- Home

- »

- Next Generation Technologies

- »

-

Next-Generation Data Storage Market Size Report, 2030GVR Report cover

![Next-Generation Data Storage Market Size, Share & Trends Report]()

Next-Generation Data Storage Market (2024 - 2030) Size, Share & Trends Analysis Report By Storage System (DAS, NAS, SAN), By Storage Technique (Magnetic Storage, SSD, Hybrid), By Storage Type, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-611-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Next-Generation Data Storage Market Summary

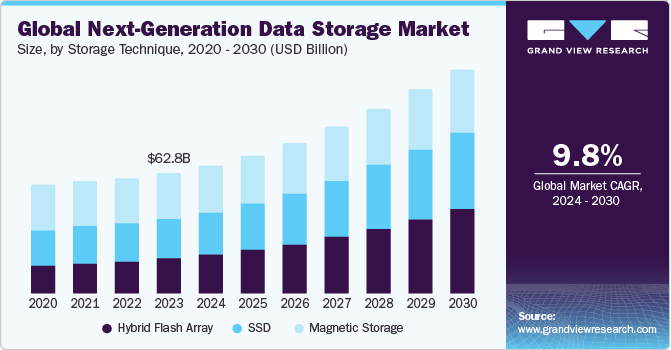

The global next-generation data storage market size was estimated at USD 66.52 billion in 2023 and is projected to reach USD 116.69 billion by 2030, growing at a CAGR of 9.8% from 2024 to 2030. Some of the key factors expected to drive the market growth in the near future include significant growth in the global penetration of IoT in retail, healthcare, manufacturing, and others and a consequent rise in the trend of cloud computing.

Key Market Trends & Insights

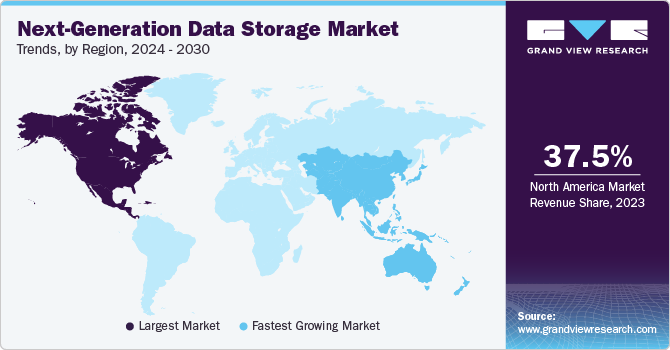

- North America dominated the next-generation data storage market with a revenue share of 37.46% in 2023.

- Based on storage system, the network-attached storage (NAS) segment is anticipated to witness at the fastest CAGR over the forecast period.

- Based on storage technique, the solid state drive storage segment led the market with the largest revenue share of 32.86% in 2023.

- Based on storage type, the local (on-premises) storage segment led the market with the largest revenue share of 52.58% in 2023.

- Based on end-use, the segment is divided into home and business.

Market Size & Forecast

- 2023 Market Size: USD 66.52 Billion

- 2030 Projected Market Size: USD 116.69 Billion

- CAGR (2024-2030): 9.8%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

Digitization of data in residential and commercial places, supported by an escalated use of laptops, smartphones, and tablets, is significantly contributing to the market growth.

There is massive growth in digital data volume across several industry verticals, such as healthcare, retail, and BFSI, which is expected to grow demand for next-gen data storage devices.

Market players are relying on the scalability, effectiveness, and flexibility of cloud data storage as data generation is increasing. To take advantage of cloud storehouse capabilities, market players are investing in innovative technologies such as crystal etching techniques. Combining Big Data analytics and cloud storage is allowing data storage companies to establish real-time and reliable access across all channels to enhance the customer experience especially when it comes to online shopping and internet banking.

There is a growing need for high-speed and robust data solutions due to the increasing demand for data digitization and the reduction of human labor. However, the high costs associated with advanced technologies that meet market needs may result in limited adoption in economically sensitive regions such as APAC and MEA. Despite this, the market's lucrative growth prospects are expected to create significant opportunities for data analytics driven by consumer demands.

The rising production of input-output devices is a key contributor to market growth. Data generation across various sectors underscores the need for its maintenance and organization. Recent technological advancements, such as online shopping, smart technologies, and automated systems, are driving a significant shift in the market. In addition, increased funding for R&D in advanced technologies to meet consumer needs is contributing to market growth.

The increasing penetration of the Internet, the growing online commerce industry, the digitization of everyday activities, and the rising volume of media data transfer are expected to boost the market penetration of solid-state drives and cloud storage. The impending launch of products with improved speed and capacity is poised to drive strong growth in the global market.

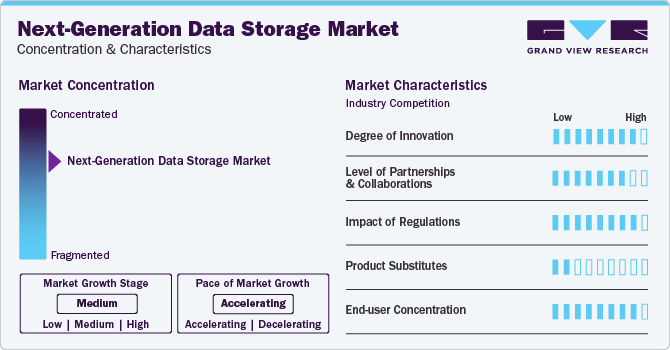

Market Concentration & Characteristics

The market is characterized by a high degree of innovation, with ongoing advancements in storage technologies, architectures, and solutions. Key players in the market continuously invest in research and development to introduce new storage technologies and features, enhancing performance, scalability, reliability, and security. Emerging technologies such as cloud computing, edge computing, artificial intelligence (AI), and machine learning (ML) drive innovation in the market, enabling organizations to leverage data more effectively for business insights and competitive advantages.

Collaboration and partnerships among industry players, including storage vendors, cloud service providers, technology integrators, and solution providers, are essential for addressing complex customer needs and driving market growth. Strategic alliances, joint ventures, and collaborations facilitate the development of integrated storage solutions, interoperability between different storage platforms, and ecosystem expansion. Partnerships with technology providers, software vendors, and system integrators enable storage vendors to offer comprehensive solutions that meet the diverse requirements of end-users and industries.

The market is subject to medium levels of regulation, driven by data protection, privacy, and compliance requirements across industries and regions. Regulations such as GDPR (General Data Protection Regulation), HIPAA (Health Insurance Portability and Accountability Act), PCI-DSS (Payment Card Industry Data Security Standard), and others influence data storage practices, security measures, and data handling procedures. Compliance with regulatory requirements is essential for storage vendors and organizations to avoid legal liabilities, penalties, and reputational damage. Adherence to industry standards and certifications demonstrates commitments to data protection and regulatory compliance.

The availability of direct substitutes for solutions is low, given the unique features, capabilities, and performance characteristics offered by advanced storage technologies. While alternative storage solutions exist, such as traditional hard disk drives (HDDs), solid-state drives (SSDs), and magnetic tape storage, they may not fully meet the scalability, performance, and efficiency requirements of environments. Next-generation data storage solutions, including cloud storage, object storage, software-defined storage, and hyper-converged infrastructure, offer distinct advantages in terms of scalability, agility, cost-effectiveness, and data management capabilities, reducing the likelihood of direct product substitutes.

The market exhibits a high concentration of end-users, with a focus on large enterprises, government agencies, financial institutions, healthcare organizations, and technology companies. These industries generate and manage vast amounts of data, driving the demand for advanced storage solutions capable of handling diverse workloads, applications, and data types. Large enterprises with complex IT environments and stringent data storage requirements are key customers for vendors, accounting for a significant portion of market demand and revenue.

Storage System Insights

Based on storage system, the direct-attached storage (DAS) segment led the market with the largest revenue share of 36.01% in 2023. The basic and simple architecture of DAS enables a variety of data accessibility features for instance, any PC or laptop may directly access their own DAS, or they can access data stored on DAS directly connected to storage servers over a network. The low cost of DAS technology drives its penetration among small- and medium-scale businesses. DAS offers superior performance compared to other storage solutions like Network-Attached Storage (NAS) and Storage Area Networks (SAN) due to its direct connection to the host computer. This direct connection results in lower latency and higher data transfer speeds, making DAS an ideal choice for applications requiring high-performance storage.

The Network-Attached Storage (NAS) segment is anticipated to witness at the fastest CAGR during the forecast period. The user-friendly nature of NAS platforms, coupled with features like automated data backup and expanded storage space, along with affordable pricing, makes NAS an appealing option, particularly for small- and medium-sized enterprises (SMEs). The segment's growth is further fueled by the increasing need for multiple users to access data from a single connected device via a secure network. NAS systems facilitate easy data access over a network, including remote access capabilities. This feature is especially advantageous for businesses with distributed teams or remote workers, as it ensures seamless data access from any location with internet connectivity.

Storage Type Insights

Based on storage type, the local (on-premises) storage segment led the market with the largest revenue share of 52.58% in 2023. The segment is driven largely by its high performance. Local storage is best suited for residential or small-sized enterprises due to its cost-effectiveness and backup & recovery capability. However, the low capacity and low reliability of local storage are a few key challenges that can hinder its adoption to a certain extent over the forecast period. On-premises storage provides organizations with complete control over their data, which is a critical factor for industries handling sensitive information, such as finance, healthcare, and government sectors. The ability to physically secure storage devices within their own facilities reduces the risk of data breaches and unauthorized access, ensuring higher levels of data security.

The hybrid storage type segment is anticipated to grow at the fastest CAGR over the forecast period. A hybrid storage system uses both local and off-site resources to manage data. As a result, hybrid storage systems allow companies to move workloads between private clouds or on-premises data storage and use the public cloud to host applications and data. The growing need to manage large volumes of data structured as well as unstructured is a crucial contributing factor to this segment’s promising growth prospects in the near future. Hybrid storage architectures enhance data resiliency and disaster recovery capabilities. By replicating critical data between on-premises and cloud storage environments, organizations can mitigate the risk of data loss due to hardware failures, natural disasters, or cyberattacks. This redundancy ensures continuous data availability and minimizes downtime in the event of a storage system failure or outage.

Storage Technique Insights

Based on storage technique, the magnetic storage segment led the market with the largest revenue share of 38.28% in 2023, driven by the easy availability and lack of competitive rivalry in magnetic storage market. Although HDD's low prices play a key role in driving their demand, the segment is likely to witness a gradual decline in market share through the forecast period driven by the emergence of improved storage mediums. The Solid-State Drive (SSD) segment is estimated to emerge as one of the fastest-growing next-generation data technology, supported by safer data encryption and storage using electronic chips instead of magnetic strips. An elongated lifecycle, low noise & heat production, high operational speed, and low power consumption are also expected to some of the key characteristics of SSD. Magnetic storage technologies like HDDs and magnetic tapes have been widely used for decades and have established a strong foothold in the market. This legacy technology continues to dominate due to its reliability, durability, and cost-effectiveness, making it a preferred choice for many organizations, especially those with large-scale storage requirements.

There is a huge difference in terms of price and performance between magnetic and SSD storage technologies. Magnetic storage is considered as the most convenient storage technology in terms of capacity, but it’s very low on performance whereas, SSD has been developed with fast performance but low capacities. A hybrid array is a type of storage technology that aims to bridge the gap between them. Furthermore, with the growing demand for efficiency and performance amongst complex enterprise applications such as big data, IoT, and artificial intelligence technologies, hybrid flash array storage technology can be used to overcome the pitfalls of traditional storage systems.

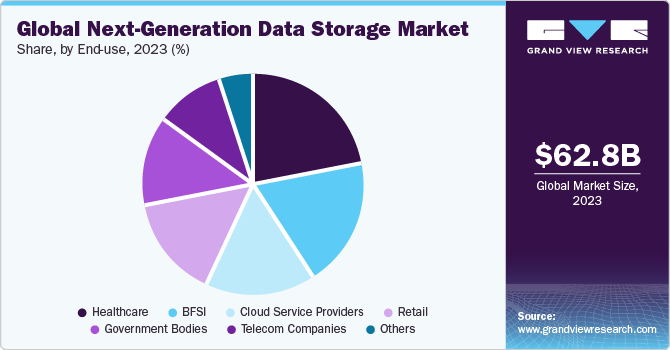

End-use Insights

Based on end-use, the segment is divided into home and business. The business segment led the market with the largest revenue share of 56.82% in 2023. It is further bifurcated it into banking, financial services, and insurance (BFSI), retail, healthcare, government bodies, telecom companies, cloud service providers, and others. The healthcare segment accounted for the largest revenue share of 21.96% in 2023 and is anticipated to retain its leading position throughout the forecast period. Data storage in the healthcare segment has undergone a paradigm shift in the last few years, from simple data storage to the utilization of cloud space for personalized treatment and care. The rising application of hybrid cloud in the healthcare industry is anticipated to be a major growth driver for the healthcare segment in the foreseeable future. Businesses, especially large enterprises, have substantial data storage requirements due to the increasing volume of digital data generated from various sources such as transactions, customer interactions, IoT devices, and multimedia content. This drives the demand for advanced data storage solutions capable of handling large-scale volumes of data and management needs.

The cloud service providers segment is projected to grow at the fastest CAGR over the forecast period. Cloud computing is likely to play a massive role in the development of next-generation machines. Technological advancements, such as hybrid cloud, IoT, BDaaS, and PaaS, are a crucial propeller of market growth in this segment.Cloud service providers invest heavily in advanced security measures to protect customer data against cyber threats, unauthorized access, and data breaches. Cloud storage solutions incorporate encryption, access controls, data isolation, and compliance certifications to ensure data security and compliance with regulatory requirements such as GDPR, HIPAA, PCI-DSS, and others. These security features and certifications provide organizations with peace of mind and confidence in the security of their data stored in the cloud.

Regional Insights

North America dominated the next-generation data storage market with a revenue share of 37.46% in 2023. North America leads the market due to its status as a technological innovation hub, with major companies driving advancements in storage technologies. Large enterprises in the region, particularly in data-intensive industries such as finance, healthcare, and technology, fuel demand for scalable solutions to manage vast data volumes generated by digital transformation initiatives and cloud computing adoption. In addition, North America's regulatory environment mandates secure storage practices, further stimulating the adoption of advanced storage solutions. Strategic partnerships between storage vendors and cloud providers, combined with ongoing investments in infrastructure, infrastructure, bolster North America's dominance in the market, making it a pivotal region for solutions.

U.S. Next-Generation Data Storage Market Trends

The next-generation data storage market in the U.S. is characterized by technological innovation, large enterprise adoption, cloud computing leadership, a robust regulatory environment, infrastructure investments, strategic partnerships, and data-intensive industries. With a concentration of leading storage technology companies and cloud service providers, the U.S. drives advancements in storage solutions while meeting regulatory compliance requirements. Investments in IT infrastructure and strategic collaborations fuel market growth, catering to the storage needs of various sectors, including finance, healthcare, and technology. This combination of factors solidifies the U.S.'s position as a dominant player in the global market, fostering innovation and driving continued market expansion.

Asia Pacific Next-Generation Data Storage Market Trends

The next-generation data storage market in Asia Pacific is anticipated to grow at the fastest CAGR during the forecast period, due to its rapid digital transformation, expanding IT infrastructure, burgeoning enterprise modernization efforts, and thriving emerging markets. With governments promoting digital initiatives and increasing data privacy concerns, businesses across Asia Pacific are investing in advanced storage solutions to comply with regulations and support innovation. Strategic partnerships and investments from leading technology companies further accelerate market growth, while the exponential growth of mobile data drives demand for storage solutions tailored to mobile workloads. As Asia Pacific continues to embrace digitalization and technology adoption, it presents significant growth opportunities for storage vendors looking to capitalize on the region's dynamic market landscape and meet the evolving storage needs of businesses across diverse industries.

The China next-generation storage market is propelled by government initiatives promoting digital transformation, rapid digitalization, and the adoption of emerging technologies like cloud computing and AI. With a booming e-commerce sector, expanding middle class, and emphasis on data security, the demand for advanced storage solutions capable of handling vast data volumes is on the rise. Domestic storage vendors, supported by government incentives and regulations, play a pivotal role, alongside strategic investments, partnerships, and global competitiveness. As China asserts its position as a key player in the global storage market, innovations, and technological advancements continue to drive market growth, presenting significant opportunities for both domestic and international players.

Europe Next Generation Data Storage Market Trends

The next-generation data storage market in Europe is characterized by a complex interplay of regulatory compliance, digital transformation initiatives, sustainability goals, and innovation ecosystems. Stringent data protection regulations such as GDPR shape storage practices, driving demand for advanced solutions that ensure privacy, security, and compliance. Europe's focus on sustainability prompts the adoption of energy-efficient storage technologies, aligning with environmental objectives. The region's growing digital economy, cloud adoption trends, and hybrid deployments stimulate demand for scalable and flexible storage solutions capable of supporting diverse workloads. In addition, concerns over data sovereignty drive the preference for local storage options and data residency solutions. Europe's vibrant innovation ecosystem fosters advancements in storage technologies, positioning the region as a hub for storage innovation and technology development. Overall, these factors underscore Europe's significance as a key market for solutions, with a strong emphasis on security, sustainability, and innovation.

The UK next-generation data storage market is defined by a combination of regulatory compliance, digital transformation initiatives, cloud adoption trends, cybersecurity priorities, innovation hubs, and data sovereignty concerns. Stringent data protection laws such as the GDPR drive demand for advanced storage solutions that ensure compliance and protect sensitive data. The country's robust digital economy, coupled with a strong emphasis on cybersecurity, accelerates the adoption of cloud storage and advanced security features. The UK's reputation as an innovation hub fosters collaboration and technological advancements in storage technologies, positioning the country as a leader in storage innovation and technology development. In addition, concerns over data sovereignty drive the preference for local storage options and data residency solutions. Overall, these factors underscore the UK's significance as a key market for solutions, with a focus on security, compliance, innovation, and data sovereignty.

Key Next-Generation Data Storage Companies Insights

Some of the key companies operating in the Market include Dell Technologies Inc., Hewlett Packard Enterprise, among others.

-

Dell Technologies offers a comprehensive portfolio of storage solutions, including traditional storage arrays, software-defined storage, hyper-converged infrastructure, and cloud-based storage services. The company's storage offerings cater to a wide range of use cases, from enterprise data centers to edge computing environments, focusing on scalability, performance, and data management capabilities

-

HPE provides a diverse range of storage solutions, spanning from traditional storage systems to modern hybrid cloud storage architectures. The company's storage portfolio includes solutions for data management, backup and recovery, software-defined storage, and AI-driven storage optimization. HPE emphasizes agility, efficiency, and intelligence in its storage offerings to support digital transformation initiatives

Rubrik, and Cohesity are some of the emerging market companies in the target market.

-

Cohesity offers hyper-converged secondary storage solutions that consolidate data protection, backup, file services, and analytics onto a single platform. The company's focus on simplifying data management and improving data visibility resonates with organizations seeking to streamline storage infrastructure and unlock insights from their data

-

Rubrik provides cloud data management solutions that combine backup, recovery, replication, and data archival capabilities in a unified platform. With a focus on hybrid cloud environments and data mobility, Rubrik helps organizations manage data across diverse IT ecosystems while ensuring security, compliance, and scalability

Key Next-Generation Data Storage Companies:

The following are the leading companies in the next-generation data storage market. These companies collectively hold the largest market share and dictate industry trends.

- Hewlett Packard Enterprise Company

- Dell Inc.

- NetApp, Inc.

- Hitachi, Ltd.

- International Business Machines Corporation

- Micron Technology, Inc.

- Netgear Inc.

- Inspur

Recent Developments

-

In February 2024, Dell Inc. announced the introduction of two new nodes to its all-flash lineup—the Dell PowerScale F210 and F710. This release offers customers the latest generation of high-performance file storage systems, utilizing best-in-class PowerEdge servers to support the most compute-intensive workloads. Integrated with the latest OneFS software, PowerScale serves as the complete AI-ready data platform, providing unmatched performance and scale, exceptional efficiency, federal-grade security, and multicloud agility

-

In March 2024, Hewlett Packard Enterprise unveiled new solutions under the HPE GreenLake cloud, streamlining storage, data, and workload management across on-premises and public cloud environments. These include HPE GreenLake Block Storage for AWS, offering software-defined storage for hybrid cloud setups. Additionally, updates to HPE GreenLake for Block Storage enhance NVMe capacity scaling and introduce HPE Infosight AIOps for improved performance and resource optimization. Furthermore, the HPE Timeless Program introduces investment protection, reducing total cost of ownership for block storage on HPE Alletra MP, while HPE GreenLake for Private Cloud Business Edition expands support to include HPE Alletra MP and HPE SimpliVity Gen 11

Next-Generation Data Storage Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 66.52 billion

Revenue forecast in 2030

USD 116.69 billion

Growth rate

CAGR of 9.8% from 2024 to 2030

Base year or estimation

2023

Historical data

2017 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Storage technique, storage type, storage system, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Singapore; Brazil; KSA; UAE; South Africa

Key companies profiled

Hewlett Packard Enterprise Company; Dell Inc.; NetApp, Inc.; Hitachi, Ltd.; International Business Machines Corporation; Micron Technology, Inc.; Netgear Inc.; Inspur,

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Next-Generation Data Storage Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the next-generation data storage market report based on storage technique, storage type, end-use, and region.

-

Storage Technique Outlook (Revenue, USD Million, 2017 - 2030)

-

Magnetic Storage

-

SSD

-

Hybrid Flash Array

-

-

Storage System Outlook (Revenue, USD Million, 2017 - 2030)

-

Direct-Attached Storage

-

Network-Attached Storage

-

Storage Area Network

-

Others

-

-

Storage Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Local (on-premise)

-

Remote (cloud)

-

Hybrid

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Home

-

Business

-

BFSI

-

Retail

-

Healthcare

-

Government Bodies

-

Telecom Companies

-

Cloud Service Providers

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Singapore

-

South Korea

-

-

South America

-

Brazil

-

-

Middle East & Africa

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global next-generation data storage market size was estimated at USD 62.83 billion in 2023 and is expected to reach USD 66.52 billion in 2024.

b. The global next-generation data storage market is expected to grow at a compound annual growth rate of 9.8% from 2024 to 2030 to reach USD 116.69 billion by 2030.

b. North America dominated the next-generation data storage market with a share of 37.5% in 2023. This is attributed to the large volume of unstructured data across several industry verticals and the need for secure and economic solutions for storing data.

b. Some key players operating in the next-generation data storage market include Hewlett Packard Enterprise Company, Dell Inc., NetApp, Inc., Hitachi, Ltd., International Business Machines Corporation, Micron Technology, Inc., Netgear Inc., and Inspur.

b. Key factors that are driving the market growth include significant penetration of IoT technology in industries such as retail, healthcare, and manufacturing and a consequent rise in the adoption of cloud computing.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.