- Home

- »

- Next Generation Technologies

- »

-

Global Multi-cloud Management Market Size Report, 2030GVR Report cover

![Multi-cloud Management Market Size, Share & Trends Report]()

Multi-cloud Management Market (2023 - 2030) Size, Share & Trends Analysis Report By Solution (Cloud Automation, Managed Services), By Enterprise Size (SME, Large), By End-use (BFSI, Healthcare), And Segment Forecasts

- Report ID: GVR-4-68039-643-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Multi-Cloud Management Market Summary

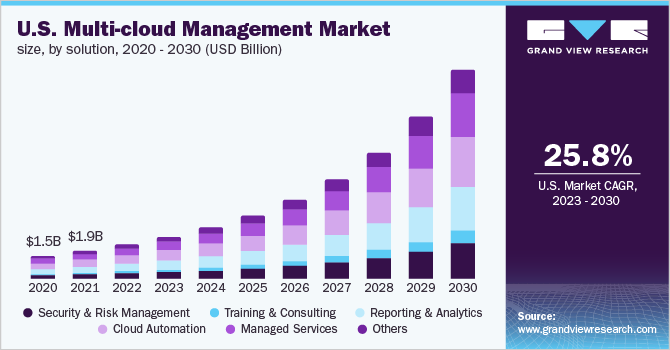

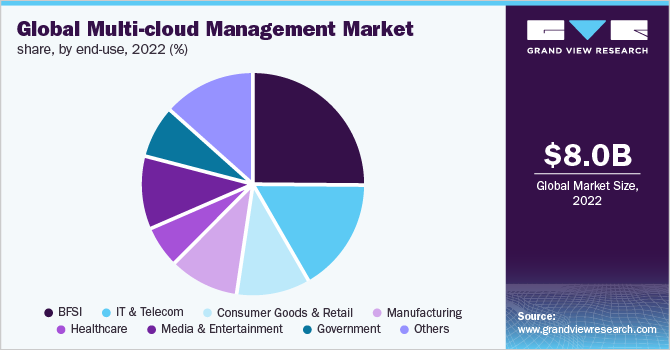

The global multi-cloud management market size was estimated at USD 8,032.7 million in 2022 and is projected to reach USD 56,019.9 million by 2030, growing at a CAGR of 28.0% from 2023 to 2030. The growing emphasis on automation, efficiency, and effective organizational governance processes is expected to drive the growth of the industry during the forecast period.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2022.

- Country-wise, the U.S. is expected to register the highest CAGR from 2023 to 2030.

- In terms of segment, cloud automation accounted for a revenue of USD 2,029.6 million in 2022.

- Security & Risk Management is the most lucrative type segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2022 Market Size: USD 8,032.7 Million

- 2030 Projected Market Size: USD 56,019.9 Million

- CAGR (2023-2030): 28.0%

- North America: Largest market in 2022

Enterprises are opting for multi-cloud management solutions to ensure efficient and more reliable services at lower prices across various platforms while avoiding a vendor lock-in situation. The rising versatility of cloud computing technologies and the growing adoption of containerization and micro-services for cloud-native applications also bode well for the growth of the market.

Multi-cloud management solutions allow enterprises to manage multiple cloud services under a single heterogeneous architecture, such as SaaS, PaaS, and IaaS. Multi-cloud management allows enterprise-class applications to be deployed and managed across public, private, and hybrid clouds. It also allows businesses to simplify cloud storage management while strengthening security. The continued rollout of high-speed 5G networks; advances in the latest technologies, including AI and machine learning; and increased flexibility offered by the latest cloud computing technologies are expected to drive the industry growth over the forecast period.

Concerns over the reliability of single cloud and vendor lock-in situations, a growing predisposition toward price-sensitive cloud installations, and the rising pressure to ensure compliance with various data security and privacy protection regulations are prompting enterprises to opt for multi-cloud management solutions. Multi-cloud management gives end-users greater bargaining power as end-users get in a better position to switch between different providers rather than relying on a single provider. In addition, end-users can utilize multi-cloud management to distribute their workload across various clouds and ensure more flexibility in data deployment.

As such, multi-cloud management typically helps in avoiding a vendor lock-in situation and allows end-users to switch easily between vendors. The outbreak of the COVID-19 pandemic has been driving the adoption of multi-cloud management solutions. Given the lockdowns and restrictions imposed by various governments in the wake of the pandemic outbreak, organizations that have already shifted their workloads to the cloud are enjoying a winning edge over their competitors. Effective cloud management allows employees to operate remotely without compromising productivity. Apart from deploying dedicated solutions to help their employees in working remotely, organizations have also cooperated with companies, such as Microsoft, AWS, and Zscaler, to improve agility while servicing clients and ensuring adequate data security in the wake of the uncertainties brought up by the pandemic.

However, a looming lack of adequate expertise and the challenges associated with redesigning the network for the cloud are some of the factors expected to restrain the industry's growth. The complex deployment structure of multi-cloud environments and the complexities involved in establishing and managing multi-cloud environments are emerging as the major market restraints. Redesigning the networks from on-premises to cloud-based deployment also calls for significant upfront investments. This can discourage SMEs from opting for multi-cloud management solutions due to budget and resource constraints. Businesses would also have to address several concerns, including those over the network architecture, before migrating to a cloud-based infrastructure and multi-cloud environments.

Solution Insights

The cloud automation segment accounted for the largest market share of over 25.25% in 2022. Companies are increasingly opting for automation to help them manage various private, public, and hybrid cloud environments with limited human resources. Artificial Intelligence (AI) and Machine Learning (ML) are expected to play a significant role in cloud automation decision-making, including extensive log analysis. Systems and solutions based on AI and ML can analyze large volumes of logging data and search for patterns. The insights obtained can be used to predict the failure of server components or application breakdowns. In other words, cloud automation can help considerably in capacity planning by facilitating better forecasting of infrastructure requirements.

Hardships in governance stemming from a multi-cloud approach also prompt businesses to opt for cloud automation to ease the management of their public, private, and hybrid cloud systems. For instance, looking forward to the future, cloud automation can accommodate dashboards, allowing engineers to view all their disparate cloud services in a single window. The adoption of cloud automation is also expected to gain traction as organizations opt for analytics services and other services to support cloud solutions. Moreover, increasing ML capabilities to analyze more contingent data can benefit cloud automation significantly.

Enterprise Size Insights

The large enterprise segment accounted for the largest share of over 57.80% of the overall revenue in 2022. A multi-cloud strategy allows businesses to choose from various cloud services and opt for those suiting their specific requirements. The ML capabilities of multi-cloud environments can potentially aid large data transfers, thereby driving the demand for multi-cloud management solutions from large enterprises. Multi-cloud adoption provides alternative options for enterprises rather than relying on the infrastructure, add-on services, and pricing quoted by a single cloud provider. Moreover, enterprises can also select a cloud provider with data centers closer to their clients to reduce latency and improve performance indicators.

Multi-cloud allows businesses to utilize a variety of cloud technologies for a variety of applications. With a multi-cloud approach, large organizations can selectively distribute their heavy workloads across several computing infrastructures. Such an approach can help save costs, encourage innovation, strengthen disaster management, ensure business continuity, and increase efficiency. Multi-cloud strategies bring IT resources closer to customers, resulting in lower latency and fewer dropouts. As the number of cloud providers continues to grow and the IT environment continues to get more complex, the competition in the industry is intensifying, subsequently prompting companies to employ the latest technologies to defend their position in the industry and expand further.

End-use Insights

The BFSI end-use segment accounted for the largest share of over 24.95% of the overall revenue in 2022. Banking organizations opt for cloud-based installations to enhance operational efficiency and ensure prompt customer service. BFSI companies typically prefer multi-cloud environments so that the other cloud can take over in the event of a failure of one cloud. Vendors are providing cloud solutions for financial institutions to secure their settings and workloads and ensure regulatory compliance highly. For instance, in September 2021, Temenos collaborated with International Business Machines Corp. to accelerate hybrid cloud adoption in the BFSI industry.

Temenos announced the availability of ‘Temenos Transact next-generation core banking’ with Red Hat OpenShift on IBM Cloud. The collaboration intended to expand the multi-cloud market for the BFSI industry and the former company’s presence in the multi-cloud market. The public cloud platform leverages the company’s industry-leading encryption services and a policy structure explicitly designed to serve financial services regulatory workloads with proactive and automated security. Industry players offering multi-cloud management are collaborating with the incumbents of the BFSI industry to launch new products.

Incumbents of the BFSI industry are incorporating both public and private cloud platforms in their workflows and utilizing multi-cloud management solutions to address the complexities associated with handling large volumes of data and avoiding a vendor lock-in situation. For instance, in September 2021, International Business Machines Corp. announced a new agreement with CaixaBank in Spain. CaixaBank will begin its CloudNow project, using IBM Cloud for Financial Services to modernize business core applications, boost efficiency, and reinforce CaixaBank’s unique vision of financial services by increasing availability and robustness.

Regional Insights

North America dominated the industry in 2022 and accounted for the maximum share of over 34.65% of the overall revenue. In North America, the cloud services market is rapidly transitioning from isolated cloud solutions to platforms combining onsite, public, and private IaaS. The continued rollout of wireless connectivity and the growing adoption of connected and IoT-enabled devices have driven the demand for innovative solutions based on the latest technologies. As a result, companies invest aggressively in modern technologies to gain a competitive advantage over their competitors. The growing demand for efficient computing frameworks also bodes well for the growth of the regional North market. Europe emerged as the second-largest region in 2022.

Apart from a strong economy, Europe is also known for its robust connectivity infrastructure, which typically drives the adoption of cloud services. A looming migration of workloads to the cloud is particularly evident in Europe as part of the efforts to lower the expenses associated with the fixed capacity infrastructure and to leverage cloud-native services to roll out a highly scalable infrastructure using the cloud. Several multi-cloud architectural regions are also driving the adoption of multi-cloud management solutions in Europe. Asia Pacific is emerging as the third-largest regional market, driven by the growing adoption of cloud-based solutions and integration of new technologies, such as IoT and edge computing.

Key Companies & Market Share Insights

Mergers & acquisitions, strategic partnerships, and new product launches are turning out to be the most effective ways for industry players to gain quick access to emerging markets. For instance, in September 2022, VMware, Inc. introduced VMware Aria, a multi-cloud management suite, to manage the cost, productivity, configuration, and deployment of infrastructure and cloud-native applications. VMware Aria is VMware Aria Graph; a graph-based centralized data solution that encapsulates the complexity of clients’ multi-cloud settings. The VMware Tanzu platform’s management of cloud-native application development, deployment, DevSecOps, and lifespan expands and supports VMware Aria. Similarly, in May 2022, Dell Technologies broadened multi-cloud experiences across data analytics, cyber recovery, and partner ecosystem.

The company offered customers innovative cloud experiences, a larger ecosystem, and products to manage and safeguard applications across data centers and multi-cloud settings. With the rising array of platforms and locations, these new services are intended to simplify businesses to store, safeguard, and manage their data and applications. On the other hand, product differentiation and upgrades are anticipated to pave the way for companies to market expansion. For instance, in February 2021, VMware, Inc. refreshed its VMware vRealize Cloud Management on-premises and Software-as-a-Service (SaaS) products. Due to the upgrades, customers’ hybrid and multi-cloud infrastructures will be more optimized, protected, and modernized. Some of the prominent players in the global multi-cloud management market include:

-

BMC Software, Inc.

-

Citrix Systems Inc.

-

CloudBolt Software, Inc.

-

CoreStack

-

Dell Technologies Inc.

-

Flexera Software LLC

-

International Business Machines Corp.

-

Jamcracker Inc.

-

Microsoft Corp.

-

Trianz

-

VMware Inc.

Multi-cloud Management Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 9.94 billion

Revenue forecast in 2030

USD 56.02 billion

Growth rate

CAGR of 28.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

The solution, enterprise size, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil

Key companies profiled

BMC Software, Inc.; Citrix Systems Inc.; CloudBolt Software, Inc.; CoreStack; Dell Technologies Inc.; Flexera Software LLC; International Business Machines Corp.; Jamcracker Inc.; Microsoft Corp.; VMware Inc.; Trianz

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Multi-cloud Management Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global multi-cloud management market report based on solution, enterprise size, end-use, and region:

-

Solution Outlook (Revenue, USD Million, 2018 - 2030)

-

Security & Risk Management

-

Training & Consulting

-

Reporting & Analytics

-

Cloud Automation

-

Managed Services

-

Others

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Small & Medium Enterprise (SME)

-

Large Enterprise

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

IT & Telecom

-

Consumer Goods & Retail

-

Manufacturing

-

Healthcare

-

Media & Entertainment

-

Government

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global multi-cloud management market size was estimated at USD 8.03 billion in 2022 and is expected to reach USD 9.94 billion in 2023.

b. The global multi-cloud management market is expected to grow at a compound annual growth rate of 28.0% from 2023 to 2030 to reach USD 56.02 billion by 2030.

b. North America dominated the multi-cloud management market with a share of 30% in 2022. The continued rollout of wireless connectivity and the growing adoption of connected devices and IoT-enabled devices have been driving the demand for innovative solutions based on the latest technologies in the region.

b. Some key players operating in the multi-cloud management market include BMC Software, Inc.; Citrix Systems Inc.; CloudBolt Software, Inc.; CoreStack; Dell Technologies Inc.; Flexera Software LLC; International Business Machines Corporation; Jamcracker Inc.; Microsoft Corporation; Concierto.cloud; and VMware Inc.

b. Key factors that are driving the multi-cloud management market growth include the growing emphasis on automation, efficiency, and effective organizational governance processes.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.