- Home

- »

- Clinical Diagnostics

- »

-

Monkeypox Testing Market Size Analysis Report, 2022-2030GVR Report cover

![Monkeypox Testing Market Size, Share & Trends Report]()

Monkeypox Testing Market (2024 - 2030) Size, Share & Trends Analysis Report By Technology (PCR, FA), By End-use (Hospitals & Clinics, Diagnostic Laboratories), By Region (Europe, North America), And Segment Forecasts

- Report ID: GVR-4-68039-982-0

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Monkeypox Testing Market Summary

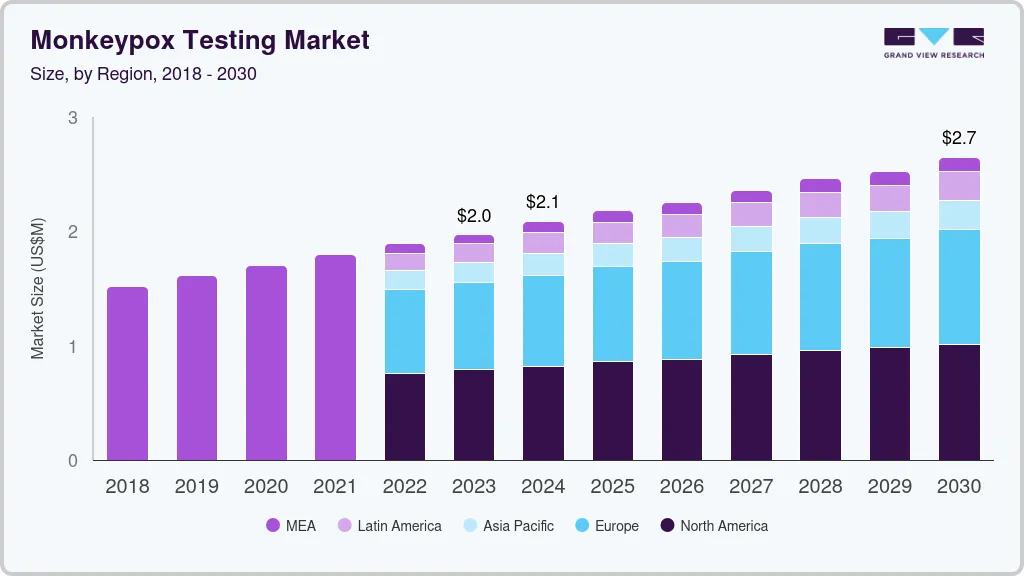

The global monkeypox testing market size was estimated at USD 2.0 million in 2023 and is anticipated to reach USD 2.7 million by 2030, growing at a CAGR of 4.3% from 2024 to 2030. The market is expected to reach USD 184.11 million in 2022 attributable to the surge in cases of monkeypox globally and the declaration of a “Public Health Emergency”.

Key Market Trends & Insights

- North America dominated the global industry and accounted for the largest share of more than 40.05% of the overall revenue in 2022.

- The Europe region is also estimated to register a significant growth rate over the forecast period.

- By technology, the PCR technology segment dominated the global industry and accounted for the highest share of more than 49.05% of the overall revenue in 2022.

- By end-use, the hospitals and clinics segment dominated the global industry and accounted for the maximum share of more than 36.60% of the overall revenue in 2022.

Market Size & Forecast

- 2023 Market Size: USD 2.0 Million

- 2030 Projected Market Size: USD 2.7 Million

- CAGR (2024-2030): 4.3%

- North America: Largest market in 2021

The industry is witnessing rapid growth due to factors, such as the increasing incidence of disease conditions worldwide aided by the difficulty in assessing the core reason behind the spread of the disease. Moreover, government initiatives to curb the spread of the virus to stop the occurrence of another pandemic is fueling the growth of the overall industry.With the number of cases on the rise and the increasing launch of novel products that provide rapid diagnosis of the condition, the market is expected to grow at a lucrative CAGRbetween 2022 and 2030. Treatment for the condition is under study, which makes it more important to increase testing, thus making the escalation of testing capacity crucial. For instance, in June 2022, to quickly increase the capacity for monkeypox testing, the Department of Health and Human Services (HHS) and the Centers for Disease Control and Prevention (CDC) started shipping orthopoxvirus tests to five private laboratory companies, including the largest reference laboratories in the country. Furthermore, technological advancements and the use of PCR technology for testing are further leading to the overall growth of the market.

A number of tests available in the market use PCR, which enhances PCR test adoption. For instance, in July 2022, Sonic Healthcare USA announced the testing availability for monkeypox.Furthermore, in July 2022,Quest Diagnostics outlined plans to introduce the CDC's orthopoxvirus test in the first half of August and announced the countrywide availability of the lab-developed molecular diagnostic test by the company to help in the identification of the monkeypox virus. However, the root cause behind the spread of the virus restrained the growth of the industry, as targeting the focus point to completely mitigate the condition is not clear, which makes it difficult to provide precise treatment for the condition.

Technology Insights

On the basis of technologies, the global industry has been further categorized into Polymerase Chain Reaction (PCR), Later Flow Assay (LFA), and others. The PCR technology segment dominated the global industry in 2022 and accounted for the highest share of more than 49.05% of the overall revenue. The segment will expand further at a steady CAGR during the forecast period. The growth of this segment is attributed to the increasing adoption of PCR technology for testing owing to the rapid and precise results offered by the PCR technique. Moreover, the majority of test kits available in the market are PCR-based tests.

For instance, in August 2022, Fulgent Genetics launched PCR-based tests for the detection of monkeypox. Moreover, in July 2022, Labcorp launched a PCR-based monkeypox detection test through the CDC initiative. The lateral flow assay technology segment is expected to have a lucrative CAGR over the forecast period owing to the increasing demand to provide rapid tests and innovative detection kits. Research and technological advancements are resulting in improving the technology involved in the diagnosis. For instance, in August 2022, JOYSBIO introduced two monkeypox test kits, both of which offer results in under 15 minutes.

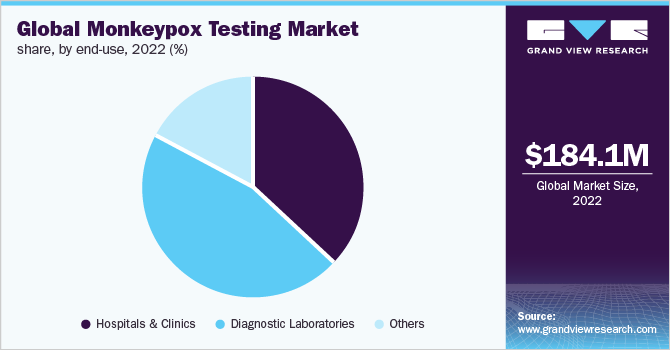

End-use Insights

On the basis of end-uses, the global industry has been further categorized into hospitals and clinics, diagnostic laboratories, and others. The hospitals and clinics end-use segment dominated the global industry in 2022 and accounted for the maximum share of more than 36.60% of the overall revenue. The segment is anticipated to expand further at a significant growth rate during the forecast period. The growth of this segment can be attributed to the high adoption of tests in these healthcare facilities with the increasing prevalence of infection among the population. Post-pandemic, awareness regarding virus spread has immensely increased.

This, in turn, has further led to early diagnosis and treatment of such viruses to stop the occurrence of another pandemic worldwide. The diagnostic laboratoriesend-use segment, on the other hand, is expected to register the fastestgrowth rate during the forecast period. The fast-paced growth of this segment can be attributed to the increasing R&D activities on account of the rising concerns over the rapid spread of the virus across the globe. For instance, in September 2022, the FDA announced guidance to support the development of tests for monkeypox testing. This, in turn, is anticipated to facilitate the development of laboratory-developed tests.

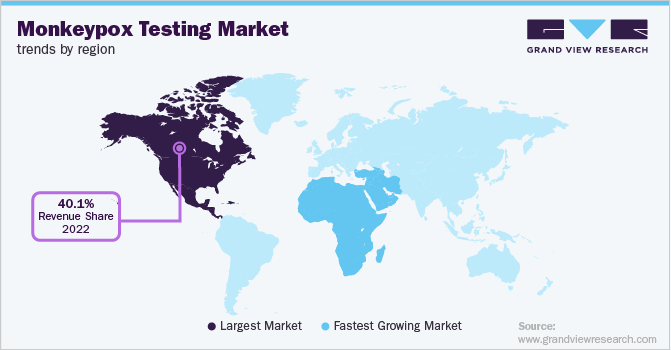

Regional Insights

On the basis of geographies, the global industry has been further categorized into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. The regional market in North America dominated the global industry and accounted for the largest share of more than 40.05% of the overall revenue in 2022. The dominance of the region is attributed to the increasing incidence of monkeypox across the region. As reported by the CDC, out of a total of 56,026 global cases reported, 21,274 cases are reported from the U.S. Moreover, the region has a presence of key players.

For instance, in July 2022, Labcorp became the first national laboratory to offer a monkeypox test and reported testing for monkeypox using the U.S. CDC orthopoxvirus test, which detects all orthopoxviruses unrelated to smallpox, including monkeypox. The Europe region is also estimated to register a significant growth rate over the forecast period. The growth is attributed to the presence of countries with the highest occurrence and spread of the virus. Spain and Germany lead the region with the highest number of cases reported to date. These countries are working on expanding their testing capacities to curb the rising incidence of the disease.

Key Companies & Market Share Insights

Increasing the number of collaborations is becoming a key strategy being adopted by the players. For instance, in June 2022, CerTest Biotec collaborated with BD (Becton, Dickinson, and Company) for the development of a molecular diagnostic test for the monkeypox virus. New tests are being introduced with emergency use approvals from the FDA. For instance, in September 2022, the monkeypox test from Quest Diagnostics received EUA approval.Some of the key players in the global monkeypox testing market include:

-

Aegis Sciences Corp.

-

Laboratory Corp. of America Holdings

-

Quest Diagnostics, Inc.

-

Sonic Healthcare Ltd.

-

QIAGEN

-

Mayo Clinic Laboratories

-

Chembio Diagnostics, Inc.

-

Sonora Quest Laboratories

-

Thermo Fisher Scientific

-

BD

Monkeypox Testing Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.1 million

Revenue forecast in 2030

USD 2.7 million

Growth rate

CAGR of 4.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middlw East & Africa

Country scope

U.S.; Canada; Germany; U.K.; France; Italy; Spain; China; Japan; India; Australia; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Aegis Sciences Corp.; Laboratory Corp. of America Holdings; Quest Diagnostics Inc.; Sonic Healthcare Ltd.; QIAGEN; Mayo Clinic Laboratories; Chembio Diagnostics, Inc.; Sonora Quest Laboratories; Thermo Fisher Scientific; BD

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

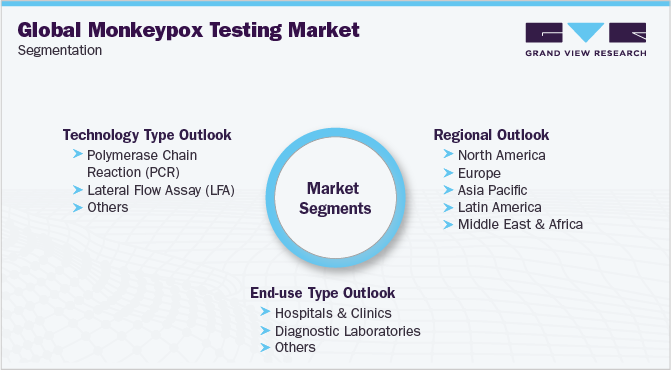

Global Monkeypox Testing Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2022 to 2030. For the purpose of this study, Grand View Research has segmented the global monkeypox testing market report on the basis of technology, end-use, and region:

-

Technology Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Polymerase Chain Reaction (PCR)

-

Lateral Flow Assay (LFA)

-

Others

-

-

End-use Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Clinics

-

Diagnostic Laboratories

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

Spain

-

France

-

Italy

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global monkeypox testing market size was estimated at USD 184.11 million in 2022 and is expected to reach USD 120.72 million in 2023.

b. The global monkeypox testing market is expected to grow at a compound annual growth rate of 4.35% from 2021 to 2030 to reach USD 2.63 million by 2030.

b. Polymerase chain reaction (PCR) technology dominated the monkeypox testing market with a share of 49.10% in 2022. This is attributable to the increasing adoption of PCR technology for testing owing to the rapid and precise results offered by the PCR technique. Moreover, majority of test kits available in the market are PCR-based tests.

b. Some key players operating in the monkeypox testing market include Aegis Sciences Corporation, Laboratory Corporation of America Holdings, Quest Diagnostics Incorporated, Sonic Healthcare Limited, QIAGEN, Mayo Clinic Laboratories, Chembio Diagnostics, Inc., Sonora Quest Laboratories, Thermo Fisher Scientific, and BD.

b. Key factors that are driving the market growth include increasing incidence of disease, government initiatives to curb the spread and increased awareness regarding early diagnosis.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.