- Home

- »

- Pharmaceuticals

- »

-

Myelodysplastic Syndrome Drugs Market Size Report, 2030GVR Report cover

![Myelodysplastic Syndrome Drugs Market Size, Share & Trends Report]()

Myelodysplastic Syndrome Drugs Market Size, Share & Trends Analysis Report By Treatment (Chemotherapy, Immune Treatments), By Route Of Administration, By End-use (Hospitals, Clinics), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-434-5

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

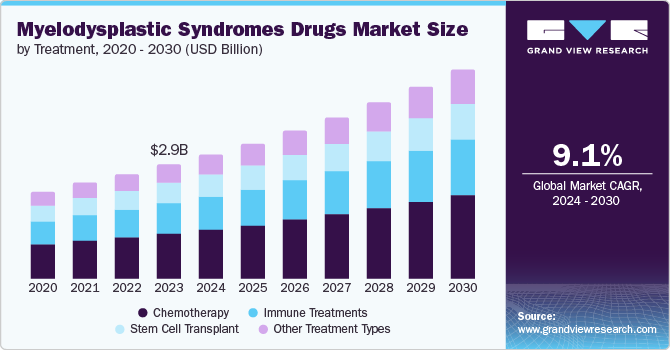

The global myelodysplastic syndrome drugs market size was valued at USD 2.88 billion in 2023 and is projected to grow at a CAGR of 9.1% from 2024 to 2030. Myelodysplastic syndrome increases with age, mostly occurring after the age of 65. The market is primarily driven by a rise in novel therapeutics. The key factors for market growth are the rising geriatric population, rising incidences of niche indications, and improving healthcare conditions.

The University of Sydney published a report in October 2023 stating Australia is getting older fast, estimating a 22% growth in the geriatric population by 2026. The rise in the elderly population is the root cause of the syndrome as it increases with age and is mostly seen in patients over the age of 80, according to the National Library of Medicine report published in July 2022. For instance, according to the Mayo Foundation, most patients with myelodysplastic syndrome are above the age of 60. Such rising incidences drive the market growth for better treatment alternatives.

Myelodysplastic syndrome progresses into acute myeloid leukemia 30% of the time, which can be expensive to treat. This is expected to drive the demand for myelodysplastic syndrome drugs. Some supportive care treatment options are available in the market, such as Erythropoiesis-stimulating agents (ESAs). These novel therapeutics drive the market growth of myelodysplastic syndrome drugs.

The U.S. Food and Drug Administration (FDA) approval proves the quality of various products. Obtaining FDA approval benefits patients and plays a vital role in the growth of the industry. For instance, the Food and Drug Administration (FDA) approved imetelstat in June 2024 for the treatment of myelodysplastic syndromes in adults with low to intermediate-1 risk of the syndrome. The rise in the syndrome encourages research institutes and companies to innovate better alternatives, hence driving market growth.

Treatment Insights

Stem cell transplant dominated the market and accounted for a share of 38.7% in 2023. Stem transplants use stem cells from healthy donors to replace damaged bone marrow. Stem cell transplant has the potential to restore the bone marrow damaged from high chemotherapy doses or from radiation therapy. The allogeneic stem transplant is the common type of transplant to treat myelodysplastic syndrome (MDS). A study published in February 2021 by Tokyo Medical and Dental University (TMDU) claimed artificial intelligence (AI) can identify healthy and productive skin stem cells quickly and accurately. Such technological advancements are further expected to drive the segment’s growth.

Chemotherapy is the second fastest-growing segment, significantly growing during the forecast period. The growing incidences of cancer are driving the chemotherapy segment to grow significantly. The World Health Organization (WHO) recorded 20 million cancer cases in 2022 and has projected 35 million cases of cancer by 2050. These rising prevalences are encouraging companies to innovate advanced products that are expected to drive market growth.

Route Of Administration Insights

Oral route of administration accounted for the largest market revenue share of 59.5% in 2023. The advantages of oral medicines, such as tablets and the elimination of injection-associated adverse events, are a few factors driving the market growth. According to the Center for Disease Control and Prevention (CDC), one in four adults suffers from needle phobia. Various companies are involved in producing oral medicinal drugs to treat myelodysplastic syndrome. Some FDA-approved oral drugs include Azacitidine (Vidaza), Decitabine (Dacogen), and Lenalidomide (Revlimid). The efforts of various companies to discover new oral drugs are expected to drive the market.

Parenteral is expected to register the fastest CAGR during the forecast period. The segment growth is attributed to immediate action against infected patients in case of emergencies. This form of drug administration provides the benefits of fast absorption, is more effective, and reduces the risk of infection and vaccine degradation. For instance, in the case of type 1 diabetes, the human body is not capable of producing insulin, hence requiring insulin to be injected for fast absorption and maintaining blood glucose levels. For instance, Dr. Reddy’s Laboratories Ltd. launched a chemotherapy drug named pemetrexed injection in the U.S. market. Some key players include Takeda Pharmaceutical Company Limited, Bristol Myers Squibb Company, and Lupin.

End-use Insights

The hospital segment accounted for the largest market revenue share of 48.6% in 2023. The rising prevalence of chronic diseases is driving hospitals to provide a concentrated treatment that cannot be treated at home. The treatment of myelodysplastic syndrome involves expert healthcare professionals with the ability to perform drug therapy, supportive care, and stem cell transplantation. Such treatment can be undertaken only at hospitals with certified doctors. For instance, Siteman Cancer Center recorded about 120 patients suffering from myelodysplastic syndrome, where they are treated through the hospital’s programs such as clinical trials and bone marrow and stem cell transplant programs.

The clinics segment is expected to register the fastest CAGR of 9.6% during the forecast period. For diagnosing diseases, new treatment alternatives are under clinical trials according to the National Cancer Institute. The clinic centers are focused on team-based care and are involved in research and innovation for the treatment. Some key players in the segment are the Mayo Foundation for Medical Education and Research (Mayo Clinic) and Cleveland Clinic, which provide wide treatment options.

Regional Insights

North America’s myelodysplastic syndromes drugs market dominated with revenue share of 35.44% in 2023. This growth is attributed to the growing geriatric population and growing incidences of myelodysplastic syndrome (MDS). According to the Leukemia & Lymphoma Society of Canada, every year, 5,900 cases of myelodysplastic syndrome (MDS) are diagnosed. This results in the growth of the treatment options such as azacitidine, decitabine, and lenalidomide drugs. Companies involved in the myelodysplastic syndromes drug market are Johnson & Johnson Services, Inc., Pfizer Inc., and Bristol-Myers Squibb company.

U.S. Myelodysplastic Syndrome Drugs Market Trends

The U.S. myelodysplastic syndrome drugs market accounted for a 29.4% share of the global market in 2023. This growth is attributed to the rise in the geriatric population, leading to the growing incidences of myelodysplastic syndrome. For instance, according to the U.S. Census Bureau report published in May 2023, 55.8 million of the population was over the age of 65 from 2020. This has resulted in the growth of myelodysplastic syndrome drugs such as vidaza, azacitidine, reblozyl, and decitabine, and the companies to seek FDA approvals. For instance, the U.S. Food and Drug Administration (FDA) approved a new therapy named Tibsovo (ivosidenib), a prescription medicine to treat rare blood cancer, myelodysplastic syndrome in October 2023. This increase in approvals and advancements in the healthcare sector are driving market growth.

Europe Myelodysplastic Syndrome Drugs Market Trends

Europe accounted for a significant market share in 2023 in the myelodysplastic syndrome drugs market. According to the World Health Organization (WHO), the older population in the European region is on the rise, with an estimated 215 million recorded in 2021 and is projected to reach 247 million by 2023. This risks the citizens with rare diseases such as myelodysplastic syndrome, resulting in the growth of the treatment options. Several key companies and research institutes in the market are engaged in the development of advanced treatment alternatives. For instance, the European Hematology Association (EHA) approved guidelines in 2021 on myelodysplastic syndromes (MDS) by the MDS-RIGHT, project which enables providing right care to the right patient suffering from this syndrome. Such initiatives are driving market growth.

Germany myelodysplastic syndrome drugs market growth for is attributed to the aging population, which increases the risk of the syndrome. According to the report published by AARP, Germany is one of the five aged societies in the world, which is projected to grow older by 24 million by 2050. The myelodysplastic syndrome is usually diagnosed in patients present with anemia, and in Germany, about 10% the adults are impacted with anemia, commonly in women more than in men. Some hospitals in Germany offering treatment for myelodysplastic syndrome, such as University Hospital Mannheim, have specialists to provide treatment such as bone marrow and stem cell transplants.

Myelodysplastic syndrome drugs market in the UK growth can be attributed to the rising cases of rare blood cancer. For instance, according to a Blood Cancer UK report published in October 2023, over 2,000 people in the UK are diagnosed with myelodysplastic syndrome (MDS) blood cancer every year. For high-risk MDS, prescribed chemotherapy drugs such as azacitidine, cytarabine, fludarabine, and idarubicin are used.

Asia Pacific Myelodysplastic Syndrome Drugs Market Trends

The Asia Pacific myelodysplastic syndrome drugs market is estimated to register the fastest CAGR over the forecast period. The growth is primarily attributed to the rising geriatric population and advancements by companies and research institutions. The rising incidence of cancer encourages clinics and hospitals to conduct clinical trials of new drugs under innovation. For instance, to treat high-risk myelodysplastic syndrome, Australia based Leukaemia Foundation began clinical trials in December 2022. Such advancements are expected to drive market growth.

The aging population in India is growing rapidly with estimated 153 million of people aged above 60 as per December 2023 report published by UNFPA organization. Such statistics raise health concerns for diseases such as rare blood cancer named myelodysplastic syndrome. Health concerns encourage companies and hospitals to innovate advanced alternatives to treat the disease. Some hospitals offering chemotherapy and bone marrow transplants are TATA Memorial Center, Rajiv Gandhi Cancer Institute & Research Centre, and Fortis Hospitals. For instance, Fortis Healthcare in Mumbai marked 100 bone marrow transplant completions in February 2024, a recommended treatment for myelodysplastic syndrome, leukemia, and various blood disorders. Such advancements and initiatives are expected to drive market growth.

Japan’s aging population is on the rise, with an estimated 36.2 million people over the age of 65, according to the World Economic Forum report published in September 2023. Elderly people are exposed to a high risk of suffering from myelodysplastic syndrome, which encourages companies to seek advanced treatment options. Key players in the region, such as Takeda Pharmaceutical Company Limited, are involved in efforts to innovate advanced treatment options. For instance, Takeda Pharmaceutical Company Limited announced approval from the Japanese Ministry of Health, Labour and Welfare for ADZYNMA Intravenous Injection 1500 to treat cTTP, a chronic blood clotting disorder, in March 2024.

Key Myelodysplastic Syndrome Drugs Company Insights

Some key companies in the myelodysplastic syndrome drugs market include Otsuka Pharmaceutical Co. Ltd, Amgen Inc., Teva Pharmaceutical Industries Ltd., and Sun Pharmaceutical Industries Limited. Key companies are involved in strategic initiatives such as in innovating new products, collaborating with institutions and other industries, and establishing partnerships.

-

Amgen is discovering, developing, manufacturing, and delivering innovative human therapeutics to treat chronic illnesses, including myelodysplastic syndrome. The Aranesp drug is being developed by the company, which can be used to treat myelodysplastic syndrome.

-

Takeda Pharmaceutical Company Limited is a biopharmaceutical company headquartered in Japan that offers a wide range of healthcare products. The company has FDA approvals for various therapies and treatments, including medicines to treat myelodysplastic syndromes, such as Pevonedistat 1016 and Pevonedistat 5005.

Key Myelodysplastic Syndrome Drugs Companies:

The following are the leading companies in the myelodysplastic syndrome drugs market. These companies collectively hold the largest market share and dictate industry trends.

- Celgene Corporation (Bristol-Myers Squibb company)

- Otsuka Pharmaceutical Co. Ltd

- Amgen Inc.

- Teva Pharmaceutical Industries Ltd.

- Sun Pharmaceutical Industries Limited

- Takeda Pharmaceutical Company Ltd

- Mylan N.V.

- Cipla Pharmaceutical Limited

- Onconova Therapeutics

- Hikma Pharmaceuticals PLC

Recent Developments

-

In February 2024, Bristol-Myers Squibb Company received approval from the Committee for Medicinal Products for Human Use (CHMP) operating under the European Medicines Agency (EMA) for Reblozyl for treating myelodysplastic syndromes.

-

In August 2023, Bristol-Myers Squibb Company received FDA approval for Reblozyl for the treatment of anemia with patients running lower-risk myelodysplastic syndromes.

-

In February 2022, Syros Pharmaceuticals Inc. received FDA approval for orphan drug designation (ODD) for tamibarotene, an oral drug to treat myelodysplastic syndrome.

Myelodysplastic Syndrome Drugs Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.14 billion

Revenue forecast in 2030

USD 5.28 billion

Growth Rate

CAGR of 9.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Treatment, route of administration, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Celgene Corporation, Otsuka Pharmaceutical Co. Ltd, Amgen Inc., Teva Pharmaceutical Industries Ltd., Sun Pharmaceutical Industries Limited, Takeda Pharmaceutical Company Ltd, Mylan N.V., Cipla Pharmaceutical Limited, Onconova Therapeutics, Hikma Pharmaceuticals PLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Myelodysplastic Syndrome Drugs Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global myelodysplastic syndrome drugs market report based on product, application, end-use, and region:

-

Treatment Outlook (Revenue, USD Million, 2018 - 2030)

-

Chemotherapy

-

Immune Treatments

-

Stem Cell Transplant

-

Other Treatment Types

-

-

Route Of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Oral

-

Parenteral

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Clinics

-

Other

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."