- Home

- »

- Medical Devices

- »

-

Nerve Wrap Market Size & Share, Industry Report, 2030GVR Report cover

![Nerve Wrap Market Size, Share & Trends Report]()

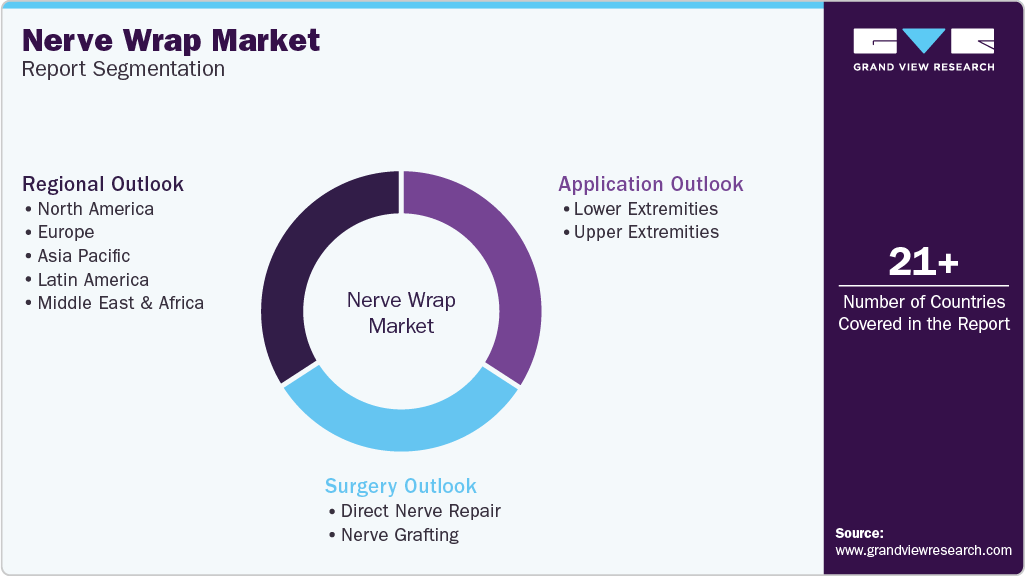

Nerve Wrap Market (2025 - 2030) Size, Share & Trends Analysis Report By Surgery (Direct Nerve Repair, Nerve Grafting), By Application (Lower Extremities, Upper Extremities), By Region (North America, Asia Pacific), And Segment Forecasts

- Report ID: GVR-4-68040-577-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Nerve Wrap Market Size & Trends

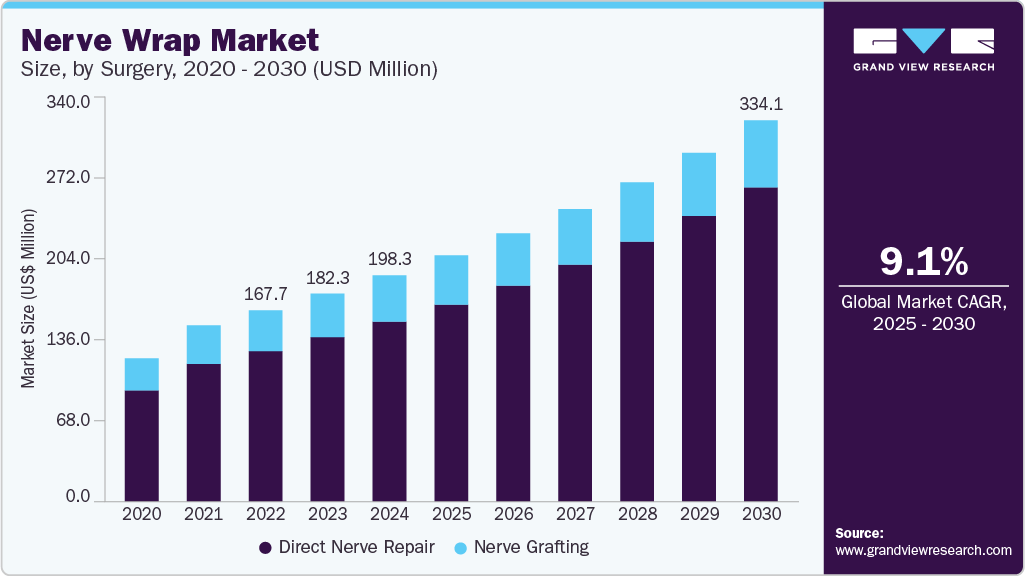

The global nerve wrap market size was estimated at USD 198.31 million in 2024 and is projected to grow at a CAGR of 9.13% from 2025 to 2030. This market growth is largely attributed to the increasing prevalence of peripheral nerve injuries (PNIs) and the rising adoption of advanced surgical solutions for nerve repair.

Key Highlights:

- The North America nerve wrap market accounted for 29.90% revenue share in 2024

- The demand for nerve wraps in the U.S. is linked to road traffic accidents, combat-related trauma, and sports injuries.

- By surgery, the direct nerve repair segment captured the largest revenue share of 79.54% in 2024.

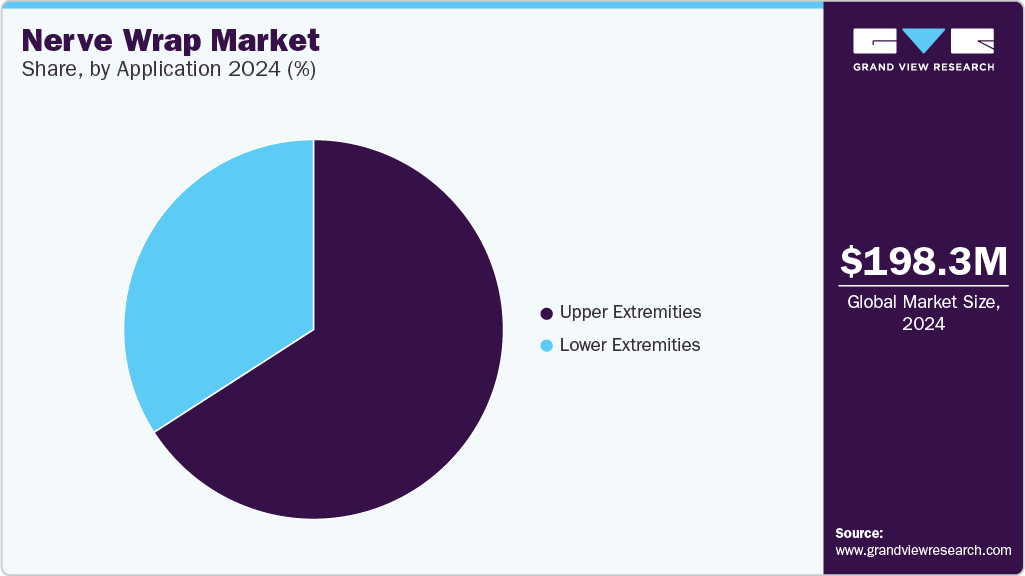

- By application, the upper extremities segment held the largest revenue share of 65.90% in 2024

Nerve wraps are increasingly used to prevent scar tissue formation and to promote optimal nerve regeneration post-surgery. According to Barrow Neurological Institute, most PNIs occur in the upper extremities, particularly the wrists and hands, where nerve wraps have demonstrated clinical efficacy in improving patient outcomes. As healthcare providers prioritize minimally invasive and effective nerve repair strategies, the demand for nerve wraps is expected to rise steadily throughout the forecast period.

The growing number of traumatic injuries, surgical procedures, and nerve compression syndromes, such as carpal tunnel syndrome, has significantly increased the demand for nerve protection and regeneration solutions such as nerve wraps. According to a report published by the National Institutes of Health (NIH), in October 2022, approximately 2.4% of the global population is affected by peripheral nerve disorders, with the prevalence rising to 8% among older adults. Moreover, according to a report by NIH in August 2023, nerve compression syndrome is a commonly reported condition in the general population, with severity ranging from mild discomfort to severe impairment.

Chronic conditions such as diabetes are major contributors to nerve damage, often resulting in neuropathy. The global rise in diabetes prevalence, particularly type 2 diabetes, is directly correlated with an increasing demand for nerve repair and protective solutions. As per the Cleveland Clinic, Type 2 diabetes is the most common form, representing 90% to 95% of all diabetes cases, driving the nerve wrap market growth.

U.S. Statewise Diabetes Incidence and Prevalence Statistics By the State Report Published by the American Diabetes Association

State

Current Adult Diagnosed Diabetes

Percent of Adult Population Suffering from Diabetes

Every Year Adult Patients with Diagnosed Diabetes

Alabama

593,500

14.9%

23,500

Alaska

46,200

8.3%

3,300

Arizona

615,200

10.6%

34,400

Arkansas

290,000

12.3%

14,000

California

3,578,900

11.7%

179,800

Colorado

322,900

6.9%

27,500

Connecticut

312,000

10.8%

17,000

Delaware

95,100

11.6%

4,800

District of Columbia (DC)

42,900

7.8%

3,300

Florida

2,071,000

11.4%

107,700 a

Georgia

1,024,100

12.1%

50,100

Hawaii

108,600

9.5%

6,700

Idaho

138,800

9.3%

8,800

Illinois

1,075,700

10.9%

58,000

Indiana

636,700

12.0%

31,200

Iowa

240,200

9.7%

14,600

Kansas

248,300

11.0%

13,300

Kentuck

486,200

13.8%

20,700

Louisiana

486,600

13.8%

20,800

Maine

116,500

10.2%

6,800

Maryland

537,000

11.1%

28,500

Massachusetts

507,500

9.0%

33,400

Michigan

855,000

10.8%

46,800

Minnesota

399,700

9.0%

26,200

Mississippi

345,500

15.3%

13,300

Missour

541,700

11.2%

28,500

Montana

77,100

8.6%

5,300

Nebraska

143,900

9.3%

9,100

Nevada

283,700

11.3%

14,800

New Hampshire

98,300

8.6%

6,800

New Jersey

746,400

10.2%

43,000

New Mexico

217,400

13.1%

9,800

New York

1,827,200

11.7%

92,000

North Carolina

1,055,400

12.4%

50,200

North Dakota

57,300

9.6%

3,500

Ohio

1,158,800

12.6%

54,400

Oklahoma

390,400

12.6%

18,200

Oregon

327,500

9.6%

20,100

Pennsylvania

1,145,500

11.1%

61,000

Rhode Island

92,600

10.4%

5,300

South Carolina

561,200

13.3%

25,000

South Dakota

73,000

10.5%

4,100

Tennessee

763,900

13.7%

32,900

Texas

2,552,500

11.1%

135,300

Utah

191,000

7.7%

14,600

Vermont

44,800

8.4%

3,100

Virginia

780,400

11.4%

40,400

Washington

536,600

8.7%

36,400

West Virginia

226,300

15.9%

8,400

Wisconsin

423,500

9.1%

27,500

Wyoming

39,300

8.7%

2,700

Source: American Diabetes Association, Grand View Research

Minimally invasive surgical methods are increasingly preferred in peripheral nerve repair because of advantages such as reduced infection risk, faster recovery, and lower postoperative pain. Nerve wraps enhance these processes by covering the repaired nerve, lessening tension, and inhibiting scar tissue formation, resulting in enhanced functional recovery and long-term results. These advancements enhance safer and more effective surgeries and encourage broader nerve wrap application in clinical settings.

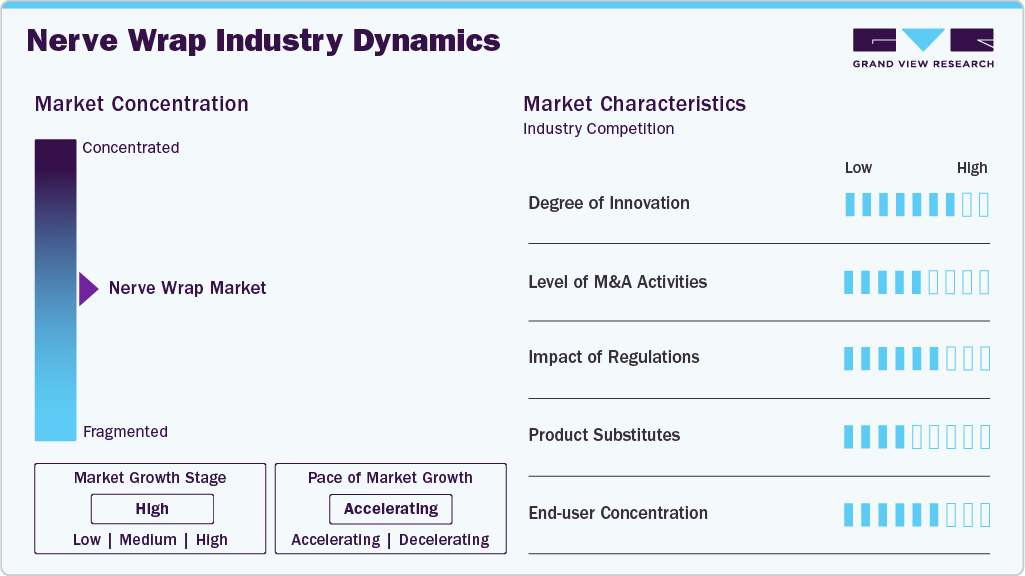

Market Concentration & Characteristics

The market for nerve wraps has seen a lot of innovations to enhance patient comfort, minimize complications, and optimize care efficiency. Some of the main innovations involve the addition of antimicrobial coatings, which reduce infection risk, and the application of flexible, biocompatible materials that enhance patient comfort and faster healing. For instance, in 2023, researchers introduced a new generation of bioactive nerve wraps that incorporate growth factors directly into the material, promoting faster nerve regeneration and improved functional recovery. These wraps, designed using advanced biomaterials, aim to mimic the natural healing environment better, offering a promising direction for future developments in nerve repair.

The nerve wrap market has experienced a low but increasing level of mergers and acquisitions (M&A) activity in recent years, driven by the growing demand for nerve repair solutions and advancements in regenerative medicine. As competition intensifies and the market matures, M&A activity is expected to remain active, especially as companies seek to consolidate their positions and diversify within the peripheral nerve repair segment.

Regulatory frameworks significantly influence the development and commercialization of nerve wraps, which are often classified as Class II or III medical devices. In the U.S., the FDA requires Class II devices to undergo a 510(k) premarket notification process, demonstrating substantial equivalence to existing devices. Class III devices necessitate more rigorous premarket approval (PMA), including clinical trials to establish safety and efficacy. In Europe, the Medical Device Regulation (MDR) 2017/745 imposes stringent requirements, including enhanced clinical evaluations, post-market surveillance, and stricter conformity assessments for Class III devices. These regulatory processes can increase development timelines and costs and ensure product safety and efficacy, fostering market confidence.

Material innovation is a key driver in the nerve wrap market, with manufacturers expanding beyond traditional synthetic polymers to include advanced biomaterials that better support nerve regeneration. Initially dominated by synthetic options like silicone, the market has grown significantly in natural and bioresorbable materials such as collagen, chitosan, and polyglycolic acid (PGA). These materials are favored for their biocompatibility, biodegradability, and ability to mimic the extracellular matrix, promoting more effective healing. Companies are also exploring hybrid and nanofiber-based materials to enhance mechanical strength and deliver bioactive agents. This material diversification enables safer, more effective solutions while aligning with regulatory and patient safety standards.

The nerve wrap market is experiencing significant regional expansion, driven by increasing awareness of nerve injuries, advances in regenerative medicine, and growing healthcare infrastructure in emerging markets. North America and Europe continue to dominate the market, owing to robust healthcare systems, high adoption rates of advanced medical technologies, and ongoing research in nerve repair. However, Asia-Pacific is becoming a key growth region as healthcare access improves and the demand for advanced medical devices rises. The growing prevalence of chronic diseases, nerve-related injuries, and surgeries in these regions, coupled with key players' expansion of manufacturing and distribution networks, is propelling the market's regional growth.

Surgery Insights

The direct nerve repair segment captured the largest revenue share of 79.54% in 2024, driven by the increasing incidence of peripheral nerve injuries largely drives the demand for nerve wraps in direct nerve repair. According to the National Institutes of Health, approximately 20 million people worldwide suffer from nerve injuries annually. As the number of surgeries for these injuries grows, there is a corresponding need for better solutions to enhance recovery. Materials like collagen-based wraps are highly sought after due to their biocompatibility and ability to mimic the extracellular matrix, thus supporting nerve regeneration. For instance, in July 2024, researchers reviewed advanced strategies including biomaterials, local drug delivery, electrical stimulation, and allografts to enhance peripheral nerve repair and improve surgical outcomes.

The nerve grafting segment is expected to grow at the highest CAGR during the forecast period, due to the increasing incidence of complex nerve injuries that require grafting instead of direct repair. When nerve gaps are too large to be bridged by suturing, grafting is used, and nerve wraps become crucial in supporting the graft, reducing mechanical stress, and guiding the regeneration of nerve fibers. The demand for bioresorbable materials, such as collagen and chitosan, is growing due to their ability to provide structural support while promoting healing and naturally degrading over time. As advancements in surgical techniques and biomaterials continue, the role of nerve wraps in nerve grafting procedures is expected to strengthen, further improving patient outcomes and recovery times.

Application Insights

The upper extremities segment held the largest revenue share of 65.90% in 2024. This segment includes nerve damage in the shoulders, hands, and arms, often resulting from trauma, repetitive strain, or surgery. These conditions may result in severe loss of function and diminished quality of life. In many upper extremity nerve repair procedures, particularly when nerve gaps are too large for direct suturing, nerve grafting is employed, and nerve wraps are essential to the success of these surgeries. The rising prevalence of upper limb injuries, especially in high-risk environments like workplaces and athletic activities, is expected to sustain and further increase the demand for nerve wraps in this segment.

The lower extremities segment is expected to grow at the highest CAGR from 2025 to 2030 due to the high prevalesnce of traumatic injuries and surgical procedures involving the legs, feet, and lower limbs. Nerve injuries in the lower extremities often result from accidents, falls, sports injuries, or surgeries, leading to functional impairments and decreased mobility. For instance, as per data published by the World Health Organization (WHO), road traffic injuries are the leading cause of death for children and young adults aged 5-29 years. Given the increasing incidence of such injuries, the demand for nerve wraps to aid in recovery and promote nerve regeneration in the lower extremities is expected to continue to grow, highlighting the critical role these wraps play in improving surgical outcomes and enhancing patient mobility.

Regional Insights

The North America nerve wrap market accounted for 29.90% revenue share in 2024, arising from high surgical volumes, advanced healthcare infrastructure, and widespread adoption of regenerative medicine technologies. The region benefits from strong collaborations between academic institutions, hospitals, and biotech companies focused on improving peripheral nerve repair outcomes. A mature reimbursement landscape and early adoption of new biomaterials support continuous innovation and market growth.

U.S. Nerve Wrap Market Trends

The demand for nerve wraps in the U.S. is linked to road traffic accidents, combat-related trauma, and sports injuries. The country is home to pioneers in bioengineered nerve wraps, with universities like Johns Hopkins and Stanford developing advanced conduits incorporating growth factors. For instance, a study reported that 2.6% of patients with upper extremity trauma and 1.2% with lower extremity trauma developed nerve injuries within two years following the injury. These injuries frequently require surgical interventions, such as nerve grafting and application of nerve wraps for regeneration and functional recovery. Moreover, the prevalence of conditions like carpal tunnel syndrome, affecting approximately 6% of adult men and 9% of adult women, further underscores the demand for effective nerve repair solutions.

Europe Nerve Wrap Market Trends

The Europe nerve wrap market represents a key growth region, focusing more on minimally invasive surgical techniques and regenerative solutions for trauma and orthopedic cases. Regional initiatives aimed at biomedical innovation, such as Horizon Europe, have provided funding for research advancing the healthcare sector, such as nerve repair research, contributing to the development of new biomaterials and treatment protocols.

The nerve wrap market in the UK has seen growing implementation of nerve wraps in reconstructive and microsurgery, especially in treating traumatic limb injuries. Moreover, clinical interest in reducing neuroma formation in amputation and nerve trauma patients has accelerated the adoption of nerve wraps in public and private healthcare sectors, for instance. A study published in the Journal of Plastic, Reconstructive & Aesthetic Surgery, in May 2023, stated that the incidence of peripheral nerve injuries (PNI) averages 11.2 per 100,000 populations annually in England. A significant proportion of these injuries involve upper limb nerves distal to the wrist, often resulting from traumatic events such as knife-related incidents. Managing these injuries increasingly involves surgical procedures like nerve grafting, highlighting the need for advanced nerve wraps to support recovery and minimize complications.

Asia Pacific Nerve Wrap Market Trends

Asia Pacific nerve wrap market is growing with the fastest CAGR over the forecast period, owing to its large patient population, rising trauma cases, and increasing investment in healthcare infrastructure. The demand is particularly strong in urban hospitals, where the adoption of advanced surgical techniques is growing. Government-backed medical innovation and support for local manufacturing have also spurred development in this region.

The nerve wrap market in China is driven by industrial injuries, increasing road traffic accidents, and an aging population undergoing more surgical interventions. Research institutes like the Chinese Academy of Sciences are developing cost-effective, biodegradable nerve wraps using silk protein and chitosan. With domestic companies investing in scalable manufacturing and government efforts to reduce reliance on imported medical devices, China is fast becoming a hub for both consumption and production of nerve wraps.

Latin America Nerve Wrap Market Trends

The Latin America nerve wrap market is experiencing steady growth, driven by the increasing prevalence of traumatic injuries and a growing aging population. As healthcare infrastructure improves and access to specialized surgical care expands, particularly in urban centers, there is a rising interest in advanced treatments, including nerve wraps, to enhance recovery outcomes. Moreover, local governments and healthcare organizations are focusing on improving the quality of healthcare services, which is facilitating the adoption of innovative medical technologies, including nerve wraps, in the region.

Middle East and Africa Nerve Wrap Market Trends

The nerve wrap market in the Middle East and Africa is still emerging but shows potential as nations prioritize upgrading healthcare services and trauma care. Increasing medical education, developing private hospitals, and investing in surgical advancement contribute to the gradually adopting of nerve repair technologies.

Saudi Arabia nerve wraps market continues to grow steadily as the nation is actively modernizing its healthcare sector under Vision 2030, with a strong focus on expanding access to specialized surgical care and regenerative medicine. Moreover, diabetic peripheral neuropathy (DPN) poses a major public health challenge in Saudi Arabia, affecting a significant portion of diabetic patients in the country. This condition frequently results in nerve injury necessitating surgery, including nerve grafting, which further fuels demand for successful nerve repair options.

Key Nerve Wrap Company Insights

Axogen Corporation; Stryker; Polyganics BV; Integra LifeSciences Corporation.; Newrotex; Orthocell Ltd; BioCircuit Technologies are some major players in the nerve wrap industry. Companies are expanding their portfolios of nerve wraps to gain a competitive advantage in the coming years. Moreover, industry players focus on obtaining approvals for advanced nerve wraps to meet the growing demand in the coming years.

Key Nerve Wrap Companies:

The following are the leading companies in the nerve wrap market.These companies collectively hold the largest market share and dictate industry trends.

- Axogen Corporation

- Stryker

- Polyganics BV

- Integra LifeSciences Corporation.

- Newrotex

- Orthocell Ltd

- BioCircuit Technologies

Recent Developments

-

In April 2025, Orthocell received FDA approval for its nerve repair product, Remplir, and was prepared to launch in the U.S. This move targets the nerve repair market, leveraging its proprietary manufacturing.

-

In February 2025, Integra LifeSciences launched the Integra Institute, a global digital education platform for healthcare professionals in the U.S. and EMEA. The platform offers on-demand resources across surgical, neurologic, ENT, and regenerative specialties, featuring webinars, surgical videos, and networking opportunities to enhance professional development.

-

In October 2024, Axogen Inc. announced the full launch of Avive, including Soft Tissue Matrix, a resorbable amniotic membrane allograft designed to protect and separate tissues during peripheral nerve healing. This innovation complements Axogen's portfolio, which includes products like Avance Nerve Graft and Axoguard Nerve Protector, offering comprehensive solutions for nerve repair.

-

In July 2024, BioCircuit Technologies initiated the first human implantations of Nerve Tape, the first FDA-approved sutureless nerve repair device. Surgeons at over 50 U.S. sites have since performed approximately 1,000 procedures using the device, simplifying nerve repair by eliminating the need for microstructures, reducing surgical time, and enhancing repair strength.

Nerve Wrap Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 215.89 million

Revenue forecast in 2030

USD 334.13 million

Growth rate

CAGR of 9.13% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Surgery, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Brazil; Argentina; South Africa; UAE; Kuwait; Saudi Arabia

Key companies profiled

Axogen Corporation; Stryker; Polyganics BV; Integra LifeSciences Corporation.; Newrotex; Orthocell Ltd; BioCircuit Technologies

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Nerve Wrap Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2025 to 2030. For this study, Grand View Research has segmented the global nerve wrap market report based on surgery, application, and region.

-

Surgery Outlook (Revenue, USD Million, 2025 - 2030)

-

Direct Nerve Repair

-

Nerve Grafting

-

-

Application Outlook (Revenue, USD Million, 2025 - 2030)

-

Lower Extremities

-

Upper Extremities

-

-

Regional Outlook (Revenue, USD Million, 2025 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

Kuwait

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global nerve wrap market size was estimated at USD 198.31 million in 2024 and is expected to reach USD 215.89 million in 2025.

b. The global nerve wrap market is expected to grow at a compound annual growth rate of 9.13% from 2025 to 2030 to reach USD 334.13 billion by 2030.

b. North America dominated the nerve wrap market with a share of 29.90% in 2024. This is attributable to high surgical volumes, advanced healthcare infrastructure, and widespread adoption of regenerative medicine technologies.

b. Some key players operating in the nerve wrap market include Axogen Corporation; Stryker; Polyganics BV; Integra LifeSciences Corporation.; Newrotex; Orthocell Ltd; BioCircuit Technologies

b. Key factors that are driving the market growth include innovations in biomaterials and regenerative medicine are enhancing the efficacy of nerve wraps, promoting their adoption in clinical settings and increase in traumatic injuries, surgical procedures, and chronic conditions like diabetes is leading to a higher demand for nerve repair solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.