- Home

- »

- Agrochemicals & Fertilizers

- »

-

Nano Fertilizer Market Size & Trends Analysis Report, 2030GVR Report cover

![Nano Fertilizer Market Size, Share & Trends Report]()

Nano Fertilizer Market Size, Share & Trends Analysis Report By Raw Material (Carbon, Silver), By Method Of Application (Spray, Soil), By Application, By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-998-8

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2020

- Forecast Period: 2022 - 2030

- Industry: Bulk Chemicals

Report Overview

The global nano fertilizer market size was estimated at USD 2705.5 million in 2021 and is expected to expand at a compounded annual growth rate (CAGR) of 14.8% from 2022 to 2030.This growth can be attributed to the growing demand for high-yield agricultural produce due to the increasing population.

According to the Food and Agriculture Organization of the United Nation (FAO), the global population is estimated to reach 9.7 billion by 2050. Hence, there is an urgent need to increase crop production by nearly 70 percent to meet the demand. This growing demand for agricultural produce can be met by using nano fertilizers. These can be easily absorbed into the plant and provide all the key nutrients to the crop in an efficient manner. Their efficacy remains far higher as compared to traditional fertilizers which promise to improve production significantly.

The increased use of mineral or chemical fertilizers has resulted in a negative impact on the quality of water and soil worldwide. This is largely due to leaching and gas emissions. Conversely, nano fertilizers are small particles and are absorbed in crops in smaller quantities providing controlled release of the active substances. This is a sea of change as compared to traditional fertilizers thus, reducing the chances of runoff, leaching, and gas emissions to the soil and atmosphere. These key benefits promise a strong shift to nano fertilizers amidst an increased drive to adopt green measures globally.

Recent empirical evidence suggests that key nutrients such as Phosphorus, Nitrogen, and Potassium, when applied to soil through traditional fertilizers, are lost into the soil at a significant rate. These rates stand at significant proportions including 80-90%, 40-70%, and 50-90% respectively. Hence, the conventional fertilization process results in a considerable loss of applied resources. Furthermore, farmers tend to apply fertilizers repeatedly to achieve desired yields, which in turn leads to the deterioration of crop quality. Thus, increasing demand for nano fertilizers as it helps in better absorption of nutrients by plants. Moreover, it does not result in long-term damage to the soil fertility, through leaching or runoff.

Raw Material Insights

Nitrogen-based nano fertilizers are expected to witness robust growth. It accounted for over 25% of revenue share in 2021. This growth is large because nitrogen-based fertilizer remains a cost-effective choice. Furthermore, the fertilizer also remains easily accessible to farmers and provides rich nutrition to various crops. Additionally, pasture and crop growth often respond positively to soil nitrogen. Thus, it acts as a critical element in the growth and reproduction of plants.

Carbon-based nanomaterials are also expected to witness promising growth during the forecast period. This is due to their stable molecular arrangement, low toxicity, and uniform dispersion which makes them a great fertilizer carriers. In addition, they are also used as light converters for supplementing the photosynthesis of plants. All these factors contribute to increased demand for carbon-based nanomaterials.

Among the carbon-based nanomaterials, carbon tubes witnessed more traction in the agricultural sector. The carbon tubes embed the ability to nano transport cross plant cell walls, impact plant growth regulation, and act as a medium for biosensors. Thus, they can act as both plant growth boosters and slow-release fertilizers.

The usage of silver-based nanomaterials in nano fertilizer continues to increase due to their ability to act as an effective fungicide. Hence, tackling the loss of crops due to bacterial growth remains a major worry for farmers worldwide. Additionally, it helps enhance seed germination, root length, and speed of germination. It also aids plants to improve their ability to absorb essential nutrients in the soil. Thus, silver-based nanomaterials act as eco-friendly as well as a green alternative to traditional fertilizers.

Application Insights

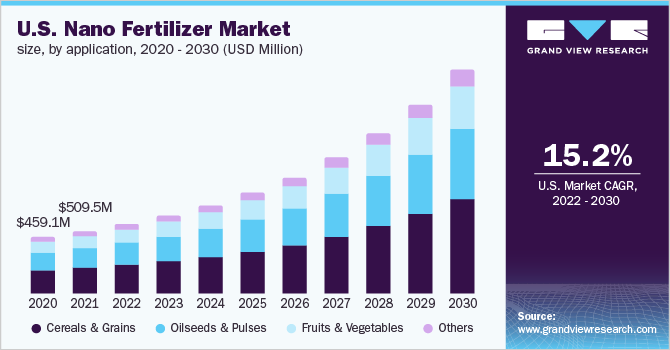

Cereals & grains in the application segment dominated the market with a revenue share of over 40% in 2021. This is due to the increasing demand for grains and cereals especially maize, wheat, and rice. According to FAO, cereal production in 2021 increased to 2815.1 million tons from 2777.7 million tons in 2020. Thus, to meet this increasing production need, farmers are shifting towards using nano fertilizers. Their ability to improve crop yield and efficiency to deliver essential nutrients remains a lucrative prospect for food growers globally.

Oil seeds and pulses held the second position in the application segment during the forecast period. This growth can be attributed to the daily requirement of pulses and oil seeds in households. This requirement remains key to fulfilling the need for vitamins, proteins, and minerals in the human body. Thus, the usage of nano fertilizers and their promise for high yields remains key for the nourishment of all including individuals, households, and the planet at large.

The fruit and vegetable segment witnessed promising growth in Europe. The continent remains the largest consumer in the segment due to its high demand for healthy nutrition. In Europe, the U.K. is among the top three importers, accounting for nearly 80% of total the fruits and vegetable production of Europe. The increasing demand for fresh fruits and vegetables in driving in Europe amidst uncertainties created by Brexit also propels the demand for nano fertilizers. The eco-friendly nature of nano-fertilizer over traditional ones also remains a promising driver of growth as sustainability initiatives continue to change production practices across industries.

Other application segment includes ornamental and fiber plants. The use of nano fertilizer in this segment is on the rise due to the ability of these plants to absorb nano fertilizers more efficiently thus getting all the nutrients required for growth with minimal wastage.

Method of Application Insights

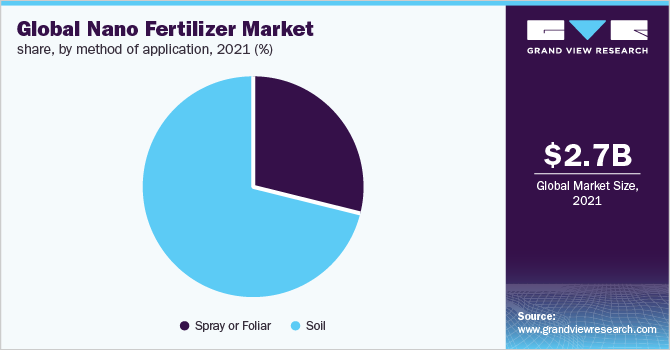

The soil method of application dominated the global market with over 70% of the revenue share in 2021. The ability of nano fertilizer particles to easily transfer nutrients into the soil, which in turn penetrates the roots of the plants, drives the growth of the soil method of application segment.

The foliar or spray application is another important method of applying nano fertilizer to crops. In this method, the fertilizer is dissolved in water and sprayed on the foliage of growing plants. The nutrient elements are then absorbed by the leaves of the plant thus resulting in sufficient delivery for the healthy growth of plants. Challenges related to application remain a restraint to the growth of this segment. The concentration of the solution should be balanced or it can result in damage because of the scorching of the leaves.

Regional Insights

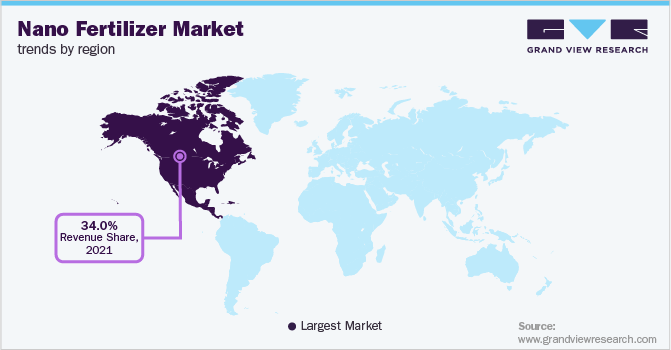

North America dominated the market in 2021 with a revenue share of over 34%. This is attributed to the increasing demand for high-yield crops in the countries such as the U.S., Canada, and Mexico with the U.S. accounting for USD 118.3 billion of agricultural exports in the year 2019. Thus, to increase the yield of crops, countries like the US have shifted from conventional fertilizer use of nano fertilizers. Its capacity of supplying nutrients to the crops in an efficient manner remains the cornerstone of its growth.

According to the data published by the United States government, in 2020, the agriculture and food industry in the U.S. accounted for USD 1.055 trillion which was 5% of the total GDP of the country. The robust rise in the agriculture and food industry, in turn, drives demand for better quality fertilizer, subsequently giving rise to advancements such as nano fertilizers.

The U.S. Department of Agriculture in 2019 announced funding of USD 72.4 million to Specialty Crop Block Grant Program to increase the vegetable, fruit, and nursery crops yield. This in turn is expected to open up new opportunities for growth for nano fertilizer in the region.

According to data published by Syngenta, a key player in the global agrochemical market, APAC remains a major contributor to the global food chain. It accounts for 19% of total agriculture and food exports worldwide. This is because of the presence of emerging economies such as India, China, Vietnam, and Indonesia. The rise of India and China as the global leading producers of rice, wheat, cotton, and tea remains a major driver of growth in the region. Furthermore, Indonesia and Vietnam remain among the top 5 producers of coffee beans. This has led to an urgent need in the region to increase productivity. Furthermore, sustainability drives to meet the rising food demand of the region is in turn driving the demand for nano fertilizers in the region.

Key countries continue to strengthen their position globally with robust funding programs and policy frameworks. The Indian government has taken several steps under the initiative Atma Nirbhar Bharat program. The initiative led to an investment of USD 4.82 billion by the government to set up new nano fertilizer manufacturing units in the region. The initiative remains key to the Indian government’s aspiration to reduce dependency on imports. Robust policy frameworks and initiatives are expected to make significant contributions to regional growth.

Key Companies & Market Share Insights

The nano fertilizer market is highly competitive with the presence of some big players holding a significant market share. New players continue to invest in scalability, and product advancement to occupy a larger share. For instance, Indian Farmers Fertilizer Cooperative Limited (IFFCO) a multi-state cooperative society produced over 87.02 lakh metric tons of fertilizer in 2021-2022, opening up new growth opportunities. Some prominent players in the global nano fertilizer market include:

-

Indian Farmers Fertilizer Cooperative Limited

-

Lazuriton Nano Biotechnology Co., Ltd.

-

Fanavar Nano-Pazhoohesh Markazi Company

-

Tropical Agrosystem India (P) Ltd.

-

EuroChem

-

Shan Maw Myae Trading Co., Ltd

-

Geolife Group

-

AG CHEMI Group, s.r.o.

-

JU Agri Sciences Pvt. Ltd.

-

Nano Solutions

Nano Fertilizer Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 3005.6 million

Revenue forecast in 2030

USD 9377.3 million

Growth Rate

CAGR of 14.8% from 2022 to 2030

Base year for estimation

2021

Historical data

2018 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million, volume in tons, and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Raw material, method of application, application, region

Regional scope

North America; Central and South America; Europe; Asia Pacific; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; China; India; Japan; Thailand; Brazil; Mexico; South Africa; Egypt

Key companies profiled

Indian Farmers Fertiliser Cooperative Limited; Lazuriton Nano Biotechnology Co. Ltd.; Fanavar Nano-Pazhoohesh Markazi Company; Tropical Agrosystem India (P) Ltd.; Shan Maw Myae Trading Co., Ltd; Geolife Group, s.r.o.; JU Agri Sciences Pvt. Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Nano Fertilizer Market Segmentation

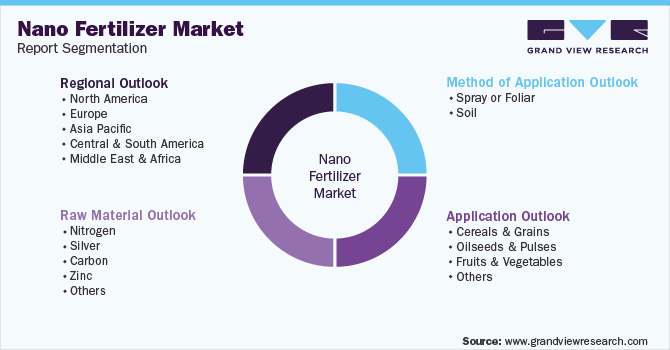

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global nano fertilizer market report based on raw material, method of application, application, and region:

-

Raw Material Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Nitrogen

-

Silver

-

Carbon

-

Zinc

-

Others

-

-

Method of Application (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Spray or Foliar

-

Soil

-

-

Application (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Cereals & Grains

-

Oilseeds & Pulses

-

Fruits & Vegetables

-

Others

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Thailand

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Egypt

-

-

Frequently Asked Questions About This Report

b. The global nano fertilizer market size was estimated at USD 2705.5 million in 2021 and is expected to reach USD 3005.6 million by 2022.

b. The nano fertilizer market is expected to grow at a compounded annual growth rate (CAGR) of 14.8 % from 2022 to 2030 to reach USD 9377.3 million by 2030.

b. Nitrogen emerged as a major raw material used for production of nano fertilizer in 2021 with a revenue share of over 25%. This is attributed to the fact that nitrogen is one of the essential element required for proper growth and development of plant. Additionally, easy and cheap availability of nitrogen has also made it the top most preference among consumers.

b. Some of the major key players in the nano fertilizer market include Indian Farmers Fertiliser Cooperative Limited, Lazuriton Nano Biotechnology Co., Ltd., Fanavar Nano-Pazhoohesh Markazi Company, Tropical Agrosystem India (P) Ltd., Shan Maw Myae Trading Co., Ltd, Geolife Group, s.r.o., JU Agri Sciences Pvt. Ltd.

b. Key factors driving the nano fertilizer market growth are increasing demand for better-yield food crops due to the continuously increasing population worldwide and diminishing resources.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."