Morphine Drugs Market Size & Trends

The global morphine drugs market size was valued at USD 23.86 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 4.69% from 2024 to 2030. The wide use of morphine in pain management is anticipated to drive the market growth. Furthermore, the prevalence of orthopedic health issues and chronic disease coupled with the increasing use of opioids like morphine, codeine to treat chronic conditions among older population is also expected to propel the market demand over the forecast period. According to the CDC, in 2020, more than 500 million individuals across the world were suffering from osteoarthritis.

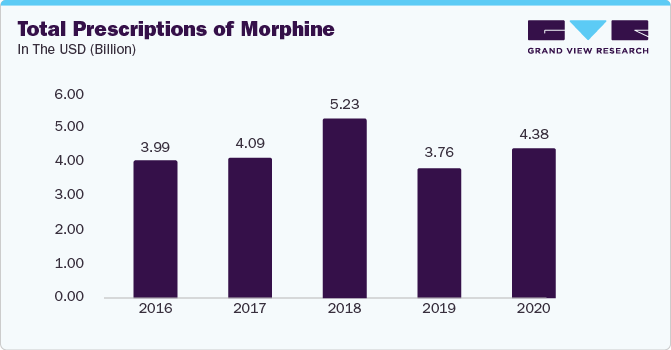

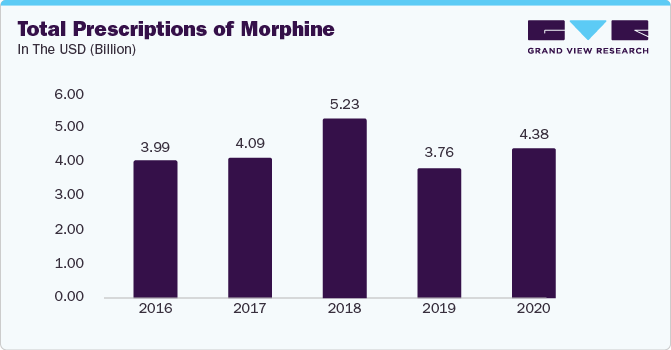

The outbreak of the COVID-19 pandemic significantly impacted the market. Numerous patients suffering from COVID-19 were experiencing chronic discomfort. This, in turn, is expected to drive demand for opioids during the COVID-19 pandemic. According to the study published by the National Library of Medicine in January 2022, various opioids were used in the COVID-19 pandemic for chronic pain management. It also reports that only remifentanil, morphine, and fentanyl were available in the primary healthcare system in Brazil for the treatment of COVID-19 patients. Thus, the increased use of opioids for analgesia in orotracheal intubation and pain management may have propelled the market during the COVID-19 pandemic.

Moreover, the increasing geriatric population, coupled with the rising prevalence of chronic disorders, is expected to boost the demand for various opioid drugs like morphine over the forecast period. The geriatric population is more susceptible to osteoarthritis disorders and chronic pain. According to the study published by the MDPI in May 2021, chronic pain was a major issue affecting more than 50% of the older population. Furthermore, the increasing incidences of arthritis are also anticipated to boost the demand for pain management medications. According to the Arthritis Society Canada, nearly 50% of individuals over 65 have arthritis. Therefore, the increasing prevalence of the population suffering from chronic pain across the globe is expected to drive the market for morphine over the forecast period.

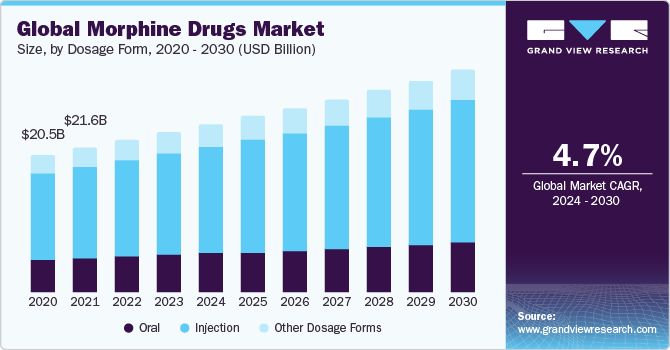

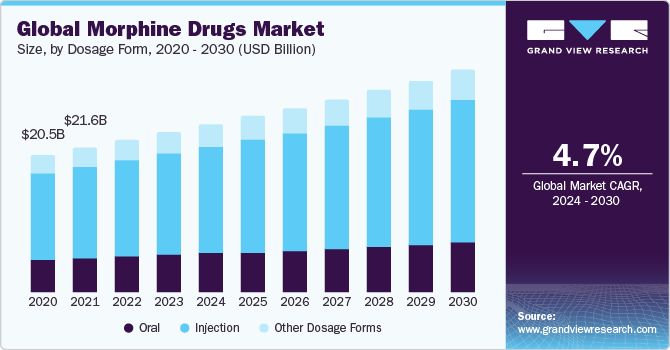

Dosage Form Insights

Based on the dosage form, the morphine drug market is segmented into injection, oral, and other dosage forms. The injection segment held the largest market share in 2023. These injections are utilized to alleviate moderate to severe pain. It can also be utilized before or during surgery with an anesthetic. Some of the brands operating in this segment include Astramorph PF, Infumorph, and Duramorph.

Application Insights

On the basis of application, the market is segmented into pain management, diarrhea suppressant, cold & cough suppressant, and others. The pain management segment accounted for the largest revenue share in 2023, owing to the wide use of morphine for pain management. It can be used to treat or alleviate pain caused by various conditions such as surgery, labor pain, cancer pain, and major trauma like accidents.

Distribution Channel Insights

On the basis of distribution channels, the market is segmented into retail pharmacies, hospital pharmacies, online pharmacies, and others. Hospital pharmacies held the largest share in 2023. Hospital pharmacies operate within a healthcare institution, which means the administration and monitoring can be done under the direct supervision of healthcare professionals. The rising accidents and trauma conditions, coupled with the extensive use of morphine for surgeries and pain medications, are expected to boost the segment growth over the forecast period.

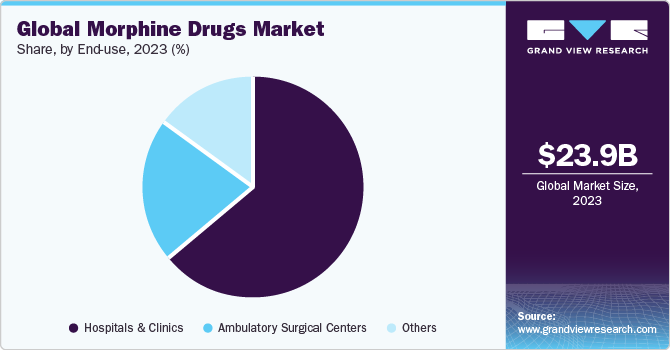

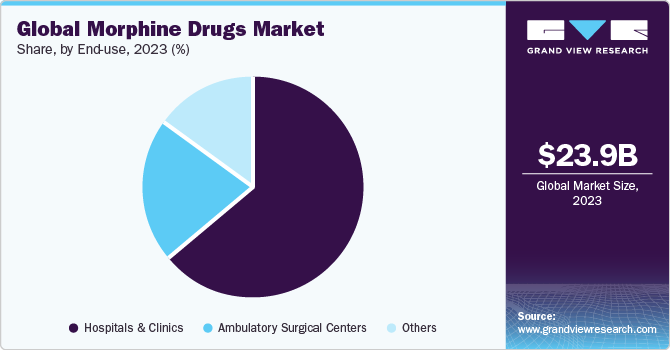

End-Use Insights

Based on end use, the morphine drug market is segmented into hospitals & clinics, ambulatory surgical centers, and others. The hospitals & clinics segment accounted for the largest revenue share in 2023. Morphine may cause some side effects like overdose, headache dizziness, lightheadedness, and mood changes. Thus, it is preferable to use it under doctor’s supervision.

Hospitals and clinics use morphine in large amounts primarily for effective pain management in patients recovering from surgery, experiencing severe injuries, or with acute medical conditions. Furthermore, according to the study published by Science Direct in 2019, opioids like morphine are used as sedatives in the Intensive Care Unit (ICU).

Regional Insights

North America dominated the market in 2023. The presence of established players is anticipated to strengthen market growth. Furthermore, the high demand in the pharmaceutical sector and the rising incidences of musculoskeletal diseases are expected to boost the regional expansion over the forecast period.

According to the factsheet published by the Department of Justice/ Drug Enforcement Administration in April 2020, morphine obtained from opium is used directly for pharmaceutical products in the U.S. Thus, the use of morphine in the pharmaceutical industry can propel the market demand over the forecast period in the region.

Competitive Insights

Key players operating in the market are Pfizer Inc., Sun Pharmaceutical Industries Ltd., Verve Health Care Ltd., Mallinckrodt Pharmaceuticals, Purdue Pharma, Qinghai Pharmaceuticals and AbbVie Inc. The market participants are working towards new product development, M&A activities, and other strategic alliances to gain new market avenues. In August 2023, a Japanese startup producing morphine, Fermelanta, won a Japan agrifood tech pitch.