- Home

- »

- Medical Devices

- »

-

Neurology Clinical Trials Market Size & Share Report, 2030GVR Report cover

![Neurology Clinical Trials Market Size, Share & Trends Report]()

Neurology Clinical Trials Market Size, Share & Trends Analysis Report By Phase (Phase I, Phase II), By Study Design (Interventional), By Indication, By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68038-352-2

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

The global neurology clinical trials market size was valued at USD 5,235.8 million in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.6% from 2023 to 2030. This is largely attributed to increasing neurological diseases, such as dementia, stroke, and peripheral neuropathy, plus growing R&D investments in neurological research.

The neurology clinical trials market was affected to a great extent in early 2020 and 2021. During the global lockdown, the majority of the trials were focused on treating and diagnosing COVID-19. However, owing to the decline in COVID-19 cases due to the growing vaccination drive worldwide, the studies for other therapeutic areas have improved. A significant number of studies for neurological disorders were started in 2022.

For instance, a study titled “SGT-53 in Children with Recurrent or Progressive CNS Malignancies” was initiated in June 2022. Similarly, a study named “GB5121 in Adult Patients with Relapsed/Refractory CNS Lymphoma” was initiated in May 2022. An increase in the number of studies post-pandemic is expected to promote market growth.

The high burden of neurological diseases globally has increased the interest of sponsors and investors in providing funding for neurological clinical studies. Significant funding has been provided for neurological trials over the years. For instance, in March 2022, a team of researchers from Brown University, New York University, and the University of Rochester received USD 16.0 million in funding from the NIH to support the research on Alzheimer’s disease. Such initiatives in the future are expected to support the segment market growth.

Over the years, the geriatric population has significantly increased globally. According to WHO, over 1.4 billion people were aged 60 and above in 2020, and this number is expected to reach 2.1 billion by 2050. The growing geriatric population is one of the major causes of neurological disorders, such as Alzheimer’s disease, stroke, and Parkinson’s disease. Alzheimer’s disease is one the most common neurological diseases affecting over 50 million people worldwide as of 2019. Parkinson’s disease affects 10 million people across the world. The high prevalence of these diseases is expected to improve the demand for research, which is expected to promote market growth.

In order to make clinical trials easier for the patients, a significant number of neurological trials is now decentralized. For instance, in August 2020, Firma Clinical Research collaborated with C2N Diagnostics to initiate a decentralized Alzheimer’s disease diagnostic clinical trial. Growing adoption of such trials is expected to improve the interest of the participants in clinical studies, which is likely to boost the market to a great extent.

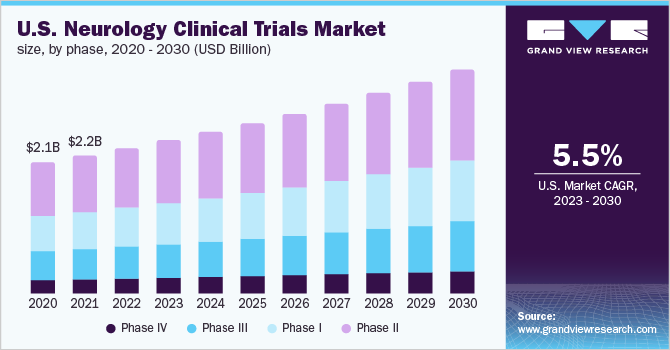

Phase Insights

The phase II clinical trials segment dominated the market for neurology clinical trials and held the largest revenue share of 46.3% in 2022. Based on phase the market is segmented into Phase I, Phase II, Phase III, and Phase IV.A growing number of industry-sponsored and non-industry-sponsored clinical trials in phase II, the complexity associated with phase II clinical trials, and the globalization of clinical trials are supporting the growth of the segment.

A significant number of phase I drugs have been approved in the past few years. For instance, the biotech company PharmaTher Holdings Ltd. stated in May 2021 that the U.S. FDA had approved its Investigational New Drug (IND) application to advance the company’s ketamine drug to phase II clinical trial, to study the safety, efficacy, and pharmacokinetics of the drug in Parkinson’s patients. Such approvals are further expected to boost segment growth.

Phase III is anticipated to register the fastest growth of 5.6% CAGR throughout the forecast period. This growth may be attributed to the fact that phase III clinical trials are the costliest and involve a large number of participants. The clinical trial market players are actively initiating phase III trials in order to understand the safety and potency of treatment. For instance, in April 2022, Pfizer stated that it intends to open clinical trial sites to conduct phase III trials of its investigational mini-dystrophin gene therapy used to treat Duchenne muscular dystrophy patients. Such initiatives by market players are likely to propel the segment's growth.

Indication Insights

The Huntington’s disease segment is anticipated to register the fastest growth rate of 6.0% throughout the forecast period. Based on indication, the market is segmented into epilepsy, Parkinson’s disease (PD), Huntington’s disease, stroke, traumatic brain injury (TBI), amyotrophic lateral sclerosis (ALS), muscle regeneration, and others. There is a high demand for newer medications as there is no available treatment for Huntington’s disease.

Most of the cases are hereditary or caused due to mutation. As of June 2022, only 222 studies were registered for HD, out of which, the majority of studies were in phases I and II, and only three studies were reported to be in phase IV. The low number of studies in phase IV and the relative lack of medication available for the diseases are expected to drive the demand for research, which is likely to have a positive impact on the market.

Epilepsy held the largest share of 21.9% in 2022. Epilepsy is one of the most common neurological diseases, with more than 65.0 million people worldwide affected by it according to the WHO. The disease is most prevalent in low- and middle-income countries, which account for 80.0% of epilepsy cases. According to ClinicalTrials.gov, there are a total of 1,755 studies for epilepsy as of June 2022. The growing awareness regarding epilepsy and demand for advanced treatment for the condition is expected to drive the segment’s market.

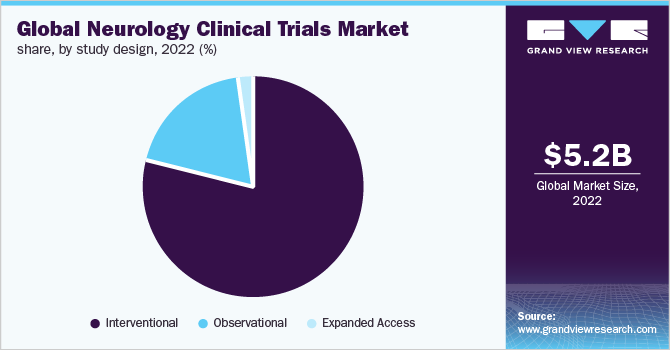

Study Design Insights

The interventional segment led the market for neurology clinical trials and accounted for the largest revenue share of 96.1% in 2022. Based on the study design, the market is segmented into interventional, observational, and expanded access. The growth can be attributed to the fact that a large number of interventional studies for Central Nervous System (CNS) conditions are being conducted across the globe.

As of June 2022, there are above 23,000 interventional studies listed on ClinicalTrails.gov related to CNS conditions. For instance, an interventional study titled Feasibility of Acquiring Hyperpolarized Imaging in Patients with Primary CNS Lymphoma was in the recruiting stage in April 2022. All these factors support the segment market.

The observational segment is anticipated to witness a substantial expansion of 5.8% CAGR throughout the forecast period. In a variety of situations, such as post-marketing safety evaluations of drugs or when clinical trials are not feasible, observational studies are routinely used to evaluate treatment effects. Furthermore, as of June 2022, of the total CNS condition studies listed on ClinicalTrials.gov, more than 7,900 are observational.

For instance, an observational study titled "The Use of Biomarkers to Predict CNS Involvement in Diffuse Large B-Cell Lymphoma: a Danish Nationwide Registry Study" was completed in January 2022. The above-mentioned factors support the segment market.

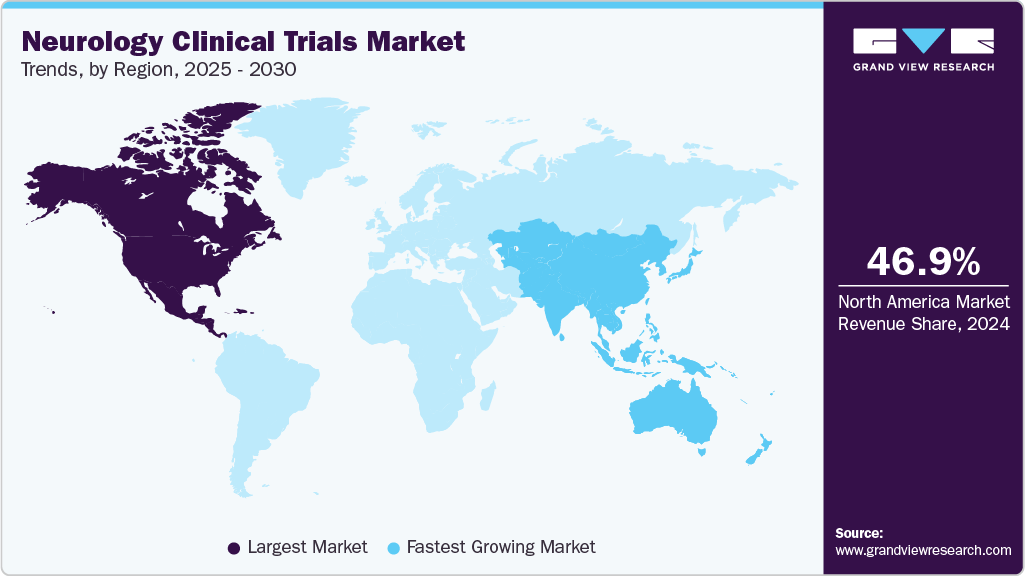

Regional Insights

North America dominated the neurology clinical trials market and accounted for the largest revenue share of 47.0% in 2022. The rising prevalence of neurological disorders and the presence of a large number of players in clinical trials are driving the market for neurology clinical trials in the region. As the population ages and total life expectancy rises, dementia would become more common, with an estimated 8.4 million Americans aged 65 and older suffering from Alzheimer's disease or another dementia by 2030.

Asia Pacific is expected to expand with the fastest CAGR of 5.9% across the forecast. Asia Pacific is the fastest-growing market as many developed nations are investing in the Asia Pacific region. Recruitment for clinical trials is increasing in Asia as compared to North America and Europe. This is due to the large patient pool & low trial cost. Moreover, researchers are actively developing new neurological treatments in the region.

For instance, in February 2021, researchers at Jawaharlal Nehru Centre for Advanced Scientific Research in India developed a small molecule named TGR 63, which had the ability to disturb the mechanism through which neurons become nonfunctional in Alzheimer's disease. Such research activities are likely to contribute to the market growth of the region.

Key Companies & Market Share Insights

The global market is characterized by the presence of a large number of global companies. Regional expansions, partnerships, collaborations and M&A activities are the key strategies undertaken by most of these companies. In April 2022, Labcorp, the parent company of Covance, collaborated with a developer of cell and gene therapy technologies, Xcell Biosciences, to expand its research capabilities in cell & gene therapies. According to the agreement, Labcorp and Xcellbio will collaborate on projects aimed at improving the efficacy and safety of cell and gene therapies for Parkinson’s disease, cancer, and other diseases. Some of the prominent players in the global neurology clinical trials market include:

-

Novartis

-

Covance

-

Med pace

-

Charles River Laboratories

-

Syneous Health

-

Icon Plc.

-

GlaxoSmithKline

-

Aurora healthcare

-

Biogen

-

IQVIA

Neurology Clinical Trials Market Report Scope

Report Attribute

Details

Market Size value in 2023

USD 5,516.5 million

Revenue forecast in 2030

USD 8,052.9 million

Growth Rate

CAGR 5.6% from 2023to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million, CAGR from 2023 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, trends

Segments covered

Phase, study design, indication, indication by study design, indication by phase

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; Mexico; Argentina; Colombia; South Africa, Saudi Arabia; UAE

Key companies profiled

IQVIA; Novartis; Covance; Med pace; Charles River Laboratories; Syneous Health; Icon Plc.; GlaxoSmithKline; Aurora healthcare; Biogen

15% free customization scope (equivalent to 5 analyst working days)

If you need specific market information, which is not currently within the scope of the report, we will provide it to you as a part of customization.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Neurology Clinical Trials Market Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018-2030. For this study, Grand View Research has segmented the global neurology clinical trials market report based on the phase, study design, indication, indication by study design, indication by phase, and region:

-

Phase Outlook (Revenue, USD Million, 2018 - 2030)

-

Phase I

-

Phase II

-

Phase III

-

Phase IV

-

-

Study Design Outlook (Revenue, USD Million, 2018 - 2030)

-

Interventional

-

Observational

-

Expanded Access

-

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Epilepsy

-

Parkinson's Disease (PD)

-

Huntington's Disease

-

Stroke

-

Traumatic Brain Injury (TBI)

-

Amyotrophic Lateral Sclerosis (ALS)

-

Muscle regeneration

-

Others

-

-

Indication by Study Design Outlook (Revenue, USD Million, 2018 - 2030)

-

Epilepsy

-

Interventional

-

Observational

-

Expanded Access

-

-

Parkinson's Disease (PD)

-

Interventional

-

Observational

-

Expanded Access

-

-

Huntington's Disease

-

Interventional

-

Observational

-

Expanded Access

-

-

Stroke

-

Interventional

-

Observational

-

Expanded Access

-

-

Traumatic Brain Injury (TBI)

-

Interventional

-

Observational

-

Expanded Access

-

-

Amyotrophic Lateral Sclerosis (ALS)

-

Interventional

-

Observational

-

Expanded Access

-

-

Muscle regeneration

-

Interventional

-

Observational

-

Expanded Access

-

-

Others

-

Interventional

-

Observational

-

Expanded Access

-

-

-

Indication by Phase Outlook (Revenue, USD Million, 2018 - 2030)

-

Epilepsy

-

Phase I

-

Phase II

-

Phase III

-

Phase IV

-

-

Parkinson's Disease (PD)

-

Phase I

-

Phase II

-

Phase III

-

Phase IV

-

-

Huntington's Disease

-

Phase I

-

Phase II

-

Phase III

-

Phase IV

-

-

Stroke

-

Phase I

-

Phase II

-

Phase III

-

Phase IV

-

-

Traumatic Brain Injury (TBI)

-

Phase I

-

Phase II

-

Phase III

-

Phase IV

-

-

Amyotrophic Lateral Sclerosis (ALS)

-

Phase I

-

Phase II

-

Phase III

-

Phase IV

-

-

Muscle regeneration

-

Phase I

-

Phase II

-

Phase III

-

Phase IV

-

-

Others

-

Phase I

-

Phase II

-

Phase III

-

Phase IV

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Colombia

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global neurology clinical trials market is expected to grow at a compound annual growth rate of 5.6% from 2023 to 2030 to reach USD 8.1 billion by 2030.

b. The global neurology clinical trials market size was estimated at USD 5.2 billion in 2022 and is expected to reach USD 5.5 billion in 2023.

b. North America led the global neurology clinical trials market with the largest revenue share of 47.0% in 2022. With an estimated 8.4 million Americans aged 65 and older suffering from Alzheimer's disease or another dementia by 2030, demand for new therapies and the presence of a large number of players in clinical trials drive the market growth in the region.

b. Some of the players operating in the neurology clinical trials market are IQVIA, Novartis, Covance, Medpace, Charles River laboratories. Others include Syneos health, Icon Plc, GlaxoSmithKline, Aurora healthcare, and Biogen.

b. In contrast to the 1990s and early 2000s, drugmakers now have better tools for manipulating and correcting genes. As a result, Neuroscience is a focus area of several large pharma firms.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."