- Home

- »

- Automotive & Transportation

- »

-

Modular Container Market Size, Share & Trends Report, 2030GVR Report cover

![Modular Container Market Size, Share & Trends Report]()

Modular Container Market (2022 - 2030) Size, Share & Trends Analysis Report By Type (Mobile, Fixed), By Revenue Source (New Product Sale, Rental), By Usage, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-012-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global modular container market size was valued at USD 26,248.3 million in 2021 and is expected to expand at a CAGR of 7.5% from 2022 to 2030. Modular containers are prefabricated steel structures used as workplaces, hospitals, laboratories, schools, worker camps on construction sites, and overnight lodgings. Modular containers come with a wide range of benefits, such as quick and easy installation, environment-friendly, and cost-effectiveness. Consumers can customize containers by adding windows & doors of the required style, and off-grid electricity generation, among others.

Additionally, the modular containers are durable and can withstand harsh weather conditions. A significant rise in industrial and commercial development is anticipated to increase the number of people moving into metropolitan regions. The rapid urbanization in cities such as New York (U.S.), Vancouver (Canada), and Mexico City (Mexico) has led to the widespread use of modular containers for housing and storage purposes, which is anticipated to propel the growth of the market in the coming years.

The growing need for sustainable construction offers lucrative opportunities for the target market. Manufacturers are shifting their focus to develop energy-efficient sustainable construction to reduce pollution and emission footprint throughout the project lifecycle. Manufacturers are putting more effort into developing energy-efficient modular containers for various industries such as construction, government, manufacturing, education, retail, and agriculture. For instance, Karmod Prefabricated Technologies, a prefab container manufacturer in Turkey, has emphasized green energy container houses manufactured using the new generation container model. These green energy homes are a crucial solution for countries experiencing power outages.

However, issues in obtaining the necessary permits to build modular container-based houses are restraining the market growth. Because prefabricated home demand is relatively new, obtaining the required permits to build a modular container-based house can take time and additional effort. However, several states in the United States host modular container homes and have regulations in place, including Texas, California, Colorado, and Oregon. The lack of proper permits or building codes obstructs construction, adversely affecting the market growth. The challenges of acquiring utility authorizations may be a barrier to using containers for living purposes.

COVID-19 Impact

The outbreak of the pandemic had a significant impact on the storage industry, particularly because of the decline in demand for modular storage rentals. Several companies continued to confront project & payment delays and subsequently ended up returning the rented equipment to customers early. Governments across the globe continued to impose stringent restrictions as the spread of coronavirus showed no signs of abating, and the vaccines got delayed. These restrictions continued to disrupt the supply chains, which led to more business closures.

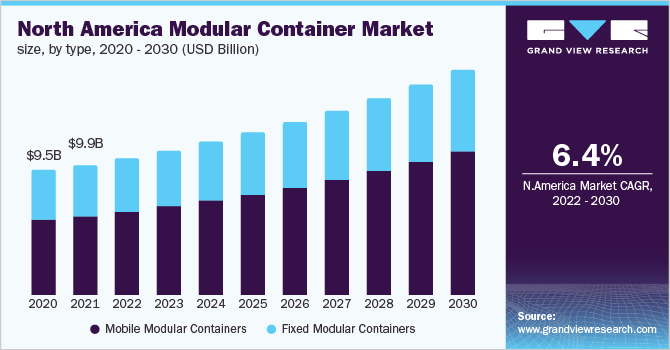

Type Insights

Based on type, the global market is bifurcated into mobile and fixed modular containers. The mobile modular container segment accounted for the largest share in 2021 and is expected to dominate the market during the forecast period because these containers are easily movable, durable, and quickly assembled on-site. They offer compelling and wide-ranging utilities, including ready-to-use offices, portable containers for storage purposes, and commercial applications in offices and building constructions. Furthermore, they provide benefits in construction applications owing to their cost-effectiveness and movability.

The fixed modular container (FMC) is expected to grow significantly during the forecast period owing to the growing popularity of container homes in developed countries like the U.S., the UK, France, and Germany. FMC is an innovative construction technology that involves offsite manufacturing techniques to prefabricate single structures in customizable sections for sustainable practices. Single-unit container homes are cost-effective, durable, and customizable.

Revenue Source Insights

Based on revenue source, the global market is segmented into new product sales and rental. The rental segment accounted for the largest share in 2021 and is expected to dominate the market during the forecast period. Companies in the target market sector typically derive the majority of their revenue from unit leasing. Key players such as WillScot Mobile Mini and McGrath RentCorp offer modular containers on lease and rental along with services such as delivery, installation, maintenance, and other ad hoc services. They also offer removal services at the end of the rental period. Furthermore, according to Relocatable Buildings Report in 2020, the average lease/rent term was 16.7 months which was low from 23.4 months in 2019.

The new product sales segment is expected to grow significantly during the forecast period. Various end-use industries, including retail, healthcare, agriculture, and education, widely purchase modular containers, which are then customized and tailored to the end user’s requirements. For instance, modular hospital construction for the healthcare industry offers an efficient yet dependable solution to the standard capacity issues that plague hospitals worldwide.

Usage Insights

Based on usage, the global market is segmented into office containers, accommodation containers, sanitary containers, locker containers, showroom containers, storage containers, and others. The storage container segment accounted for the largest share in 2021 and is anticipated to dominate the market during the forecast period owing to increased demand for modular storage containers by various industry manufacturers and wholesalers.

A storage container in the manufacturing industry effectively stores various manufacturing equipment such as compressors, machinery, materials, and tools inventory in a small space. This container is commonly used in warehouses, manufacturing facilities, and construction sites. At the construction sites, they are used to store equipment and materials.

The office container segment is expected to witness the highest growth during the forecast period. The popularity of the modular office style can be attributed to its exquisite aesthetic features and strong structural design. Containers are also being used for commercial applications due to advancements in prefabricated building technology.

Container Size Insights

Based on container size, the global market is segmented below 10 feet, 10-20 feet, 21-40 feet, and above 40 feet. The 10-20 feet segment accounted for the largest share in 2021 and is expected to dominate the market during the forecast period. A 10-20 feet modular container is the most commonly used container structure owing to the apt size suitable across most applications such as storage, office space, and locker space. The 20ft shipping container is widely used. It's the standard container range used to transport raw materials like iron ore, rock, and heavy machinery. A 20 feet container has an outer length, width, and height of approximately 20', 8', and 8'6", respectively. A 20 feet container offers a total capacity of 33 cubic meters' space.

The 21 - 40 feet segment is expected to grow significantly during the forecast period. These containers are widely used for industrial and commercial applications, and these container categories have an ample capacity of around 67.7 cubic meters. These containers are large enough to create compartments for different utilities, such as exhibition displays, food stalls, operating rooms for generators and boilers, and even portable stages.

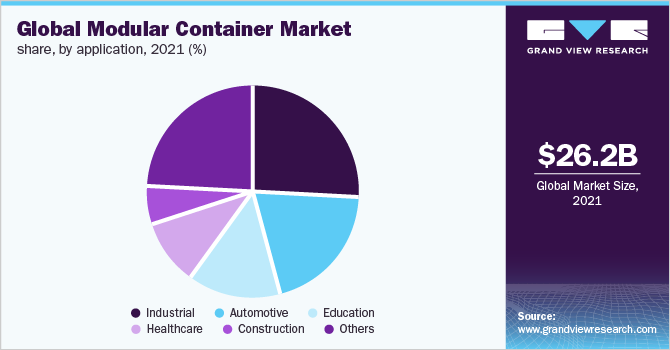

Application Insights

The industrial segment accounted for the largest share in 2021 and is expected to dominate the market during the forecast period. Industrial containers are used for product support to handle and store items that make up a unit load. Modular containers are the ideal solution for industrial storage needs. Modular storage containers can be used for water treatment enclosures and offer several advantages over traditional systems.

These containers are suitable for large-scale cleanup efforts as they can be easily transported from one location to another. Unlike conventional structures, they can also be reused and recycled. Modular storage containers solve a variety of problems for various industries. Additionally, they have significantly lower maintenance costs and offer quick availability and superior wind, snow, and rain protection. Moreover, these containers are durable, resulting in long-term cost savings.

The construction segment is anticipated to witness the highest growth during the forecast period. Modular containers are widely used in both residential and commercial construction. These containers are more effective, long-lasting, and configurable, meeting long-term demand. Furthermore, modular construction has numerous advantages, including durability, attractive designs, and high-quality construction. These advantages can be utilized when constructing parking garages, commercial buildings, and residences. Modular construction is prevalent because it is environmentally friendly, requires little maintenance, and reduces overall costs such as material, construction equipment, and overhead, among other expenses.

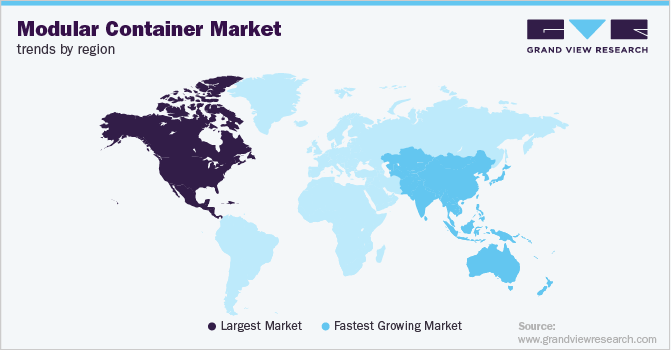

Regional Insights

North America has the largest share in 2021 and is expected to dominate the market during the forecast period. Modular construction is gaining popularity in the U.S. owing to significant growth in infrastructure and industries. Currently, modular construction accounts for about 4% of the country's housing market. However, as per industry experts, modular construction is expected to be adopted in half or more than half of the upcoming projects within the next three years.

Factors such as increasing government initiatives and rising financial expenditure on construction activities, along with the growing popularity of portable and modular infrastructure across the U.S., are expected to provide lucrative growth opportunities for market growth over the forecast period. Moreover, the presence of key players such as Falcon Structures, Truston, WillScot Mobile Mini Holdings Corp., Gaint Containers, and Pac-Van, Inc. is driving the market growth in the region.

Asia-Pacific is expected to witness the highest growth during the forecast period owing to the use of modular containers in construction activities across the region. Most construction projects are currently underway, due to which secured space is required for storing inventories such as rods and cement. This is expected to boost the target market during the forecast period. China and India are at the forefront of driving market growth in the Asia-Pacific region.

Key Companies & Market Share Insights

To broaden their product offering, industry companies adopt various growth strategies such as partnerships & collaborations, mergers & acquisitions, investments, contracts & agreements, and product/service launches. For instance, in November 2021, Modulaire Group announced the acquisition of Alquibalat, S.L. (Balat). Balat offers modular building containers for rent and sale in the construction industry. More than 15,000 of its locations, including those in Madrid, Bilbao, Barcelona, Coruna, Seville, Malaga, and Valencia, are operated in Spain and Portugal. Modulaire increased its presence in the Spanish market through this acquisition. The strategic goals of Modulaire Group were in line with this acquisition strategy. Some prominent players in the modular container market include:

-

MODULE-T PREFABRIK SYSTEMS DIS TIC LTD STI

-

Prefabex

-

McGrath RentCorp

-

Prefabricated Modular Steel Structures - MODSTEEL

-

HENAN K-HOME STEEL STRUCTURE CO., LTD.

-

Kwikspace

-

Falcon Structures

-

Truston

-

WillScot Mobile Mini Holdings Corp.

-

PODS Enterprises LLC

Modular Container Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 27,891.4 million

Revenue forecast in 2030

USD 49,896.9 million

Growth rate

CAGR of 7.5% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million and CAGR from 2022 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Type, revenue source, usage, container size, application, region

Regional scope

North America; Europe; Asia Pacific; South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; China; India; Japan; Brazil

Key companies profiled

MODULE-T PREFABRIK SYSTEMS DIS TIC LTD STI; Prefabex; McGrath RentCorp; Prefabricated Modular Steel Structures - MODSTEEL; HENAN K-HOME STEEL STRUCTURE CO., LTD.; Kwikspace; Falcon Structures; Truston; WillScot Mobile Mini Holdings Corp.; PODS Enterprises LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Modular Container Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the segments from 2017 to 2030. For this study, Grand View Research has segmented the global modular container market report based on type, revenue source, usage, container size, application, and region:

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Mobile Modular Containers

-

Fixed Modular Containers

-

-

Revenue Source Outlook (Revenue, USD Million, 2017 - 2030)

-

New Product Sales

-

Rental

-

-

Usage Outlook (Revenue, USD Million, 2017 - 2030)

-

Office Container

-

Sanitary Container

-

Locker Container

-

Showroom Containers

-

Accommodation Containers

-

Storage Containers

-

Others

-

-

Container Size Outlook (Revenue, USD Million, 2017 - 2030)

-

Below 10 Feet

-

10-20 Feet

-

21-40 Feet

-

Above 40 Feet

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Construction

-

Industrial

-

Education

-

Healthcare

-

Automotive

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global modular container market size was estimated at USD 26,248.3 million in 2021 and is expected to reach USD 27,891.4 million in 2022.

b. The global modular container market is expected to grow at a compound annual growth rate of 7.5% from 2022 to 2030 to reach USD 49,896.9 million by 2030.

b. North America held the largest share in 2021 and is expected to dominate the market during the forecast period. Modular construction is gaining popularity in the U.S. owing to significant growth in infrastructure and industries. Currently, modular construction accounts for about 4% of the country's housing market. However, as per industry experts, modular construction is expected to be adopted in half or more than half of the upcoming projects within the next three years.

b. Major players operating in the modular container market include MODULE-T PREFABRIK SYSTEMS DIS TIC LTD STI (Turkey), Prefabex (Turkey), McGrath RentCorp (U.S.), Prefabricated Modular Steel Structures - MODSTEEL (Turkey), HENAN K-HOME STEEL STRUCTURE CO., LTD. (China), Kwikspace (South Africa), Falcon Structures (U.S.), Truston, WillScot Mobile Mini Holdings Corp. (U.S.), and PODS Enterprises LLC (U.S.).

b. A significant rise in industrial and commercial development is anticipated to increase the number of people moving into metropolitan regions. The rapid urbanization in cities such as New York (U.S.), Vancouver (Canada), and Mexico City (Mexico) has led to the widespread use of modular containers for housing and storage purposes, which is anticipated to propel the growth of the market in the coming years.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.