- Home

- »

- Next Generation Technologies

- »

-

Multi-cloud Networking Market Size, Industry Report, 2033GVR Report cover

![Multi-cloud Networking Market Size, Share & Trends Report]()

Multi-cloud Networking Market (2025 - 2033) Size, Share & Trends Analysis Report By Component (Solution, Services), By Deployment (Public Cloud, Private Cloud, Hybrid Cloud), By Enterprise Size, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-646-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Multi-cloud Networking Market Summary

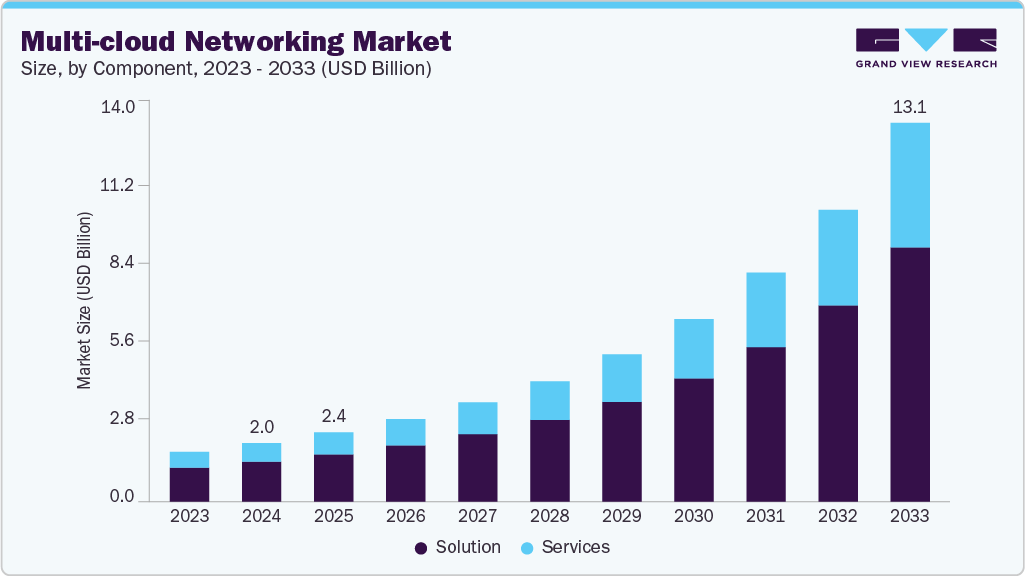

The global multi-cloud networking market size was estimated at USD 2.03 billion in 2024 and is projected to reach USD 13.14 billion by 2033, growing at a CAGR of 23.7% from 2025 to 2033. The rise of edge computing is further accelerating demand in the multi-cloud networking market.

Key Market Trends & Insights

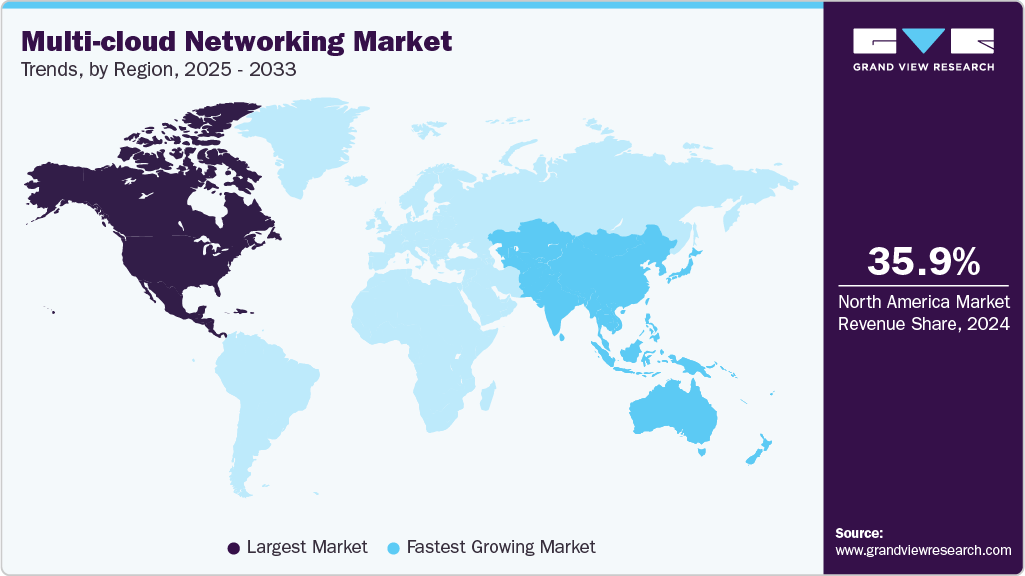

- North America held a 35.9% revenue share of the global multi-cloud networking market in 2024.

- In the U.S., the growing emphasis on environmental, social, and governance (ESG) reporting is accelerating the demand for multi-cloud networking systems.

- By component, the solutions segment held the largest revenue share of 68.5% in 2024.

- By deployment, the public cloud segment held the largest revenue share in 2024.

- By enterprise size, the large enterprises segment held the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.03 Billion

- 2033 Projected Market Size: USD 13.14 Billion

- CAGR (2025-2033): 23.7%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The market is also seeing momentum from the growth of DevOps and cloud-native development practices. As organizations accelerate their use of containers, microservices, and CI/CD pipelines across multiple clouds, the need for consistent networking policies and real-time observability has intensified. Developers and IT teams require a networking framework that supports dynamic workload scaling, automated service discovery, and reliable east-west traffic routing between containers and services across different cloud environments. Multi-cloud networking platforms are increasingly integrating with container orchestration tools like Kubernetes to provide these capabilities natively. This integration not only accelerates development cycles but also ensures application performance and compliance, which are vital for modern, cloud-native businesses.Additionally, digital transformation initiatives across industries are compelling enterprises to modernize their IT infrastructure, often leading to the adoption of multiple cloud platforms for specialized needs. For instance, a company might use Microsoft Azure for collaboration tools, AWS for analytics, and Google Cloud for AI services. This diversification enhances business capabilities but significantly increases networking complexity. Multi-cloud networking solutions are essential in such scenarios because they offer abstraction and orchestration layers that simplify inter-cloud communication and network governance. By doing so, they help businesses maintain agility while expanding their digital footprint, which is increasingly seen as a core aspect of long-term competitiveness.

The increasing adoption of Solution-Defined Networking (SDN) and Network Function Virtualization (NFV) is driving the multi-cloud networking market growth. These technologies enable network administrators to abstract and automate complex networking tasks, such as traffic management, load balancing, and security policy enforcement, across multiple cloud environments. By leveraging SDN and NFV, businesses gain the agility to scale network resources dynamically in response to fluctuating demands while also reducing manual overhead and infrastructure costs. In a multi-cloud scenario, where agility and consistency are paramount, these capabilities become vital.

Moreover, growing investment in 5G infrastructure and edge computing is driving the multi-cloud networking market growth. As telecom operators and enterprises roll out 5G networks, there is a parallel demand for distributed computing environments that can process data closer to end users or connected devices. This shift requires seamless connectivity between cloud cores and edge nodes, and between multiple clouds that host complementary services. Multi-cloud networking platforms are essential in managing the complex interplay of data flows, ensuring ultra-low latency, high bandwidth, and secure communication channels. The ability to orchestrate networking across edge, private, and public clouds is now critical to support emerging 5G-enabled applications such as autonomous vehicles, smart manufacturing, and immersive media, all of which depend on a robust and dynamic networking backbone.

Component Insights

The solution segment dominated the market with a share of 68.5% in 2024. The increased need for network automation and observability in multi-cloud environments is contributing to the growth of the solutions segment. Managing multiple, interconnected networks manually is time-consuming and error-prone, especially in organizations that rely on dynamic, containerized, or microservices-based applications. Modern solutions offer AI-driven insights, intelligent routing, traffic optimization, and automated provisioning, helping enterprises improve operational efficiency and reduce downtime. These capabilities are particularly critical for businesses with global footprints or rapidly changing workloads, where agility and resilience are non-negotiable. As a result, demand is surging for multi-cloud networking solutions that offer robust automation and analytics features tailored to enterprise needs.

The services segment is projected to be the fastest-growing segment from 2025 to 2033. The rise of hybrid and edge computing models contributes to the services segment growth in the multi-cloud networking market. As enterprises extend their cloud infrastructure closer to end users through edge nodes and data centers, they require expertise in integrating these disparate components into a unified networking framework. Service providers are critical in orchestrating these deployments, especially when latency-sensitive applications such as autonomous vehicles, IoT systems, or real-time analytics are involved. These services ensure that the networking fabric between cloud, edge, and on-premise environments is robust, optimized, and resilient, enabling high-performance and reliable user experiences. This integration work is highly specialized and requires not only technical skills but also strategic planning, making services an essential component of the market.

Deployment Insights

The public cloud segment dominated the multi-cloud networking market in 2024. The proliferation of Software-as-a-Service (SaaS) applications hosted in public clouds is also pushing organizations to adopt multi-cloud networking architectures. Enterprises depend on a variety of SaaS tools that reside in different public clouds, creating a need for efficient routing and access management to ensure smooth user experiences. Without robust multi-cloud networking, organizations can encounter latency, service interruptions, and security gaps when trying to connect users to cloud-based resources. Therefore, multi-cloud networking solutions that offer centralized visibility, intelligent traffic routing, and security policy enforcement are increasingly indispensable, especially for large organizations with global operations and a hybrid workforce.

The hybrid cloud segment is projected to grow at a significant CAGR from 2025 to 2033. The development of containerized applications and the adoption of Kubernetes are further pushing hybrid cloud strategies forward, creating additional demand for sophisticated multi-cloud networking. Containers are inherently portable, and when deployed in hybrid environments, they require consistent networking policies, service discovery, and secure communication across clusters. Multi-cloud networking solutions provide the necessary abstraction layer to manage connectivity, enforce network segmentation, and monitor traffic across hybrid cloud architectures. As more organizations adopt cloud-native technologies, the ability to integrate and manage containerized workloads across on-premise and cloud platforms becomes a central requirement, reinforcing the importance of networking in hybrid setups.

Enterprise Size Insights

The large enterprises segment dominated the multi-cloud networking market in 2024. The development of containerized applications and the adoption of Kubernetes are further pushing hybrid cloud strategies forward, creating additional demand for sophisticated multi-cloud networking. Containers are inherently portable, and when deployed in hybrid environments, they require consistent networking policies, service discovery, and secure communication across clusters. Multi-cloud networking solutions provide the necessary abstraction layer to manage connectivity, enforce network segmentation, and monitor traffic across hybrid cloud architectures. As more organizations adopt cloud-native technologies, the ability to integrate and manage containerized workloads across on-premise and cloud platforms becomes a central requirement, reinforcing the importance of networking in hybrid setups.

The small & medium enterprises (SMEs) segment is projected to be the fastest-growing segment from 2025 to 2033. The increasing use of edge computing and distributed IoT systems by SMEs, especially in sectors like retail, manufacturing, and logistics, further drives the demand for cloud networking. These edge deployments often process and transmit data to cloud platforms for analytics or coordination with other systems. Multi-cloud networking allows SMEs to manage these edge-to-cloud data flows securely and efficiently, ensuring real-time communication and centralized control. The ability to link edge infrastructure with multi-cloud environments helps SMEs harness the power of localized processing while still leveraging centralized data insights and cloud-scale analytics. This hybrid approach becomes a competitive enabler for SMEs adopting smart and connected technologies.

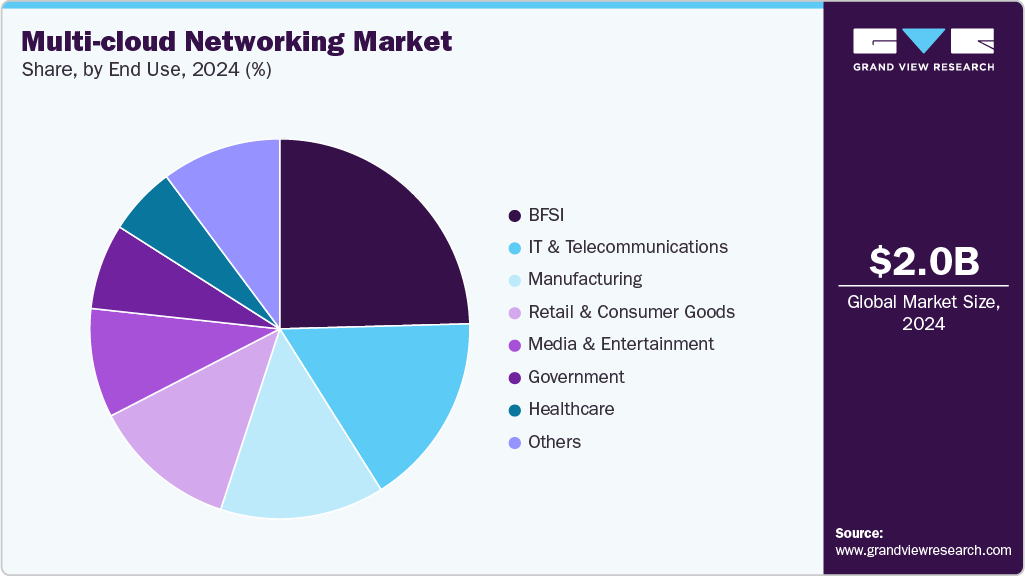

End Use Insights

The BFSI segment dominated the market in 2024. The surge in mobile and digital banking services has driven BFSI organizations to adopt scalable, agile IT infrastructures that can support fluctuating workloads and provide uninterrupted user experiences. Customers expect 24/7 access to financial services through apps, websites, and automated chatbots, requiring back-end systems that can dynamically balance loads and reduce latency. Multi-cloud networking plays a pivotal role by enabling low-latency connections between cloud-based applications and core systems, as well as between regional data centers and customer endpoints. By optimizing application delivery across geographies and cloud zones, financial institutions can meet customer expectations while ensuring reliability and performance.

The manufacturing segment is projected to be the fastest-growing segment from 2025 to 2033. The manufacturing segment is increasingly driving demand in the multi-cloud networking market as the industry undergoes rapid digital transformation through initiatives such as Industry 4.0, smart factories, and the Industrial Internet of Things (IIoT). Modern manufacturing environments are heavily reliant on real-time data from sensors, machines, supply chain platforms, and production monitoring systems. These systems are often distributed across various geographic locations and cloud platforms. Multi-cloud networking enables manufacturers to unify and manage this complex digital infrastructure, allowing data to move securely and efficiently between cloud services, edge devices, and on-premise operations.

Regional Insights

North America multi-cloud networking market held the largest share of 35.9% in 2024. The rise of DevOps and agile development practices across North American enterprises is fueling market growth. Businesses are accelerating the deployment of applications across diverse environments and leveraging CI/CD pipelines that span multiple clouds. This fast-paced development landscape requires networking solutions that are as dynamic and programmable as the applications they support. Multi-cloud networking meets this need by offering API-driven configurations, policy automation, and seamless integration with cloud-native platforms. As a result, developers and IT operations teams gain greater flexibility to deploy, scale, and secure applications without being constrained by traditional networking bottlenecks or manual configurations.

U.S. Multi-cloud Networking Market Trends

The multi-cloud networking industry in the U.S. is projected to grow during the forecast period. The booming software-as-a-service (SaaS) and platform-as-a-service (PaaS) ecosystems in the U.S. are accelerating the adoption of multi-cloud networking. Enterprises are subscribing to a wide array of cloud-native applications, many of which are hosted on different cloud providers. As these services become critical to daily operations, from customer relationship management (CRM) and enterprise resource planning (ERP) to supply chain logistics, organizations require networking frameworks that can support seamless, secure, and high-performance connectivity. Multi-cloud networking enables this by creating integrated environments that facilitate smooth data and application movement across service boundaries, improving efficiency and business responsiveness.

Asia Pacific Multi-cloud Networking Market Trends

The multi-cloud networking industry in Asia Pacific is expected to be the fastest growing segment, with a CAGR of 26.1% from 2025 to 2033. The surge in 5G rollout and edge computing initiatives is driving the demand for the multi-cloud networking market. Asia Pacific is at the forefront of 5G deployments, with telecom operators and governments investing heavily in next-generation network infrastructure. As 5G enables ultra-low latency and high-bandwidth connectivity, it also drives the proliferation of edge computing use cases in manufacturing, retail, healthcare, and transportation. These edge environments require seamless integration with centralized cloud platforms for data processing, analytics, and storage. Multi-cloud networking ensures that edge nodes, regional clouds, and global data centers are efficiently interconnected, supporting real-time applications and unlocking new revenue opportunities for enterprises operating in the region.

China multi-cloud networking industry is projected to grow during the forecast period. The rapid development of smart cities and IoT infrastructure is also stimulating the growth of the multi-cloud networking market in China. With a rising number of connected devices deployed in urban infrastructure, manufacturing plants, and logistics networks, there is an immense need for real-time data processing and intelligent analytics. These applications require distributed computing models where edge, regional, and core cloud platforms work in tandem. Multi-cloud networking acts as the enabler of this architecture, providing the agility and scalability necessary to interlink diverse computing nodes and cloud services across large geographical areas, all while meeting latency, security, and reliability requirements.

Europe Multi-cloud Networking Market Trends

The multi-cloud networking industry in Europe is expected to grow during the forecast period. The rise in remote and hybrid work arrangements in Europe is also fueling demand for advanced networking solutions that can connect users to multiple cloud-hosted applications and data sources efficiently. With employees accessing resources from different locations, devices, and networks, enterprises need reliable connectivity and consistent security policies across all points of interaction. Multi-cloud networking supports this requirement by offering centralized control over network paths, secure user access, and performance optimization, thereby enabling a smoother and safer remote work experience. This capability is increasingly seen as essential to maintaining productivity and security in the post-pandemic digital workplace.

The UK multi-cloud networking industry is expected to grow during the forecast period. The growing culture of public accountability in the U.K., fueled by heightened media coverage, NGO activism, and societal expectations, is making disclosure a reputational priority. In areas such as gender pay reporting, carbon emissions transparency, and modern slavery statements, companies are not just reacting to legal mandates but also voluntarily enhancing their disclosures to maintain public trust. The reputational risks of vague, delayed, or inconsistent reporting have led organizations to proactively adopt disclosure solutions that offer real-time updates, centralized approval mechanisms, and multi-format publishing capabilities. These systems ensure that corporate messages are clear, synchronized across platforms, and aligned with the organization’s values and brand narrative.

Key Multi-cloud Networking Market Companies Insights

Key players operating in the multi-cloud networking market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Multi-cloud Networking Companies:

The following are the leading companies in the multi-cloud networking market. These companies collectively hold the largest market share and dictate industry trends.

- Alkira, Inc.

- Arrcus Inc.

- Aviatrix, Inc.

- Carahsoft Technology Corp.

- Cisco Systems, Inc.

- Equinix, Inc.

- F5, Inc.

- HCL Technologies Limited

- Hewlett Packard Enterprise Development LP

- IBM Corporation

- Microsoft Corporation

- Netskope

- Tata Communications Limited

- VMware, Inc.

- Zenlayer

Recent Developments

-

In April 2025, Hewlett Packard Enterprise Development LP announced significant enhancements to its HPE Aruba Networking and HPE GreenLake cloud platforms. Among the latest innovations is the introduction of the HPE Aruba Networking Central Network Access Control (NAC), which features advanced cloud-based access controls. This upgrade is designed to support universal zero trust network access (ZTNA) initiatives by enabling IT teams to define and enforce role-based access policies more efficiently, ensuring precise control over user and device access.

-

In March 2025, F5, Inc., and StarHub signed a Memorandum of Understanding (MoU) aimed at advancing multi-cloud security, networking, and digital experiences for enterprises in Singapore and the broader Asia-Pacific region. This partnership reflects a mutual commitment to supporting businesses in managing the complexities of multi-cloud environments while maintaining robust security, optimal performance, and operational efficiency. Spanning five years, the MoU establishes a strategic foundation for collaboration, with a focus on jointly developing innovative solutions to strengthen cybersecurity, cloud networking, and enterprise digital experiences.

-

In July 2024, F5, Inc. collaborated with Console Connect to integrate their services across multiple Points of Presence (PoPs), significantly expanding F5’s global backbone and strengthening its multi-cloud networking capabilities. This collaboration delivers enhanced multi-cloud connectivity and security by enabling private, secure connections that bypass the public internet. As a result, customers gain access to F5 Distributed Cloud Services such as DDoS Protection via Console Connect’s global network for public-facing applications.

-

In April 2024, Cisco Systems, Inc. acquired Isovalent, marking a major advancement in its strategy to shape the future of secure, multi-cloud networking. Isovalent's groundbreaking technologies are set to become a foundational element of Cisco's Security Cloud vision, an AI-powered, cloud-delivered, and unified security platform built to support organizations of all sizes, delivering state-of-the-art protection against threats across multi-cloud environments.

Multi-cloud Networking Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.40 billion

Revenue forecast in 2033

USD 13.14 billion

Growth rate

CAGR of 23.7% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, enterprise size, end use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

IBM Corporation; Microsoft Corporation; VMware, Inc.; Cisco Systems, Inc.; Hewlett Packard Enterprise Development LP; Tata Communications Limited; Aviatrix, Inc.; F5, Inc.; Equinix, Inc.; Alkira, Inc.; Arrcus Inc.; Netskope; Carahsoft Technology Corp.; HCL Technologies Limited; Zenlayer

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Multi-cloud Networking Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global multi-cloud networking market report based on component, deployment, enterprise size, end use, and region:

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Solution

-

Network Security

-

Network Orchestration

-

Network Monitoring and Visibility

-

Others

-

-

Services

-

Professional Services

-

Managed Services

-

-

-

Deployment Outlook (Revenue, USD Million, 2021 - 2033)

-

Public Cloud

-

Private Cloud

-

Hybrid Cloud

-

-

Enterprise Size Outlook (Revenue, USD Million, 2021 - 2033)

-

Small & Medium Enterprises

-

Large Enterprises

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

BFSI

-

IT & Telecommunications

-

Retail & Consumer Goods

-

Government

-

Manufacturing

-

Healthcare

-

Media & Entertainment

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global multi-cloud networking market size was estimated at USD 2.03 billion in 2024 and is expected to reach USD 2.40 billion in 2025.

b. The global multi-cloud networking market is expected to grow at a compound annual growth rate of 23.7% from 2025 to 2033 to reach USD 13.14 billion by 2033.

b. The solution segment dominated the multi-cloud networking market with a market share of 68.5% in 2024. The increased need for network automation and observability in multi-cloud environments is contributing to the growth of the solutions segment.

b. Some key players operating in the market include IBM Corporation, Microsoft Corporation, VMware, Inc., Cisco Systems, Inc., Hewlett Packard Enterprise Development LP, Tata Communications Limited, Aviatrix, Inc., F5, Inc., Equinix, Inc., Alkira, Inc., Arrcus Inc., Netskope, Carahsoft Technology Corp., HCL Technologies Limited, Zenlayer

b. Factors such the rise of edge computing and the growth of DevOps and cloud-native development practices plays a key role in accelerating the multi-cloud networking market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.