- Home

- »

- Advanced Interior Materials

- »

-

Nanoimprint Lithography Systems Market Size Report, 2030GVR Report cover

![Nanoimprint Lithography Systems Market Size, Share & Trends Report]()

Nanoimprint Lithography Systems Market Size, Share & Trends Analysis Report By Type (Hot Embossing, UV-based Nanoimprint Lithography (UV-NIL)), By Application (Semiconductors, Optical Device), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-466-6

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

Market Size & Trends

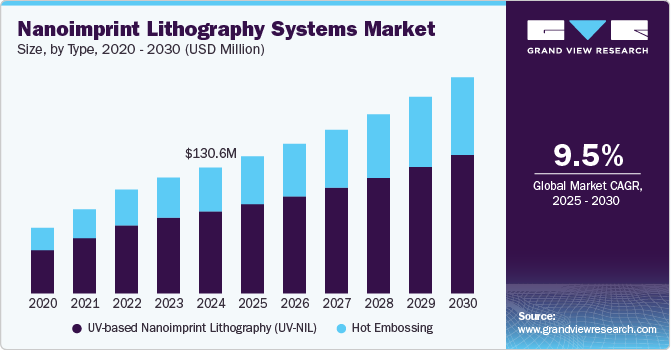

The global nanoimprint lithography system market size was estimated at USD 130.6 million in 2024 and is expected to reach USD 224.3 million by 2030, growing at a CAGR of 9.5% over the forecast period from 2025 to 2030. NIL technology is gaining traction due to its high-resolution patterning capability, cost-effectiveness, and compatibility with various applications such as semiconductors, biotechnology, and optical system. The rising demand for miniaturized and highly precise devices in sectors such as electronics and healthcare is driving the adoption of NIL system. Advancements in NIL, especially UV-based nanoimprint lithography (UV-NIL), are enabling the development of more complex and smaller patterns, further fueling market growth. Industries requiring high precision and efficiency in nanofabrication, particularly in semiconductors and biotechnology, are investing heavily in NIL technology.

Increasing demand for nano-scale fabrication in various industries, including optical devices and biotechnology, is driving the adoption of NIL technology, particularly UV-based NIL. The capability to produce high-resolution patterns at a lower cost compared to traditional lithography methods makes NIL a preferred choice for many industries aiming to scale up production without compromising precision.

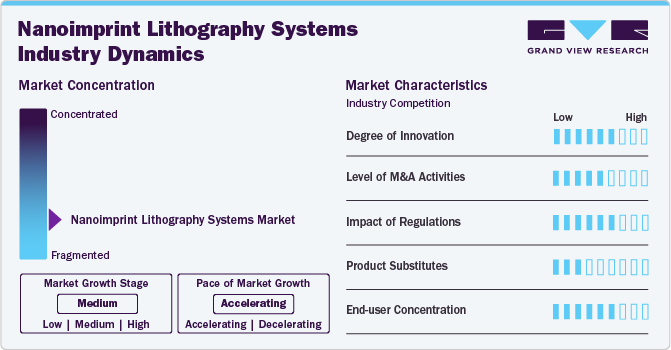

Market Concentration & Characteristics

The global nanoimprint lithography systems market is highly fragmented, characterized by a diverse range of players catering to various sectors, including semiconductors, electronics, and nanotechnology. As industries increasingly demand miniaturization and higher precision in their products, the adoption of NIL technology is expanding across multiple applications. The semiconductor industry, in particular, remains a significant contributor to the growth of the market, driven by the need for more efficient, high-resolution patterning in chip manufacturing. Manufacturers are responding by developing innovative NIL systems with advanced capabilities, such as higher throughput, enhanced precision, and compatibility with new materials.

In addition, the focus on product differentiation and technological advancements has become more pronounced within the NIL market. Companies are investing in the development of next-generation NIL systems that offer improvements in resolution, scalability, and cost efficiency. As the market remains fragmented, a competitive landscape has emerged, with various players striving to meet the growing demand for specialized solutions in applications such as photonics, sensors, and nanodevices. This dynamic fosters continuous innovation, pushing the boundaries of NIL technology to address specific industry needs and create new growth opportunities across various sectors.

Moreover, regulatory bodies across key regions, such as the U.S. FDA, European Union’s CE marking, and international ISO standards, impose guidelines on the manufacturing, usage, and disposal of NIL systems and their components, particularly in industries such as semiconductors, medical devices, and electronics. Compliance with these regulations is crucial for market players to ensure their products meet safety and performance expectations. In addition, there is increasing scrutiny on environmental impact, prompting manufacturers to develop eco-friendly materials and sustainable processes. As NIL technology is adopted in more high-precision and sensitive applications, navigating evolving regulations will be key to maintaining market access and fostering long-term growth.

Drivers, Opportunities & Restraints

Key drivers of the nanoimprint lithography system industry include the rising demand for miniaturized semiconductor devices and advancements in nanoscale manufacturing technologies. Nanoimprint lithography system offers cost-effective solutions for high-resolution patterning, making it ideal for semiconductors, optical system, and biotechnology applications.

Opportunities in the industry arise from the growing use of nanoimprint lithography system in biotechnology for applications such as biomolecule patterning and drug delivery systems. The integration of NIL technology into emerging industries like photonic crystals and flexible electronics also provides significant growth prospects.

However, high initial investment costs and the complexity of integrating NIL into existing production workflows pose challenges, especially for smaller manufacturers. In addition, competition from alternative lithography methods, such as electron beam lithography, may limit NIL adoption in certain applications.

Type Insights

Hot embossing Nanoimprint Lithography (NIL) system is a critical tool in the nano-manufacturing industry, renowned for its ability to imprint high-resolution patterns onto various substrates through thermal processes. Hot embossing NIL system is widely valued for its ability to produce high-fidelity features with exceptional repeatability and resolution, making it ideal for applications in semiconductor fabrication, optical devices, and micro-electromechanical systems (MEMS).

The UV-based nanoimprint lithography (UV-NIL) segment dominated the market in 2024 accounting for a 65.3% market share. The growth of the segment is driven by its ability to offer high throughput and compatibility with a wide range of materials. Its application in the production of high-resolution semiconductor devices and optical components has positioned UV-NIL as the preferred technology for industries that require precision at the nanoscale level.

Application Insights

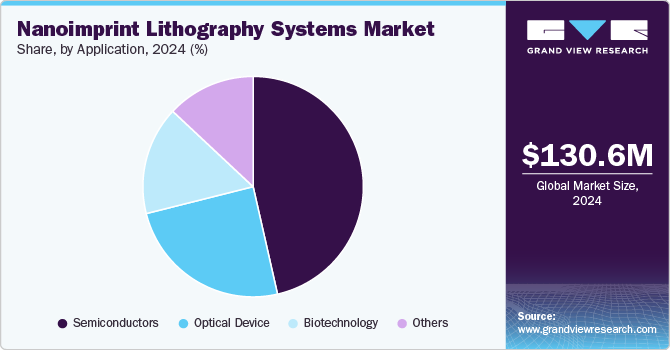

The semiconductor industry dominated the market, accounting for 46.4% of the global nanoimprint lithography system market revenue share in 2024. The ongoing push for miniaturization in electronics manufacturing is driving NIL's adoption as a cost-effective alternative to photolithography, particularly for applications involving microchips and MEMS devices.

Regional Insights

The Asia Pacific nanoimprint lithography (NIL) equipment market poised to witness significant growth in the global driven by rapid industrialization, increasing demand for advanced manufacturing technologies, and strong investments in semiconductor fabrication. Countries such as Japan, South Korea, and Taiwan are leading in the adoption of NIL technology due to their well-established semiconductor and electronics industries.

China nanoimprint lithography systems market is expected to expand at a CAGR of 11.3% over the forecast period. China is emerging as a key player in the global nanoimprint lithography equipment market, driven by its expanding semiconductor industry and significant investments in nanotechnology research. The Chinese government’s focus on self-reliance in advanced manufacturing, particularly in semiconductors and biotechnology, is fostering the rapid adoption of NIL technology. In addition, the growth of the optical equipment and electronics sectors in China is further boosting demand for NIL systems.

The nanoimprint lithography systems industry in Taiwan accounted for 34.9% of the regional market share in 2024. The market is experiencing significant growth, driven by the country's strong position in semiconductor manufacturing and advanced technology development. Taiwan's semiconductor industry, home to key players like TSMC, is increasingly adopting NIL technology for its potential to create smaller, more precise patterns on semiconductor wafers, which is critical for producing next-generation microchips. The demand for NIL systems is further fueled by the rise of applications in fields such as nanotechnology, electronics, and photonics. Taiwan's robust R&D infrastructure, along with government support for technological innovation, is positioning the country as a growing hub for NIL systems, attracting investments and fostering advancements in this field.

North America Nanoimprint Lithography Systems Market Trends

North America remains one of the largest markets for nanoimprint lithography equipment, with the U.S. leading in the development and commercialization of NIL technology. The strong presence of semiconductor manufacturers, coupled with increasing adoption in biotechnology, pharmaceuticals, and optical devices, is propelling market growth in the region.

The U.S. is a dominant force in the global nanoimprint lithography equipment market accounting for 84.7% of the regional market share in 2024, supported by a robust semiconductor industry and a strong focus on research and development in nanotechnology. Major applications of NIL in the U.S. include semiconductors, biotechnology, and optical devices, where the demand for high-precision, cost-effective nanofabrication solutions is high. The U.S. also leads in the integration of NIL for advanced biomedical applications, including biosensors and medical devices.

Europe Nanoimprint Lithography Systems Market Trends

Europe has been a strong market for nanoimprint lithography equipment, particularly in sectors like optics, biotechnology, and semiconductors. The region’s commitment to innovation in nanotechnology, along with strong research and development infrastructure, has supported the growth of NIL applications in advanced manufacturing. Countries such as Germany, France, and the UK are at the forefront of NIL adoption, driven by their focus on high-precision equipment for biotechnology and photonics.

The nanoimprint lithography systems industry in Germany is expected to expand at a CAGR of 9.8% over the forecast period. The market in the country is growing steadily, supported by the country’s strong manufacturing and automotive sectors, which are increasingly incorporating advanced semiconductor technologies. Germany's leadership in precision engineering, coupled with its focus on innovation in nanotechnology and microelectronics, is driving demand for NIL systems. The market benefits from the country’s robust research and development ecosystem, including collaboration between industry leaders and research institutions, positioning Germany as a key player in the development and application of NIL for high-tech industries such as automotive, healthcare, and electronics.

The Nanoimprint Lithography (NIL) systems market in the UK accounted for 18.5% of the regional market share in 2024., fueled by the country’s focus on advancing photonics, nanotechnology, and semiconductor industries. The UK’s leading universities and research institutions, along with government initiatives supporting technological innovation, are key drivers of this growth. NIL technology is gaining traction in applications such as optical data storage, sensor development, and microelectronics, with increasing demand for high-precision manufacturing processes. The UK is positioning itself as a significant player in the global NIL market through collaborations between academia and industry, further boosting its technological capabilities.

Middle East & Africa Nanoimprint Lithography Systems Market Trends

The Nanoimprint Lithography (NIL) systems market in the Middle East and Africa is witnessing growth driven by increasing investments in technological infrastructure and innovation. The region’s expanding focus on diversifying its economies away from oil dependency is pushing governments to invest in high-tech industries such as semiconductors, electronics, and nanotechnology. Countries such as the UAE and Saudi Arabia are focusing on building smart cities, advanced manufacturing, and research centers, which drive the adoption of NIL systems for precision and miniaturization of components. In addition, growing demand for telecommunications and healthcare innovations is further fueling the need for advanced lithography technologies in the region.

Latin America Nanoimprint Lithography Systems Market Trends

In Latin America, the growth of the Nanoimprint Lithography (NIL) systems market is primarily driven by the increasing demand for high-performance electronics, semiconductors, and communication devices. The region’s focus on technological development, supported by initiatives from countries such as Brazil and Mexico, is leading to greater investments in the semiconductor and nanotechnology sectors. NIL systems are becoming essential for the production of advanced components needed for consumer electronics, automotive applications, and renewable energy technologies. The rise of tech startups and growing interest in smart manufacturing solutions are also contributing to the expansion of NIL technology in Latin America.

Key Nanoimprint Lithography Systems Company Insights

Some of the key players operating in the market include EV Group (EVG), Canon Inc., Nanonex, Corp., SUSS MicroTec SE, NIL TECHNOLOGY, and Obducat AB

-

EV Group (EVG) is a one of the leading supplier of equipment for nanoimprint lithography (NIL), wafer bonding, and metrology solutions. Founded in Austria, EVG serves a wide range of industries, including semiconductors, MEMS, and photonics. The company is known for its pioneering NIL technology, which is utilized in applications ranging from advanced optics to biotechnology.

-

Canon Inc., established a strong presence in the nanoimprint lithography equipment market. Leveraging its expertise in precision optics and advanced manufacturing, Canon offers cutting-edge NIL solutions for semiconductor fabrication and other high-tech applications. The company’s NIL equipment is designed to meet the growing demands for miniaturization and high-resolution patterning in electronics and biotechnology sectors.

-

Nanonex, Corp. is a U.S.-based company known for its pioneering work in nanoimprint lithography. The company specializes in high-throughput, cost-effective NIL equipment designed for applications in semiconductors, optics, and biotechnology. Nanonex is credited with introducing the world’s first NIL tool and continues to innovate in the field, offering solutions that enable the production of nanoscale patterns with high precision and repeatability.

-

NIL TECHNOLOGY, a Denmark-based company, specializes in nanoimprint lithography and nanostructuring solutions for applications in optics, photonics, and biotechnology. The company focuses on providing high-quality NIL equipment and services that enable the mass production of nanoscale patterns for advanced technology products.

Key Nanoimprint Lithography Systems Companies:

The following are the leading companies in the nanoimprint lithography systems market. These companies collectively hold the largest market share and dictate industry trends.

- EV Group (EVG)

- Canon Inc.

- Nanonex, Corp.

- SUSS MicroTec SE

- NIL TECHNOLOGY

- Obducat AB

- AMO GmbH

- Stensborg A/S

- Germanlitho

- Morphotonics

View a comprehensive list of companies in the Nanoimprint Lithography Systems Market

Recent Developments

-

In October 2023, Canon launched the FPA-1200NZ2C, a nanoimprint semiconductor manufacturing tool designed for circuit pattern transfer, a key process in semiconductor production. With this NIL-based equipment, alongside its photolithography systems, Canon expands its semiconductor manufacturing lineup to cater to both advanced and existing device needs.

-

In November 2023, EV Group (EVG) completed the expansion of its corporate headquarters with the opening of its "Manufacturing V" facility. This new facility significantly increases production and warehouse space, supporting the manufacturing of EVG equipment components for the MEMS, nanotechnology, and semiconductor markets.

Nanoimprint Lithography Systems Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 142.2 million

Revenue forecast in 2030

USD 224.3 million

Growth rate

CAGR of 9.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea; Taiwan; Brazil;

Argentina; South Africa; Saudi Arabia; UAE; Israel

Key companies profiled

EV Group (EVG); Canon Inc.; Nanonex, Corp.; SUSS MicroTec SE; NIL TECHNOLOGY; Obducat AB; AMO GmbH; Stensborg A/S; Germanlitho; Morphotonics

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Nanoimprint Lithography Systems Market Segmentation

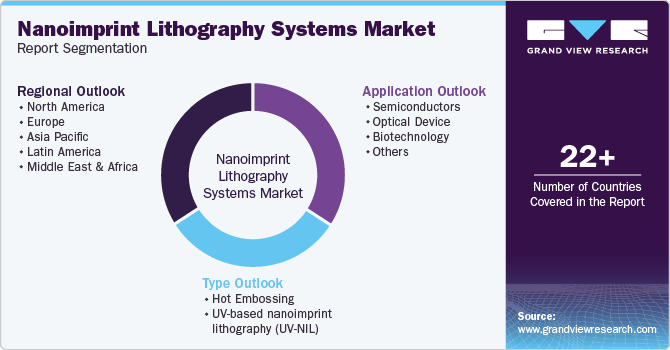

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global nanoimprint lithography system on the type, application, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Hot Embossing

-

UV-based nanoimprint lithography (UV-NIL)

-

-

Application (Revenue, USD Million, 2018 - 2030)

-

Semiconductors

-

Optical Device

-

Biotechnology

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Taiwan

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Israel

-

-

Frequently Asked Questions About This Report

b. The global nanoimprint lithography system size was estimated at USD 130.6 million in 2024 and is expected to reach USD 142.2 million in 2025.

b. The global nanoimprint lithography system, in terms of revenue, is expected to grow at a compound annual growth rate of 9.5% from 2025 to 2030 to reach USD 224.3 million by 2030.

b. The semiconductor application segment dominated the market in 2024 accounting for 46.4% of the market share. The use of Nanoimprint Lithography (NIL) systems in the semiconductor industry is growing rapidly due to their ability to produce highly precise and cost-effective patterns at the nanoscale. NIL technology offers significant advantages over traditional photolithography, such as higher resolution, lower cost, and the ability to create complex patterns on various materials

b. Some of the key players operating in the nanoimprint lithography system are EV Group (EVG), Canon Inc., Nanonex, Corp., SUSS MicroTec SE, NIL TECHNOLOGY, Obducat AB, AMO GmbH, Stensborg A/S, Germanlitho, Morphotonics

b. Key factors driving the Nanoimprint Lithography (NIL) system include its ability to achieve high-resolution patterns at a lower cost compared to traditional photolithography, and its growing demand in semiconductor manufacturing for miniaturization and advanced component production. Additionally, NIL's versatility in various applications like nanotechnology and photonics is expanding its market potential.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."