- Home

- »

- Medical Devices

- »

-

Neurovascular Catheters Market Size, Share Report, 2030GVR Report cover

![Neurovascular Catheters Market Size, Share & Trends Report]()

Neurovascular Catheters Market Size, Share & Trends Analysis Report By Type (Microcatheter, Balloon Catheter, Access Catheter, Embolization Catheter), By Applications, By End-use, And Regional Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68038-420-8

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

The global neurovascular catheters market size was estimated at USD 3.22 billion in 2023 and is projected to expand at a CAGR of 7.25% from 2024 to 2030. The increasing prevalence of neurological conditions such as brain aneurysms and stroke, the adoption of unhealthy lifestyle, increasing awareness among the population about the treatment of neurological conditions, increasing disposable income, and new product launch by the key market players are some of the prime factors driving the market.

Minimally invasive surgeries are gaining popularity owing to reduced risk and trauma associated with these procedures. Strokes, or hemorrhage, are the result of damaged, blocked or injured blood vessels, which can cause bleeding or circulation problems in the brain. Open or minimally invasive surgical techniques are used for the treatment of blocked blood vessels of the brain.

To remove the blockage from the brain, minimally invasive endovascular surgery techniques are preferred. Neurovascular catheters coupled with other advanced devices are preferred as minimally invasive techniques for the treatment of aneurysm, stroke, and other blood vessel conditions in the brain. This minimally invasive technique offers quicker recovery and less stress on the body as compared to open surgery.

Moreover, minimally invasive neurovascular surgeries involve fewer interruptions of muscles and tendons, making the procedure more natural and easier. Certain benefits offered by these catheters, such as easy access to intracranial space, minimal invasion, and simplification of complex procedures owing to advanced designs & features of catheters, make wound closure easier as well as enable faster healing as compared to traditional, open surgery.

Increasing concern for more esthetic and natural appearance in all age groups and less amount of blood loss during minimally invasive surgeries are among the major market growth drivers. Such procedures will further help lower trauma and facilitate quicker recovery than invasive procedures. Thus, neurovascular catheters involve less amount of blood loss and quicker recovery time, which is expected to increase the demand for minimally invasive neurovascular procedures.

A slew of potential new technologies, mergers and acquisitions in the neurovascular space are on the horizon. For instance, in October 2022, the Medtronic Neurovascular Co-Lab Platform was created to help speed much-needed innovation in stroke treatment and care. Their community platform aims to transform ideas and technology into breakthrough global medicines by giving entrepreneurs and physicians with insight and care, and, most importantly, ensuring that innovation reaches as many people as possible around the world. As a result, the availability of new treatment choices and an expanding variety of tactics will drive up demand for neurovascular catheters in the coming years.

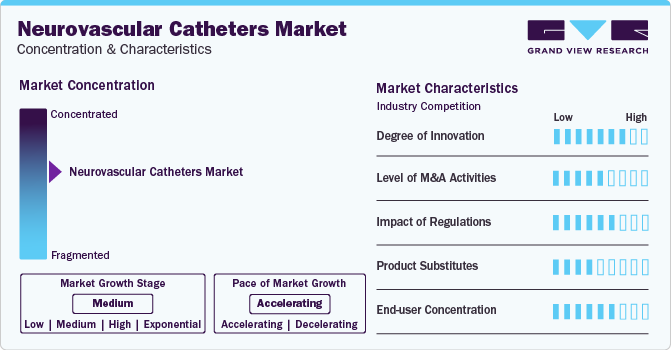

Market Concentration & Characteristics

The degree of innovation in the neurovascular catheter market has been quite significant in recent years, reflecting the development of advanced technologies to improve the safety, effectiveness, and efficiency of treatments for neurovascular diseases. For instance, in May 2024, Penumbra has recently introduced the MIDWAY 43 and MIDWAY 62 delivery catheters, engineered to offer optimal tracking and a dependable platform for facilitating the delivery of diverse embolization treatments within the neurovascular system. These innovations include the introduction of flow diversion devices, improvements in catheter navigability and flexibility, and advancements in materials that reduce the risk of complications.

The neurovascular catheter market is also characterized by a high level of merger and acquisition (M&A) activity by the leading players. The increasing demand for innovative and effective stroke management and neurovascular intervention solutions drives this trend. Major healthcare companies and medical device manufacturers are keen on expanding their product portfolios and enhancing their technological capabilities through strategic acquisitions. For instance, in December 2023, the EQT X fund and Zeus Company, Inc., entered into an agreement for EQT to acquire Zeus Company Inc. from the Tourville family. The transaction demonstrates EQT’s dedication to collaborating with top-tier, mission-driven businesses that provide fundamentally important services to the community.

Regulatory requirements in the neurovascular catheters sector are crucial for maintaining patient safety and the effectiveness of products. However, these regulations also pose obstacles to innovation, market access, and expenses. To successfully introduce their products to the market and ensure ongoing adherence to these standards, companies in this domain must adeptly manage these regulatory challenges throughout the entire lifespan of their products.

There are various substitutes for neurovascular catheters in the market. Some of the commonly used alternatives include stent retrievers, flow diverters, embolic coils, and angiographic catheters. These products may provide similar benefits to neurovascular catheters.

The neurovascular catheter market is significantly affected by the concentration of end users. The market has seen a growing demand from End-users such as hospitals, clinics, ASCs, and others. The increasing prevalence of brain aneurysms and the shift towards minimally invasive neurosurgical procedures have led to a rise in the demand for neurovascular catheters.

Type Insights

In terms of type, the embolization catheters segment dominated the market in 2023 with the largest revenue share of 27.48%. During a catheter embolization procedure, drugs or synthetic substances called embolic agents are injected through a catheter into a selected blood vessel to block blood flow feeding the tumor or malformation. Neurovascular embolization catheters used to stop or control abnormal bleeding can close off vessels supplying blood to a tumor or to treat aneurysms. They are a minimally invasive treatment and offer better control over bleeding than open surgeries. Thus, increasing demand for embolization catheters in the treatment of aneurysms is expected to boost the market.

Embolization catheters offered by Biomerics are used to occlude or block blood flow to an area of the body. For instance, in May 2022, Biomerics launched a new division called Biomerics Imaging Guided Intervention (IGI). The IGI Division of Biomerics offers innovative image production and processing technologies for real-time minimally invasive advanced surgery operations. Biomerics IGI was established to link Biomerics interventional catheter technology with its imaging and guidance technologies in order to allow these systems which is anticipated to boost the segment growth in near future.

Microcatheter is anticipated to witness the fastest CAGR over the forecast period. Microcatheters are small, hollow tubes inserted into blood vessels used in neurovascular procedures. They are intended to deliver various neurovascular devices to the brain site and are used in numerous diagnostic & therapeutic cranial procedures. These catheters are advanced devices and designed with several properties, such as softness, trackability, hydrophilic coating, & stability.

Increasing number of growth strategies by key market players such as product launch, mergers & acquisitions, and others along with the rising prevalence of acute ischemic stroke will drive the segment growth in near future. For instance, in March 2022, Guerbet announced that it will launch a new line of guidewires, resulting in a broad range of embolization solutions and interventional imaging available and more than double its line of microcatheter. These factors are propelling the segment growth over the forecast period.

Component Insights

In terms of components, the nylon tubing/pebax segment dominated the market in 2023 with the largest revenue share of 38.98%. The superior properties of Pebax and nylon contribute to higher success rates in neurovascular interventions by reducing procedural complications, such as catheter kinking or breakage. Manufacturers are encouraged to innovate new types of catheters using these materials to meet specific clinical needs, such as variable stiffness catheters that offer different flexibilities along their length for enhanced navigation.

Moreover, the biocompatibility & safety profiles of Pebax and nylon facilitate smoother regulatory approvals for new catheters, which increases the time to market. As technology and materials science continue to advance, the impact of these materials on the market is expected to grow, leading to innovative solutions in neurovascular care. These factors are expected to drive the segment’s growth over the forecast period.

Application Insights

In terms of application, the brain aneurysms segment dominated the market in 2023 with the largest revenue share of 32.79%. Brain aneurysms, also called intracranial aneurysms, are leaks or ruptured blood vessels, that cause bleeding in the brain. Factors contributing to the formation of intracranial aneurysms are hypertension, smoking, injury or trauma to blood vessels, a complication from a few types of blood infections, and genetic predisposition. Thus, a global increase in the prevalence of brain aneurysms is anticipated to boost the market in the forecast period.

The treatment of an aneurysm includes surgical clipping, medical therapy, endovascular therapy, or coiling without or with adjunctive devices. Some of the FDA-approved microcatheters available for the treatment of cerebral aneurysms are the JET Family of Reperfusion Catheters System (Penumbra) and CODMAN ENTERPRISE 2 (Johnson & Johnson). These devices can recover or destroy blood clots in aneurysms, thus boosting the market growth.

The others segment is anticipated to grow at the fastest CAGR over the forecast period. Other application segments consist of Moyamoya disease, carotid artery stenosis, and cerebral atherosclerosis. Moyamoya disease is a rare cerebral disorder caused by obstructed arteries at the base of the brain. The condition may cause a recurrent transient ischemic attack, stroke, or bleeding in the brain. According to NORD, Moyamoya disease incidence is higher in Asian countries, such as Japan, Korea, and China, than Europe or North America.

Carotid artery stenosis, also called carotid artery disease, is a blockage or narrowing of carotid arteries. This usually results in the build-up of fatty deposits called plaque within the arteries, which is called atherosclerosis. It can get worse over a period to completely block the artery, which may lead to stroke. Common risk factors include smoking, high blood pressure, age, diabetes, obesity, and an unhealthy lifestyle. Cerebral or intracranial arteriosclerosis is caused by hardening and thickening of arterial walls in the brain. It can lead to transient ischemic or hemorrhagic strokes, or even long-term motor impairments. Thus, the increasing prevalence of the abovementioned neurovascular disorders is anticipated to drive the market.

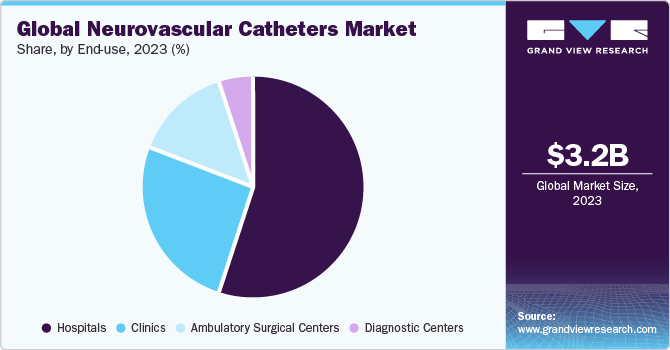

End-use Insights

In terms of end use, the hospital segment dominated the market in 2023 with the largest revenue share of 55.29%. The growth of this segment can be attributed primarily to the increasing patient pool suffering from neurovascular disorders, such as ischemic & hemorrhagic stroke, brain aneurysm, Traumatic brain injury (TBI), and Arteriovenous Malformation (AVM). For instance, according to the World Stroke Organization, throughout their lifetime, 1 in 4 persons over the age of 25 years is expected to experience a stroke. Every year, 13.7 million people are expected to experience their first stroke, and 5.5 million of them may die. Without suitable action, it appears that the annual death toll will increase to 6.7 million.

Moreover, over 15 million people are living with the impact of hemorrhagic stroke globally. Furthermore, the availability of technologically advanced neurovascular catheters, coupled with favorable reimbursement policies, can further enhance market growth in hospitals during the forecast period. For instance, Medtronic offers comprehensive services to secure and maintain coverage & payment for various neurovascular devices.

In addition, the increasing number of patients being admitted to hospitals due to surgeries, therapies, and treatments is projected to favor the neurovascular catheters industry. Thus, the subsequent increase in a number of patients across the globe, the launch of technologically advanced products, and favorable reimbursement policies are leading to a growing demand for hospital treatments.

The ambulatory surgical centers segment is anticipated to grow at the fastest CAGR over the forecast period. Ambulatory Surgical Centers (ASCs) offer several advantages to patients, including shorter procedure time and same-day discharge, as compared to hospitals. Most neurosurgeries can now be performed at ASCs, as surgical procedures can be more advanced and less invasive. Since ASCs can be less expensive than hospitals, they provide significant cost savings to patients. Due to these reasons, ASCs have been growing rapidly.

Thus, the growth of the ASC segment can be attributed to shorter procedure time and advancements in minimally invasive surgical techniques. An increase in the number of ASCs and other healthcare modern facilities is expected to drive the segment. For instance, according to ASC Becker in April 2024, the total number of Medicare-certified ASCs in the U.S. is nearly 6,087. Thus, an increasing number of ASCs and rising awareness about the availability & advantages of other medical facilities are expected to help this segment grow over the forecast period.

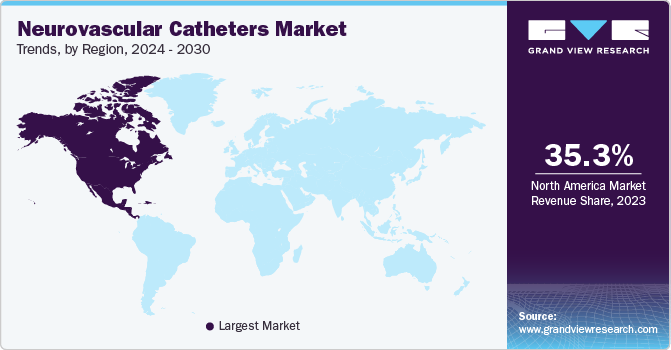

Regional Insights

North America neurovascular catheters market held the largest share and accounted for 35.29% of global revenue in 2023. This high share is attributable to the increase in the prevalence of various neurovascular disorders such as stroke & brain aneurysms as well as the rise in the demand for minimally invasive neurological procedures.Government support, including the formation of the American Society of Craniofacial Surgery (ASCFS), aimed at raising awareness about less invasive Craniomaxillofacial (CMF) surgeries, is anticipated to drive market growth throughout the forecast period.

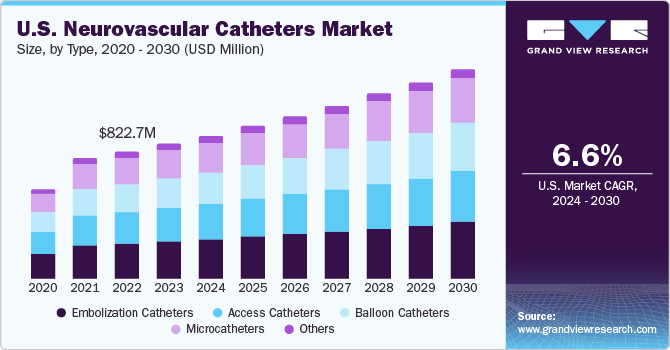

U.S. Neurovascular Catheters Market Trends

The neurovascular catheters market in U.S. held the largest share in North America neurovascular catheters market in 2023. An increasing number of initiatives being undertaken by various organizations is expected to fuel market growth. For instance, The Bee Foundation (TBF), a nonprofit organization, is focused on spreading awareness and reducing the number of deaths due to cerebral aneurysm by innovative research. The market for neurovascular catheters is anticipated to be driven by these factors.

Europe Neurovascular Catheters Market Trends

Europe neurovascular catheters market is driven by factors such as increasing incidence of acute ischemic stroke, rising adoption of sedentary lifestyle, and introduction of technologically advanced products in the European market are contributing to the growth of the neurovascular catheters market.

The neurovascular catheters market in UK is driven by factors such as increasing awareness regarding the treatment of acute ischemic stroke and the presence of several major players in the market are among major factors contributing to the market growth. In addition, several initiatives related to the treatment of acute ischemic stroke in the UK are expected to boost market growth.

France neurovascular catheters market is anticipated to witness significant growth over the forecast period owing to technological advancements, rising prevalence of neurovascular disorders, growing geriatric population, and increasing healthcare expenditure are some of the factors fueling the market growth.

The neurovascular catheters market in Germany is driven by factors, such as an increase in the prevalence of acute ischemic stroke, leading to a higher number of mechanical thrombectomy procedures, and high adoption of technologically advanced products are among major factors driving the growth of Germany market over the forecast period.

Asia Pacific Neurovascular Catheters Market Trends

Asia Pacific neurovascular catheters market is anticipated to witness significant growth. This is due to a very high prevalence of kidney diseases, rapid improvements in medical infrastructure, and the availability of insurance policies. Moreover, the presence of a large patient pool and the growing need for technologically advanced & cost-efficient healthcare solutions are expected to present significant regional growth opportunities in the market.

The neurovascular catheters market in China accounted for the largest share of the Asia Pacific market in 2023. The presence of key market players in the region and rising strategic initiatives by key players are expected to boost the demand for neurovascular catheters in China in the coming years.

Japan neurovascular catheters market is moderately competitive, with the presence of some major companies offering neurovascular catheters. Major players in the market are adopting several strategies such as mergers & acquisitions and partnerships & collaborations to stay competitive in the market.

Latin America Neurovascular Catheters Market Trends

The neurovascular catheters market in Latin America is driven due to the region's growing geriatric population and rising healthcare costs, which are expected to fuel demand for neurovascular catheters in coming years.

MEA Neurovascular Catheters Market Trends

MEA neurovascular catheters market is expected to witness significant growth due to various factors, such as growing health insurance penetration, increasing privatization, and rising regional disease burden are factors expected to drive regional market growth. The Saudi Arabia market accounted for the largest share of the MEA market.

Global Incidence For all Ischemic Stroke for Year 2022

Measure: Incidence

Number

Crude rate per 100,000 per year (95% UI)

Age-adjusted rate per 100,000, per year (95% UI)

Approved Statement for use in World Stroke Organization (WSO) Materials

Ages (all), Sexes (both)

7,630,803

94.51 (81.91-110.76)

98.62 (84.90-115.80)

There are over 7.6 million new ischaemic strokes each year. Globally, over 62% of all incident strokes are ischaemic strokes.

15-49 years

865,723

22.00 (16.37-29.50)

-

Each year, over 11% of all ischaemic strokes occur in people 15-49 years of age.

<70 years

4,427,351

60.87 (49.72-72.93)

-

Each year, over 58% of all ischaemic strokes occur in people under 70 years of age.

Men (all ages)

3,445,762

88.79 (76.15-103.81)

90.91 (78.52-106.55)

Each year, 45% of all ischaemic strokes occur in men.

Women (all ages)

4,185,041

108.52 (93.57-127.20)

97.22 (84.12-113.94)

Each year, 55% of all ischaemic strokes occur in women.

Global prevalence for all Ischemic Stroke for Year 2022

Measure: Prevalence

Number

Crude rate per 100,000 per year (95% UI)

Age-adjusted rate per 100,000, per year (95% UI)

Approved Statement for use in World Stroke Organization (WSO) Materials

Ages (all), Sexes (both)

77,192,498

997.65 (889.92-1,117.39)

950.97 (849.82-1,064.06)

Globally, there are over 77 million people currently living who have.

experienced ischaemic stroke.

15-49 years

14,480,207

367.97 (306.12-440.40)

-

19% of people who have experienced an ischaemic stroke and are currently.

living are people 15-49 years of age.

<70 years

47,161,262

648.37 (569.07-730.52)

-

61% of people who have experienced an ischaemic stroke and are currently.

living are under the age of 70.

Men (all ages)

33,216,442

855.88 (759.25-967.92)

863.51 (767.96-974.62)

43% of people who have experienced an ischaemic stroke and are currently.

living are men.

Women (all ages)

43,976,056

1,140.31 (1,020.45-1,273.16)

1,025.52 (918.48-1,144.69)

57% of people who have experienced an ischaemic stroke and are currently.

living are women.

Globally, women account for just over half (56%) of all persons who have

experienced an ischaemic stroke.

Key Neurovascular Catheters Company Insights

Top manufacturers are adapting to the shift towards user comfort through technological advancements, and innovative products. These innovative products are driving the market growth positively over the forecast period. Moreover, the market is experiencing significant growth, driven by advancements in minimally invasive surgical procedures and a rising incidence of neurovascular diseases. Emerging players in this market are contributing to its dynamic landscape through innovation and strategic expansions.

Key emerging companies in the market include:

-

Imperative Care Inc.: Known for its innovative neurovascular devices aimed at improving stroke care.

-

Acandis GmbH: A German company focusing on the development of neurovascular stents and catheters.

-

Access Vascular, Inc.: Specializes in novel catheter technologies designed to reduce complications.

-

Balt USA LLC: Offers a range of neurovascular products, including embolization and access catheters.

-

Shape Memory Medical Inc.: Develops shape memory polymer technology for neurovascular applications.

Key Neurovascular Catheters Companies:

The following are the leading companies in the neurovascular catheters market. These companies collectively hold the largest market share and dictate industry trends.

- Medtronic

- Nordson Corporation

- Stryker Corporation

- Terumo Corporation

- Integer Holdings Corporation

- Penumbra, Inc.

- Johnson & Johnson Services, Inc.

- Integra LifeSciences Corporation

Recent Developments

-

In May 2024, Scientia Vascular has received FDA approval for two of its neurovascular catheters, the company announced. The Plato 17 microcatheter, according to Scientia Vascular, provides doctors with enhanced control and stabilization for neurovascular procedures and is compatible with DMSO

-

In February 2024, CERENOVUS, Inc., launched CEREGLIDE 71 Intermediate Catheter, a next-generation intermediate catheter with TruCourse indicated for the revascularization of patients suffering from acute ischemic stroke

-

In July 2023, Stryker launched its Q Guidance System with Cranial Guidance Software to offer physicians an intraoperative guiding system and image-based planning tool that helps with instrument placement and patient anatomy identification during cranial surgery. Craniotomies, transsphenoidal and skull base surgeries, shunt placements, and biopsies can all be performed using the program

-

In November 2023, Terumo Corporation announced the establishment of Terumo South Africa (Pty) Ltd. (Terumo South Africa), its newest subsidiary in South Africa. In the company’s ongoing efforts to broaden its worldwide reach and fortify its position in important developing countries, this deliberate decision marks a critical turning point

Neurovascular Catheters Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.44 billion

Revenue forecast in 2030

USD 5.23 billion

Growth rate

CAGR of 7.25% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; U.K.; France; China; Japan; India; South Korea; Australia; Brazil; Mexico; KSA; UAE; South Africa

Key companies profiled

Medtronic; Nordson Corporation; Stryker Corporation; Terumo Corporation; Integer Holdings Corporation; Penumbra, Inc.; Johnson & Johnson Services, Inc.; Integra LifeSciences Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Neurovascular Catheters Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the neurovascular catheters market research report based on the type, component, application, End-use, and region.

-

Type Outlook (Revenue USD Million, Volume unit; 2018 - 2030)

-

Microcatheters

-

Balloon Catheters

-

Access Catheters

-

Embolization Catheters

-

Others

-

-

Component Outlook (Revenue USD Million; 2018 - 2030)

-

Catheter Mandrels

-

Catheter Liners

-

Reflow Heat Shrinks

-

Nylon Tubing/Pebax

-

Other Components

-

-

Application Outlook (Revenue USD Million; 2018 - 2030)

-

Embolic Stroke

-

Brain Aneurysm

-

Arteriovenous Malformations

-

Others

-

-

End-use Outlook (Revenue USD Million; 2018 - 2030)

-

Hospitals

-

Clinics

-

Ambulatory Surgical Centers

-

Diagnostic Centers

-

-

Regional Outlook (Revenue USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global neurovascular catheters market was estimated at USD 3.22 billion in 2023 and is expected to reach USD 3.44 billion in 2024.

b. The global neurovascular catheters market is expected to grow at a compound annual growth rate of 7.25% from 2024 to 2030 to reach USD 5.23 billion by 2030.

b. North America dominated the neurovascular catheters market with a share of 35.29% in 2023. This is attributable to the increasing government initiatives, rising demand for minimally invasive surgical procedures and technological advancement by the key market players in the region.

b. Some key players operating in the neurovascular catheters market include Medtronic, Stryker, phenox GmbH, Penumbra, Inc., Integer Holdings Corporation, Terumo Corporation, Integra LifeSciences Corporation, Biomerics, Acandis GmbH, and Spiegelberg GmbH & Co. KG.

b. Key factors that are driving the neurovascular catheters market growth include the increasing prevalence of neurological conditions such as brain aneurysms and stroke, adoption of unhealthy lifestyles, increasing disposable income, and new product launch by the key market players.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."