- Home

- »

- Pharmaceuticals

- »

-

Narcolepsy Therapeutics Market Size & Share Report, 2030GVR Report cover

![Narcolepsy Therapeutics Market Size, Share & Trends Report]()

Narcolepsy Therapeutics Market (2024 - 2030) Size, Share & Trends Analysis Report By Treatment (Narcolepsy With Cataplexy, Secondary Narcolepsy), By Product (Sodium Oxybate, Tricyclic Antidepressants), By Region, And Segment Forecasts

- Report ID: 978-1-68038-626-4

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Narcolepsy Therapeutics Market Summary

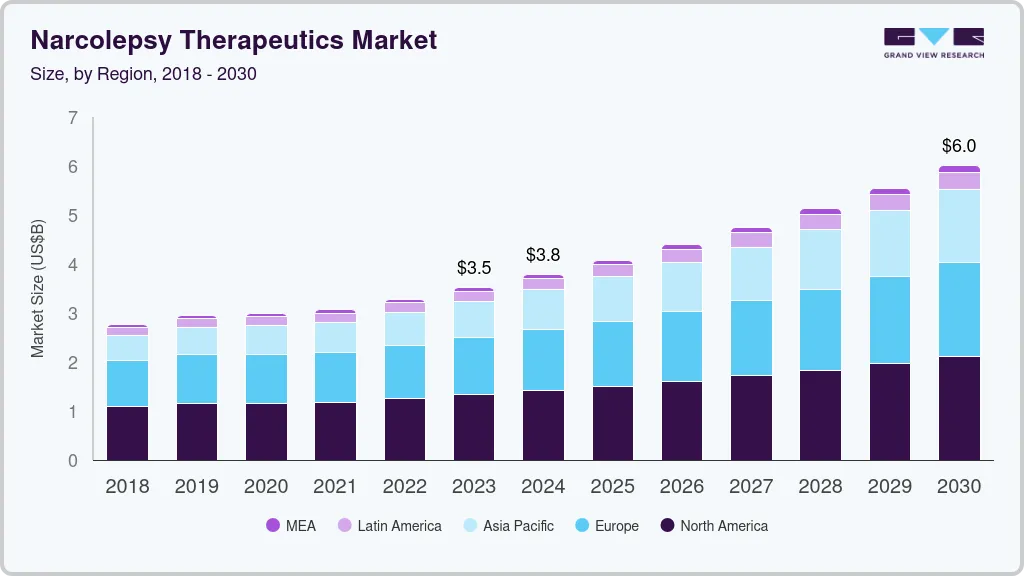

The global narcolepsy therapeutics market size was estimated at USD 3.52 billion in 2023 and is expected to reach USD 6.01 billion by 2030, growing at a CAGR of 7.9% from 2024 to 2030. Narcolepsy is a lifelong sleep disorder with sudden uncontrollable sleep attacks and affects every aspect of a patient’s life causing difficulties in day-to-day routine.

Key Market Trends & Insights

- North America dominated the market in terms of revenue with a share of 38.03% in 2022.

- Asia Pacific is expected to register the fastest CAGR of 10.37% over the forecast period.

- By treatment, the narcolepsy with cataplexy segment led the market with a revenue share of 54.28% in 2022.

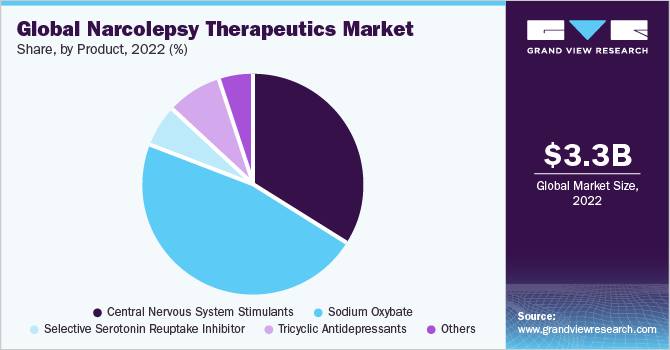

- By product, the sodium oxybate segment dominated the market with a revenue share of 46.70% in 2022.

Market Size & Forecast

- 2023 Market Size: USD 3.52 Billion

- 2030 Projected Market Size: USD 6.01 Billion

- CAGR (2024-2030): 7.9%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

The increasing prevalence of disease, increasing R&D activities & investments, and the introduction of novel therapeutic products are some of the key factors driving market growth. According to the National Institute of Neurological Disorders and Stroke (NINDS) estimates, 135,000 to 200,000 persons have narcolepsy in the U.S. The prevalence of the disease increases with rising stress levels in patients, hence the number of patients with diagnosed narcolepsy is expected to increase in the coming years.

An increase in patient base is among the major factors driving the market growth over the forecast period. According to the National Organization for Rare Disorders, the incidence of the disease is around 1 in 2,000 people. Similarly, according to the study conducted by the American Academy of Neurology, the prevalence of the disease varies from 20 to 67 per 100,000 individuals in European countries. Moreover, as per the NORD article, the chances of being undiagnosed or misdiagnosed with the disease are higher worldwide. Technological advancements in disease diagnosis may increase the patient base; hence it is expected to propel the market growth over the forecast period. According to data published by Narcolepsy UK, at least 25,000 people in the UK are suffering from this condition, and approximately 75% of them remain untreated as they are undiagnosed or misdiagnosed.

An increase in research & development (R&D) activities to introduce novel therapeutic products for the treatment of disease is propelling the market growth. In recent years, R&D activities have gained momentum, which will lead to the introduction of new treatment options in the coming years. For instance, in May 2021, Takeda Pharmaceutical Company Limited announced the initiation of R&D for the development of narcolepsy drug candidates. The company aims to apply for market approval of the drug by March 2025. Moreover, recently approved medications are increasing the prescription of novel drugs due to better treatment options for the disease. For instance, in July 2020, the U.S. FDA approved Xywav for the treatment of narcolepsy in patients aged seven years and older.

Favorable government initiatives are anticipated to fuel the segment growth over the forecast period. For instance, in January 2022, the U.S. FDA granted Orphan Drug Exclusivity for Jazz Pharmaceuticals’ Xywav for the treatment of idiopathic hypersomnia in adults. Moreover, increasing funding by government and non-government organizations is encouraging market players and research institutes to increase R&D activities related to the disease. For instance, till December 2021, WORCESTER donated USD 1 million through Wake Up Narcolepsy, a nonprofit organization, for research related to neurological disorders, including narcolepsy. Such favorable initiatives undertaken by government and non-government bodies are expected to boost market growth over the forecast period.

Increasing awareness programs conducted by various regulatory bodies and non-government organizations are guiding people and healthcare professionals to improve the quality of life of patients with narcolepsy. For instance, organizations such as Wake Up Narcolepsy, the American Academy of Sleep Medicine, the Society for Women’s Health Research, Narcolepsy UK, Narcolepsy Australia, and Narcolepsy Network among others are increasing awareness levels about the disease among people. In 2023, World Narcolepsy Day is scheduled for 22nd September to increase awareness about the disease globally. More than 30 organizations will participate in the program worldwide.

Treatment Insights

Narcolepsy with cataplexy was identified as the largest segment in terms of revenue with a market share of 54.28% in 2022, owing to the increasing prevalence of cataplexy as a major symptom in patients and increasing adoption of novel drugs such as WAKIX, Xyrem, and Xywav for the disease treatment. In October 2020, Harmony Biosciences Holdings, Inc. received U.S. FDA approval for its WAKIX (pitolisant) for treating adult cataplexy associated with narcolepsy. Moreover, cataplexy is the confirming symptom for a conclusive diagnosis, as observed in some cases. Although cataplexy is rarely the first symptom of narcolepsy, approximately 75% of narcoleptic patients suffer from it.

Narcolepsy without cataplexy segment is anticipated to grow at the fastest CAGR of 8.31% from 2023 to 2030. The key factors responsible for the growth of this segment are the high prevalence of the disease and the increase in public awareness via awareness campaigns conducted by various networks, such as the U.S. Narcolepsy Network and Europe Narcolepsy Network. Approximately 80% of the cases belong to type 2 narcolepsy. An increase in the diagnosis of the disease is expected to increase the treatment rate of the disease.

Product Insights

Sodium oxybate dominated the narcolepsy therapeutics market with a revenue share of 46.70% in 2022 and is expected to grow at the fastest CAGR over the forecast period. High prescription rates coupled with the high cost of these drugs, the presence of favorable reimbursement policies, and the rising awareness levels pertaining to diagnosis & associated treatments are anticipated to drive the segment growth. The American Academy of Sleep Medicine (ASSM) has recommended Xyrem (Sodium oxybate) as a standard treatment option for EDS and cataplexy related to narcolepsy. Most insurance companies, including Medicare and Medicaid, offer reimbursement for Xyrem. Manufacturers also offer assistance programs for patients who do not have insurance coverage or are unable to afford the drug.

Central nervous system stimulants held the second-largest share at 33.85% of the market in 2022. The high prescription rate of drugs to improve wakefulness is supporting the segment's growth. Moreover, increasing R&D activities related to CNS stimulants for patients with rare neurological diseases are expected to fuel segment growth. For instance, in December 2021, Harmony Biosciences Holdings, Inc. published data related to the evaluation of CNS drugs for excessive daytime sleepiness and narcolepsy with cataplexy.

Regional Insights

North America dominated the narcolepsy therapeutics market in terms of revenue with a share of 38.03% in 2022. An increase in R&D activities, and result-oriented collaborations of research institutes, academic institutes & corporate sector fuels the segment growth. The availability of many products, increasing R&D activities, and government-favorable initiatives are expected to drive the market. For instance, according to the research published by Stanford Medicine in September 2021, the extended release of sodium oxybate reduced attacks of muscle weakness in patients.

Asia Pacific is expected to register the fastest CAGR of 10.37% over the forecast period owing to economic development, rising awareness among people, high disposable income, growing investments in pharmaceutical & biotechnology sectors, and supportive government initiatives in the region. In addition, the flourishing generics industry and improving healthcare facilities are anticipated to result in further market growth in the coming years.

Key Companies & Market Share Insights

Market players are undertaking strategies such as new product launches, acquisitions, and collaborations to increase their market share. For instance, in May 2023, Avadel Pharmaceuticals received final U.S. FDA approval for its drug Lumryz for the treatment of narcolepsy. Similarly, in May 2022, Axsome Therapeutics, Inc. completed the acquisition of Sunosi from Jazz Pharmaceuticals in the U.S. market. In addition, many players are supporting their consumers via various strategies, such as out-of-pocket co-pays & free products for eligible patients, to increase their market penetration. For instance, Jazz Pharmaceuticals has initiated Patient Assistance Programs for those unable to afford insurance coverage for therapies. Some prominent players in the global narcolepsy therapeutics market include:

-

Teva Pharmaceutical Industries Ltd.

-

Jazz Pharmaceuticals, Inc.

-

Harmony Biosciences

-

Novartis AG

-

Rhodes Pharmaceuticals L.P.

-

Janssen Global Services, LLC

-

Eli Lilly and Company

Narcolepsy Therapeutics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.79 billion

Revenue forecast in 2030

USD 6.01 billion

Growth rate

CAGR of 7.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

August 2023

Quantitative units

Revenue in (USD million/billion) and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Treatment, product, region

Region scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Teva Pharmaceutical Industries Ltd.; Jazz Pharmaceuticals, Inc.; Harmony Biosciences; Novartis AG; Rhodes Pharmaceuticals L.P.; Janssen Global Services, LLC; Eli Lilly and Company

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Narcolepsy Therapeutics Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global narcolepsy therapeutics market report based on treatment, product, and region:

-

Treatment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Narcolepsy With Cataplexy

-

Narcolepsy Without Cataplexy

-

Secondary Narcolepsy

-

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Central Nervous System Stimulants

-

Sodium Oxybate

-

Selective Serotonin Reuptake Inhibitor

-

Tricyclic Antidepressants

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global narcolepsy therapeutics market size was estimated at USD 3.28 billion in 2022 and is expected to reach USD 3.52 billion in 2023.

b. The global narcolepsy therapeutics market is expected to grow at a compound annual growth rate of 7.85% from 2023 to 2030 to reach USD 6.01 billion by 2030.

b. Narcolepsy with cataplexy dominated the narcolepsy therapeutics market with a share of 54.28% in 2022. This is attributable to the increasing prevalence of cataplexy as a major symptom in patients.

b. Some key players operating in the narcolepsy therapeutics market include Teva Pharmaceutical Industries Ltd.; Jazz Pharmaceuticals PLC; Addrenex Pharmaceuticals, Inc.; Graymark Healthcare, Inc.; and BIOPROJET.

b. Key factors that are driving the market growth include the increasing global prevalence of narcolepsy, narcolepsy awareness programs and services, and the presence of reimbursement policies regarding narcolepsy.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.