquired BRITCO Structures, USA (BUSA), a Texas-based modular building manufacturer specializing in complex commercial projects. BUSA, founded in 2011, complements Sunbelt's strategy of providing custom modular solutions. This acquisition enhances Sunbelt's national platform, expanding its government, education, healthcare, housing, and offerings. It marks Sunbelt's 11th acquisition, following its purchase by Littlejohn & Co. in 2024.

Modular Construction Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 119.41 billion

Revenue forecast in 2033

USD 207.82 billion

Growth rate

CAGR of 8.2% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, material, application, module, region

Regional scope

North America; Europe; Asia Pacific; Middle East & Africa; Central & South America

Country scope

U.S.; Canada; Mexico; Germany; UK; Sweden; China; India; Japan; Singapore; Australia; Brazil; Saudi Arabia; UAE

Key companies profiled

Sekisui House Ltd.; LAING O'ROURKE; Red Sea International; Skanska; Bouygues Construction; Premier Modular Limited; LEUSBERG GmbH & Co KG; DuBox; Wernick Group; CIMC Modular Building Systems Holdings Co., Ltd. (CIMC-MBS); Riko Hiše d.o.o; Lendlease Corporation; Modulaire Group; Guerdon, LLC; Hickory Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Modular Construction Market Report Segmentation

This report forecasts revenue growth at regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the modular construction market report based on type, application, material, module and region.

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Relocatable

-

Permanent

-

-

Material Outlook (Revenue, USD Million, 2021 - 2033)

-

Wood

-

Steel

-

Concrete

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Residential

-

Commercial

-

Industrial

-

Healthcare

-

Educational

-

-

Module Outlook (Revenue, USD Million, 2021 - 2033)

-

Four-sided

-

Open-sided

-

Partially open-sided

-

Mixed modules & floor cassettes

-

Modules supported by a primary structure

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Sweden

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Singapore

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global modular construction market size was estimated at USD 111.07 billion in 2025 and is expected to reach USD 119.41 billion in 2026.

b. The global modular construction market is expected to grow at a compound annual growth rate of 8.2% from 2026 to 2033 to reach USD 207.82 billion by 2033.

b. The permanent segment led the modular construction market and accounted for a revenue share of 64.6% in 2025. Permanent modular construction provides enhanced design flexibility and customization, allowing for the creation of visually appealing and architecturally diverse buildings.

b. Some of the key players operating in the modular construction market include Sekisui House Ltd., LAING O'ROURKE, Red Sea International, Skanska, Bouygues Construction, Premier Modular Limited, LEUSBERG GmbH & Co KG, DuBox, Wernick Group, CIMC Modular Building Systems Holdings Co., Ltd. (CIMC-MBS), Riko Hiše d.o.o, Lendlease Corporation, Modulaire Group, Guerdon, LLC, Hickory Group

b. Key factors driving the modular construction market include faster project timelines, lower costs, improved flexibility, reduced material waste, and advancements in building technologies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.