- Home

- »

- Catalysts & Enzymes

- »

-

Nanocatalysts Market Size & Share, Industry Report, 2033GVR Report cover

![Nanocatalysts Market Size, Share & Trends Report]()

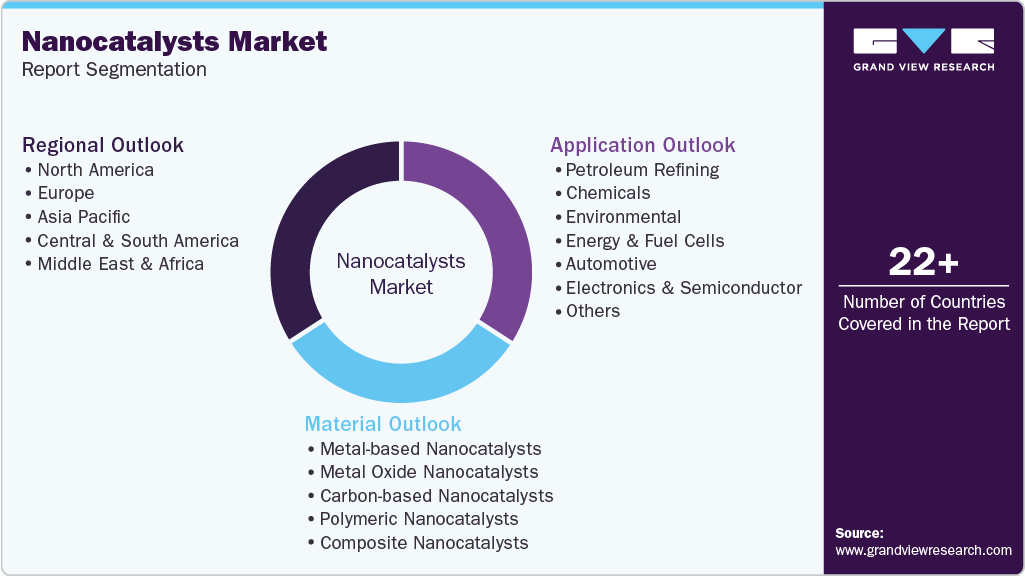

Nanocatalysts Market (2025 - 2033) Size, Share & Trends Analysis Report By Material (Metal-based, Carbon-based), By Application (Petroleum Refining, Chemicals, Environmental), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-704-1

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Nanocatalysts Market Summary

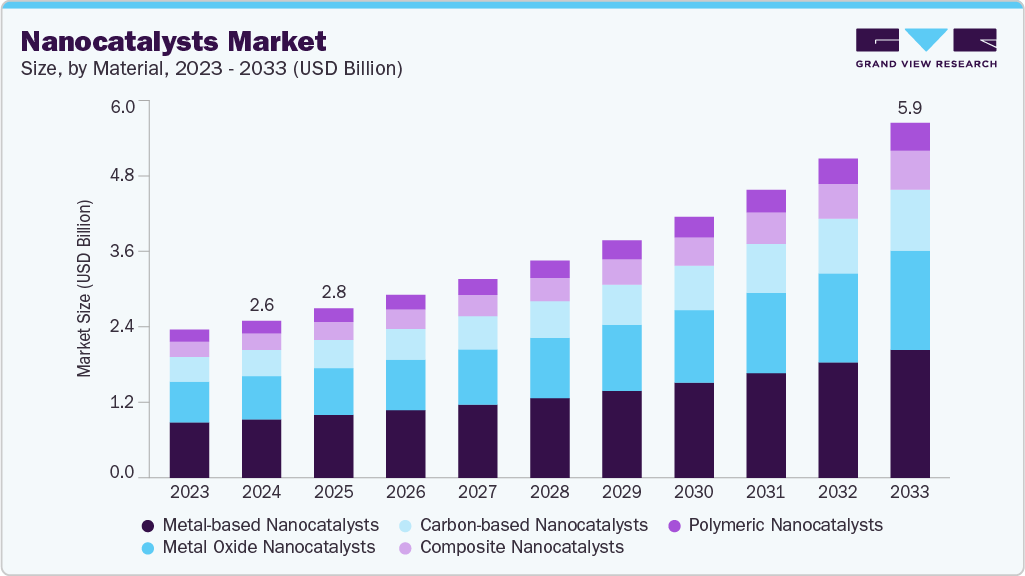

The global nanocatalysts market size was estimated at USD 2,618.9 million in 2024 and is projected to reach USD 5,926.3 million by 2033, growing at a CAGR of 9.7% from 2025 to 2033. The global shift toward sustainable industrial practices has significantly increased the demand for cleaner and more efficient catalytic processes.

Key Market Trends & Insights

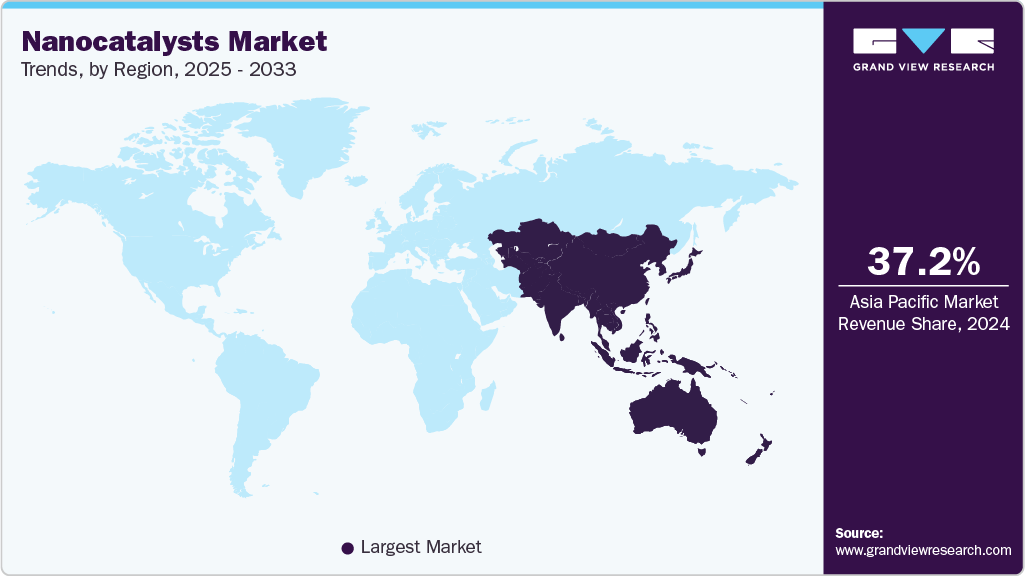

- Asia Pacific dominated the nanocatalysts market with the largest revenue share of 37.2% in 2024.

- The market in China is expected to grow at the highest CAGR of 10.1% from 2025 to 2033.

- By material, the composite nanocatalysts segment is expected to grow at a significant CAGR of 10.2% from 2025 to 2033 in terms of revenue.

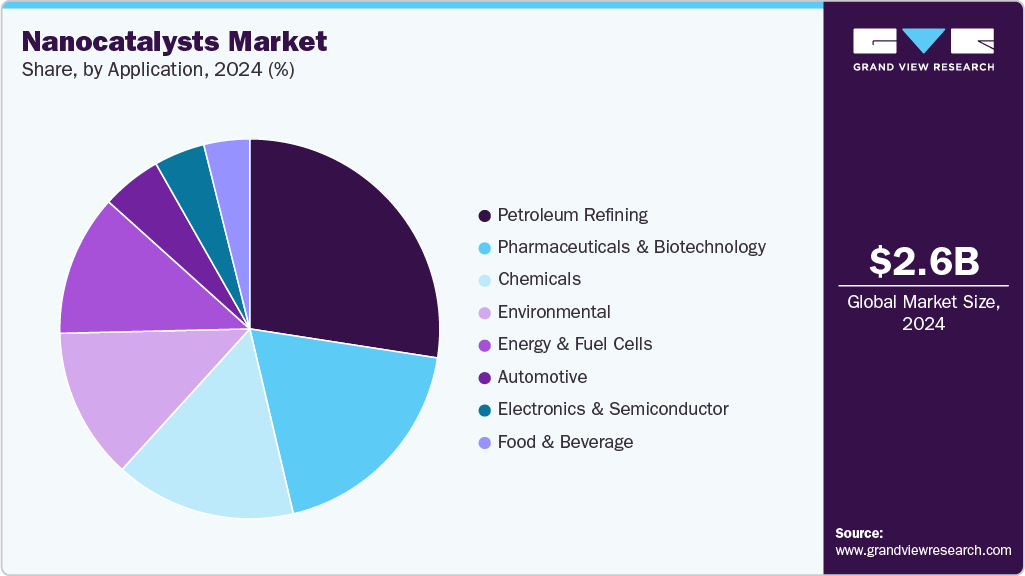

- By application, the petroleum refining segment held the largest revenue share of 31.7% in 2024 in terms of value.

- By material, the metal-based nanocatalysts segment held the largest revenue share of 37.2% in 2024 in terms of value.

Market Size & Forecast

- 2024 Market Size: USD 2,618.9 Million

- 2033 Projected Market Size: USD 5,926.3 Million

- CAGR (2025-2033): 9.7%

- Asia Pacific: Largest market in 2024

Nanocatalysts offer higher surface area, enhanced reactivity, and superior selectivity compared to conventional catalysts, which allows for reduced energy consumption and minimized waste generation. These attributes make nanocatalysts especially attractive in sectors like petrochemicals, environmental remediation, and pharmaceuticals, where companies are pressured to lower carbon emissions and meet stricter environmental regulations without compromising productivity or profitability.

The global market is ripe with opportunities driven by the rising emphasis on sustainability, circular economy models, and green chemistry. Emerging applications in green hydrogen production, carbon capture technologies, and next-generation pharmaceuticals present lucrative growth avenues. In addition, increasing R&D collaborations between academia and industry, supported by government funding, are accelerating the development of novel nanocatalyst formulations with improved performance and cost-efficiency. Integrating AI and high-throughput screening tools for catalyst discovery will unlock new material innovations and expand the market's addressable scope across mature and emerging economies.

Despite their promising performance, the commercialization of nanocatalysts faces key challenges related to high production costs, complex synthesis processes, and scalability issues. The precision and control required during nanoparticle fabrication often lead to increased operational expenses, which can hinder adoption, especially among small and medium-sized enterprises. Moreover, concerns regarding nanoparticle exposure's environmental and health impacts have prompted regulatory scrutiny, potentially slowing deployment across certain regions and applications. Furthermore, the lack of standardized catalyst recovery and reusability protocols limits their economic viability in large-scale industrial settings.

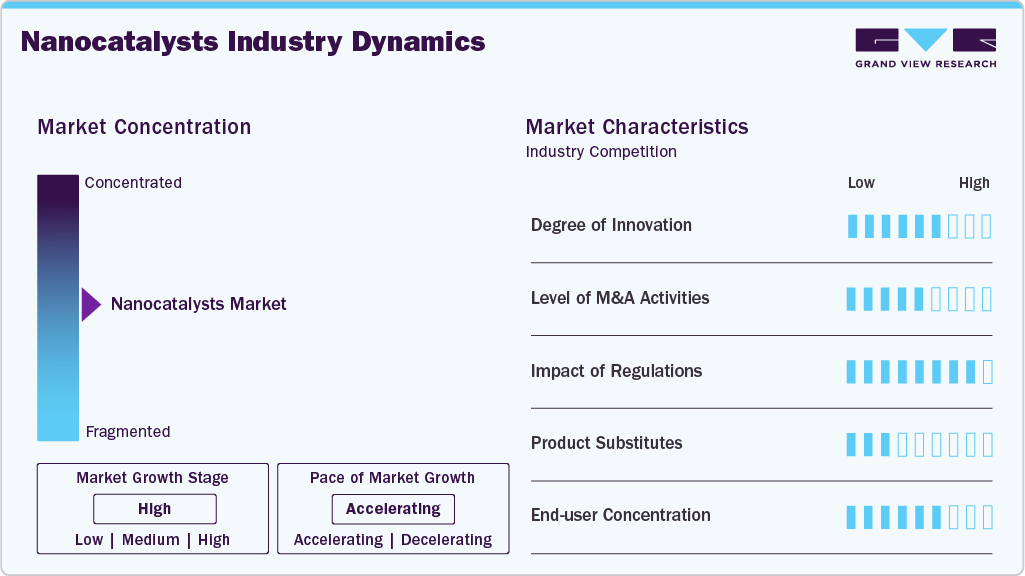

Market Concentration & Characteristics

The market is moderately fragmented, with a few global players, such as BASF SE, Dow, Bayer AG, and Evonik, dominating the competitive landscape. These companies benefit from their scale of operations, competitive pricing, and diversified product offerings. They are actively investing in research and development, expanding production capacities, and focusing on sustainable practices to strengthen their positions in the competitive market.

Leading players in the market are adopting a mix of strategic initiatives to strengthen their market position and drive innovation. These strategies include robust investments in R&D to develop advanced, application-specific nanocatalysts with enhanced performance and sustainability profiles. Companies are also pursuing strategic partnerships and collaborations with academic institutions, research labs, and clean tech firms to accelerate technology commercialization. Furthermore, many players are expanding their global footprint through mergers, acquisitions, and capacity enhancements in high-growth regions such as the Asia Pacific and North America, while aligning their product portfolios with evolving regulatory standards and green chemistry initiatives.

Material Insights

The metal-based nanocatalysts segment held the largest revenue share of 37.2% in 2024, primarily due to their exceptional catalytic efficiency, high surface reactivity, and broad applicability across critical industries such as petroleum refining, automotive, energy, and pharmaceuticals. Metals like platinum, palladium, gold, and silver are widely used in nanoparticle form to accelerate chemical reactions with high precision and selectivity. Their established role in emission control systems, hydrogen fuel cells, and industrial chemical synthesis, combined with their proven stability and recyclability, continues to drive strong demand. Moreover, the increasing focus on decarbonization and clean energy solutions has further reinforced their importance in electrochemical and catalytic applications, particularly in fuel cell and hydrogen production technologies.

Other material segments also witness steady growth due to their unique functional advantages. Metal Oxide Nanocatalysts are gaining traction in environmental remediation and photocatalysis due to their chemical stability, cost-effectiveness, and ability to degrade pollutants under light exposure. Carbon-based Nanocatalysts, including graphene and carbon nanotubes, are increasingly adopted in energy storage and biosensing applications due to their high conductivity and tunable surface properties. Polymeric Nanocatalysts are emerging as a green alternative for controlled and reusable catalytic systems in pharmaceutical and biochemical applications. Meanwhile, Composite Nanocatalysts, which combine the benefits of multiple materials, are being engineered to deliver enhanced activity, durability, and selectivity, making them suitable for advanced applications in fuel processing, smart materials, and precision catalysis.

Application Insights

The petroleum refining segment held the largest revenue share of 31.7% in 2024, driven by nanocatalysts' critical role in enhancing refining efficiency, improving product yields, and meeting stringent environmental regulations. Nanocatalysts are widely deployed in hydrocracking, catalytic reforming, and desulfurization due to their superior surface area, thermal stability, and selectivity, enabling more effective breakdown of heavy hydrocarbons into high-value fuels. As global refiners increasingly focus on cleaner fuel production and operational optimization, nanocatalysts are becoming integral to reducing emissions and maximizing throughput. In addition, the growing integration of nanotechnology into catalyst regeneration and lifecycle extension further reinforces their value in refining operations.

Beyond petroleum refining, other application segments are experiencing accelerated growth due to nanocatalysts' versatility across industries. In the Chemicals sector, nanocatalysts enable greener and more efficient synthetic pathways for polymers, intermediates, and specialty chemicals. The environmental segment is witnessing a strong demand for nanocatalysts in air and water purification systems, which are supported by rising global pollution control mandates. In Energy & Fuel Cells, nanocatalysts are essential for improving electrochemical performance and cost-efficiency, especially in hydrogen and renewable energy applications. Meanwhile, the Automotive sector relies on nanocatalysts for advanced emission control technologies. Emerging uses in Electronics & Semiconductor manufacturing, Food & Beverage processing, Pharmaceuticals & Biotechnology, particularly in drug synthesis and targeted delivery, are also contributing to market expansion by leveraging the precision and reactivity offered by nanocatalytic systems.

Regional Insights

Asia Pacific dominated the market in 2024 with a revenue share of 37.2%, supported by rapid industrialization, strong growth in the chemical and refining sectors, and increasing investments in clean energy technologies. The region benefits from favorable government policies, expanding manufacturing capabilities, and a robust research ecosystem in countries like China, India, Japan, and South Korea. Rising demand for energy-efficient and sustainable catalytic systems across environmental, automotive, and energy applications further accelerates adoption. In addition, ongoing infrastructure development and environmental mandates drive widespread deployment of nanocatalysts in air and water purification systems.

China Nanocatalysts Market Trends

The nanocatalysts market in China played a pivotal role in the Asia Pacific market, driven by its massive refining capacity, chemical production scale, and growing focus on green technologies. The country is a global manufacturing hub and a leading adopter of advanced catalytic technologies, particularly in petroleum refining, fuel cells, and pollution control. Substantial government funding in nanotechnology R&D and environmental remediation projects continues to stimulate market demand. Moreover, China’s ambitious carbon neutrality goals encourage developing and deploying nanocatalyst-based solutions across the energy, transport, and industrial sectors.

North America Nanocatalysts Market Trends

The nanocatalysts market in North America accounted for a significant 30.6% of the global market in 2024, fueled by strong technological innovation, a mature industrial base, and stringent environmental regulations. The region has witnessed early adoption of nanocatalysts in petroleum refining, pharmaceuticals, and fuel cell applications. Substantial investments in hydrogen infrastructure, carbon capture technologies, and clean energy R&D support market expansion. Moreover, the presence of leading nanomaterials companies and close collaboration between academia and industry are fostering the commercialization of next-generation nanocatalytic systems tailored for high-performance and sustainable applications.

The U.S. nanocatalysts market remained the key contributor to the North American market, supported by its advanced R&D infrastructure, high-value chemical manufacturing, and strong regulatory push for emissions reduction. Federal initiatives promoting clean energy, such as the Inflation Reduction Act and hydrogen development programs, are catalyzing demand for nanocatalyst-based technologies in energy and environmental applications. The country also leads in pharmaceutical innovation and semiconductor manufacturing, further driving nanocatalyst adoption in precision synthesis and fabrication processes.

Europe Nanocatalysts Market Trends

The nanocatalysts market in Europe held a 25.5% market share in 2024, driven by its strong environmental agenda, advanced manufacturing landscape, and regulatory support for sustainable chemical processes. EU policies such as the Green Deal and REACH regulation push industries to transition to cleaner, more efficient catalytic technologies. The region has been a frontrunner in deploying nanocatalysts for emissions control, green hydrogen production, and renewable energy systems. Furthermore, well-established automotive and pharmaceutical sectors in countries like Germany, France, and the Netherlands contribute to consistent market demand.

Germany nanocatalysts market stood out as a leading European market due to its strong industrial base, world-class engineering capabilities, and aggressive sustainability targets. The country is investing heavily in green hydrogen, e-mobility, and circular economy initiatives, all relying on advanced nanocatalytic processes. With a focus on industrial decarbonization and process efficiency, German manufacturers increasingly integrate nanocatalysts into chemical synthesis, fuel processing, and environmental technologies. Support from national research programs and collaboration with EU-funded projects further reinforce Germany’s nanocatalyst innovation and deployment leadership.

Central & South America Nanocatalysts Market Trends

The nanocatalysts market in Central & South America is growing and is driven by rising investments in refining, mining, and environmental remediation. Countries such as Brazil, Argentina, and Chile are witnessing increased adoption of catalytic technologies to improve industrial efficiency and comply with emerging environmental standards. Although the market is relatively smaller compared to developed regions, improving regulatory frameworks, foreign direct investment, and public-private R&D partnerships are expected to enhance nanocatalyst penetration in the years ahead, particularly in the energy and chemical sectors.

Middle East & Africa Nanocatalysts Market Trends

The nanocatalysts market in the Middle East & Africa region presents growing opportunities, particularly in petrochemical refining, water treatment, and renewable energy sectors. Gulf nations like Saudi Arabia and the UAE invest in nanotechnology and advanced materials as part of their economic diversification strategies, creating demand for high-performance catalytic systems. In Africa, rising urbanization and industrialization are gradually increasing the need for efficient water purification and emissions control technologies. While the region faces technological access and infrastructure challenges, international collaborations and government-led sustainability initiatives are expected to drive gradual market development.

Key Nanocatalysts Company Insights

Key players, such as BASF SE, Dow, Bayer AG, and Evonik, are dominating the market.

- BASF SE is a leading player in the global market, leveraging its extensive expertise in advanced materials, chemical innovation, and sustainable solutions. The company offers a broad portfolio of nanocatalysts tailored for diverse applications, including petroleum refining, emissions control, chemical synthesis, and clean energy systems. BASF’s strategic focus on R&D and collaboration with academic institutions and industrial partners enables the development of high-performance nanocatalytic technologies that align with global sustainability and efficiency goals. With a strong global manufacturing footprint and commitment to digitalization and green chemistry, BASF continues strengthening its market leadership by delivering innovative, scalable, and environmentally responsible nanocatalyst solutions across key end-use industries.

Key Nanocatalysts Companies:

The following are the leading companies in the nanocatalysts market. These companies collectively hold the largest market share and dictate industry trends.

- BASF SE

- Dow, Inc.

- Bayer AG

- Evonik Industries AG

- NanoScale Corporation

- Nanophase Technologies Corporation

- Catalytic Solution, Inc.

- Hyperion Catalysis International

- Headwaters NanoKinetix, Inc.

- Nanostellar, Inc.

Nanocatalysts Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2,826.8 million

Revenue forecast in 2033

USD 5,926.3 million

Growth rate

CAGR of 9.7% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Volume in kilotons, revenue in USD million, and CAGR from 2025 to 2033

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, application, region

Regional scope

North America; Europe; Asia Pacific; Middle East & Africa; Central & South America

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Saudi Arabia; South Africa; Brazil; Argentina

Key companies profiled

BASF SE; Dow, Inc.; Bayer AG; Evonik Industries AG; NanoScale Corporation; Nanophase Technologies Corporation; Catalytic Solution, Inc.; Hyperion Catalysis International; Headwaters NanoKinetix, Inc.; Nanostellar, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Nanocatalysts Market Report Segmentation

This report forecasts volume & revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global nanocatalysts market report based on material, application, and region:

-

Material Outlook (Volume, Kilotons, Revenue, USD Million, 2021 - 2033)

-

Metal-based Nanocatalysts

-

Metal Oxide Nanocatalysts

-

Carbon-based Nanocatalysts

-

Polymeric Nanocatalysts

-

Composite Nanocatalysts

-

-

Application Outlook (Volume, Kilotons, Revenue, USD Million, 2021 - 2033)

-

Petroleum Refining

-

Chemicals

-

Environmental

-

Energy & Fuel Cells

-

Automotive

-

Electronics & Semiconductor

-

Food & Beverage

-

Pharmaceuticals & Biotechnology

-

-

Regional Outlook (Volume, Kilotons, Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Frequently Asked Questions About This Report

b. The global nanocatalysts market size was estimated at USD 2,618.9 million in 2024 and is expected to reach USD 2,826.8 million in 2025.

b. The global nanocatalysts market is expected to grow at a compound annual growth rate of 9.7% from 2025 to 2033 to reach USD 5,926.3 million by 2033.

b. The metal-based nanocatalysts segment held the largest revenue share of 37.2% in 2024 due to their superior catalytic efficiency, high surface reactivity, and widespread use in critical applications such as petroleum refining, fuel cells, and emission control. Their proven performance, stability, and versatility across industrial processes continue to drive strong demand globally.

b. Some of the key players operating in the nanocatalysts market include BASF SE, Dow, Inc., Bayer AG, Evonik Industries AG, NanoScale Corporation, Nanophase Technologies Corporation, Catalytic Solution, Inc., Hyperion Catalysis International, Headwaters NanoKinetix, Inc., Nanostellar, Inc.

b. The global nanocatalysts market is driven by the growing demand for cleaner, high-efficiency catalytic solutions across industries such as energy, chemicals, and environmental management. Advancements in nanotechnology, coupled with increasing investments in sustainable and green chemistry applications, are further accelerating market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.