- Home

- »

- Food Additives & Nutricosmetics

- »

-

Monosodium Glutamate Market Size, Industry Report, 2030GVR Report cover

![Monosodium Glutamate Market Size, Share & Trends Report]()

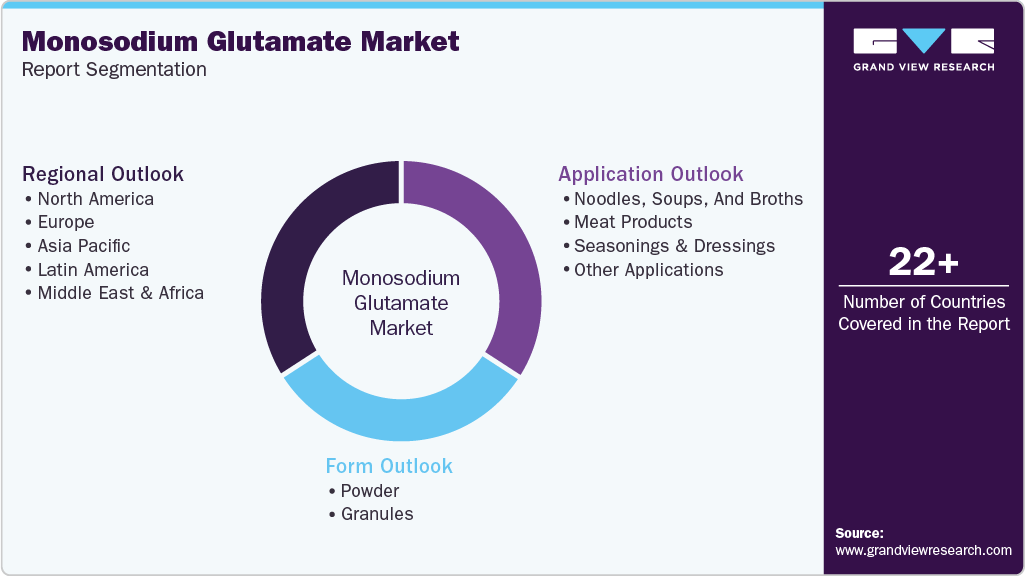

Monosodium Glutamate Market (2025 - 2030) Size, Share & Trends Analysis Report By Form (Powder, Granules), By Application (Noodles, Soups, Broths, Meat, Seasonings & Dressings), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-607-4

- Number of Report Pages: 60

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Monosodium Glutamate Market Summary

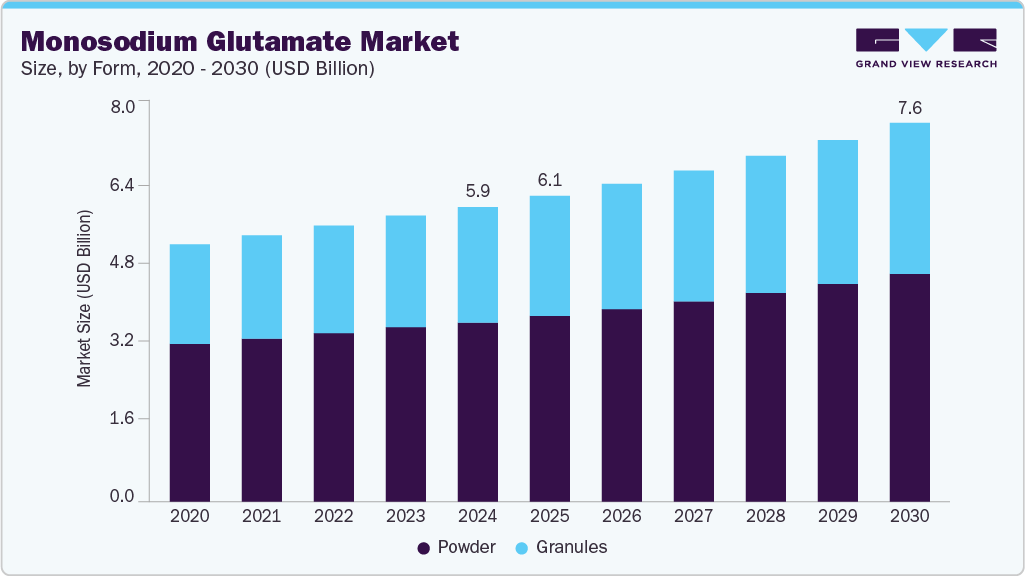

The global monosodium glutamate market size was estimated at USD 5.89 billion in 2024 and is projected to reach USD 7.58 billion by 2030, growing at a CAGR of 4.4% from 2025 to 2030. The key growth drivers for the industry include rising urbanization, increasing consumption of processed and ready-to-eat foods, and the compound’s ability to deliver a strong umami flavor at a low cost.

Key Market Trends & Insights

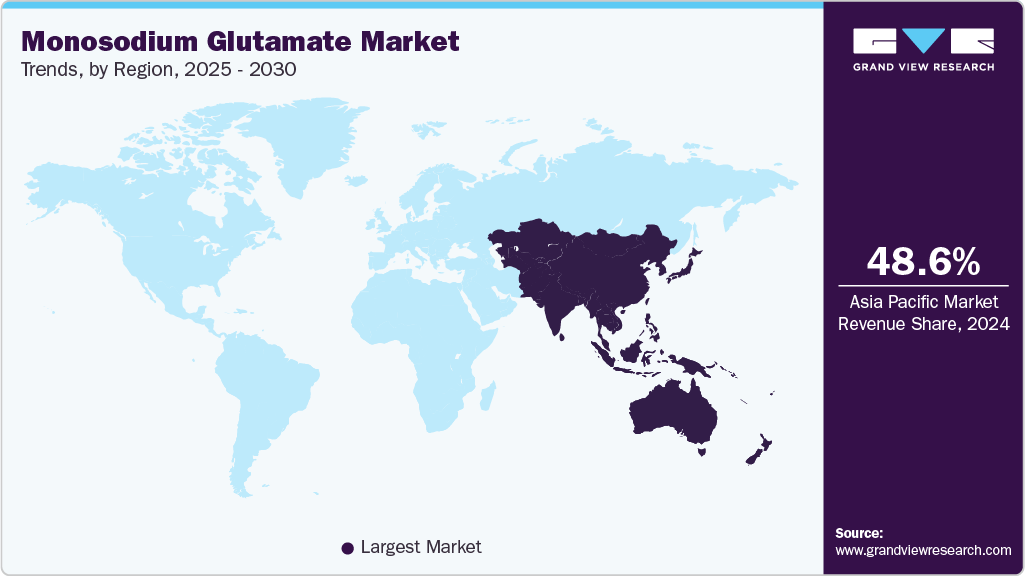

- The Asia Pacific region held the largest revenue share of 48.6% in 2024.

- China dominated the Asia Pacific MSG market in 2024 with 44.4% of revenue share.

- By form, the powder form of monosodium glutamate held the largest revenue share of 60.8% in 2024.

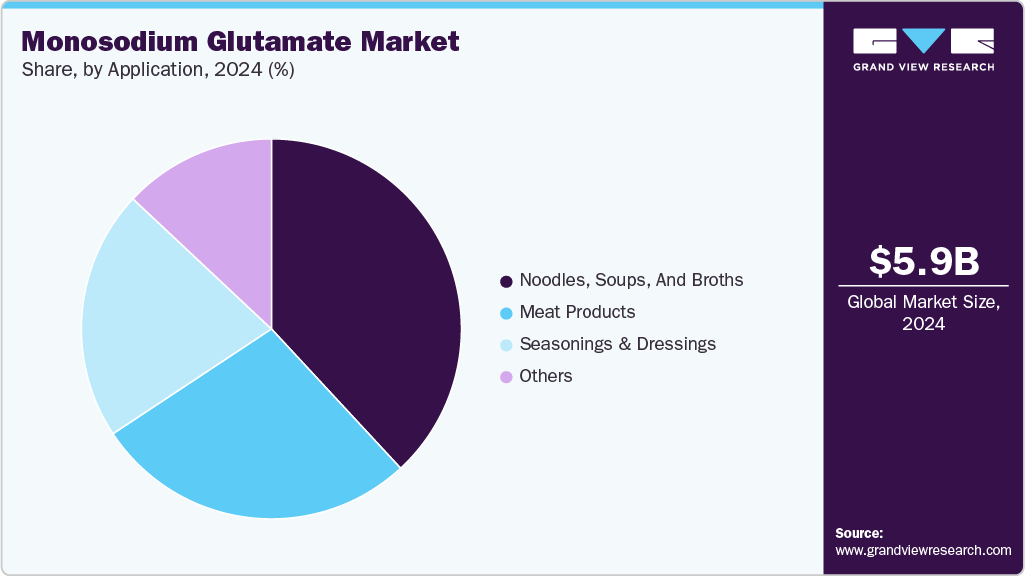

- By application noodles, soups, and broths segment dominated the industry with a revenue share of 38.1% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 5.89 Billion

- 2030 Projected Market Size: USD 7.58 Billion

- CAGR (2025-2030): 4.4%

- Asia Pacific: Largest market in 2024

Asia’s expanding middle class and evolving dietary preferences have further accelerated demand. Countries such as China, Thailand, and Vietnam are leading consumers due to high demand in both household and industrial applications. The widespread use of monosodium glutamate (MSG) in international foodservice chains and packaged snacks continues to bolster market momentum globally. Despite strong demand, growing health concerns linked to MSG consumption present a significant restraint. Scientific studies have associated excessive MSG intake with metabolic disorders such as obesity, diabetes mellitus, hypertension, and even cancer initiation, due to mechanisms involving oxidative stress, insulin resistance, pancreatic beta cell damage, and hypothalamic lesions. These findings have triggered a wave of public skepticism and regulatory scrutiny, particularly in health-conscious and developed markets, potentially limiting its growth trajectory.

However, the market presents considerable opportunities in emerging economies where demand for affordable flavor enhancers in mass-produced food continues to grow. There is also potential in the development of low-sodium or modified MSG alternatives that retain flavor-enhancing properties while addressing health concerns. Furthermore, as plant-based and processed food categories expand globally, MSG use in these applications may open new avenues for innovation and growth.

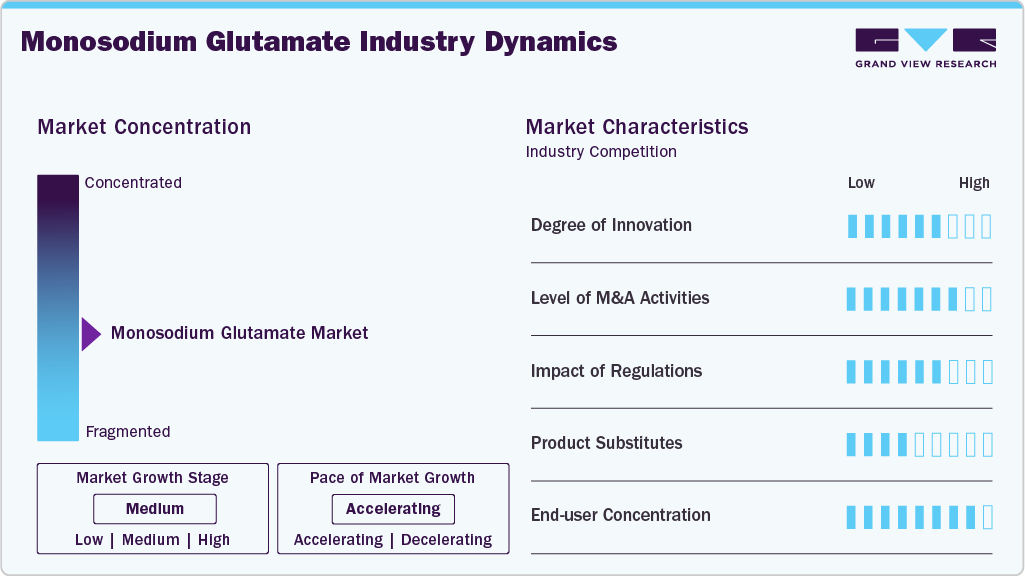

Market Concentration & Characteristics

The market is moderately fragmented, with a few global players, such as Ajinomoto Co. Inc., COFCO, Ningxia Eppen Biotech Co. Ltd, Fufeng Group, and Meihua Holdings Group Co. Ltd. dominating the competitive landscape. These companies benefit from their scale of operations, competitive pricing, and diversified product offerings. They are actively investing in research and development, expanding production capacities, and focusing on sustainable practices to strengthen their positions in the competitive market.

Top players in the market are adopting a mix of geographic expansion, product innovation, capacity enhancement, and strategic partnerships to strengthen their market position. Companies are investing in advanced fermentation technologies to improve yield and reduce production costs, while also exploring the development of low-sodium and natural flavor enhancer alternatives to align with clean-label trends. Additionally, leading manufacturers are expanding their footprint in high-growth regions like Southeast Asia, Africa, and Latin America, leveraging localized production and distribution strategies to meet rising demand and regulatory requirements efficiently.

Form Insights

The powder form of monosodium glutamate held the largest revenue share of 60.8% in 2024 due to its greater versatility, solubility, and ease of handling than granules. Powdered MSG dissolves more quickly and uniformly in both hot and cold applications, making it a preferred choice for large-scale food manufacturers, commercial kitchens, and household cooking. Its finer particle size allows for more precise dosing and better distribution of umami flavor, which enhances the taste experience across a wider range of food products such as soups, sauces, instant noodles, and snacks. In contrast, granular MSG requires more time to dissolve and is less efficient in recipes that demand rapid or uniform mixing.

The granules segment held a smaller revenue share in 2024 due to its lower solubility, limited application versatility, and relatively higher handling complexity. While granulated MSG is still used in certain industrial and culinary settings, it lacks the widespread utility and ease of blending that powdered MSG offers, especially in mass food processing and household cooking. Additionally, powdered MSG’s cost-efficiency in packaging, transport, and formulation gives it a competitive edge, leading most manufacturers and foodservice providers to prefer it over granules. As a result, the granules segment remains more niche and less commercially dominant in terms of overall market contribution.

Application Insights

The noodles, soups, and broths segment dominated the industry with a revenue share of 38.1% in 2024 due to its more extensive and frequent usage of MSG compared to other application areas. These products rely heavily on MSG to enhance the umami flavor profile, making them more flavor-dependent than meat products or seasonings. Instant noodles and packaged soups are highly consumed across Asia Pacific, where MSG usage is culturally and commercially more accepted. This segment benefits from higher consumption rates, larger production volumes, and greater flavor uniformity requirements, making MSG an indispensable additive. Compared to meat products or dressings, these items are more often mass-produced and shelf-stable, necessitating flavor consistency that MSG provides more effectively.

The rapid growth of the convenience food industry has positioned noodles, soups, and broths as more accessible and affordable meal options, especially in urban and price-sensitive markets. With rising demand in emerging economies like India, Indonesia, and Nigeria, where these food products are becoming dietary staples, MSG usage in this segment is also expanding faster. Compared to seasonings and dressings, which may use alternative natural flavoring agents, this segment continues to favor MSG for its cost-efficiency and stronger flavor-enhancing capacity, reinforcing its dominant revenue share in 2024.

Regional Insights

The Asia Pacific region held the largest revenue share of 48.6% in 2024 due to its higher consumption intensity, strong manufacturing base, and cultural preference for umami-rich foods. Countries like China, Indonesia, Vietnam, and Thailand not only account for a significant portion of global MSG consumption but also serve as leading production and export hubs.

China plays a pivotal role in the market, serving as the largest producer, consumer, and exporter of MSG worldwide. The country's dominance is driven by its robust food processing industry, high per capita consumption of MSG-infused products, and presence of leading domestic manufacturers such as Fufeng Group and Meihua Holdings.

Europe Monosodium Glutamate Market Trends

Europe held the second-largest revenue share of 26.7% in 2024, primarily due to its well-established processed food sector, rising demand for ethnic cuisines, and growing consumption of ready-to-eat and packaged meals. While traditionally more cautious about food additives, European markets have seen increased acceptance of MSG driven by evolving consumer preferences, particularly in urban areas where convenience foods are in higher demand.

The Germany monosodium glutamate marketis driven by its advanced food processing industry, rising multicultural culinary demand, and growing preference for convenience and ready-to-eat foods. The country’s expanding population of international consumers and increasing popularity of Asian cuisine have led to a steady rise in MSG usage across both retail and food service sectors.

North America Monosodium Glutamate Market Trends

North America held a significant position in the market, driven by the growing demand for convenience foods, rising multicultural food consumption, and expanding foodservice industry across the United States and Canada. The region’s consumers are increasingly embracing diverse global cuisines, especially Asian-inspired flavors, which has elevated MSG usage as a key flavor enhancer. Additionally, the presence of large-scale food manufacturers and quick-service restaurant chains fuels consistent MSG demand for processed snacks, soups, and ready-to-eat meals.

U.S. Monosodium Glutamate Market Trends

The U.S. monosodium glutamate market represents a crucial segment of the North American MSG market. It is propelled by the expanding ready-to-eat and convenience food sectors and a growing interest in diverse ethnic cuisines, particularly Asian flavors. Major food manufacturers and quick-service restaurants incorporate MSG to enhance flavor profiles while maintaining cost efficiency.

Latin America Monosodium Glutamate Market Trends

Latin America is emerging as a high-growth market, driven by increasing urbanization, rising disposable incomes, and expanding demand for processed and convenience foods in countries like Brazil, Mexico, and Argentina. The region’s growing middle class is showing a stronger preference for flavor-enhanced packaged meals and fast food, fueling MSG consumption.

Middle East & Africa Monosodium Glutamate Market Trends

The Middle East & Africa region represents a promising and increasingly dynamic market, fueled by rapid urbanization, population growth, and the rising popularity of processed and convenience foods. Countries such as Saudi Arabia, the UAE, and South Africa are experiencing growing demand for flavor-enhanced food products, particularly as Western and Asian cuisines gain traction in urban centers.

Key Monosodium Glutamate Company Insights

Some of the key players operating in the market include Ajinomoto Co. Inc., COFCO, Ningxia Eppen Biotech Co. Ltd, Fufeng Group, and Meihua Holdings Group Co. Ltd.

Henkel AG

-

Ajinomoto Co., Inc., headquartered in Tokyo, is a global leader in the monosodium glutamate (MSG) market, renowned for pioneering the commercial production of MSG under its flagship brand, AJI-NO-MOTO, since 1909. With operations spanning over 30 countries, Ajinomoto maintains a robust presence in Asia, the Americas, and Europe, leveraging its extensive distribution networks and localized production facilities to meet diverse market demands. The company has strategically expanded its MSG production capacities in key regions, including Brazil, Vietnam, and Thailand, to reinforce its supply capabilities and cost competitiveness. Ajinomoto has enhanced its manufacturing footprint in the United States by establishing a new MSG production facility focused on sustainability and efficiency, aligning with the growing consumer preference for responsibly sourced ingredients. Additionally, Ajinomoto actively engages in consumer education initiatives, such as the "Know MSG" campaign, to dispel misconceptions about MSG's safety and promote its benefits as a natural flavor enhancer. Ajinomoto continues solidifying its position as a dominant and innovative force in the global MSG industry through these concerted efforts.

Shandong Qilu Biotechnology Group Co., Henan Lotus Flower Gourmet Powder Co., and Shandong Xinle Monosodium Glutamate Limited Company are some of the emerging market participants in this industry.

-

Shandong Qilu Biotechnology Group Co., Ltd., established in 2001 and headquartered in Qingdao, China, is a prominent player in the market. As one of China's top five MSG manufacturers, the company boasts an annual production capacity of 200,000 tons, marketed under well-known brands like "999" and "Junma”. Leveraging advanced microbial fermentation techniques and a robust grain-based production infrastructure, Shandong Qilu ensures high-purity MSG products that meet international standards, including ISO 9001, ISO 22000, HACCP, Halal, and Kosher certifications. The company's extensive export network spans North America, Europe, Southeast Asia, and the Middle East, supported by a comprehensive logistics and distribution system.

Key Monosodium Glutamate Companies:

The following are the leading companies in the monosodium glutamate market. These companies collectively hold the largest market share and dictate industry trends.

- Ajinomoto Co. Inc

- COFCO

- Ningxia Eppen Biotech Co., Ltd

- Fufeng Group, Meihua Holdings Group Co. Ltd

- Gremount International Company Limited

- Cargill Incorporated

- Shandong Qilu Biotechnology Group Co.

- Henan Lotus Flower Gourmet Powder Co.

- Shandong Xinle Monosodium Glutamate Limited Company

Monosodium Glutamate Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6.12 billion

Revenue forecast in 2030

USD 7.58 billion

Growth rate

CAGR of 4.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, Volume in Kilotons, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Form, application, and region

Regional scope

North America; Europe; Asia Pacific; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Italy; Spain; France; China; Japan; South Korea; Saudi Arabia; South Africa; Brazil; Argentina

Key companies profiled

Ajinomoto Co. Inc.; COFCO; Ningxia Eppen Biotech Co., Ltd; Fufeng Group; Meihua Holdings Group Co., Ltd; Gremount International Company Limited; Cargill Incorporated; Shandong Qilu Biotechnology Group Co.; Henan Lotus Flower Gourmet Powder Co.; Shandong Xinle Monosodium Glutamate Limited Company

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Monosodium Glutamate Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global monosodium glutamate market report based on application, form, and region.

-

Application Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

Noodles, Soups, and Broths

-

Meat Products

-

Seasonings & Dressings

-

Other Applications

-

-

Form Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

Powder

-

Granules

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Italy

-

Spain

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Latin America

-

Brazil

-

Argentina

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.