Nano-enabled Packaging Market Trends

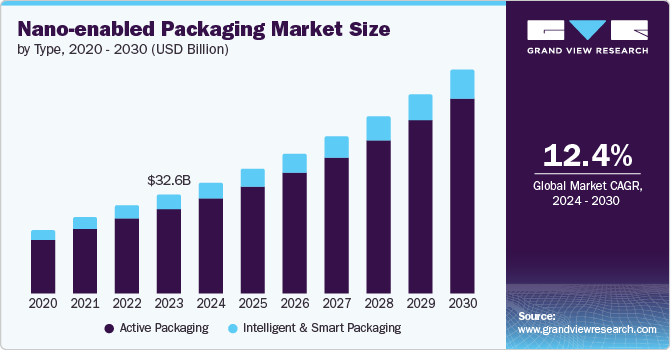

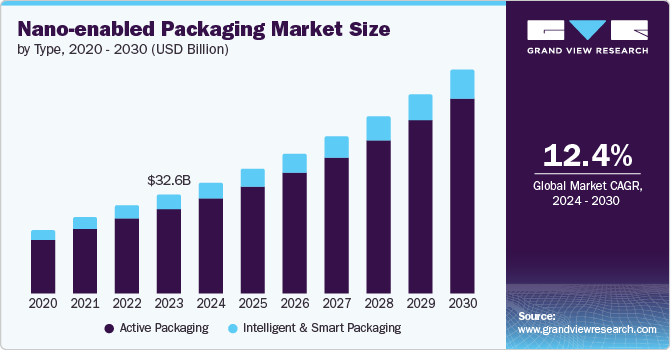

The global nano-enabled packaging market size was valued at USD 32.56 billion in 2023 and is projected to grow at a CAGR of 12.4% from 2024 to 2030. The increasing need for sustainable packaging solutions is driving the integration of nano-enabled packaging in the food and beverage sector. Nano-enabled packaging provides prolonged shelf life, superior barrier characteristics, and enhanced food safety. Swift progress in nanotechnology is facilitating the creation of cutting-edge packaging solutions customized for distinct food and beverage items, thereby accelerating market growth.

To ensure the freshness of the product and, more importantly, the quality, businesses are increasingly turning to advanced packaging solutions that enhance protection levels and potentially reduce food wastage. The food and beverage industry stands out as a key driver in the demand for nano-enabled packaging. Urbanization trends, changing consumer preferences, and the growing number of working women have driven the increased demand for ready-to-eat meals, convenience foods, and packaged beverages.

Increasing digitalization and consumer shift towards clean food are some of the factors propelling the market growth. Additionally, there is a notable rise in the consumption of fresh vegetables, fruits, and meat across numerous countries globally. Furthermore, the expanding pharmaceutical industry is amplifying the demand for nano-enabled packaging in its products to safeguard drugs from air, moisture, and light.

Nano-enabled packaging represents an innovative category within active or intelligent packaging that enhances food safety, freshness, and convenience, thereby influencing market dynamics significantly. It efficiently provides protection from UV rays and light, thereby preserving the quality and nutritional value of foods. Moreover, ongoing investments and governmental efforts to integrate nanotechnologies across various sectors are poised to enhance market expansion during the projected timeframe.

Type Insights

In 2023, intelligent & smart packaging emerged as the market leader, capturing the largest revenue share of 85.6%. This can be attributed to increasing consumer trust & safety against fraudulent packaged goods by real-time monitoring of the quality, freshness, and authenticity of goods through radio frequency identification (RFID) tags and nano-enabled sensors in packaging.

The active packaging segment is anticipated to exhibit CAGR of 10.4% from 2024 to 2030. There is a rising demand for active packaging owing to the rising popularity of packaged and ready to eat foods. Moreover, the beverages business, which includes bottles and cans among other products, is also anticipated to have a favorable effect on this market.

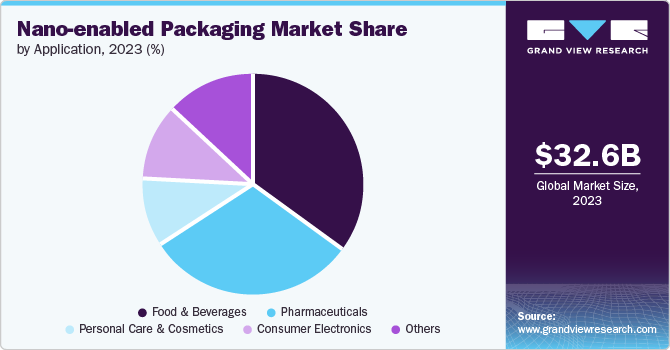

Application Insights

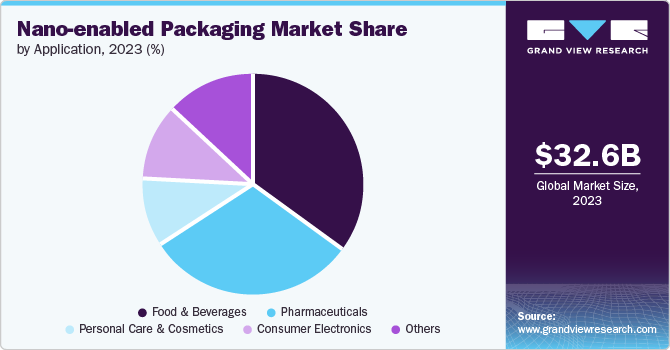

Food & beverages segment dominated the market and accounted for a share of 34.7% in 2023. The rising consumption of packaged food products and the growing preference among food and beverage retailers and manufacturers for shelf-stable and sustainable packaging solutions are contributing to the demand for nano-enabled packaging in the industry. Furthermore, increasing consumer demand for healthy, fresh, and safely preserved food and beverage products with extended shelf life underscores the robust growth of the food and beverage Nano-enabled packaging market.

The pharmaceuticals segment is expected to witness the fastest CAGR of 13.3% during the forecast period. The primary driver of the pharmaceutical nano-enabled packaging market's expansion is the growing population and the increase in the number of people affected by various diseases.

Regional Insights

In 2023, North America nano-enabled packagingmarket accounted for a revenue share of 29.05% of the global market, due to the strong growth of the pharmaceutical industry, strict regulatory standards ensuring top-notch packaging quality, rising demand for creative packaging solutions, and a strong emphasis on patient safety and adherence.

U.S Nano-enabled Packaging Market Trends

The U.S. nano-enabled packaging in the dominated the North America nano-enabled packaging market with a share of 72.0% in 2023, owing to rising consumer demand for convenient and hygiene food packaging. This is relevant in U.S., with its large population and busy lifestyles.

Europe Nano-enabled Packaging Market Trends

The Europe nano-enabled packaging market is expected to witness a significant growth during the forecast period from 2024 to 2030. The heightened focus on food safety and hygiene has propelled the adoption of nano-enabled packaging in Europe. Consumers and manufacturers alike are increasingly prioritizing packaging solutions that prevent contamination and maintain product freshness throughout the supply chain.

The Germany nano-enabled packaging market emerged as the market leader in Europe. Increase in demand across various sectors such as food and beverage, pharmaceuticals, and personal care is driving a notable transition towards eco-friendly and sustainable packaging solutions.

The UK nano-enabled packaging market is expected to witness a notable growth in the coming years owing to growing demand for sustainable packaging solutions and a rising consumer demand for ready to eat foods. In addition, the food and beverages sector create a strong demand for improve packaging solutions.

Asia Pacific Nano-enabled Packaging Market Trends

The nano-enabled packaging in Asia Pacific dominated the market and is projected to witness the fastest CAGR of 13.5% during the forecast period. The growth can be attributed to increasing demand for packaged goods, prompting the need for advanced packaging solutions to maintain product safety and quality, thereby establishing dominance in the market. India and China are the major countries in this region, owing to the higher consumption from food & beverages and pharmaceutical industries.

The China nano-enabled packaging market is expected to grow rapidly during the forecast period owing to the higher consumption from food & beverages and pharmaceutical industries. Moreover, China is a global manufacturing powerhouse for several food and pharma companies driving a massive demand for innovative packaging solution.

The India nano-enabled packaging market is expected to witness a significant growth, owing to the increasing demand for consumer electronics and a strong focus on packaging that is environmentally friendly.

Key Nano-enabled Packaging Company Insights

Some of the key companies in global nano-enabled packaging market include Amcor; Sonoco Products Company; CCL Industries Inc.

-

Amcor develops and produces flexible packaging, rigid containers, specialty cartons, closures and services for food, beverages, pharmaceuticals, medical-device, home & personal-care, and other products.

-

Sonoco Products Company is a producer of industrial and consumer packaging products. It provides packaging solutions across several sectors such as food & beverages, household products, beauty and personal care, healthcare, electronics and appliances, construction.

Key Nano-enabled Packaging Companies:

The following are the leading companies in the non-enabled packaging market. These companies collectively hold the largest market share and dictate industry trends.

- Amcor

- Sealed Air

- Klöckner Pentaplast

- Tetra Pak International S.A.

- CCL Industries Inc.

- Sonoco Products Company

- BASF SE

- Avery Dennison

- DuPont Teijin Films

- Checkpoint Systems, Inc

Recent Developments

-

In June 2024, Sonoco announced that it entered into a contract to acquire Evisoys, from KPS Capital Partners, LP for USD 3.9 billion. The transaction is expected to enhance its core business and invest in high-return opportunities.

-

In March 2023, Amcor and Nfinite Nanotechnology Inc. announced that they entered into a joint research project agreement to validate Nfinite’s nanocoating technology to enhance compostable and recyclable packaging.

Nano-enabled Packaging Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2024

|

USD 36.53 billion

|

|

Revenue forecast in 2030

|

USD 73.69 billion

|

|

Growth rate

|

CAGR of 12.4% from 2024 to 2030

|

|

Base year for estimation

|

2023

|

|

Historical data

|

2018 - 2022

|

|

Forecast period

|

2024 - 2030

|

|

Quantitative units

|

Revenue in USD million and CAGR from 2024 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Type and Application

|

|

Regional scope

|

North America, Europe, Asia Pacific, Latin America, MEA

|

|

Country scope

|

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Japan, China, India, Australia, South Korea, Brazil, Argentina, South Africa, Saudi Arabia and UAE.

|

|

Key companies profiled

|

Amcor; Klöckner Pentaplast; Sealed Air; Tetra Pak International S.A.; Sonoco Products Company; CCL Industries Inc.; BASF SE; DuPont Teijin Films; Avery Dennison; Checkpoint Systems, Inc;

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

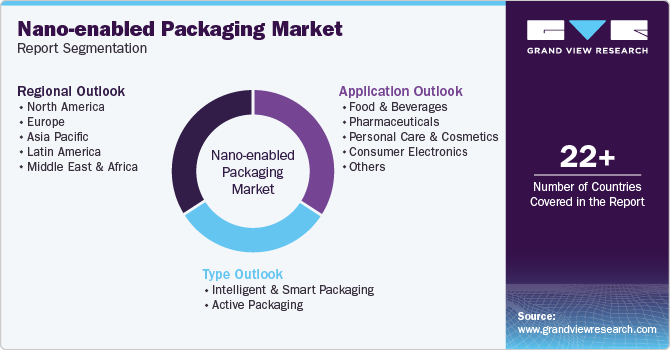

Global Nano-enabled Packaging Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global nano-enabled packaging market report based on type, application, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Latin America

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE