- Home

- »

- Beauty & Personal Care

- »

-

Natural Hair Care Product Market Size Report, 2020-2027GVR Report cover

![Natural Hair Care Product Market Size, Share & Trends Report]()

Natural Hair Care Product Market Size, Share & Trends Analysis Report By End Use (Men, Women), By Distribution Channel (Offline, Online), By Region, And Segment Forecasts, 2020 - 2027

- Report ID: GVR-4-68038-955-5

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2016 - 2018

- Forecast Period: 2020 - 2027

- Industry: Consumer Goods

Report Overview

The global natural hair care product market size was valued at USD 8.74 billion in 2019 and is expected to grow at a compound annual growth rate (CAGR) of 4.7% from 2020 to 2027. Rising awareness related to the benefits of natural hair care products is one of the key factors fueling market growth. Most of the natural hair care products contain antioxidants that contain Vitamin E, which provides nourishment to the scalp and promotes hair growth. Detrimental effects of using chemical-based shampoos and conditioners, such as bad hair quality and rough scalp, have goaded consumers to opt for natural products. Consumers have become ingredient savvy and they avoid picking products with sulfates, parabens, mineral oil, and alcohol, thus boosting the demand for natural hair care products.

Millennials are one of the prominent consumer segment for natural hair care products. According to the Asia Cosmetics report, in 2017, globally, close to 56% of millennials and Gen X actively bought natural beauty and grooming products owing to growing consciousness regarding chemical-free products. Moreover, close to 40% of the change in the buying decision of the consumers has inflected because of natural ingredient listing on the packaging. Shifting consumer perception towards natural ingredient based products in the cosmetic and personal care domain is expected to boost demand for natural hair care products in the market.

Companies operating in the natural hair care manufacturing have been considering rebranding and new product launches and emphasizing on growing concerns, such as hair fall, dull hair, lack of hair volume, and thinning hair, which is fueling the growth of the market. Natural haircare brands, therefore, seek consumers through products offering a solution in the long run. For instance, in 2017, dpHue haircare brand launched apple cider vinegar scalp scrub with pink Himalayan sea salt featuring natural ingredients, such as avocado oil, aloe vera, and apple cider vinegar, which helps in eliminating dead skin cells and rebalancing the scalp’s pH.

The proactive approach of consumers in buying and shifting to complicated hair care regime, including using pre-shampoo mask, after shower hair gel, hair shampoo, and conditioners, is making brands to innovate, develop, and market new natural products to keep pace with such consumer dynamics. For instance, in 2017, Bumble and Bumble, a beauty brand, launched Bb Hairdresser’s invisible oil balm-to-oil pre-shampoo masque containing a combination of six natural oils, such as coconut oil, argan oil, macadamia nut oil, sweet almond oil, safflower seed oil, and grape seed oil, for conscious consumers.

Covid-19 had a severe impact on the beauty and personal care industry. Store closures due to stay home and lockdown measures implemented by the government across the globe have resulted in grim consequences, with sales decreasing considerably from February 2020. The pandemic situation has goaded people to spend more judiciously and avoid frivolous purchasing. Since natural hair care products have been in the burgeoning stage, the pandemic has refrained people from purchasing these products, which usually have premium pricing.

End-use Insights

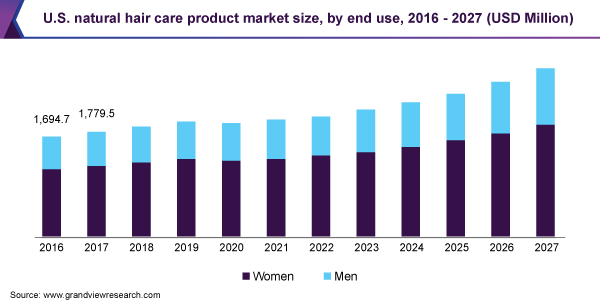

The women segment led the market and accounted for 72.6% share of the global revenue in 2019. This segment is expected to maintain the lead over the forecast period owing to the growing preference for natural hair care products to confront hair related issues, such as dull hair, hair fall, hair coloring, damaged hair, and split ends. Hair is considered to be one of the most precious body parts by women, which makes them buy hair care products with the utmost attention. According to the NPD report 2018, 50% of American women prefer natural products and are conscious about purchases when it comes to scalp and skin application.

The men segment is anticipated to expand at the fastest CAGR of 5.0% from 2020 to 2027. Accepting hair as an important part of the overall grooming, coupled with increasing inclination towards natural hair care products, is expected to drive the segment. Over the years, men have become conscious of personal grooming and are focusing on regular hair care practices alike women. According to a Google report, in 2016, there were about 6% more searches relating to men's hair compared with women's hair. Moreover, social media has been contributing to creating awareness amongst men about self-grooming, health and hygiene, and posting product recommendations.

Distribution Channel Insights

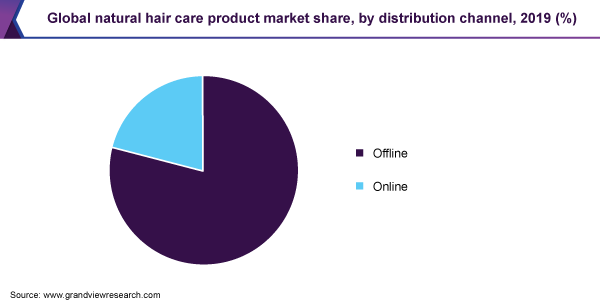

Offline distribution channels dominated the market and accounted for 79.1% share of the global revenue in 2019. Brick and mortar stores including independent brand stores, departmental stores, multi-brand outlets, and hypermarkets are quick to launch popular natural beauty products in the market and offer exclusive deals to their customers, thereby boosting the sale growth. These stores have been focusing on offering natural and chemical-free category set-up to pique customers’ interest and provide them with a facility to choose from numerous brands before making a purchase. For instance, in 2018, the Sephora premium outlet launched a clean beauty category section, which excluded those which are free from parabens, sulfates, and phthalates.

The online distribution channel is expected to witness the fastest growth over the forecast period. The rising popularity of e-commerce channels is likely to lead to considerable growth prospects for the market owing to a wider distribution network and greater product availability. These factors have been influencing both established and new manufacturers to sell their products through online channels. Amazon.com, Inc.; Sephora.com, Webuynatural.com, and naturalproductsonline.co.uk are some of the major online retailers of natural products across the globe.

Regional Insights

Europe dominated the market for natural hair care products and accounted for 38.2% share of the global revenue in 2019. Growing demand for natural products and cosmetic brands that are replacing synthetic chemicals with natural ingredients is a key factor fueling the market growth in the region. Europe, being the largest beauty and cosmetics region, opens doors of opportunities for various natural cosmetic manufactures. According to Cosmetics Europe, a European trade association for the cosmetics and personal care industry, in 2018, the beauty and cosmetics market size was valued at USD 94.0 billion. The high concentration of manufacturers in European countries, such as Germany and France, is expected to drive innovation in natural hair care products.

Asia Pacific is expected to the fastest-growing regional market for natural hair care products over the forecast period. The inclination of consumers towards natural products is expected to shoot up demand for such products, especially in developing countries, such as India and China. Many startups have been tapping into the natural hair care and cosmetic products market in the region. For instance, in 2016, Tvakh, an Indian startup, started offering completely natural hair and skin care products to attract ingredient-conscious consumers.

Key Companies & Market Share Insights

The market has been characterized by the presence of both international and domestic market participants. Key market players focus on strategies, such as innovation and new product launches, to enhance their portfolio in the market. Some of the prominent players in the natural hair care product market include:

-

Procter & Gamble

-

NatureLab Tokyo

-

Estee Lauder

-

Mama Earth

-

St. Botanica

-

Bollati

-

John Master Organics

-

Phyto Botanical Power

-

Amazon Beauty Inc.

-

Organic Harvest

Natural Hair Care Product Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 8.54 billion

Revenue forecast in 2027

USD 12.66 billion

Growth Rate

CAGR of 4.7% from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Revenue in USD million and CAGR from 2020 to 2027

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

End-use, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S.; Germany; U.K.; France; China; India; Brazil

Key companies profiled

Procter & Gamble; NatureLab Tokyo; Estee Lauder; Mama Earth; St. Botanica; Bollati; John Master Organics; Phyto Botanical Power; Amazon Beauty Inc.; Organic Harvest

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global natural hair care product market report on the basis of end-use, distribution channel, and region:

-

End-use Outlook (Revenue, USD Million, 2016 - 2027)

-

Men

-

Women

-

-

Distribution Channel Outlook (Revenue, USD Million, 2016 - 2027)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2027)

-

North America

-

The U.S.

-

-

Europe

-

Germany

-

The U.K.

-

France

-

-

Asia Pacific

-

China

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa (MEA)

-

Frequently Asked Questions About This Report

b. The global natural hair care product market size was estimated at USD 8.74 billion in 2019 and is expected to reach USD 8.54 billion in 2020.

b. The global natural hair care product market is expected to grow at a compound annual growth rate of 4.7% from 2020 to 2027 to reach USD 12.66 billion by 2027.

b. Europe dominated the market with a share of 38.2% in 2019. This is attributable to rising natural product benefits awareness coupled with increased product scrutiny and standardization have been increasing the consumer confidence to try out new products.

b. Some key players operating in the natural hair care product market include Procter & Gamble, NatureLab Tokyo, Estee Lauder, Mama Earth, St. Botanica, Bollati, John Master Organics, Phyto Botanical Power, Amazon Beauty Inc., and Organic Harvest.

b. Key factors that are driving the market growth include awareness related to the benefits of natural hair care products, and Gen X actively buy natural beauty and grooming products owing to the growing consciousness towards chemical-free products across the world.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."