- Home

- »

- Homecare & Decor

- »

-

Natural Household Cleaners Market, Industry Report, 2030GVR Report cover

![Natural Household Cleaners Market Size, Share & Trends Report]()

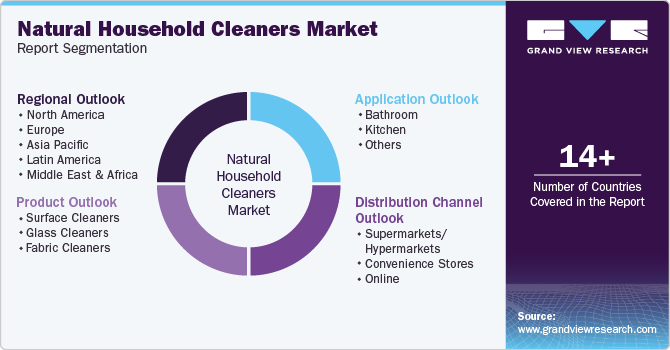

Natural Household Cleaners Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Surface, Glass), By Application, By Distribution Channel (Supermarkets/Hypermarket, Convenience Stores, Online), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-346-1

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Natural Household Cleaners Market Summary

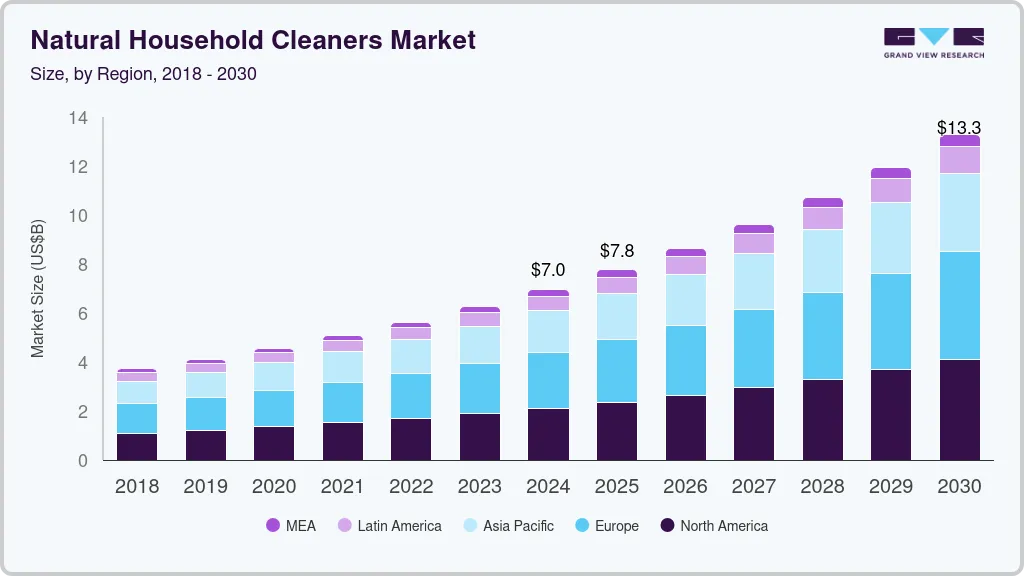

The global natural household cleaners market size was valued at USD 6.97 billion in 2024 and is projected to reach USD 13.28 billion by 2030, growing at a CAGR of 11.3% from 2025 to 2030. Increasing consumer awareness about the harmful effects of conventional chemical-based cleaning products on health and the environment is a significant driver.

Key Market Trends & Insights

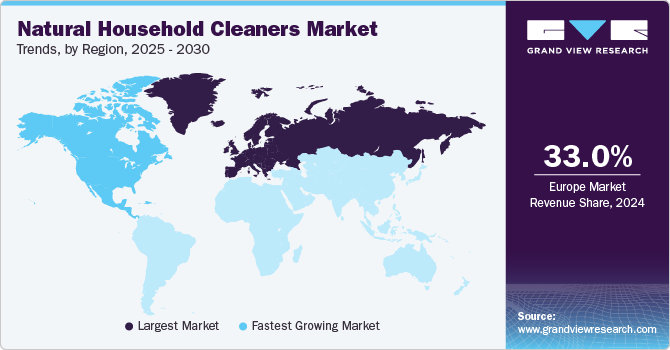

- Europe natural household cleaners industry dominated the global market with the largest revenue share of 33.0% in 2024.

- The U.S. natural household cleaners industry is expected to grow significantly over the forecast period.

- Based on product, surface cleaners segment dominated the market, with the largest revenue share of 55.3% in 2024.

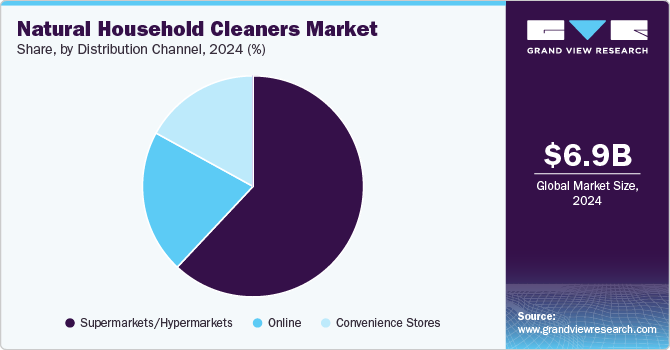

- Based on distribution channel, supermarkets/hypermarkets segment dominated the market with the largest revenue share in 2024.

- Based on application, the bathrooms segment dominated the market with the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 6.97 Billion

- 2030 Projected Market Size: USD 13.28 Billion

- CAGR (2025-2030): 11.3%

- Europe: Largest market in 2024

- North America: Fastest growing market

Consumers are increasingly seeking natural and eco-friendly alternatives that are safe for their families and reduce environmental impact. The growing trend towards sustainable living and using organic products has further fueled the demand for natural household cleaners. Additionally, stringent regulations and bans on harmful chemicals in cleaning products by various governments and regulatory bodies have prompted manufacturers to develop and market eco-friendly alternatives. The rise in disposable incomes and the willingness of consumers to spend more on premium, natural products also contribute to market growth. Furthermore, innovative marketing strategies and the availability of a wide range of natural household cleaners through various distribution channels, including e-commerce, have increased product visibility and accessibility.

Over the past few years, extensive usage of conventional household cleaning products including floor, fabric, and glass cleaners, has resulted in increasing the occurrences of various chronic diseases. Harmful chemicals present in the cleaners got absorbed into the skin and sometimes inhaled, which may cause chronic diseases including asthma and skin irritation. According to a report published by the American Thoracic Society's American Journal of Respiratory and Critical Care Medicine, in 2018, the chemicals present in the cleaning products are very hazardous to human health. It may impact human lungs as badly as smoking 20 cigarettes on a daily basis. These side effects have forced consumers to prefer natural cleaning products.

Increasing concerns over germs, viruses, and bacteria in the living spaces, coupled with rising awareness regarding health and hygiene, led to a rise in demand for natural products with antimicrobial and disinfectant properties. In addition, governments across the globe are taking initiatives to remove or reduce the content of harmful chemicals from household cleaning products.

Product Insights

Surface cleaners dominated the market, with the largest revenue share of 55.3% in 2024. Surface cleaners are essential for maintaining cleanliness and hygiene in homes, particularly in high-touch areas such as kitchen countertops, bathrooms, and living spaces. The growing awareness of the importance of using natural and eco-friendly cleaning products has driven consumers to opt for surface cleaners that are free from harsh chemicals and toxins. Additionally, the increasing incidence of allergies and respiratory issues associated with chemical-based cleaners has heightened the demand for safer alternatives. The broad applicability of surface cleaners and their effectiveness in removing dirt, grime, and bacteria make them a preferred choice for households. Furthermore, expanding product offerings, including various scents and formulations catering to specific cleaning needs, has boosted their popularity.

The fabric cleaners segment is expected to grow at the fastest CAGR of 11.8% over the forecast period. Increasing consumer awareness about the harmful effects of conventional laundry detergents, which often contain harsh chemicals, has led to a growing preference for natural and eco-friendly fabric cleaners. These products are gentle on fabrics and skin, reducing the risk of allergies and skin irritations. The rising trend towards sustainable living and using organic products has also fueled demand for natural fabric cleaners. The availability of various formulations, including liquid, powder, and pod forms, caters to diverse consumer preferences. Innovations in product development, such as incorporating plant-based ingredients and biodegradable packaging, have also contributed to the segment's growth. Furthermore, the expansion of e-commerce platforms has made it easier for consumers to access a wide range of natural fabric cleaners, boosting market penetration.

Application Insights

Bathrooms dominated the market with the largest revenue share in 2024 owing to the heightened emphasis on maintaining hygiene and cleanliness in bathrooms, which are often considered high-risk areas for germ accumulation. Natural bathroom cleaners are favored for their effectiveness in removing tough stains, soap scum, and bacteria without the use of harsh chemicals, making them safer for both users and the environment. Additionally, the increasing awareness of the harmful effects of traditional chemical-based cleaners has driven consumers to opt for eco-friendly alternatives. The broad range of natural bathroom cleaners, including those specifically formulated for tiles, toilets, and glass surfaces, ensures comprehensive cleaning solutions. Furthermore, the availability of pleasant scents and essential oil-infused products adds to their appeal, making bathroom cleaning a more pleasant task.

Kitchen is expected to grow at the fastest CAGR over the forecast period. The kitchen requires regular and thorough cleaning to maintain hygiene and prevent contamination. The increasing consumer awareness about the harmful effects of chemical-based cleaning products on food safety and health has led to a growing preference for natural and eco-friendly kitchen cleaners. These products effectively remove grease, grime, and food residues without leaving harmful residues that could affect food quality. Additionally, the rise in health-conscious consumers and the trend toward organic and natural living have further fueled the demand for natural kitchen cleaners. Innovations in product formulations, including the use of plant-based ingredients and essential oils, have enhanced the effectiveness and appeal of these cleaners. Furthermore, the convenience of purchasing natural kitchen cleaners online and through various retail channels has boosted their accessibility.

Distribution Channel Insights

Supermarkets/hypermarkets dominated the market with the largest revenue share in 2024. These retail channels offer a convenient one-stop shopping experience, attracting a large number of consumers looking for a variety of household products in one place. The wide range of natural household cleaners available in supermarkets and hypermarkets, including surface cleaners, fabric cleaners, and bathroom and kitchen cleaners, ensures that consumers can find products that meet their specific cleaning needs. The strong distribution networks and frequent promotions, discounts, and loyalty programs offered by these retail outlets make them an attractive shopping destination. The ease of access and the ability to compare different brands and products in person further enhance the consumer experience.

The online channel is expected to grow at the fastest CAGR over the forecast period. The convenience and accessibility of online shopping have become increasingly appealing to consumers, allowing them to purchase natural household cleaners from the comfort of their homes. E-commerce platforms offer a vast selection of products, enabling consumers to easily compare brands, read reviews, and make informed purchasing decisions. The rise of digital marketing and targeted advertising has also enhanced the visibility and attractiveness of online shopping for natural cleaning products. Furthermore, subscription services and online bulk purchase options provide added convenience and cost savings for consumers. The ongoing expansion of e-commerce infrastructure, coupled with the growing trend of digital shopping, has made it easier for consumers to access a wide range of natural household cleaners.

Regional Insights

Europe natural household cleaners industry dominated the global market with the largest revenue share of 33.0% in 2024. European consumers are highly conscious of environmental and health impacts, leading to a strong preference for eco-friendly and natural products. Stringent regulations and policies aimed at reducing chemical usage and promoting sustainability have further fueled the demand for natural household cleaners. The region's commitment to reducing its carbon footprint and promoting sustainable living practices has encouraged manufacturers to develop and market eco-friendly cleaning products. Additionally, the increasing awareness of the harmful effects of conventional chemical-based cleaners on health and the environment has prompted consumers to seek safer alternatives. The presence of well-established brands and a robust retail network, including both physical stores and e-commerce platforms, ensures wide accessibility and availability of natural household cleaners.

Asia Pacific Natural Household Cleaners Market Trends

Asia Pacific natural household cleaners industry was identified as a lucrative region in 2024. The region’s growth is attributed to the increasing urbanization, rising disposable incomes, and heightened consumer awareness about environmental sustainability. Consumers in the region are becoming more conscious of the harmful effects of chemical-based cleaning products on health and the environment, leading to a growing preference for natural and eco-friendly alternatives. Countries such as China, Japan, and India are witnessing a surge in demand for natural household cleaners, fueled by the expanding middle class and the increasing focus on healthy living. The availability of a wide range of natural cleaning products through both traditional retail channels and e-commerce platforms has made it easier for consumers to access these products. Additionally, local manufacturers are innovating with plant-based ingredients and sustainable packaging to cater to the evolving preferences of eco-conscious consumers. The influence of social media and digital marketing has further boosted the visibility and appeal of natural household cleaners in the region.

North America Natural Household Cleaners Market Trends

North America natural household cleaners industry is expected to grow at the fastest CAGR of 11.8 % over the forecast period. Consumers in the region increasingly seek cleaning products free from harsh chemicals and toxins, reflecting a growing awareness of the potential health risks associated with conventional cleaners. The trend towards green living and the demand for organic and natural products have significantly boosted the market for natural household cleaners. The presence of major players in the industry, along with their continuous efforts to innovate and introduce new products, has contributed to market growth. Additionally, the rise of e-commerce and digital retail channels has made it convenient for consumers to explore and purchase a variety of natural cleaning products. The increasing focus on eco-friendly packaging and sustainable practices by manufacturers resonates with North America's environmentally conscious consumer base.

U.S. Natural Household Cleaners Market Trends

The U.S. natural household cleaners industry is expected to grow significantly over the forecast period. The country’s growth is driven by the increasing incidence of allergies and respiratory issues, prompting consumers to seek safer alternatives to conventional chemical-based cleaners. The influence of environmental advocacy groups and stringent regulations aimed at reducing chemical usage has also played a significant role in promoting natural cleaning products. The availability of a diverse range of natural household cleansers, including surface cleaners, fabric cleaners, and specialty cleaners, caters to the varied needs of American consumers. Furthermore, the rise of organic supermarkets and health stores, along with the growing popularity of online shopping, has made natural household cleansers more accessible to a wider audience. The market is also benefiting from continuous product innovations and leading brands' introduction of eco-friendly packaging solutions.

Key Natural Household Cleaners Company Insights

Some key companies in the natural household cleaners market include Henkel AG & Co. KGaA, Procter & Gamble, Unilever, Johnson & Son Inc., Reckitt Benckiser Group PLC, Godrej Consumer Products Limited, and others.

-

Henkel AG & Co. KGaA is a prominent player in the natural household cleansers industry, known for its commitment to sustainability and innovation. The company offers a range of eco-friendly cleaning products under its Pro Nature brand, including surface, fabric, and bathroom cleaners. These products are made using sustainable ingredients and are packaged in up to 100% recycled plastic and cardboard. The company's focus on reducing its carbon footprint and promoting sustainable development has made it a leader in the natural household cleansers market.

-

Procter & Gamble is another key player in the natural household cleansers market, offering a wide range of eco-friendly cleaning products. The company's EC30 line is designed to create cleaning products that leave no trace, with reusable, biodegradable, or recyclable packaging. P&G's home care products include handwash, laundry detergent, toilet cleaner, and surface cleaner, all formulated to be environmentally responsible.

Key Natural Household Cleaners Companies:

The following are the leading companies in the natural household cleaners market. These companies collectively hold the largest market share and dictate industry trends.

- Henkel AG & Co. KGaA

- Procter & Gamble

- Unilever

- Johnson & Son Inc.

- Reckitt Benckiser Group PLC

- Godrej Consumer Products Limited

- The Clorox Company

- Kao Corporation

- The Honest Company, Inc.

- Midea Group

Recent Developments

- In July 2024, Klin Space, a brand committed to providing safe and environmentally friendly cleaning solutions, is undergoing a rebranding as it enters the online market.

Natural Household Cleaners Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7.76 billion

Revenue forecast in 2030

USD 13.28 billion

Growth rate

CAGR of 11.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, Australia & New Zealand, South Korea, Brazil, South Africa, Saudi Arabia

Key companies profiled

Henkel AG & Co. KGaA; Procter & Gamble; Unilever; Johnson & Son Inc.; Reckitt Benckiser Group PLC; Godrej Consumer Products Limited; The Clorox Company; Kao Corporation; The Honest Company, Inc. ; Midea Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Natural Household Cleaners Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global natural household cleaners market report based on product, application, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Surface Cleaners

-

Glass Cleaners

-

Fabric Cleaners

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Bathroom

-

Kitchen

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarkets/Hypermarkets

-

Convenience Stores

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Africa

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.