- Home

- »

- Medical Devices

- »

-

Network Point-of-Care Glucose Testing Market Report, 2030GVR Report cover

![Network Point-of-Care Glucose Testing Market Size, Share & Trends Report]()

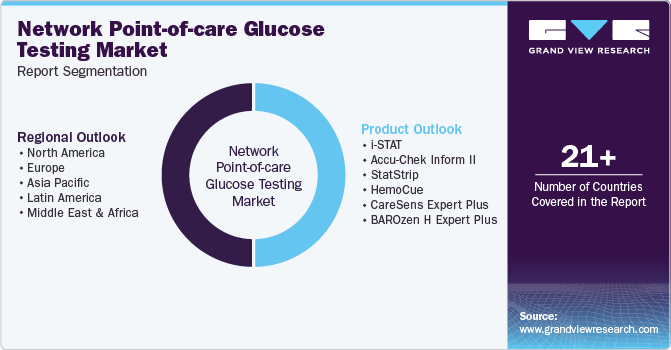

Network Point-of-Care Glucose Testing Market Size, Share & Trends Analysis Report By Product (i-STAT, Accu-Chek Inform II, StatStrip, HemoCue, CareSens Expert Plus), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-609-7

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

“2030 Network Point-of-Care Glucose Testing market value to reach USD 1.78 billion”

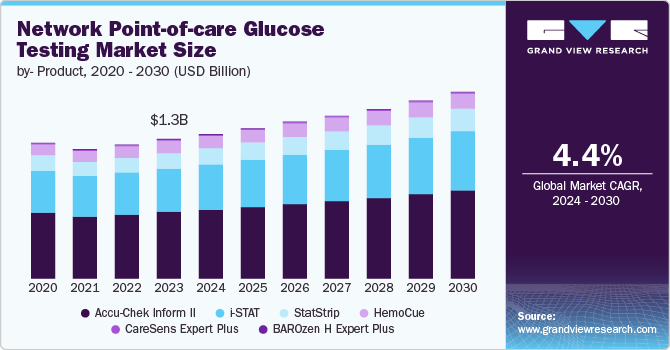

The global network point-of-care glucose testing market size was estimated at USD 1.33 billion in 2023 and is projected to grow at a CAGR of 4.4% from 2024 to 2030. The increasing need for remote patient monitoring (RPM), data-driven patient analysis, and advanced data transfer techniques integration are among the key drivers propelling the market's expansion. North Africa and Middle East have witnessed a significant rise in the number of diabetes cases. Moreover, according to the International Diabetes Federation, India reported 741,947,000 diabetes cases in 2021. Thus, fast-growing economies and growing awareness about diabetes are expected to create substantial growth opportunities for diabetes devices.

Network point-of-care (PoC) glucose testing is preferred for diagnosing diabetes and assessing patients' health status. This method has proven to be effective in avoiding treatment delays and delivering quick results. In addition, the rising interest in RPM systems and the importance of data-driven patient outcomes are fueling the market growth.

A rise in the incidence rate of diabetes is the root cause of several disorders, such as strokes, kidney failure, and cardiovascular diseases. These conditions are also recognized as comorbidities. Key industry players are actively involved in innovating and improving blood glucose monitoring devices. Government and other organizations are undertaking initiatives to increase awareness about PoC glucose monitoring systems. These factors will help boost the market growth.

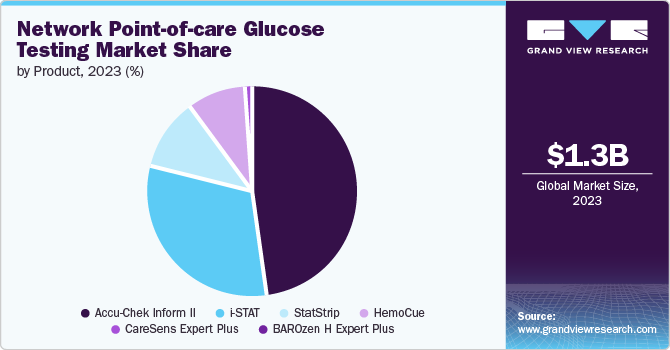

Product Insights

The Accu-Chek Inform II segment dominated the market and accounted for a revenue share of 48.4% in 2023 as it is designed to meet the needs of healthcare professionals to monitor blood glucose levels efficiently. The glucose meter tracks blood glucose levels in capillary, venous, neonatal, arterial, and whole blood samples. Healthcare professionals use Accu-Chek Inform II to quantitatively assess glucose levels in fresh venous, arterial, neonatal, and capillary whole blood obtained from the finger to monitor the efficacy of glucose regulation.

The CareSens Expert Plus segment is expected to grow at the fastest CAGR of 9.1% over the forecast period, driven by its advanced features that enable automatic strip recognition for glucose and β-ketones. Moreover, the system's seamless real-time data transfer capabilities via various connectivity options, including Wi-Fi, Ethernet, USB, and NFC, facilitate easy access to critical information. These features enhance the user experience and enable seamless integration with healthcare systems, contributing to its growing popularity in the market.

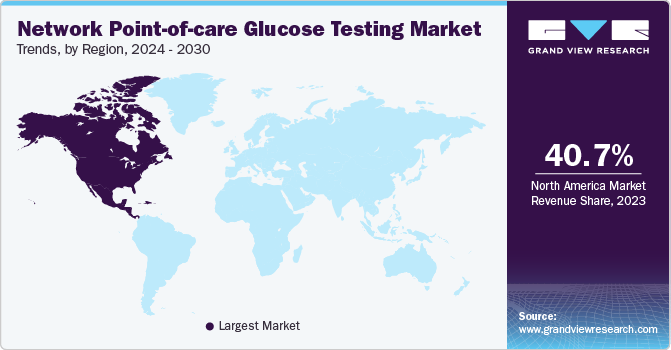

Regional Insights

North America dominated the market with a revenue share of 40.7% in 2023 owing to the presence of major players that have played a significant role in driving regional market growth. Their presence has led to an increase in the availability of glucose-testing products, ultimately boosting the regional market’s growth.

U.S Network Point-of-Care Glucose Testing Market Trends

The network point-of-care glucose testing market in the U.S. dominated the North America regional market with a share of 75.7% in 2023. This dominance can be attributed to the growing trend of RPM, which enables healthcare providers to remotely track patients' glucose levels, improving patient care and outcomes. Moreover, initiatives aimed at increasing diabetes awareness and promoting early detection have contributed to market growth, highlighting the importance of timely and accurate glucose testing in diabetes management.

Europe Network Point-of-Care Glucose Testing Market Trends

The Europe network point-of-care glucose testing market is expected to experience substantial growth over the forecast period. Government institutes and organizations are spreading awareness to adopt PoC glucose testing devices. The market growth can be attributed to various factors, including increasing demand for rapid and precise diagnostic tools for the diabetic field due to the growing prevalence of diabetes in the region.

The network point-of-care glucose testing market in the UK is expected to grow rapidly in the coming years. The demand for remote monitoring solutions has increased, driven by the pressing need for efficient healthcare management amidst the ongoing COVID-19 pandemic. Furthermore, government efforts to raise awareness about diabetes and the rising prevalence of the disease among individuals aged 20 to 75 years are concurrently fueling market growth. As a result, the need for safe and accurate remote monitoring technologies has become increasingly evident, driving innovation and adoption in the industry.

Asia Pacific Network Point-of-Care Glucose Testing Market Trends

The Asia Pacific network point-of-care glucose testing market is projected to experience significant growth, registering a CAGR of 5.0% over the forecast period. The market growth can be attributed to a rise in the number of diabetes patients in the region, particularly in populous countries, such as China and India. The rising purchasing power of these countries is also contributing to market growth, as individuals can invest in diabetes management solutions.

The network-based point-of-care glucose monitoring system market in China is poised for rapid expansion, driven by the rising demand for RPM, the growing diabetic patient population, and proactive government initiatives. The Chinese government's efforts to raise awareness of diabetes management have led to a rise in patients seeking glucose monitoring services. Furthermore, the COVID-19 pandemic hastened the adoption of RPM technologies, including network-based glucose monitoring systems, as healthcare providers seek more efficient and effective ways to manage patient care.

Key Network Point-of-Care Glucose Testing Company Insights

A rise in demand for diabetes management devices and technological advancements are predicted to entice new participants. To remain competitive, existing players are consistently revamping their offerings. The integration of telemedicine is anticipated to enhance the demand for both global and local brands in developing nations.

-

Prodigy Diabetes Care, LLC, an engineering and design company, is developing products that are specifically designed for diabetic patients. It is focused on the provision of blood glucose monitoring systems and other diabetes products to distributors, ensuring optimal care for their patients

-

Nova Biomedical offers whole blood analyzers that cater to the needs of hospitalized and critically ill patients. Nova analyzers provide prompt results at affordable prices, ensuring efficient, and cost-effective patient care

Key Network Point-of-Care Glucose Testing Companies:

The following are the leading companies in the network point-of-care glucose testing market. These companies collectively hold the largest market share and dictate industry trends.

- Abbott, LLC

- Nova Biomedical

- Danaher

- F. Hoffmann-La Roche Ltd.

- Ascensia Diabetes Care Holdings AG

- Prodigy Diabetes Care, LLC

- Nipro Corporation Japan

- ACON Laboratories, Inc.

Recent Developments

-

In June 2024, Abbott Laboratories received the FDA clearance for two over-the-counter glucose monitoring devices, Libre Rio and Lingo. Libre Rio targets type 2 diabetes patients not using insulin, while Lingo tracks glucose levels and provides personalized insights

-

In March 2024, Nova Biomedical launched its New Generation StatStrip Glucose Hospital Meter System, which obtained FDA 510k clearance. The new meter features enhanced cybersecurity, wireless charging, RFID data entry, and rugged casing, ensuring accurate and secure glucose testing for critically ill patients

Network Point-of-Care Glucose Testing Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.38 billion

Revenue forecast in 2030

USD 1.79 billion

Growth rate

CAGR of 4.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Abbott, LLC; Nova Biomedical; Danaher; F. Hoffmann-La Roche Ltd.; Ascensia Diabetes Care Holdings AG; Prodigy Diabetes Care, LLC; Nipro Corp. Japan; ACON Laboratories, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Network Point-of-Care Glucose Testing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global network point-of-care glucose testing market report based on product and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

i-STAT

-

Accu-Chek Inform II

-

StatStrip

-

HemoCue

-

CareSens Expert Plus

-

BAROzen H Expert Plus

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global network point of care glucose testing market size was estimated at USD 1.33 billion in 2023 and is expected to reach USD 1.38 billion in 2024.

b. The global network point of care glucose testing market is expected to grow at a compound annual growth rate of 4.4% from 2024 to 2030 to reach USD 1.79 billion by 2030.

b. North America dominated the network point of care glucose testing market with a share of 39.1% in 2023. This is attributable to presence of key market players such as Abbott, Nova Biomedical, and Prodigy Diabetes Care, LLC

b. Some key players operating in the network point of care glucose testing market market include F. Hoffmann-La Roche Ltd, Abbott, Nova Biomedical, Bayer AG, and Danaher

b. Key factors that are driving the market growth include high demand for remote patient monitoring, data-based patient analysis, and integration with advanced data transfer techniques.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."