- Home

- »

- Next Generation Technologies

- »

-

Native Advertising Market Size, Share, Industry Report, 2033GVR Report cover

![Native Advertising Market Size, Share & Trends Report]()

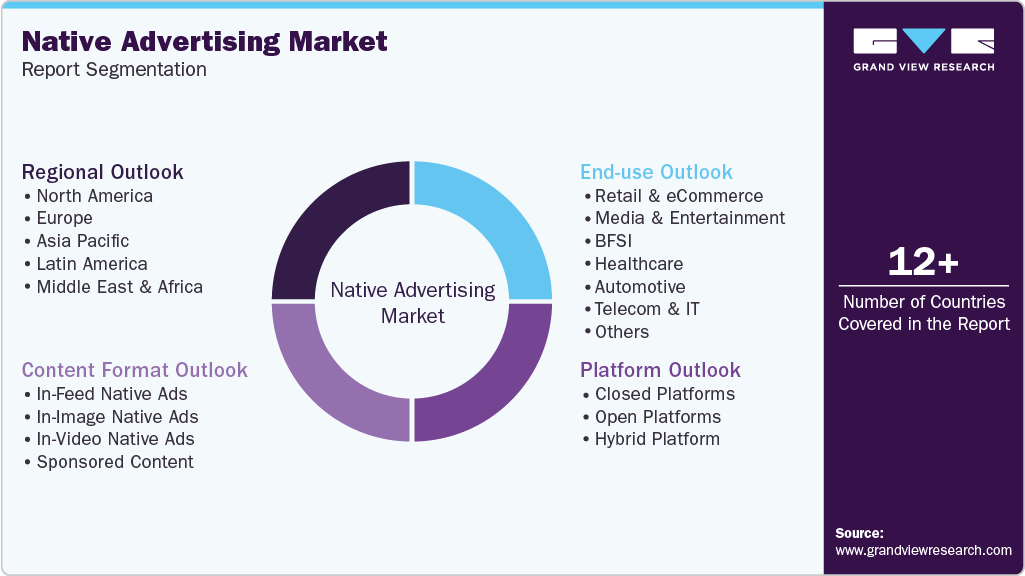

Native Advertising Market (2025 - 2033) Size, Share & Trends Analysis Report, By Content Format (In-Feed Native Ads, In-Image Native Ads, In-Video Native Ads, Sponsored Content), By Platform, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-643-4

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Native Advertising Market Summary

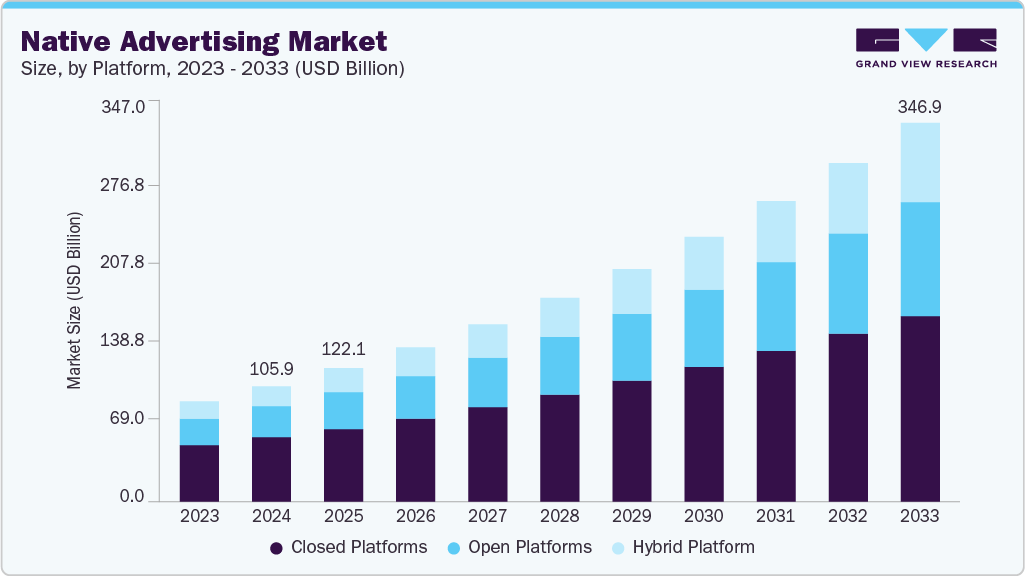

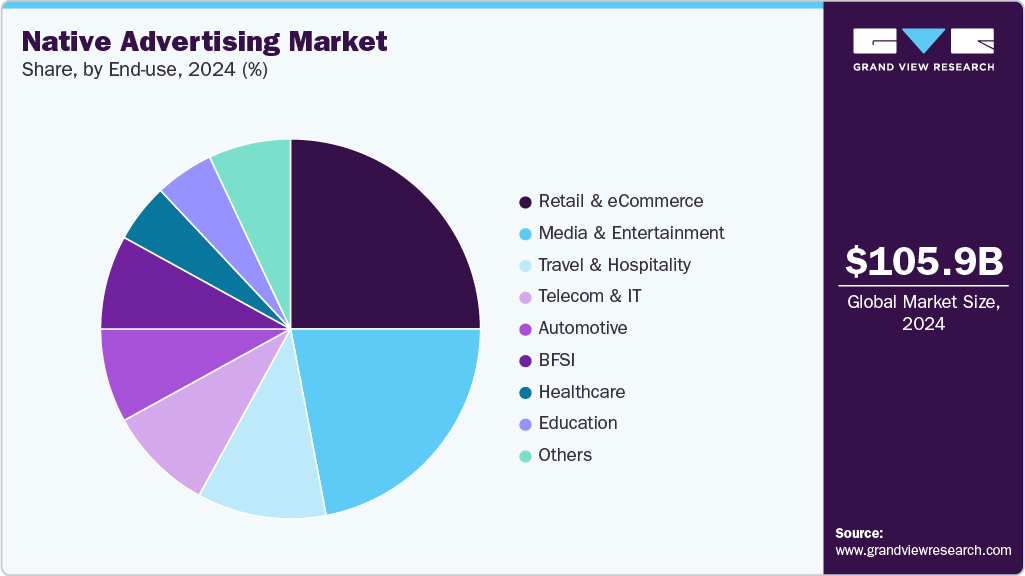

The global native advertising market size was estimated at USD 105.88 billion in 2024 and is projected to reach USD 346.88 billion by 2033, growing at a CAGR of 13.9% from 2025 to 2033. The market growth is primarily driven by the rising need for non-intrusive and privacy-compliant digital marketing, the native advertising market is gaining traction due to increasing ad fatigue from traditional formats and growing demand for contextually relevant brand messaging.

Key Market Trends & Insights

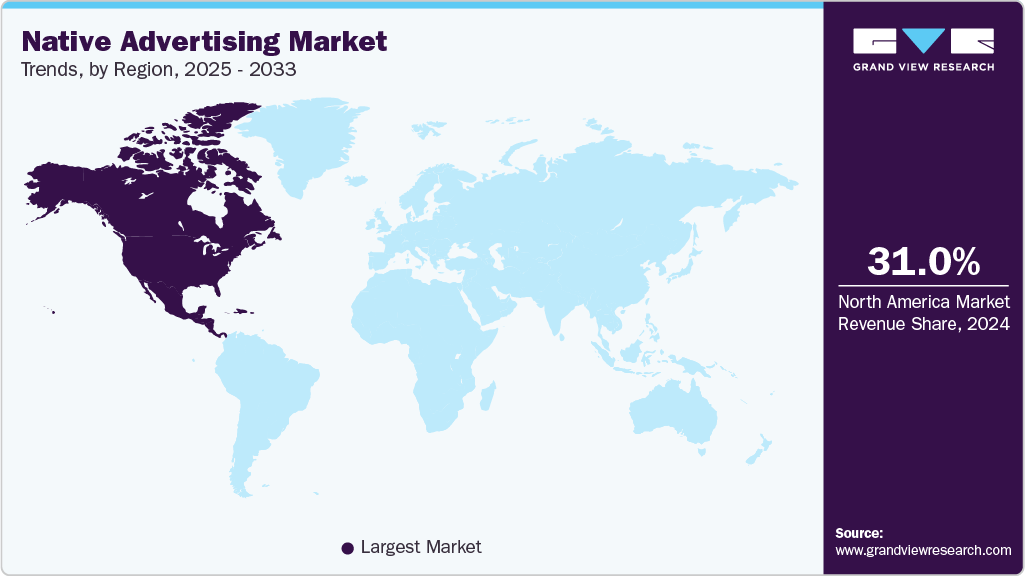

- North America dominated the global native advertising market with the largest revenue share of 31.0% in 2024.

- The native advertising market in the U.S. led the North America market and held the largest revenue share in 2024.

- By content format, the in-feed native ads segment led the market, holding the largest revenue share of 42.7% in 2024.

- By platform, the closed platform segment held the dominant position in the market and accounted for the leading revenue share of 55.6% in 2024.

- By end use, the education segment is expected to grow at the fastest CAGR 17.1% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 105.88 Billion

- 2033 Projected Market Size: USD 346.88 Billion

- CAGR (2025-2033): 13.9%

- North America: Largest market in 2024

The increasing demand for personalized user experiences is transforming the native advertising industry. Consumers are showing clear preferences for content that resonates with their interests, prompting advertisers to shift from generic ads to tailored messaging formats. This personalization is powered by artificial intelligence (AI) and machine learning, allowing platforms to deliver native content that blends seamlessly into the digital environment. As a result, the native advertising industry is evolving into a performance-driven ecosystem that prioritizes relevance, engagement, and ROI.The growing demand for privacy-compliant advertising is reshaping the native advertising industry. With regulations such as GDPR and CCPA enforcing stricter data usage policies, advertisers are turning to native formats that rely on contextual rather than behavioral targeting. These formats offer a non-intrusive approach to engage users while maintaining compliance with evolving legal frameworks. Consequently, the native advertising industry is witnessing increased investment in privacy-focused ad technologies and platforms.

Accelerated by the deprecation of third-party cookies, the native advertising industry is prioritizing first-party data strategies to sustain targeting effectiveness. This shift is compelling publishers and advertisers to harness their own audience insights to deliver more precise and compliant campaign executions. Native formats-by design-enable contextually relevant placements that align with evolving privacy expectations. As a result, native advertising is emerging as a key driver of digital marketing resilience in a post-cookie era.

Fueled by the dominance of mobile usage in consumer behavior, native advertising is rapidly scaling across mobile-first digital ecosystems. Marketers are capitalizing on the seamless integration of native formats within mobile apps and social feeds to enhance visibility and engagement. Interactive formats such as short-form videos, swipeable content, and embedded shopping elements are proving especially effective in driving user action. This momentum is positioning mobile-native advertising as a central pillar in growth-focused digital strategies.

Content Format Insights

The in-feed native ads segment dominated the market with a share of over 42% in 2024. driven by the demand for seamless user experiences, the In-Feed Native Ads segment is becoming a cornerstone of modern digital advertising strategies. Advertisers are increasingly embedding native content directly within news feeds, social timelines, and content streams to match the format and flow of organic content. This non-disruptive approach significantly improves user engagement and brand recall, particularly on mobile platforms where feed-based consumption dominates. As brands seek to blend storytelling with performance, the In-Feed Native Ads segment continues to drive scalable, high-conversion advertising outcomes across industries.

The in-video native ads segment is expected to register the fastest CAGR of over 16% from 2025-2033, owing to the surge in video consumption across digital platforms, the In-Video Native Ads segment is experiencing robust growth and elevated advertiser interest. Brands are leveraging native video formats to deliver promotional content that aligns naturally with editorial or user-generated video streams. This seamless integration enhances viewer engagement while reducing ad fatigue, making it a preferred choice for performance-driven campaigns. As platforms such as YouTube, TikTok, and streaming services expand their native offerings, the In-Video Native Ads segment is becoming a vital component of omnichannel advertising strategies.

Platform Insights

The closed platforms segment dominated the market in 2024, driven by the need for greater control over user experience and data security maintaining a dominant position in the native advertising ecosystem. Platforms such as Facebook, Instagram, and LinkedIn operate within tightly managed environments, offering advertisers curated native ad placements with high targeting precision. These walled gardens provide seamless integration, standardized formats, and access to rich first-party data-benefits that continue to attract brand marketers. As privacy regulations tighten and performance expectations rise, closed platforms remain a reliable channel for measurable, brand-safe native advertising.

The hybrid platform segment is expected to grow at the fastest CAGR in the coming years, owing to the growing need for both scalability and control in digital advertising, the Hybrid Platform segment is witnessing accelerated adoption across the native advertising landscape. These platforms blend the openness of programmatic ecosystems with the control and security of closed environments, offering a balanced approach for advertisers. This hybrid model enables brands to execute data-driven campaigns at scale while maintaining contextual relevance and brand safety. As marketers prioritize flexibility and unified audience engagement, hybrid platforms are emerging as a key enabler of high-performance native advertising strategies.

End Use Insights

The retail & eCommerce segment dominated the market in 2024, primarily driven by the need to enhance digital customer journeys. The segment is increasingly adopting native advertising to boost engagement and conversions. Retailers are leveraging native formats to deliver personalized product placements and contextually relevant promotions across content-rich environments. These ads seamlessly integrate with editorial and social feeds, creating a more authentic and less disruptive shopping experience. As consumer expectations for relevancy and convenience rise, native advertising is becoming a key performance driver in omnichannel retail strategies.

The education segment is expected to grow at a fastest CAGR in the coming years, Owing to the rising demand for digital learning solutions and skill-based education the segment is increasingly turning to native advertising to reach target audiences effectively. Institutions and EdTech platforms are leveraging contextually integrated ads to promote courses, webinars, and certifications within relevant editorial and informational content. This approach enhances visibility while preserving credibility, especially among digitally savvy learners who are resistant to overt promotional messaging. As the online education market becomes more competitive, native advertising is proving instrumental in driving student acquisition and fostering long-term brand engagement.

Regional Insights

North America native advertising market dominated the market with a share of 31.0% in 2024, driven by the shift toward programmatic advertising has seen significant growth in cross-platform campaigns that emphasize personalized content delivery. Marketers are increasingly integrating native formats into omnichannel strategies, using AI and real-time bidding (RTB) to enhance targeting accuracy and ROI. The region is also witnessing consolidation among native ad tech providers, creating full-stack solutions that blend display, video, and native formats seamlessly. Demand is particularly high among media companies seeking to reduce dependence on traditional display and social platforms.

U.S. Native Advertising Market Trends

The U.S. native advertising market dominated the market with a share of over 81% in 2024. Owing to rising privacy regulations such as CCPA and the phasing out of third-party cookies, U.S. advertisers are increasingly turning to native advertising for its contextual relevance and non-intrusive format. Native ads are preferred for their ability to deliver branded messages within editorial environments while maintaining compliance with privacy norms. In addition, U.S.-based publishers are investing heavily in in-house content studios to deliver sponsored articles and branded experiences at scale. This trend is accelerating the shift from performance marketing toward content-driven customer engagement.

Europe Native Advertising Market Trends

The Europe native advertising market is expected to grow at a CAGR of 11.7% from 2025 to 2033, primarily driven by strict GDPR compliance, the European native advertising market is evolving toward contextual and non-personalized ad targeting methods. Brands and publishers are favoring native formats over programmatic display due to their editorial alignment and ability to build trust. There is a strong push across Europe to enhance transparency in content labeling and disclosure practices, boosting user trust in sponsored messages. Additionally, European media outlets are increasingly collaborating with native ad platforms to monetize traffic while adhering to consent-driven data strategies.

The Germany native advertising market is expected to grow at a significant rate in the coming years. The growing demand for ad formats that enhance user trust has made native advertising a preferred approach among German marketers. With a privacy-conscious audience and strong publisher influence, Germany favors native ads that are educational, informative, and integrated naturally within content. German companies are also investing in data clean rooms and contextual targeting to better align native placements with GDPR norms. This has resulted in a surge in high-quality sponsored content, particularly in news, automotive, and B2B publishing environments.

The UK native advertising market is expected to grow at a significant rate in the coming years. The increasing demand for premium publisher collaborations in the UK has fueled growth in branded content and native storytelling. UK advertisers are placing greater emphasis on quality engagement rather than high-volume impressions, which aligns with native formats' core strengths. Influencer-led native campaigns and long-form sponsored articles are gaining traction, especially in lifestyle, finance, and travel sectors. The UK's well-established media ecosystem is enabling seamless integration of native formats within editorial content across both print and digital platforms.

Asia Pacific Native Advertising Market Trends

Asia Pacific native advertising market is expected to grow at the fastest CAGR of 17.4% from 2025 to 2033, driven by mobile-first digital behavior and social commerce growth, native advertising in the Asia Pacific region is expanding rapidly across mobile news apps, short video platforms, and e-commerce ecosystems. Countries such as India, Indonesia, and Thailand are showing robust adoption of native formats due to increasing smartphone penetration and time spent on mobile content. In-app native video and recommendation widgets are performing especially well, as consumers respond positively to integrated brand experiences.

The China native advertising market is owing to the dominance of super-app ecosystems such as WeChat, Baidu, and Toutiao, native advertising in China is deeply integrated into social, search, and entertainment experiences. Native content formats-especially short-form videos, branded livestreams, and AI-driven recommendations-are central to digital marketing strategies in the country. Chinese advertisers are heavily investing in algorithmic optimization and influencer partnerships to increase conversion within native environments. The government's tight regulation of ad content and data collection has also shifted the focus toward native formats that are less intrusive and more content-aligned.

The Japan native advertising market is increasing demand for subtle, culturally-sensitive advertising has made native formats the preferred choice in Japan’s digital market. Japanese consumers place high value on seamless, non-disruptive content, which aligns well with the nature of native advertising. Native ads in Japan are often designed to educate or inform, blending naturally with editorial content in news and lifestyle platforms.

Key Native Advertising Company Insights

Some of the key players operating in the market include Taboola and Outbrain, and among others.

-

Taboola is a global leader in content discovery and native advertising, known for driving high engagement through personalized content recommendations. The company partners with major publishers and advertisers to serve native ads across websites, mobile apps, and digital platforms. Taboola's algorithmic targeting and large-scale reach position it as a preferred choice for performance-based native campaigns. Its specialization lies in delivering sponsored content and product recommendations through in-feed and content carousel formats.

-

Outbrain is a pioneer in the native advertising ecosystem, offering advanced content recommendation technology to brands and publishers worldwide. It enables marketers to engage users via personalized, non-intrusive native ad experiences on premium digital properties. Outbrain focuses heavily on AI-driven targeting and optimization tools to improve ad relevance and user engagement. The company specializes in driving traffic and conversions through native placements embedded within editorial content.

Nativo Inc, and MGID are some of the emerging market participants in the native advertising market.

-

Nativo Inc is gaining traction in the native advertising space with its emphasis on automation, brand storytelling, and seamless user experience. The platform allows publishers and advertisers to scale native campaigns efficiently while maintaining editorial quality. Nativo's technology is built to streamline branded content distribution across open and closed environments. The company specializes in native ad formats that prioritize context, relevance, and high-quality content integration.

-

MGID is an up-and-coming global native advertising platform, known for its competitive pricing and broad publisher network. It offers a wide variety of native formats including in-content, recommendation widgets, and video ads optimized for user engagement. MGID is rapidly expanding in emerging markets, positioning itself as a cost-effective solution for performance marketing. The company specializes in audience targeting, real-time analytics, and monetization for mid-tier publishers.

Key Native Advertising Companies:

The following are the leading companies in the native advertising market. These companies collectively hold the largest market share and dictate industry trends.

- Taboola

- Outbrain

- RevContent

- MGID

- TripleLift

- Nativo Inc

- Media.net

- Sharethrough

- Verizon Media (Yahoo Native)

- Teads

Recent Developments

-

In April 2025, MGID partnered with Integral Ad Science (IAS) to strengthen third-party ad measurement and optimization. The integration provides advertisers with real-time insights into viewability, attention, brand safety, and invalid traffic. This move enhances transparency and reinforces MGID’s focus on delivering trustworthy, high-performing native ad campaigns.

-

In April 2025, Taboola expanded its partnership with Gannett to strengthen its AI-driven Realize offering. This integration gives performance advertisers access to Gannett’s full display inventory, including USA TODAY and over 200 local sites. The move enhances targeting and campaign performance using Taboola’s first-party data and publisher integrations.

-

In October 2024, MGID, a global native advertising platform, partnered with Entertainment Network India Limited (ENIL), popularly known as Mirchi, to accelerate the adoption of native advertising across India. The collaboration brings together MGID’s advanced native ad formats-such as rich media and video-with Mirchi’s MPing digital ad network, which is trusted by over 800 brands. This strategic alliance aims to simplify campaign planning, execution, and optimization while expanding native ad reach across more than 60 Indian cities.

Native Advertising Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 122.09 billion

Revenue forecast in 2033

USD 346.88 billion

Growth rate

CAGR of 13.9% from 2025 to 2033

Base year of estimation

2024

Actual data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Content format, platform, end use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Taboola; Outbrain; RevContent; MGID; TripleLift; Nativo Inc; Media.net; Sharethrough; Verizon Media (Yahoo Native); Teads

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Native Advertising Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global native advertising market report based on content format, platform, end use, and region.

-

Content Format Outlook (Revenue, USD Million, 2021 - 2033)

-

In-Feed Native Ads

-

In-Image Native Ads

-

In-Video Native Ads

-

Sponsored Content

-

-

Platform Outlook (Revenue, USD Million, 2021 - 2033)

-

Closed Platforms

-

Open Platforms

-

Hybrid Platform

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Retail & eCommerce

-

Media & Entertainment

-

BFSI

-

Healthcare

-

Automotive

-

Telecom & IT

-

Travel & Hospitality

-

Education

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global native advertising market size was estimated at USD 105.88 billion in 2024 and is expected to reach USD 122.09 billion in 2025.

b. The global native advertising market is expected to grow at a compound annual growth rate of 13.9% from 2025 to 2033 to reach USD 346.88 billion by 2033.

b. North America dominated the native advertising market with a share of 31.0% in 2024, driven by the growing integration of programmatic advertising, increasing consumer preference for non-disruptive ad formats, and rising investments by brands in content-driven marketing strategies.

b. Some key players operating in the native advertising market include Taboola, Outbrain, RevContent, MGID, TripleLift, Nativo Inc, Media.net, Sharethrough, Verizon Media (Yahoo Native), and Teads.

b. Key factors that are driving the market growth include the integration of AI and IoT is enhancing automation capabilities, cloud-based solutions are enabling scalable deployment, and strategic collaborations are expanding global reach.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.