- Home

- »

- Advanced Interior Materials

- »

-

Neoprene Fabric Market Size & Share, Industry Report, 2030GVR Report cover

![Neoprene Fabric Market Size, Share & Trends Report]()

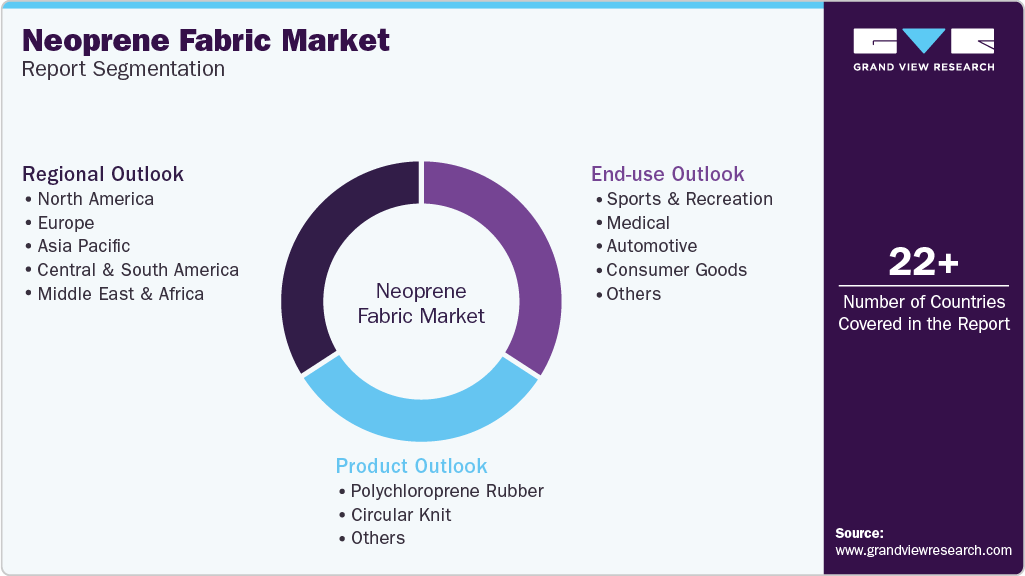

Neoprene Fabric Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Polychloroprene Rubber, Circular Knit), By End Use (Automotive, Medical, Consumer Goods), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-592-3

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Neoprene Fabric Market Size & Trends

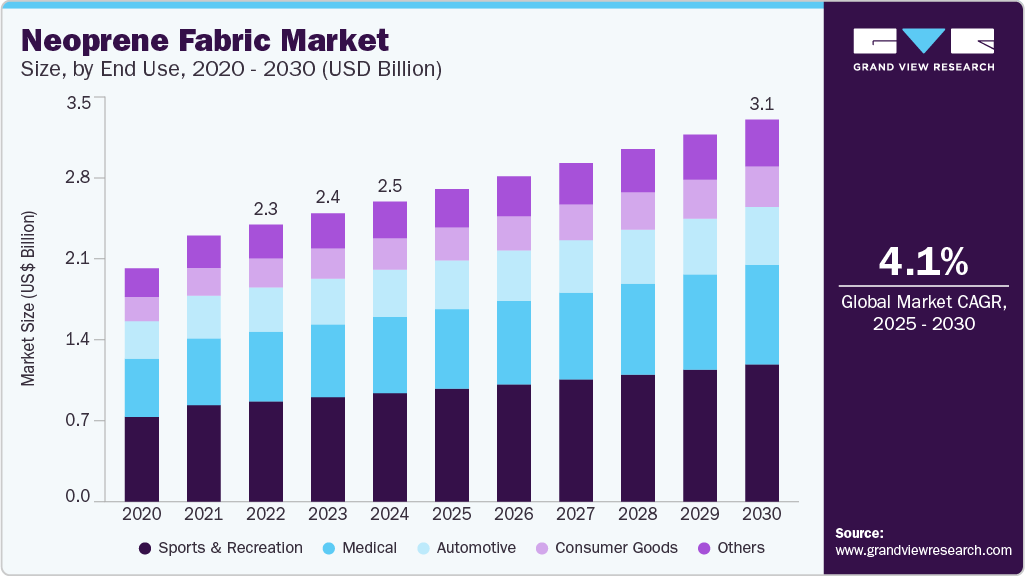

The global neoprene fabric market size was estimated at USD 2.46 billion in 2024 and is expected to expand at a CAGR of 4.1% from 2025 to 2030, driven by the increasing demand from the sports and outdoor apparel industry.

Key Highlights:

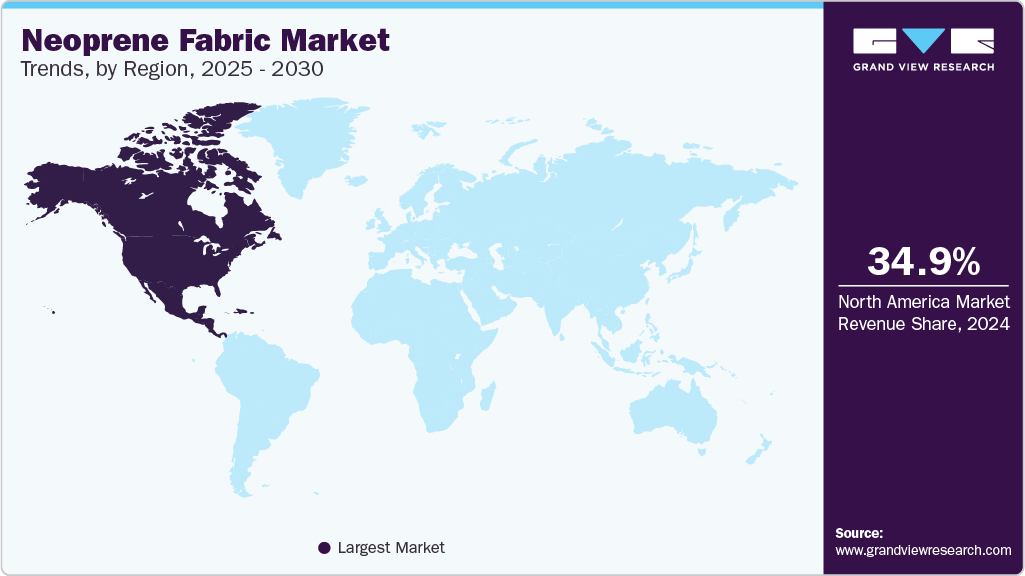

- North America dominated the market and accounted for the largest revenue share of about 34.9% in 2024

- The neoprene fabric market in the U.S. benefits from a strong base of end-user industries, particularly in healthcare, sportswear, and defense.

- In terms of segment, the sports & recreation segment dominated the market and accounted for the largest revenue share of 36.2% in 2024

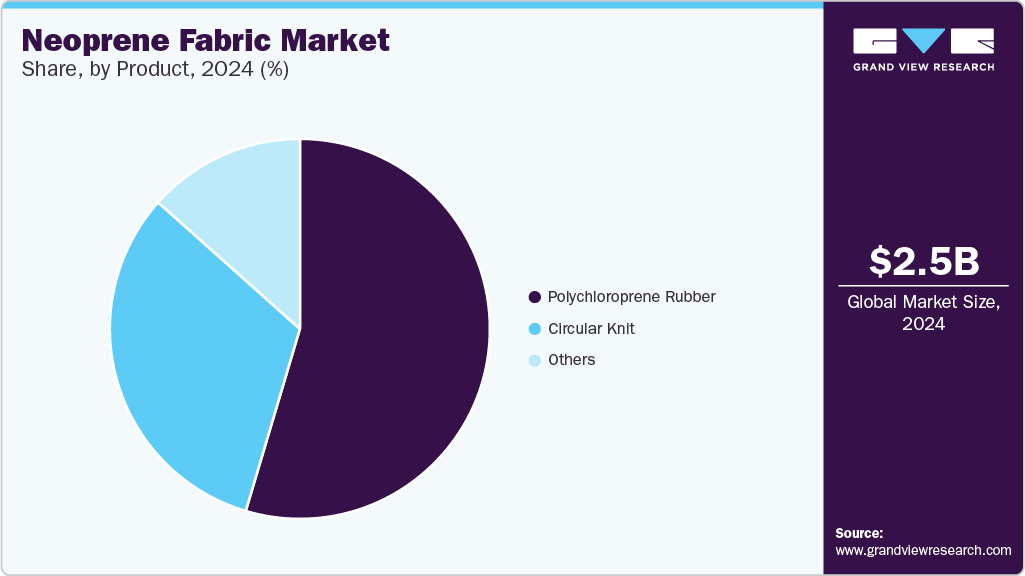

- In terms of segment, the polychloroprene rubber segment led the market and accounted for the largest revenue share of 54.7% in 2024

Neoprene fabric, known for its exceptional flexibility, thermal insulation, and water resistance, is widely used in manufacturing wetsuits, athletic braces, gloves, and protective gear. The rising popularity of water sports such as surfing, diving, and swimming, along with a growing interest in fitness and outdoor recreational activities, is fueling the need for high-performance fabrics.

This trend is particularly notable in regions with extensive coastal activity and strong athletic communities, where neoprene-based products are essential for each product type and safety. Technological advancements in fabric engineering have also bolstered market growth. Manufacturers are developing lightweight, eco-friendly, and sustainable neoprene alternatives to cater to evolving consumer preferences and stringent environmental regulations. Innovations in laminating neoprene with other textiles have enhanced comfort, breathability, and aesthetics, making the fabric more appealing for fashion and lifestyle applications. These developments open new avenues for neoprene usage beyond traditional segments, including consumer electronics accessories and luxury goods.

Another key driver is the expanding automotive and industrial applications of neoprene fabric. Due to its resistance to oil, chemicals, heat, and weathering, neoprene is extensively used in manufacturing automotive seat covers, gaskets, hoses, and industrial protective gear. The demand for durable and protective materials such as neoprene is accelerating with growing automotive production and an increased focus on worker safety in industrial environments. The material's versatility makes it a preferred choice for applications requiring mechanical resilience and thermal stability.

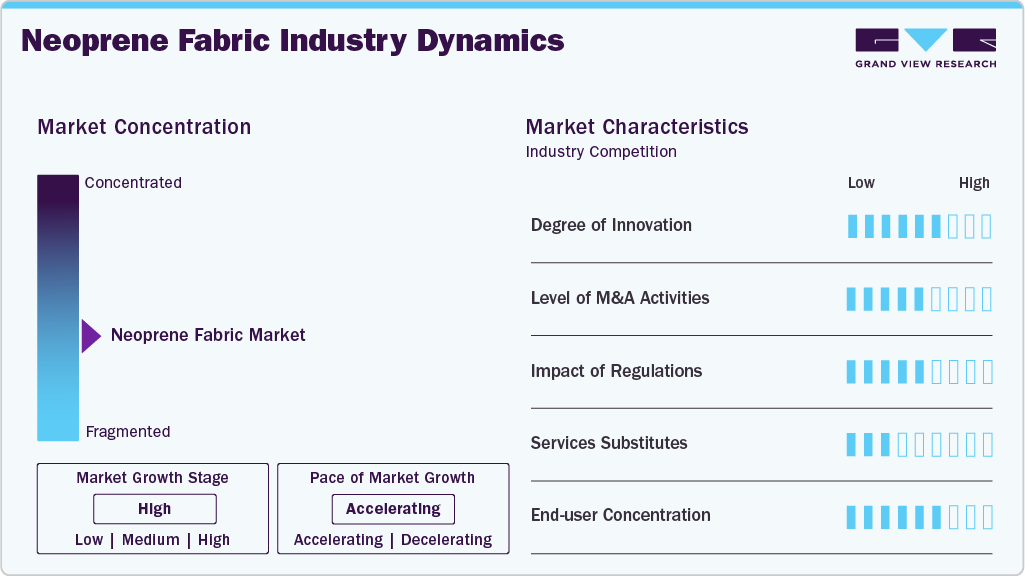

Market Concentration & Characteristics

The global neoprene fabric industry exhibits a moderate to high level of market concentration, with a few key players dominating production and distribution across various regions. The degree of innovation in the industry is relatively steady, with developments focusing on enhancing product flexibility, thermal insulation, and resistance to water, UV rays, and chemicals.

Technological advancements are also being directed toward developing eco-friendly alternatives to traditional neoprene, such as limestone-based variants, in response to environmental concerns and rising demand for sustainable materials. However, innovation is often incremental, shaped largely by specific per product type demands from end-user industries such as sportswear, automotive, and medical. In addition, the market has witnessed a moderate level of mergers and acquisitions, particularly among companies seeking to expand their geographic reach, improve product portfolios, or integrate vertically within the value chain.

Regulatory influence on the neoprene fabric industry is significant, especially in relation to environmental sustainability and occupational health and safety standards. Strict regulations concerning the emission of volatile organic compounds (VOCs) and the disposal of synthetic rubber waste have prompted manufacturers to seek cleaner production processes and compliant raw materials.

Moreover, service substitutes such as thermoplastic elastomers, natural rubber-based textiles, and synthetic alternatives offer competition, though they may lack the unique balance of durability and flexibility that neoprene provides. The end-user concentration remains high, with the sports and outdoor apparel, industrial safety, and automotive sectors accounting for a substantial share of the demand. These sectors heavily influence product development trends and market dynamics, reinforcing the importance of per product type-oriented material innovation and strategic collaborations with manufacturers.

End Use Insights

The sports & recreation segment dominated the market and accounted for the largest revenue share of 36.2% in 2024, driven by its exceptional flexibility, thermal insulation, and water-resistant properties. Neoprene is widely used in manufacturing wetsuits, gloves, and sports braces, providing athletes with comfort, mobility, and protection in aquatic and land-based sports. The growing popularity of water sports such as surfing, scuba diving, and snorkeling globally, particularly in coastal and adventure tourism destinations, has contributed to the segment’s expansion.

Medical is expected to grow at the fastest CAGR of 4.5% over the forecast period, driven by the material’s excellent flexibility, durability, and chemical resistance, making it suitable for various healthcare applications. Neoprene is widely used in orthopedic supports, braces, medical gloves, and therapeutic wraps due to its ability to conform to body contours while providing consistent compression. Its biocompatibility and hypoallergenic properties further enhance its applicability in patient-centric solutions, ensuring comfort and reduced risk of allergic reactions.

Product Insights

The polychloroprene rubber segment led the market and accounted for the largest revenue share of 54.7% in 2024. The rising demand for high-performance and multifunctional fabrics in sports and fitness apparel is boosting the adoption of polychloroprene rubber. Its inherent elasticity and cushioning effect provide comfort and flexibility, making it a preferred material in sportswear. Growing awareness of safety and comfort, coupled with the expansion of global recreational water sports and fitness trends, continues to drive demand for polychloroprene-based neoprene fabrics in consumer and industrial applications.

The circular knit segment is expected to grow at the fastest CAGR of 4.3% over the forecast period, driven by its superior flexibility and stretchability. This makes it ideal for applications requiring comfort and form-fitting properties, particularly in sportswear, active wear, and wetsuits, where performance and mobility are critical. Manufacturers are increasingly choosing circular knit neoprene for its ability to conform to body shapes while retaining thermal insulation and durability.

Regional Insights

North America dominated the market and accounted for the largest revenue share of about 34.9% in 2024. In North America, the market is driven by technological advancements, diverse industrial applications, and increasing consumer inclination toward high-product type materials. The region’s well-established textile and automotive sectors heavily utilize neoprene fabric due to its durability, weather resistance, and thermal insulation properties. Furthermore, the growing popularity of recreational water sports, outdoor fitness trends, and occupational safety standards fuels demand in apparel, accessories, and protective gear. Rising awareness around sustainable and alternative synthetic rubber fabrics also prompts regional innovation and investment.

U.S. Neoprene Fabric Market Trends

The neoprene fabric market in the U.S. benefits from a strong base of end-user industries, particularly in healthcare, sportswear, and defense. Increasing demand for medical-grade neoprene in braces, supports, and orthopedic wear, combined with the rising prevalence of lifestyle-related ailments, is accelerating market uptake. The U.S. also sees growing consumer interest in eco-conscious and durable sportswear products, pushing brands to innovate neoprene blends with reduced environmental impact. Moreover, the country’s defense and law enforcement sectors contribute to consistent demand for impact-resistant and flame-retardant neoprene fabrics in tactical and protective clothing.

Asia Pacific Neoprene Fabric Market Trends

The neoprene fabric market in Asia Pacific is driven by rapid industrialization, rising disposable incomes, and increasing interest in recreational activities. These factors are driving demand across various segments, particularly in sportswear and outdoor apparel. Countries such as Japan, South Korea, and India are witnessing robust growth in water sports, fitness awareness, and automotive production, all of which rely on neoprene fabric for thermal insulation and durability. In addition, growing investments in manufacturing infrastructure and a thriving textile industry are further fueling market expansion.

China neoprene fabric market represents a dominant force within the Asia Pacific region due to its large-scale manufacturing capabilities and extensive raw material availability. The country's leadership in producing low-cost yet high-per product type neoprene fabric has bolstered both domestic consumption and export volumes. Continuous research in eco-friendly neoprene alternatives is also gaining traction in response to regulatory scrutiny and environmental concerns.

Europe Neoprene Fabric Market Trends

The neoprene fabric market in Europe is experiencing rising demand, driven by heightened environmental consciousness and stringent regulatory frameworks that encourage sustainable material development. Technological innovation and consumer preference for premium outdoor clothing and accessories bolster the market, especially in countries like France, Italy, and the Netherlands. In Germany, a leader in automotive and industrial manufacturing, neoprene fabric is increasingly used for noise insulation, protective covers, and high-product type apparel, supported by a strong focus on quality standards and technical precision.

Germany neoprene fabric market, as a central hub for engineering and automotive innovation, is witnessing strong demand for neoprene fabrics in protective gear, industrial safety applications, and automotive interiors. The country’s emphasis on occupational safety and a high-quality manufacturing culture drives the adoption of durable, chemical-resistant materials such as neoprene. Furthermore, the growing trend of functional sportswear among German consumers supports additional demand in the consumer apparel segment.

Latin America Neoprene Fabric Market Trends

The neoprene fabric market in Latin America is propelled by rising sports and recreational activities, particularly in Brazil, Argentina, and Mexico. The region’s extensive coastline and warm climate encourage the use of neoprene wetsuits and aquatic sports gear. Moreover, expanding automotive assembly lines and construction activities generate demand for neoprene-based safety equipment and industrial products. Growth in the regional middle class is also boosting demand for higher-quality consumer goods, including functional clothing made with neoprene.

Middle East & Africa Neoprene Fabric Market Trends

The neoprene fabric market in the Middle East & Africa is driven by growth in the oil & gas sector, increasing industrial safety requirements, and infrastructure development. Neoprene's resistance to oil, heat, and harsh chemicals makes it suitable for protective clothing and sealing applications in the region’s energy and construction industries. In addition, increasing interest in water sports tourism, especially in the UAE and South Africa, contributes to demand for neoprene wetsuits and accessories. As disposable incomes rise, the product type-driven and high-quality textiles market is expected to expand further.

Key Neoprene Fabric Company Insights

Some of the key players operating in the market include Active Foam Products Inc. and Brunotti Europe B.V.

-

Active Foam Products offers a range of neoprene sheet materials with varying densities and thicknesses. Due to their thermal insulation, shock absorption, and durability, these are primarily used in orthotics, protective gear, and recreational equipment.

-

Brunotti Europe B.V. is a Netherlands-based brand known for its active lifestyle and sportswear products, particularly in board sports like surfing and kiteboarding. The company has a strong presence across Europe, focusing on product type and sustainability. Brunotti designs and manufactures wetsuits and accessories using high-quality neoprene fabric. These products emphasize flexibility, warmth, and environmental consciousness, targeting consumers involved in aquatic sports.

Colmant Coated Fabrics, Eastex Products, Inc., are some of the emerging market participants.

-

Colmant Coated Fabrics is a French manufacturer specializing in technical rubber-coated fabrics. The company has a heritage of innovation and serves a variety of sectors, including automotive, aerospace, and marine. Its neoprene fabric offerings include a wide range of coated textiles that are water-resistant, flame-retardant, and mechanically robust.

-

Eastex Products, Inc. is a U.S.-based supplier of high-product type textiles, specializing in laminated and coated fabrics for the medical, orthopaedic, and sports sectors. The company is known for its material innovation and customer collaboration. Eastex offers laminated neoprene materials used in orthopaedic braces, sports support, and wearable medical devices in the neoprene fabric segment.

Key Neoprene Fabric Companies:

The following are the leading companies in the neoprene fabric market. These companies collectively hold the largest market share and dictate industry trends.

- Active Foam Products Inc.

- Auburn Manufacturing, Inc.

- Brunotti Europe B.V.

- Colmant Coated Fabrics

- Eastex Products, Inc.

- Fabric House S.r.l.

- Johnson Outdoors Inc.

- Lomo Watersport UK

- Rip Curl International Pty Ltd. (KMD Brands)

Recent Developments

-

In March 2025, Rivertex Technical Fabrics Group underscored its dedication to sustainability and innovation through key initiatives. The company launched Rivercyclon 605 SD, a fully recyclable fabric tailored for diverse outdoor uses such as rain covers and protective equipment. In the same period, Rivertex expanded its headquarters in the Netherlands by adding a 1,200 m² energy-efficient extension to foster collaboration and drive innovative developments.

Neoprene Fabric Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.57 billion

Revenue forecast in 2030

USD 3.14 billion

Growth rate

CAGR of 4.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea

Key companies profiled

Active Foam Products Inc., Auburn Manufacturing, Inc., Brunotti Europe B.V., Colmant Coated Fabrics, Eastex Products, Inc., Fabric House S.r.l., Johnson Outdoors Inc., Lomo Watersport UK, Rip Curl International Pty Ltd. (KMD Brands)

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Neoprene Fabric Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global neoprene fabric market report based on product, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Polychloroprene Rubber

-

Circular Knit

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Sports & Recreation

-

Medical

-

Automotive

-

Consumer Goods

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global neoprene fabric market size was estimated at USD 2.46 billion in 2024 and is expected to reach USD 2.57 billion in 2025.

b. The global neoprene fabric market is expected to grow at a compound annual growth rate of 4.1% from 2025 to 2030 to reach USD 3.14 billion by 2030.

b. The sports & recreation segment dominated the market and accounted for the largest revenue share of 36.2% in 2024, driven by its exceptional flexibility, thermal insulation, and water-resistant properties

b. Some of the prominent companies in the neoprene fabric market include Active Foam Products Inc., Auburn Manufacturing, Inc., Brunotti Europe B.V., Colmant Coated Fabrics, Eastex Products, Inc., Fabric House S.r.l., Johnson Outdoors Inc., Lomo Watersport UK, Rip Curl International Pty Ltd. (KMD Brands)

b. Key factors driving the neoprene fabric market include its superior thermal insulation, chemical resistance, flexibility, and growing demand across medical, sportswear, and industrial applications.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.