- Home

- »

- Homecare & Decor

- »

-

Natural Insect Repellent Market Size, Industry Report, 2030GVR Report cover

![Natural Insect Repellent Market Size, Share & Trends Report]()

Natural Insect Repellent Market (2025 - 2030 ) Size, Share & Trends Analysis Report By Product (Personal, Area), By Insect Type (Mosquitos, Bugs), By Type (Outdoors, Indoors), By Distribution Channels, By Region, And Segment Forecast

- Report ID: GVR-4-68040-572-0

- Number of Report Pages: 114

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Natural Insect Repellent Market Summary

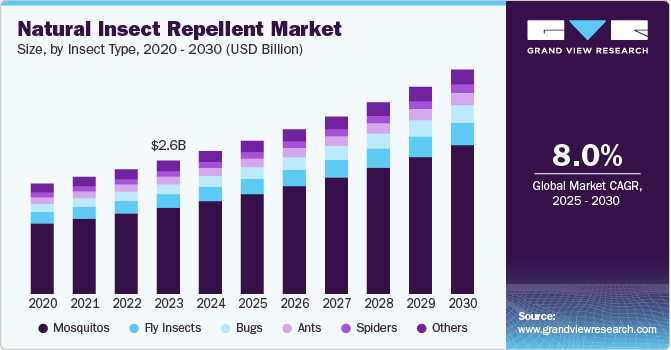

The global natural insect repellent market size was estimated at USD 2.79 billion in 2024 and is projected to reach USD 4.37 billion by 2030, growing at a CAGR of 8.0% from 2025 to 2030. The growth is driven by the demand for natural alternatives, growing awareness of health and environmental concerns, increased outdoor recreational activities, and advancements in product formulations.

Key Market Trends & Insights

- North America natural insect repellent market is expected to grow at a CAGR of 6.9 % during the forecast period.

- The natural insect repellent market in the U.S. accounted for a revenue share of around 80%.

- The natural insect repellent market in Asia Pacific accounted for a revenue share of 35.1% in 2024.

- Based on product, personal natural insect repellents accounted for a revenue share of 63.4% in 2024.

- In terms of insect type, the mosquito segment accounted for a revenue share of 64.9% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.79 billion

- 2030 Projected Market Size: USD 4.37 billion

- CAGR (2025-2030): 8.0%

- Asia Pacific: Largest market in 2024

Improvements in natural product formulations have substantially contributed to the growth in demand for natural insect repellents. Enhanced formulations are boosting the effectiveness and efficiency, which in turn is fueling the demand for these products. For instance, some products now provide longer-lasting effects, minimizing the need for frequent application. The STEM™, a brand of S.C. Johnson, offers insect repellents formulated with plant-derived active ingredients like lemongrass, mint, and rosemary oils. These products are designed to be safe for use around children and pets, meeting the growing consumer demand for eco-friendly options.

The improvement in formulation is closing the gap between conventional chemical-based repellents and natural alternatives, making plant-based solutions more appealing to consumers. Many products blend citronella with other natural oils, such as eucalyptus or tea tree oil, and employ encapsulation methods that gradually release active ingredients over an extended period. This innovation prolongs effectiveness, often offering protection for 4-6 hours or longer with just one application. With such a blend. Badger Anti-Bug Shake & Spray is a natural insect repellent that blends citronella, cedarwood, and rose geranium oils, offering up to 4 hours of protection with just one application. While it doesn’t explicitly use encapsulation technology, the natural oils are chosen for their insect-repelling properties and release active ingredients over time. This DEET-free, organic spray is safe for children and environmentally friendly, making it a non-toxic, eco-conscious alternative to chemical-based repellents.

The rising awareness regarding the potentially harmful impacts of chemical-based products, particularly those that include DEET, has led many individuals to seek alternatives in plant-derived repellents. Natural insect repellents mainly contain plant ingredients, such as citronella, lemongrass, eucalyptus, neem oil, and lavender. The threat of insect-borne diseases, such as Zika, malaria, and dengue, motivates people to explore safer protective measures, and natural repellents are perceived as a reliable, non-toxic option, which has caused notable changes in consumer habits, prompting individuals to seek safer and more sustainable options for insect protection.

As global awareness of insect-transmitted diseases such as malaria in sub-Saharan Africa, dengue in Southeast Asia, and Zika in the Americas increases, there has been a rise in the creation of region-specific natural insect repellents. For instance, neem oil is particularly popular in countries like India for its effectiveness against mosquitoes, while citronella and eucalyptus oils are more widely utilized in the U.S. and Europe. This trend illustrates an increasing acknowledgment that different regions may necessitate tailored solutions.

In addition, the growing enthusiasm for outdoor activities like camping, hiking, and traveling has further increased the need for natural insect repellents. As individuals spend more time outdoors, they seek insect protection that fits their health-conscious and eco-friendly lifestyle preferences. This trend is especially notable in North America and Europe, where outdoor tourism has surged, particularly following the pandemic, and has resulted in a significant demand for eco-friendly insect repellents from natural components. Products containing plant-based oils like citronella, lemongrass, and eucalyptus are becoming increasingly popular due to their effectiveness and sustainability. A survey by Gerber Finance of 1,000 consumers revealed that 61% hold natural product companies to higher standards than conventional ones. Additionally, 70% expect natural brands to disclose sourcing and ingredients, compared to just 46% for conventional brands, and 62% expect natural products to be high quality, versus 49% for conventional alternatives.

Consumer Survey & Insights

An online survey of personal mosquito-repellent strategies published on Peer J, an open-access peer-reviewed scientific mega journal, in 2023, highlighted that the most commonly used repellent was DEET spray (48%), followed closely by citronella candles (43%) and ‘natural’ repellent sprays (36%). However, it also observed that the unsubstantiated fears of possible side effects of DEET have created a large market for ‘‘natural’’ DEET-free repellents with a variety of active ingredients such as citronella, lemongrass, eucalyptus, neem oil, and lavender.

Consumers are increasingly choosing natural mosquito repellents that offer convenience and sustainability, especially for outdoor activities like hiking and camping. Products such as travel-size sprays, wipes, and wearable bands meet the practical needs of outdoor enthusiasts. Brands like Bon Appetit and Murphy’s Naturals use plant-based ingredients and eco-friendly packaging to cater to this trend. Multi-oil formulations and long-lasting, chemical-free protection are key features driving consumer preference, which appeal to consumers looking for more effective and environmentally responsible products.

Product Insights

Personal natural insect repellents accounted for a revenue share of 63.4% in 2024, driven by their direct application for personal safety during outdoor pursuits like camping, hiking, and traveling. Important growth drivers include increased outdoor recreational activities, heightened urban contact with insects, and increasing worry about insect-transmitted diseases such as malaria, Zika, and dengue. A broad range of formats, such as sprays, lotions, wipes, and wearable gadgets, also accommodate various consumer preferences, enhancing demand further.

The area segment is estimated to grow at a CAGR of 8.5% during the forecast period.Insect-repellent products are mainly utilized in residential and commercial lawns, patios, and gardens. Items like citronella candles, mosquito traps, and area sprays are becoming more popular for creating insect-free environments during outdoor events. The segment is experiencing consistent growth as more people are interested in eco-friendly lifestyle options, particularly in urban and suburban areas where outdoor living is favored, and seasonal insect activity is prominent.

Insect Type Insights

The mosquito segment accounted for a revenue share of 64.9% in 2024. This is mainly due to the rising incidence of diseases transmitted by mosquitoes, including malaria, dengue, and Zika, especially in tropical and subtropical climates. Significant trends include the increasing need for durable, plant-based options and region-specific products designed to address the distinct mosquito populations and disease threats in various locations. The emphasis on sustainability and environmentally friendly goods further boosts the expansion of natural mosquito repellents.

Bug repellents are expected to witness a CAGR of 8.9% during the forecast period, fueled by increasing preference for natural and chemical-free methods to address pest issues, particularly in home and outdoor environments. Shoppers are choosing plant-derived repellents from essential oils such as peppermint, rosemary, and tea tree oil, which can effectively target various insects. Significant trends involve the growth of environmentally friendly products and multi-insect repellents that offer protection against different pests while supporting health-oriented decisions.

Distribution Channel Insights

Sales of natural insect repellents through hypermarkets & supermarkets held a revenue share of 42.2% in 2024. Brick-and-mortar stores remain a leading option due to their extensive range of products, convenience, and competitive prices, making them a preferred choice for shoppers looking for quick access to natural repellents. The increased customer traffic in large retail locations, particularly during peak seasons for outdoor activities. Furthermore, product promotions, bulk purchase discounts, and the ability to compare different brands in one location boost their appeal. As consumer preferences evolve towards eco-friendly and natural options, hypermarkets and supermarkets increasingly offer various plant-based repellents, in line with the rising demand for non-toxic and sustainable products.

Sales of natural insect repellents through online channels are expected to grow at a CAGR of 9.0% from 2025 to 2030. The expansion is fueled by the growing inclination towards e-commerce, which provides convenience, a broader range of products, and competitive prices. Shoppers value the opportunity to effortlessly compare different natural insect repellent options, read reviews, and have them delivered right to their homes. Notable trends include increased direct-to-consumer brands, customized shopping experiences, and subscription services for regular product restocking. Moreover, the rise of environmentally conscious consumer habits and the accessibility of natural alternatives through online channels are further propelling this trend, establishing it as an essential avenue for the natural insect repellent sector.

Type Insights

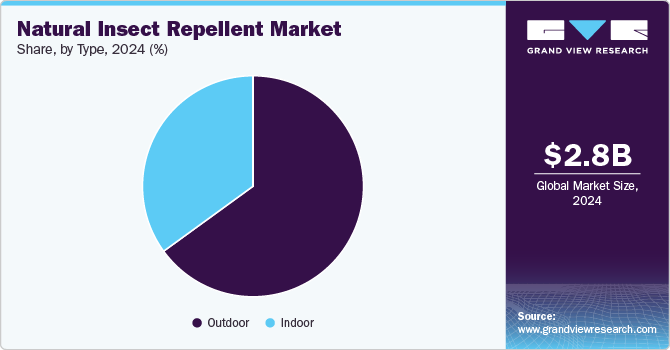

Outdoor repellents accounted for a revenue share of 64.5% in 2024, as the rising popularity of outdoor activities such as camping, barbecues, garden parties, and picnics drives market growth. There is a rising demand for products like mosquito coils, citronella candles, and sprays for large outdoor environments such as backyards, gardens, and parks. With the rise of urbanization and the growing prevalence of outdoor spaces like patios and rooftop gardens, the need for effective, eco-friendly insect repellents in these areas continues to grow, especially after the increase in outdoor activities following the pandemic.

Indoor repellents are expected to grow at a CAGR of 8.4% during the forecast period.There is a growing consumer interest in non-toxic, eco-friendly options for managing indoor pests. As awareness of the health risks linked to chemical repellents increases, more people are turning to natural alternatives such as essential oil-based sprays, diffusers, and plug-in devices. Notable trends include a surge in aromatherapy products that repel insects and enhance indoor air quality, along with a greater emphasis on safe solutions for children. This trend mirrors a wider aspiration for healthier living spaces, particularly in urban areas where indoor environments are more susceptible to insect infestations.

Regional Insights

North America natural insect repellent market is expected to grow at a CAGR of 6.9 % during the forecast period. In North America, consumers are inclined to pay extra for organic and non-toxic options that align with their broader commitment to environmental sustainability. There has been a noticeable increase in outdoor tourism, with people participating in activities such as camping, hiking, backpacking, mountain biking, and beach trips, which often expose them to higher risks of insect encounters. Consequently, the demand for reliable, non-toxic insect protection has surged. In response, there has been an upsurge in the creation of portable, user-friendly natural insect repellents like wipes, sprays, and repellent bands tailored for active outdoor enthusiasts.

U.S. Natural Insect Repellent Market Trends

The natural insect repellent market in the U.S. accounted for a revenue share of around 80%, driven by strong consumer demand for natural, non-toxic alternatives. Heightened awareness of the health risks linked to synthetic chemicals like DEET and growing environmental concerns have accelerated the shift toward plant-based repellents featuring ingredients such as citronella, peppermint, and eucalyptus oils. The surge in outdoor activities post-pandemic, such as camping, hiking, and gardening, has further propelled demand for convenient and portable solutions, including sprays, wipes, and wearable repellents. Continued innovation in formulation, such as extended-release technologies and eco-friendly packaging, supports the U.S. market's robust growth trajectory.

Asia Pacific Natural Insect Repellent Market Trends

The natural insect repellent market in Asia Pacific accounted for a revenue share of 35.1% in 2024, driven by rising consumer preference for plant-based alternatives, growing awareness of health and environmental concerns, and increased participation in outdoor recreational activities. Countries like India and China are seeing heightened demand for repellents made with neem, citronella, and eucalyptus, reflecting cultural familiarity with natural remedies. Advancements in formulations, such as wearable and long-lasting repellents, further fuel market growth. Additionally, a shift toward eco-friendly packaging and DEET-free solutions is aligning with regional sustainability efforts and consumer health consciousness.

Key Natural Insect Repellent Companies Insights

Key players operating in the natural insect repellent market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Natural Insect Repellent Companies:

The following are the leading companies in the natural insect repellent market. These companies collectively hold the largest market share and dictate industry trends.

- S.C. Johnson & Son

- Reckitt Benckiser

- Spectrum Brands

- Badger Balm

- Eco Defense

- Dabur International

- Godrej Consumer Products

- W. S. Badger Company

- Jyothy Labs

Recent Developments

-

In May 2024, Vanilla Mozi, an Australian skincare brand, entered the U.S. market with its innovative, natural insect repellent products.Launching in the U.S. market with its innovative, natural insect repellent products that combine clean beauty with effective outdoor protection, Vanilla Mozi will offer US consumers a sustainable and chemical-free alternative to conventional options.

-

In May 2023, Murphy’s Naturals, an outdoor lifestyle company known for its natural products, launched an exclusive insect repellent spray kit at Costco. The new Costco-exclusive Lemon Eucalyptus Oil Insect Repellent Spray Bundle contains one 4-oz. spray bottle and two 2-oz. spray bottles of Murphy’s Naturals’ plant-based formula, which is designed to repel mosquitoes for up to six hours.

Natural Insect Repellent Market Report Scope

Report Attribute

Details

Market revenue in 2025

USD 2.98 billion

Revenue forecast in 2030

USD 4.37 billion

Growth rate

CAGR of 8.0% from 2025 to 2030

Actuals

2018 - 2024

Forecast period

2025 - 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, insect type, type, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; and Middle East & Africa

Country scope

U.S; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

S.C. Johnson & Son; Reckitt Benckiser; Spectrum Brands; Johnson & Johnson; Badger Balm; Eco Defense; Dabur International; Godrej Consumer Products; W.S. Badger; and Jyothy Labs

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Natural Insect Repellent Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global natural insect repellent market report based on product, insect type, type, distribution channel, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Personal

-

Cream, Gels & Lotions

-

Sprays and Aerosol

-

Wipes

-

Roll On & Sticks

- Others (wearable bands, beads, etc.)

-

-

Area

-

Sprays and Aerosols

-

Coils

-

Candles

-

Electric Diffusers

-

Others

-

-

-

Insect Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Mosquitos

-

Bugs

-

Fly Insects

-

Ants

-

Spiders

-

Others (Cricket, Cockroach, Ticks, etc.)

-

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Indoor

-

Outdoor

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hypermarkets & Supermarkets

-

Pharmaceutical & Drug Store

-

Specialty Store

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global natural insect repellent market was estimated at USD 2.79 billion in 2024 and is expected to reach USD 2.98 billion in 2025.

b. The global natural insect repellent market is expected to grow at a compound annual growth rate of 8.0% from 2025 to 2030 to reach USD 4.38 billion by 2030.

b. The Asia Pacific region dominated the global natural insect repellent market with a share of 35.12% in 2024. The demand for consumer preference for natural alternatives, growing awareness of health and environmental concerns, increased outdoor recreational activities, and advancements in product formulations.

b. Some of the key players operating in the natural insect repellent market include S.C. Johnson & Son, Reckitt Benckiser, Spectrum Brands, Johnson & Johnson, Badger Balm, Eco Defense, Dabur International, Godrej Consumer Products, W.S. Badger, and Jyothy Labs.

b. Natural mosquito repellents accounted for the revenue share of 64.9% in 2024 in the natural insect repellent industry. This is mainly due to the rising incidence of diseases transmitted by mosquitoes, including malaria, dengue, and Zika, especially in tropical and subtropical climates

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.