- Home

- »

- Plastics, Polymers & Resins

- »

-

Molded Fiber Packaging Market Size, Industry Report, 2033GVR Report cover

![Molded Fiber Packaging Market Size, Share & Trends Report]()

Molded Fiber Packaging Market (2025 - 2033) Size, Share & Trends Analysis Report By Source (Wood Pulp, Non-Wood Pulp), By Type (Thermoformed, Transfer), By Product, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-457-0

- Number of Report Pages: 180

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Molded Fiber Packaging Market Summary

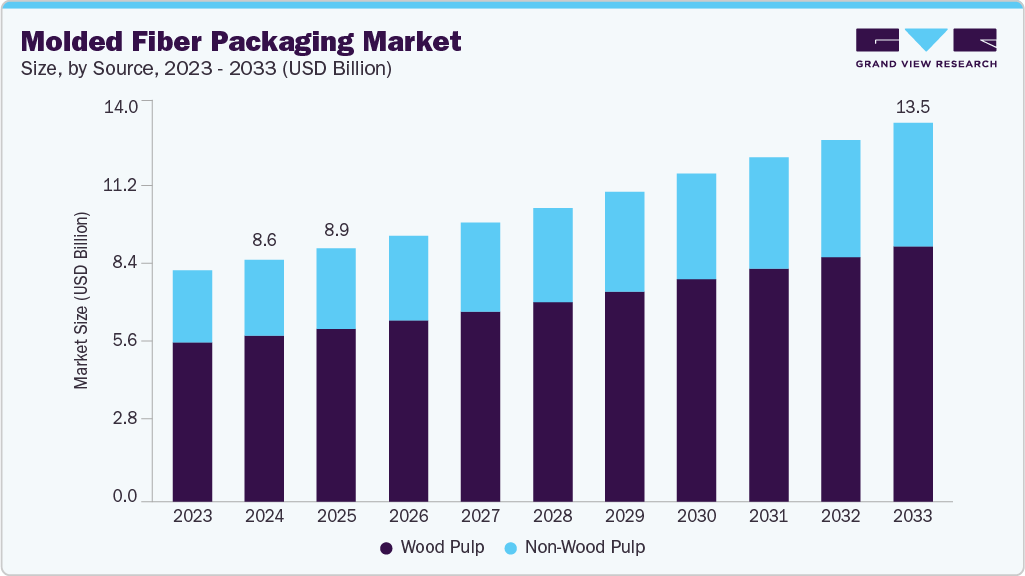

The global molded fiber packaging market size was estimated at USD 8.60 billion in 2024 and is projected to reach USD 13.48 billion by 2033, growing at a CAGR of 5.2% from 2025 to 2033. Growing consumer-driven demand for sustainable and environmentally-friendly packaging solutions is expected to drive market growth over the forecast period.

Key Market Trends & Insights

- Asia Pacific dominated the molded fiber packaging market with the largest revenue share of over 34.0% in 2024.

- The molded fiber packaging market in the U.S. is expected to grow at a substantial CAGR of 5.5% from 2025 to 2033.

- By source, the non-wood pulp segment is expected to grow at a considerable CAGR of 5.6% from 2025 to 2033 in terms of revenue.

- By type, the thermoformed segment is expected to grow at a considerable CAGR of 5.7% from 2025 to 2033 in terms of revenue.

- By product, the clamshells segment is expected to grow at a considerable CAGR of 5.9% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 8.60 Billion

- 2033 Projected Market Size: USD 13.48 Billion

- CAGR (2025-2033): 5.2%

- Asia Pacific: Largest market in 2024

Eggs are packaged in molded fiber trays and clamshells, which are then sold to restaurants, foodservice operators, and individual buyers. In addition, per capita egg consumption is increasing on a yearly basis in the world. Thus, the rising consumption of eggs, owing to the expanding population, associated health benefits, and increasing demand for higher protein intake, is anticipated to drive the demand for molded fiber packaging products, thereby propelling market growth.The rising consumption of eggs has increased the production of eggs. Eggs are packed in plastic as well as molded fiber trays and clamshells, which are further sold to retail chains and foodservice operators. The U.S., Netherlands, and Turkey are among the top exporters of eggs in the world. Molded fiber packaging can also be used for the storage and transportation of eggs, which is expected to drive the market over the forecast period.

Apart from eggs, fruits such as apples, avocados, guavas, and oranges are packaged in molded fiber packaging products such as trays. Factors such as a growing population, rising disposable income, and the growing trend of a healthy lifestyle are expected to drive the demand for fresh fruits in the coming years. This is expected to augment the demand for molded fiber packaging over the forecast period.

Manufacturers are striving to maintain a healthy competitive environment across the market space by implementing various strategies. For instance, in January 2024, Genpak launched a new sustainable molded fiber packaging line called the revamped Harvest Fiber, which includes hinged food service containers, trays, and tableware made from renewable fibers with no intentionally added PFAS. These containers are microwaveable and suitable for both hot and cold food applications, designed to meet the needs of foodservice operators by combining environmental sustainability with reliable performance and durability. The packaging is also BPI Certified Commercially Compostable and USDA BioPreferred, offering a practical and economical solution for restaurants facing increasing regulations against PFAS, while maintaining meal integrity for in-house and off-premises dining.

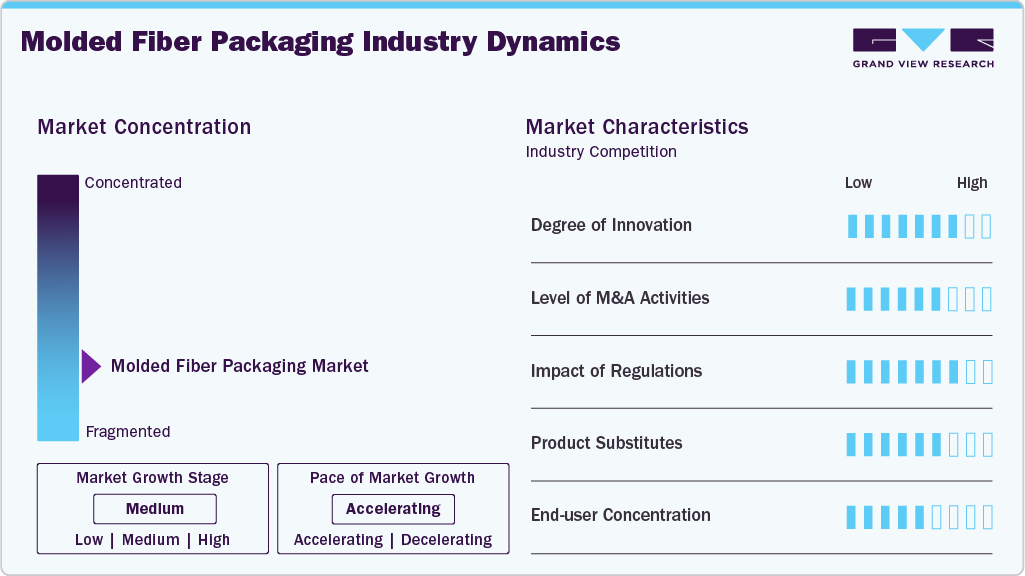

Market Concentration & Characteristics

The industry is characterized by its strong emphasis on sustainability, as products are primarily made from renewable, recycled, or biodegradable materials such as paper pulp, bagasse, and bamboo fibers. This eco-friendly approach aligns with growing consumer awareness about environmental issues and regulatory initiatives promoting recyclable and compostable packaging solutions. Companies in this industry aim to reduce plastic waste while providing functional alternatives for packaging across various sectors.

The industry is heavily influenced by environmental regulations and sustainability standards. Compliance with guidelines on recyclability, compostability, and biodegradability is essential for market acceptance. Regulations such as the EU’s Single-Use Plastics Directive and various national Extended Producer Responsibility (EPR) programs incentivize the adoption of molded fiber solutions and drive market growth, especially in regions with strict environmental policies.

Source Insights

Based on source, the wood pulp segment accounted for the largest market share of over 68.0% in terms of revenue in 2024. Molded fiber packaging manufacturers mainly use waste newspapers for manufacturing fiber. The wide availability of wastepaper and virgin wood can be attributed to the highest share of the segment in 2024.

Non-wood pulp is expected to be the fastest growing source segment, with a growth rate of 5.6% over the forecast period. Non-wood pulp sources eliminate the need for virgin wood and, hence, provide complete sustainability, contributing to its growing market penetration rate.

Type Insights

Transfer molded fiber type products dominated and accounted for a market share of over 48.0% in terms of revenue in 2024. The wide-scale adoption of transfer molded fiber products, such as trays and clamshells for eggs and fruit packaging, can be attributed to the highest revenue share of the segment in the global market.

The thermoformed molded products segment is expected to grow with the highest growth rate of 5.7% over the forecast period. Thermoformed molded products offer higher aesthetic appeal, which has been driving considerable traction for the segment since the past several years.

Product Insights

Trays dominated the product segment, with a revenue share of over 34.0% of the global molded fiber packaging market in 2024. Low cost, wide availability, and good shock absorption characteristics for the packaging of fragile products such as eggs and glass beverage bottles contributed to the highest share of the segment.

Clamshells are anticipated to progress in the product segment at a CAGR of 5.9% over the forecast period. The demand for molded fiber clamshells is rapidly increasing due to the high demand for retail egg packaging.

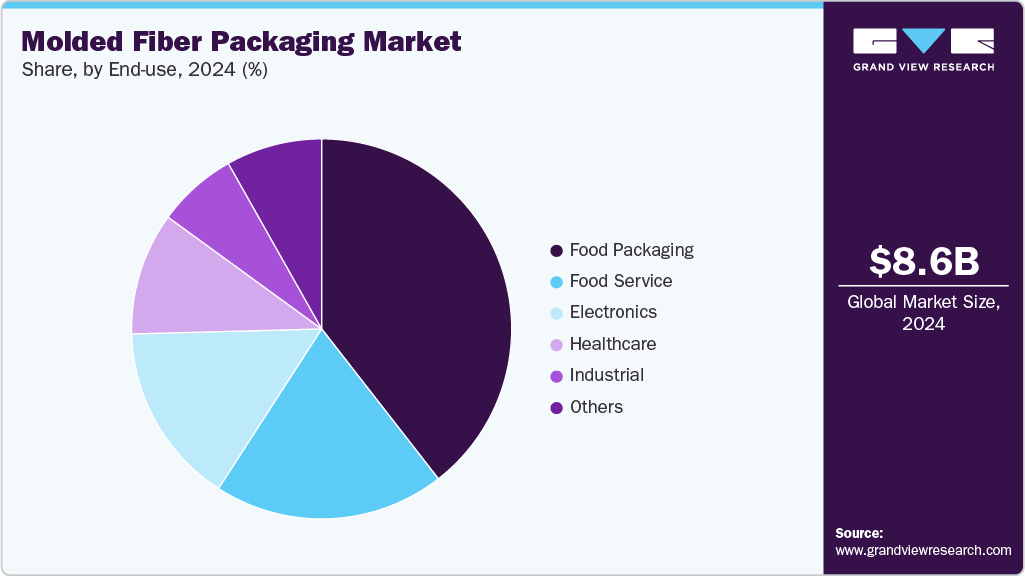

End Use Insights

Food packaging emerged as the most significant end-use segment in 2024 and accounted for over 39.0% of the overall market share. Molded fiber packaging products, such as trays and clamshells used in the food industry, offer cushioning for fragile food items such as fruits and eggs. The molded fiber trays are used for stacking fruits in cardboard boxes. The growing import and export of fruits globally is expected to drive the demand for molded fiber packaging in the food packaging end-use industry.

The food service sector is expected to be the fastest growing end-use segment in the market, driven by the growing demand for eco-friendly, disposable packaging solutions in restaurants, cafés, fast food chains, and catering services. Molded fiber products such as plates, bowls, trays, clamshells, and cups are widely used to replace single-use plastics due to their biodegradability, compostability, and cost-effectiveness. The rising trend of takeout, delivery services, and outdoor dining has further accelerated the adoption of molded fiber packaging.

Regional Insights

Asia Pacific molded fiber packaging industry held the largest market share of over 34.0% in 2024. The region is segmented into China, Japan, and India. China accounted for the largest market share of the market in 2024 in Asia Pacific, attributed to the large food & beverage industry, followed by the electronics market, owing to the high population and increasing disposable income of consumers in the country. Moreover, the country is home to several electronic companies such as Huawei Technologies Co., Ltd, Lenovo, Xiaomi, and others, which gives rise to demand for molded fiber packaging to store and transport delicate electronic goods.

This growth in market share can be ascribed to the rising importance of using disposable packaging solutions on account of rising instances of environment-related problems faced by economies such as China and India in recent years. According to various sources, crates of unwanted packaging waste from the West have accumulated in many ports of Indonesia, the Philippines, and Vietnam. In another instance, huge piles of toxic waste from plastics from Europe and the U.S. have piled up across Malaysia. To improve these situations, local authorities and governments have vowed to reduce the landfill waste accumulated in the Southeast Asia region by introducing strict regulations related to waste disposal. These steps are likely to lead to the adoption of more sustainable packaging solutions across the verticals.

China Molded Fiber Packaging Market Trends

China is the largest food & beverage market in Asia Pacific, with a high consumer spending on eating out. Out of this foodservice, full-service restaurants accounted for the highest share (around 70%) of sales. Emergence of problems related to the environment and pollution in the country has forced the governmental agencies and organizations to strictly adhere to sustainability strategies. This essentially meant to adopt biodegradable packaging solutions and ban the use of single-use plastic.

North America Molded Fiber Packaging Market Trends

Increasing digitization and focus on reducing the use of plastics, especially in packaged food and foodservice industry, are expected to augment the demand for molded fiber packaging in North America. Regulations pertaining to environmental safety and the rising need for easy disposal are expected to drive the demand for bio-based materials in packaging applications. This is expected to boost the overall market growth in the coming years.

In November 2021, ProAmpac Intermediate, Inc. acquired Irish Flexible Packaging and Fispak from their parent company, IFP Investments Limited. With these acquisitions, ProAmpac advances its strategy to expand in Europe and the United Kingdom by further enhancing its existing product offering with a strong portfolio of sustainability-focused flexible packaging capabilities. Such collaborations and partnerships are expected to drive the demand for molded fiber packaging over the forecast period.

Europe Molded Fiber Packaging Market Trends

The growth of the molded fiber packaging market in Europe can be attributed to the wide application scope for molded fiber packaging in the food service & packaging industry in Europe. The EU had close to one million restaurants and mobile food services in 2023, and the number is expected to increase during the forecast period. With an increasing number of restaurants and other food outlets, the demand for sustainable packaging solutions is also expected to grow. The member countries of the EU maintain a stringent regulatory regime to keep a check on environmental impacts caused by the disposal of wastes, mainly plastics.

Key Molded Fiber Packaging Company Insights

Key players operating in the molded fiber packaging market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Molded Fiber Packaging Companies:

The following are the leading companies in the molded fiber packaging market. These companies collectively hold the largest market share and dictate industry trends.

- Amcor plc

- Huhtamaki

- Hartmann Packaging A/S

- CKF Inc.

- Stora Enso

- PulPac

- Genpak

- ProAmpac

- Otarapack

- Mayr-Melnhof Karton AG

- Pro-Care Packaging

- Pactiv Evergreen Inc.

- Sabert Corporation

- Henry Molded Products Inc.

- Wynalda Packaging

- Dart Container Corporation

- Jiangyin Pton Molded Fiber Products Co., Ltd

- Fuzhou QiQi Paper Products Co., Ltd.

Recent Developments

-

In June 2025, Stora Enso and Matrix Pack entered a strategic partnership to accelerate the development of sustainable formed fiber packaging. This collaboration combines Stora Enso's leadership in renewable materials with Matrix Pack's global manufacturing expertise. The partnership aims to scale up fiber-based solutions to replace conventional plastics, enhancing circularity in packaging.

-

In June 2025, International Paper announced its exit from the molded fiber market as part of a strategic transformation to streamline operations and focus on sustainable packaging growth. The company will close its packaging facility in Marion, Ohio, and its recycling facility in Wichita, Kansas.

-

In June 2025, PulPac secured a EUR 20.0 million loan from the European Investment Bank to advance its Dry Molded Fiber technology. The funding will drive R&D efforts to enhance product performance and expand sustainable packaging solutions. This move aims to accelerate the shift from plastic to fiber-based packaging across industries.

Molded Fiber Packaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 8.99 billion

Revenue forecast in 2033

USD 13.48 billion

Growth rate

CAGR of 5.2% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Volume in kilotons; revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, type, product, end use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Southeast Asia; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

Amcor plc; Huhtamaki; Hartmann Packaging A/S; CKF Inc.; Stora Enso; PulPac; Genpak; ProAmpac; Otarapack; Mayr-Melnhof Karton AG; Pro-Care Packaging; Pactiv Evergreen Inc.; Sabert Corporation; Henry Molded Products Inc.; Wynalda Packaging; Dart Container Corporation; Jiangyin Pton Molded Fiber Products Co., Ltd; Fuzhou QiQi Paper Products Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

Global Molded Fiber Packaging Market Report Segmentation

This report forecasts volume & revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global molded fiber packaging market report on the basis of source, type, product, end-use, and region:

-

Source Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Wood Pulp

-

Non-wood Pulp

-

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Thick Wall

-

Transfer

-

Thermoformed

-

Processed

-

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Trays

-

End Caps

-

Bowls & Cups

-

Clamshells

-

Plates

-

Others

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Food Packaging

-

Food Service

-

Electronics

-

Healthcare

-

Industrial

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Southeast Asia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global molded fiber packaging market was estimated at USD 8.60 billion in 2024 and is expected to reach USD 8.99 billion in 2025.

b. The global molded fiber packaging market is expected to grow at a compound annual growth rate of 5.2% from 2025 to 2033, reaching around USD 13.48 billion by 2033.

b. Asia Pacific accounted for over 34.4% of the total market share in 2024. This growth in market share can be ascribed to the rising importance of using disposable packaging solutions due to rising instances of environment-related problems faced by economies such as China and India in recent years.

b. Some key players in the molded fiber packaging market include Brodrene Hartmann A/S, Huhtamako Oyj, CKF Inc., Inc., Thermoform Engineered Quality LLC, Genpak, LLC, Eco-Products, Inc., Pro-Pac Packaging Limited, Fabri-Kal, Hentry Molded Products, Inc., and Sabert Corporation.

b. Growing consumer demand for sustainable and environmentally friendly packaging solutions is expected to drive market growth over the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.