- Home

- »

- Beauty & Personal Care

- »

-

Natural Skin Care Products Market Report, 2022-2030GVR Report cover

![Natural Skin Care Products Market Size, Share & Trends Report]()

Natural Skin Care Products Market Size, Share & Trends Analysis Report By Type (Mass, Premium), By Product (Facial Care, Body Care), By End-use (Men, Women), By Distribution Channel, By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-018-0

- Number of Report Pages: 75

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Consumer Goods

Report Overview

The global natural skin care products market size was valued at USD 6.7 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 6.6% from 2022 to 2030. One of the primary factors driving the market is growing awareness about the adverse effects of chemicals on the skin, such as irritation and dullness. The increasing awareness about the benefits of organic ingredient-based items has prompted customers to seek out eco-friendly, natural skin care products. The recent Covid-19 outbreak has severely impacted the growth of the beauty and personal grooming industry. The pandemic disrupted production as well as sales of beauty and personal care products through both online and offline channels due to social distancing and stay-home policies.

Demand for new orders from retailers has come to a standstill as the major markets are under lockdown, which has drastically altered the supply chain in the market globally. Skin care products are popular since they are usually always utilized daily. Growing consumer awareness of the benefits of natural products, as well as rising environmental concerns, are likely to increase product demand in the upcoming years. Furthermore, chemical-free products are gaining popularity among young people and millennials who choose to support organically grown beauty product start-ups, which is projected to increase demand for natural products.

Increasing investments in research and development, coupled with the rising trend of natural ingredients, have encouraged manufacturers to launch new products. For instance, in June 2021, SO’BiOétic, the leading organic beauty brand in France, recently launched its organic beauty product line in the U.S. with the Instagram challenge “Have You Taken the #SOBiOWhaleChallenge”? According to the article published in Mancunian Matters in July 2021, A survey carried out by Prodge showed that 34 percent of consumers preferred to buy natural and organic skin care when given the option to do so.

Beauty and cosmetic products that are free from chemicals and transparent about the content have been preferred by consumers, which is likely to drive the demand for natural skin care products. Growing celebrity involvement in the promotion of sustainable beauty products is expected to resonate well with young consumers. Millennials who spend a lot of time on the internet have a high inclination towards trending online articles, product launches, and celebrity endorsements. Influential personalities such as Hailey Bieber promoting bareMinerals, and Jessica Alba co-founded The Honest Company. These brand innovations and launches are likely to contribute to the growth of the market.

Type Insights

The mass segment led the market for natural skin care products and accounted for the largest revenue share of 71.9% in 2021. The presence of manufacturers producing organic ingredient-based products that may be utilized regularly while keeping product cost in mind is a major factor driving this segment's growth. Himalaya, for example, is a sustainable personal care brand that offers a wide range of products at reasonable prices, including skin, body, and hair care. These manufacturers and brands continue to drive the market for natural skin care products. A shift in consumer preference towards mass natural skin products has been observed, to avoid parabens that exist in conventional cosmetics.

The premium segment is anticipated to expand at the fastest CAGR of 6.8% from 2022 to 2030. Premium product line offerings are the same as mass products, however, these are available with tangible and intangible attributes, such as botanical blends, which makes consumers pay more for them. Quality and extra value-added offerings are the key factors driving the market for natural skin care products. Brands such as True Botanicals, Amala, Dr. Alkaitis, Alitura Naturals, and Vered Organic Botanicals are some of the premium brands that offer natural products.

Product Insights

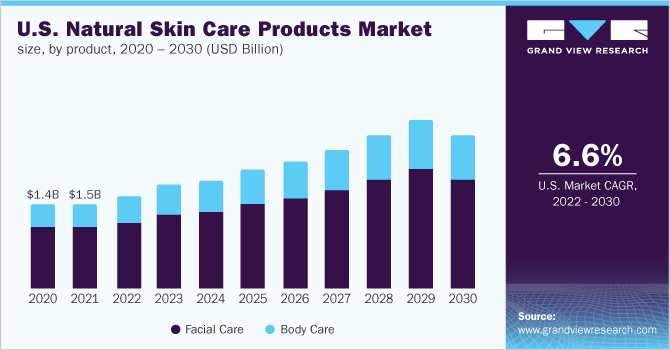

The facial care segment led the market for natural skin care products and accounted for the largest revenue share of 71.8% in 2021. Growing preference for complicated facial care routines among women as well as men in the recent past has been a prominent reason for the segment growth. The high popularity of facial remedies has enthused established manufacturers to expand their product offerings by acquiring promising companies about natural skin care. Based on a study published by AAD in 2020, the occurrence of acne in adults is increasing, affecting up to 15% of American women annually. Thus, manufacturers are focusing on producing facial care acne-prone skin that doesn’t contain any detrimental ingredients or chemicals.

The body care segment is anticipated to expand at the fastest CAGR of 6.8% from 2022 to 2030. Shifting consumer consciousness related to overall healthy skin, high brand promotions through online channels, and regular product launches have helped the segment to become in the mainstream lately. Expansions and new product launches in this segment are likely to augment the product demand. For instance, in August 2021, Kosmea, an Australian natural beauty brand announced its official launch in India by rolling out two products Certified Organic Rosehip Oil and Revive Illuminating Essence.

End-use Insights

The women segment led the market for natural skin care products and accounted for the largest revenue share of 77.7% in 2021. One of the primary elements driving market expansion is a growing preference for natural skin care products to avoid outbreaks and discomfort caused by synthetic cosmetics. Women are more concerned about their appearance than men, and thus pay more attention to their skin and the quality of ingredients they use for it.

The men segment is anticipated to expand at the fastest CAGR of 7.0% from 2022 to 2030. Growing awareness among males related to grooming and skin nourishment globally has been driving the demand over the years. This has encouraged manufacturers to focus on the male personal grooming product line. For instance, in October 2020, Zen Skin care has debuted in Pakistan by launching natural skin care products for men including hair oil, and face and body wash.

Distribution Channel Insights

The hypermarkets and retail chain segment made the largest contribution in the natural skin care products market and accounted for revenue share of over 48.1% in 2021. These stores have been focusing on offering natural and chemical-free categories set up to pique customer interest and offer them a facility to choose from numerous brands before making a purchase. Moreover, many retailers are focusing on revamping the product portfolio in the stores owing to the popularity of eco-friendly and sustainable products.

The e-commerce segment is projected to register a CAGR of 7.0% from 2022 to 2030. Rising internet penetration amongst consumers and target marketing done by companies to reach all customer touchpoints are likely to fuel the growth of this segment. For instance, in May 2020, Mamaearth, a beauty, and cosmetics brand, which offers natural skin, hair, and baby care products, launched Mother’s Day campaign. In this campaign, mothers had to post a TikTok video on #MamaearthMummySong and tag the brand to win prizes for the most liked video on the internet. These strategies by brands tend to gain more consumer engagement and trust.

Regional Insights

Europe dominated the market for natural skin care products and accounted for the largest revenue share of over 33.2% in 2021. According to the article by Cosmetics Design Europe in March 2021, naturalness is the most important aspect of a beauty product for consumers in Germany France. Consumers in countries such as the U.K., France, Italy, and Germany are more conscious about what they apply to their skin, and thus prefer natural, herbal, and organic for skin care routines. In Asia Pacific, the market for natural skin care products is expected to witness a CAGR of 6.8% from 2022 to 2030. The inclination of consumers towards naturally manufactured is expected to shoot up demand for such products, especially in developing countries, such as India and China.

Many leading startups such as Skincraft, Natures Tattva, and mCaffeine have been tapping into the natural skin and body care segment in the region. In North America, the market is expected to witness a CAGR of 6.7% from 2022 to 2030. Consumers in the countries such as U.S. and Canada are willing to pay a high price for a more youthful appearance, along with brighter and glowing skin. For instance, according to a Simmons National Consumer Study in March 2021, on average, Americans spend USD 322.88 on skin care each year. This increased spending is estimated to contribute to market growth.

Key Companies & Market Share Insights

The market includes both international and domestic participants. Key market players focus on strategies such as innovation and new product launches in retails about natural products to enhance their portfolio offering in the market.

-

In November 2021, Victoria's Secret, the leading intimate specialty retailer, has expanded its global presence with the launch of its first-ever beauty e-commerce store in India.

-

In May 2021, the Vegan beauty brand for men Phy recently launched its new Tea Tree Dandruff Control Shampoo that is touted to be gentle, sulfate-free, and silicone-free. The antibacterial properties and soothing aroma of Australian-origin tea tree oil combined with willow bark in this shampoo work to provide a flake-free itch-free scalp and nourished hair.

-

In July 2021, the U.K. based startup has expanded onto online beauty retailer major Feelunique, continuing its non-D2C growth plan to upscale across multiple channels and engage mass consumers.

Some of the prominent key players in the natural skin care products market include:

-

Procter & Gamble

-

The Estée Lauder Companies Inc.

-

Mama Earth

-

Unilever

-

The Clorox Company

-

Honest Co.

-

The Body Shop

-

L’Oréal

-

FOM London Skincare

-

Bloomtown

Natural Skin Care Products Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 7.3 billion

Revenue forecast in 2030

USD 11.87 billion

Growth Rate

CAGR of 6.6% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, product, end-use, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Germany; U.K.; France; China; India; Brazil

Key companies profiled

Procter & Gamble; The Estée Lauder Companies Inc.; Mama Earth; Unilever; The Clorox Company; Honest Co.; The Body Shop; L’Oréal; FOM London Skincare; Bloomtown

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global natural skin care products market report on the basis of type, product, end-use, distribution channel, and region:

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Mass

-

Premium

-

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Facial Care

-

Cleansers

-

Moisturizers

-

Others

-

-

Body Care

-

Body Lotions

-

Body Wash

-

Others

-

-

-

End-use Outlook (Revenue, USD Million, 2017 -2030)

-

Men

-

Women

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Direct Selling

-

Hypermarkets & Retail Chain

-

E-commerce

-

Pharmacy & Drugstores

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. Europe dominated the natural skin care products market with a share of 33.2% in 2021. According to the article by Cosmetics Design Europe in March 2021, naturalness is the most important aspect of a beauty product for consumers in Germany France. Consumers in countries such as the UK, France, Italy, and Germany are more conscious about what they apply to their skin, and thus prefer natural, herbal, and organic for skin care routines.

b. Organic products are gaining traction among a growing number of consumers, driven by the rising environmental awareness globally. Usage of organically-sourced ingredients in product formulations is anticipated to surge in the next few years as per the trends observed in skin care product consumption.

b. The global natural skin care products market size was estimated at USD 6.7 billion in 2021 and is expected to reach USD 7.3 billion in 2022.

b. The global natural skin care products market is expected to grow at a compound annual growth rate of 6.6% from 2022 to 2030 to reach USD 11.87 billion by 2030.

b. Some key players operating in the natural skin care products market include Procter & Gamble; The Estée Lauder Companies Inc.; Mama Earth; Unilever; The Clorox Company; Honest Co.; The Body Shop; L’Oréal; FOM London Skincare; and Bloomtown.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."