- Home

- »

- Clinical Diagnostics

- »

-

Neurological Biomarkers Market Size & Share Report, 2030GVR Report cover

![Neurological Biomarkers Market Size, Share & Trends Report]()

Neurological Biomarkers Market Size, Share & Trends Analysis Report By Application (Alzheimer’s, Parkinson’s, Multiple Sclerosis, Autism), By Type, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-823-7

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Neurological Biomarkers Market Trends

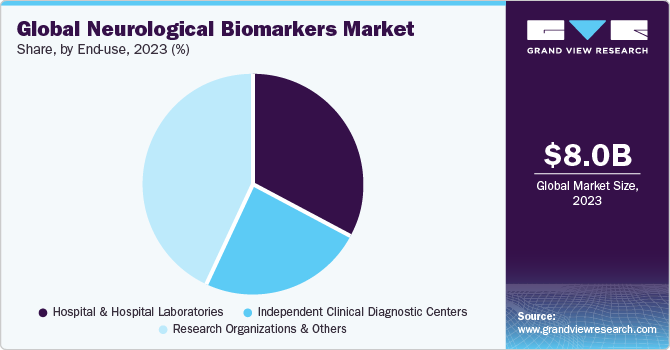

The global neurological biomarkers market size was valued at USD 8.05 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 12.89% from 2024 to 2030. Technological advancements, a rising prevalence of neurological disorders such as Parkinson's disease, Alzheimer's Disease (AD), dementia, brain tumors, & epilepsy, and increased funding for R&D of neurological biomarkers are factors responsible for market growth over the forecast period.

The COVID-19 pandemic brought both opportunities and challenges in the market for neurological biomarkers. While there was a growing demand for biomarkers due to the virus's neurological implications, hurdles such as disruptions in research and development activities, delayed clinical trials, and economic constraints disrupted market expansion. These challenges can hinder market growth by impeding the timely introduction of new neurological biomarkers, affecting their overall adoption and market penetration.

An increasing prevalence of neurological disorders is anticipated to drive market advancement. As per WHO estimates, in the U.S., stroke is the third leading cause of death and Parkinson’s disease currently impacts around 1 million people in the country. Technological advancements in biomarkers have made it easier for physicians and researchers to track & manage brain health.

Recent advancements in detection and biomarker signatures have helped in making neurological diseases more treatable. With an advent of neurological biomarkers detected in blood over the past few years, diagnosing diseases such as Alzheimer’s, autism, chronic traumatic encephalopathy, major depressive disorder, and Parkinson’s disease is likely to become easier.

As per a WHO article published in February 2023, every year, nearly 5 million people globally are diagnosed with epilepsy. Rising cases of Alzheimer’s disease in older people is expected to fuel market growth. For instance, according to WHO, globally, over 55 million people have dementia and about 10 million new cases are reported every year. According to Alzheimer’s Association, approximately 13.8 million people aged 65 and above are expected to suffer from Alzheimer’s dementia by 2060.

The development and introduction of Blood Based Biomarkers (BBBMs) for diagnosing AD & mild traumatic brain injury, among other conditions, contribute to market growth. For instance, in March 2020, NIH-funded researchers developed a blood-based test for detecting phosphorylated-tau-181 (ptau181), which indicates the presence of AD. This approach is less costly and invasive than existing brain imaging & spinal fluid tests. In January 2021, Abbott introduced the first rapid blood test for traumatic brain injury, including concussion. The i-STAT TBI plasma test measures a specific protein found in blood after a TBI and can help avoid the need for CT scans in case of negative test results.

Furthermore, growing research and innovation activities to help diagnose Parkinson’s disease using antigen-antibody binding techniques is fueling market growth. For example, according to an article by NCBI, in 2022, diagnosis of Parkinson's disease by investigating the inhibitory effect of serum components on P450 inhibition assay requires immunoblotting analysis, and it demonstrates that P450 inhibition assay can discriminate between sera from healthy individuals and patients with Parkinson’s disease. Moreover, this technique is easier to perform and is faster than other assays, as it does not require any pretreatment.

Biomarker discovery has been increasing in this segment in recent years. For instance, in April 2021, two novel sleep biomarkers associated with neurodegenerative diseases, including Parkinson’s disease and dementia, were discovered by a group of NIH-funded institutions using the Sleep Profiler EEG Sleep Monitor by Advanced Brain Monitoring, Inc. This discovery is not only critical in deriving a correlation with neurological diseases but also to improve brain-related understanding. Such developments are likely to further propel research in this segment.

Market Dynamics

Presence of organizations offering funds at several stages of research is anticipated to drive market growth. For instance, University of North Texas Health Science Center (HSC) was granted around USD 45.5 million as funding from National Institutes of Health (NIH) to support research regarding cause of Alzheimer's and brain aging disproportionately affecting Mexican Americans. NIH is also offering funds for research on biomarkers—Health and Aging Brain Among Latino Elders (HABLE) study.

The possibility to measure CNS markers in an easily accessible sample offers space to use blood-based neurological biomarkers to track disease progression in clinical routines or in clinical trials. For instance, blood Neurofilament Light Protein (NfL) concentrations can be used to monitor disease progression in brain damage or multiple sclerosis after a case of traumatic brain injury or cardiac arrest, among several other applications. Several market players are offering neurofilament light chain tests to diagnose neurological disorders. For instance, Labcorp offers these tests for assessing neuronal damage from sports-related concussion and neurodegenerative diseases.

There are several challenges associated with biomarkers for neurological disease diagnosis. The use of neurological biomarkers may be limited by their cost and invasiveness. Moreover, other challenges concerning biomarker discovery and validation that increase investments are sample storage, processing procedure, collection methods, and assay standardization within & across laboratories. For instance, among 196 candidate BBBMs, only 19 were highlighted for future consideration by the Alzheimer's Precision Medicine Initiative. However, none of the 19 BBBMs were estimated to meet the target product profile. Thus, operational issues, including cost, feasibility, and availability, may limit adoption of neurological biomarkers in clinical practice.

Type Insights

Proteomic biomarkers accounted for largest share of 30.49% of the neurological biomarkers market in 2023. Various powerful systems can detect and even measure low concentration of proteomic neurological biomarkers. For example, Merck’s SMCxPRO can quantify proteins in blood-plasma samples and support managing neurological conditions such as Alzheimer’s. This has aided in the early diagnosis of neurological conditions, fueling market growth. Also, recent improvements in sensitivity & reproducibility in instruments, such as LC-MS/MS, microarray technology, and development of immunoassay-based single-molecule quantification & multiplexing, are further boosting proteomics-based biomarker research.

Other types, which include digital biomarkers, are anticipated to witness significant revenue growth through 2030. Digital biomarkers offer various biopharmaceutical and pharmaceutical firms with supplemental and contextual data to conclude clinical trial decisions. For instance, in May 2022, NeuraLight received funding of USD 25 million to develop novel digital biomarkers for diagnosing neurological diseases. Thus, growing funding for digital biomarkers is expected to fuel segment growth.

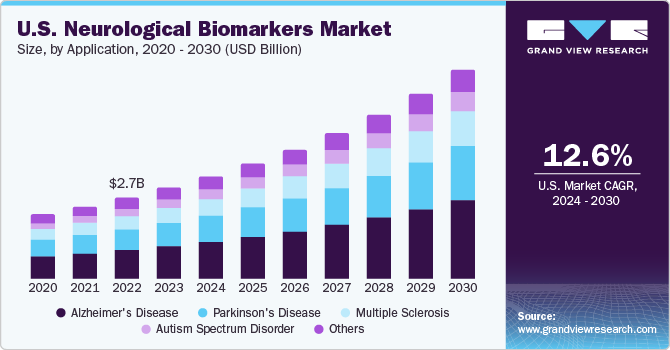

Application Insights

Alzheimer’s disease accounted for the largest market share in 2023 and is expected to remain dominant during the forecast period due to rising disease prevalence and increasing awareness for its early diagnosis and timely treatment. According to Alzheimer’s Association, globally, approximately 55 million individuals are living with dementia, with this number anticipated to rise to 78 million by 2030 and around 139 million by 2050. Moreover, in the U.S., approximately 6.5 million individuals are estimated to live with AD in 2022.

The Parkinson’s disease segment is expected to expand at a substantial CAGR from 2024 to 2030. Increasing R&D activities in biomarkers can potentially offer new opportunities for Parkinson’s therapeutics. For instance, according to an article published in Pharmaceutical Technology, in October 2022, a research study identified a novel cerebrospinal fluid biomarker for Parkinson’s disease, strengthening the scope of possible drug targets. Thus, neurological biomarkers may open new avenues for treating Parkinson’s disease and are projected to drive market expansion during the forecast period.

End-use Insights

Research organizations and other end-use areas accounted for a dominant market share in 2023.Research institutes, such as the National Institute of Neurological Disorders and Stroke (NINDS), have been providing significant funding for biomarker discovery, validation, and qualification of various neurological disorders. In May 2022, Amprion Inc. received an additional research grant of around USD 730,000 from NINDS for continued validation of the SYNTap Biomarker Test to diagnose neurological diseases or disorders.

Hospital & hospital laboratories segment, meanwhile, is expected to grow at the fastest CAGR through 2030, owing to an increase in hospitalization rates. Diagnostic centers often function in collaboration with hospitals, enabling hospitals to have in-house diagnostic setups. Furthermore, ongoing development of healthcare infrastructure is anticipated to enhance existing hospital facilities. A majority of blood-based biomarker assays are purchased by hospitals and are used in significant volumes.

Regional Insights

North America accounted for a significant revenue share in 2023 and is expected to witness strong growth from 2024 to 2030. This growth can be attributed to increased understanding of significant potential of biomarkers in drug development. A strong presence of regulatory bodies is also expected to fuel regional growth of biomarker-based drug development. For instance, in March 2022, H.U. Group Holdings Inc. and its subsidiary Fujirebio launched Lumipulse, a fully automated biomarker for Alzheimer’s. Increasing government funding for development of neurological biomarkers is expected to further fuel market growth.

Asia Pacific is meanwhile expected to advance at the highest CAGR through 2030. A noticeable increase in disposable income in developing countries, such as India & China, rising incidence of neurological disorders, and growing geriatric population that is highly susceptible to these diseases, along with a fast-growing prevalence of target diseases are further expected to propel regional market expansion.

Advancements in R&D by major companies are expected to positively impact regional market development.For instance, in June 2022, researchers from Hiroshima University and Kobe University developed a novel blood test for diagnosis of Parkinson’s disease. In addition, researchers had previously developed an inhibition assay P450 to identify changes in Parkinson’s disease.

Key Companies & Market Share Insights

Companies are adopting strategies that allow them to use their resources to aid in new product developments and enhance their supply chain.

-

In October 2023, C2N Diagnostics unveiled a cutting-edge fluid biomarker for Alzheimer's Disease, aiming to assist researchers in monitoring neurofibrillary "Tau" tangle pathology. This innovative test represents a major stride forward, providing valuable tools to understand and track the progression of Alzheimer's disease by focusing on Tau protein abnormalities

-

In July 2023, Quanterix Corporation announced the launch of LucentAD, a biomarker blood test to assist in the diagnosis of Alzheimer’s disease in individuals

Key Neurological Biomarkers Companies:

- Abbott

- Thermo Fisher Scientific, Inc.

- Merck & Co., Inc.

- Bio-Rad Laboratories, Inc.

- Johnson & Johnson Services, Inc.

- DiaGenic ASA

- Banyan Biomarkers, Inc.

- Quanterix

- Alseres Pharmaceuticals, Inc.

- Rules-Based Medicine

Neurological Biomarkers Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 9.06 billion

Revenue forecast in 2030

USD 18.75 billion

Growth rate

CAGR of 12.89% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

December 2023

Quantitative units

Revenue in USD billion/million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; India; China; Japan; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; Saudi Arabia; UAE; South Africa; Kuwait

Key companies profiled

Abbott; Thermo Fisher Scientific, Inc.; Bio-Rad Laboratories, Inc.; Merck & Co., Inc.; Johnson & Johnson Services, Inc.; Alseres Pharmaceuticals, Inc.; DiaGenic ASA; Banyan Biomarkers, Inc.; Rules-Based Medicine; Quanterix

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

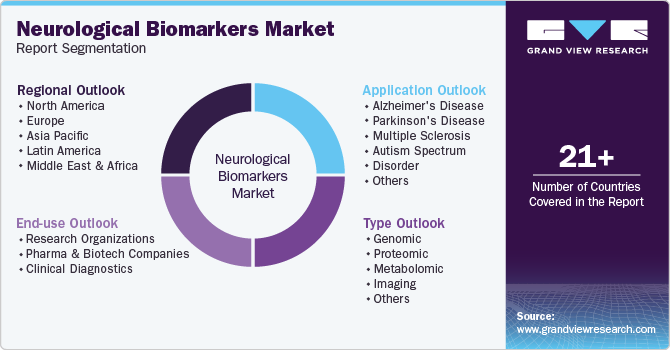

Global Neurological Biomarkers Market Report Segmentation

This report forecasts revenue growth at the global, regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global neurological biomarkers market report on the basis of type, application, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Genomic

-

Proteomic

-

Metabolomic

-

Imaging

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Alzheimer's Disease

-

Parkinson's Disease

-

Multiple Sclerosis

-

Autism Spectrum Disorder

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital & Hospital Laboratories

-

Independent clinical diagnostic centers

-

Research Organizations and Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

India

-

China

-

Japan

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Argentina

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global neurological biomarkers market size was estimated at USD 8.05 billion in 2023 and is expected to reach USD 9.06 billion in 2024.

b. The global neurological biomarkers market is expected to witness a compound annual growth rate of 12.89% from 2024 to 2030 to reach USD 18.75 billion in 2030.

b. Based on application, Alzheimer's Disease segment held the largest share of 35.89% in 2023, owing to high prevalence of the disease and availability of a higher number of products for clinical use.

b. Some key players operating in the neurological biomarkers market include Abbott; Thermo Fisher Scientific, Inc.; Bio-Rad Laboratories, Inc.; Merck & Co., Inc.; Johnson & Johnson Services, Inc.; BANYAN BIOMARKERS, INC.; Myriad Genetics, Inc.; DiaGenic ASA; and Quanterix Corporation.

b. The major factors driving neurological biomarkers market growth are the increasing prevalence of neurological diseases, technological advancements, and the need for early diagnosis of neurological disorders.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."