- Home

- »

- Alcohol & Tobacco

- »

-

Nicotine Pouches Market Size, Share, Industry Report, 2030GVR Report cover

![Nicotine Pouches Market Size, Share & Trends Report]()

Nicotine Pouches Market (2025 - 2030) Size, Share & Trends Analysis Report By Product Type (Tobacco-derived Nicotine, Synthetic Nicotine), By Distribution Channel (Offline, Online), By Flavor, By Strength, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-961-3

- Number of Report Pages: 134

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Nicotine Pouches Market Summary

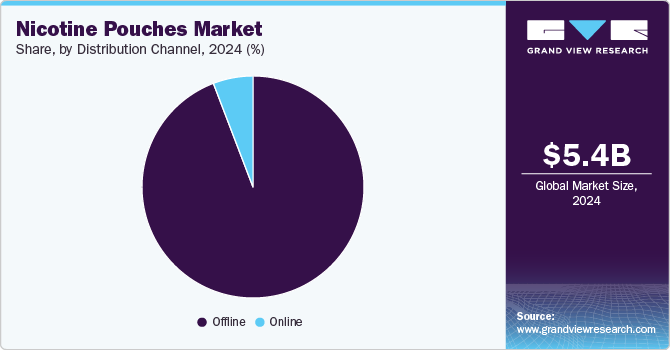

The global nicotine pouches market size was estimated at USD 5.39 billion in 2024 and is projected to reach USD 25.40 billion by 2030, growing at a CAGR of 29.6% from 2025 to 2030. The growing interest in nicotine pouches among younger consumers who are trying to quit smoking, coupled with the rising demand for alternative products that do not involve lung exposure, will drive industry growth during the forecast period.

Key Market Trends & Insights

- North America dominated the nicotine pouches market with the revenue share of 78.4% in 2024.

- The U.S. nicotine pouches market accounted for the largest market share in North America in 2024.

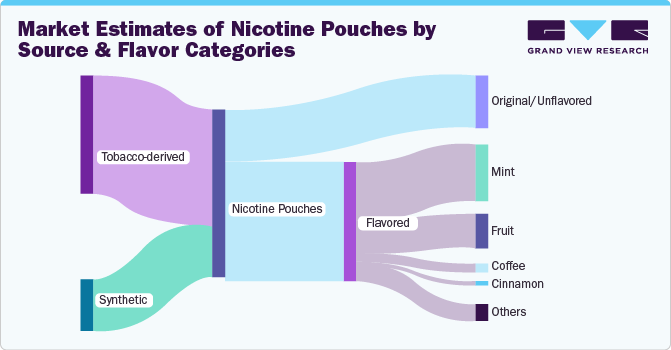

- By product type, the tobacco-derived segment led the market with a share of 95.7% in 2024.

- By flavor, the flavored segment led the market with a revenue share of 89.92% in 2024.

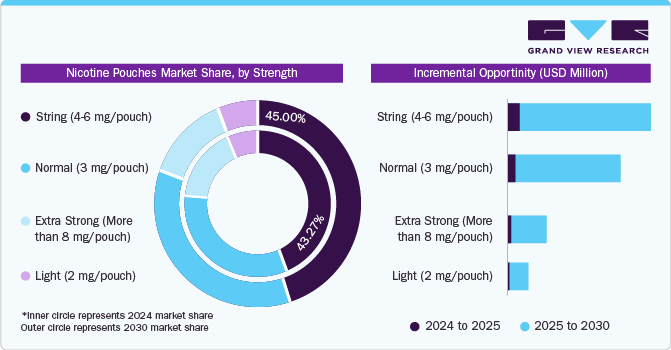

- By strength, the strong (4-6 mg/pouch) segment led the market with a share of 43.3% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 5.39 Billion

- 2030 Projected Market Size: USD 25.40 Billion

- CAGR (2025-2030): 29.6%

- North America: Largest market in 2024

Rutgers, one of America's leading public research universities, published a report in March 2022 that assesses consumer awareness and interest in nicotine pouches among U.S. smokers. About 1,018 smokers in the U.S. were surveyed about their knowledge of nicotine pouches, and the study found that approximately 29% of smokers were aware of these products, 6% had tried the product, and 17% were interested in trying it.

The growing penetration of online retailers selling nicotine pouches has made it convenient for consumers who want to shift to safer alternatives to smoking. This factor contributed to the growth in the sales of nicotine pouches in 2023 and is expected to continue over the forecast period. There is a growing consumer demand for nicotine products that are safer and free from the negative effects of smoke or inhalation. According to the Centers for Disease Control and Prevention (CDC), sales of nicotine pouches in the U.S. increased 300 times between 2016 and 2021.

Key players in the market, including British American Tobacco and Swedish Match, witnessed rapid growth in their modern oral segment in the U.S. from 2020 to 2021. For instance, in the first half of 2021, Swedish Match witnessed a 50% increase in sales of its ZYN products in the U.S. In addition, according to a company report, the shipment of ZYN nicotine pouches amounted to 173.9 million cans in 2021, up from 114.1 million cans in 2020.

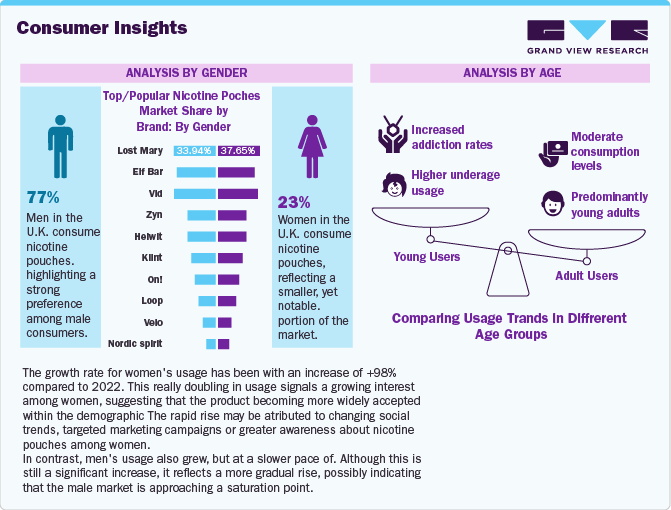

According to a 2023 article published by Boltbe, a nicotine pouches manufacturer, nicotine pouches have become increasingly popular as a smokeless alternative for satisfying nicotine cravings. These small, flavored packets are easy to use and discreet and are growing in popularity due to industry marketing strategies, product availability, and social trends. Their appeal on social media has fueled the demand for nicotine pouches. Influencers and content creators play a major role in establishing trends and shaping perceptions around nicotine pouch usage. Social media platforms like Instagram have created a "digital echo chamber" that normalizes nicotine pouch use within certain social circles. For example, influencers such as D'vey, a DJ, and Billie-Jean Blackett, a model and reality TV star, have posted content featuring the Velo brand, portraying it as a "cool lifestyle product."

Regulatory Insights

Country

Regulatory Body

Product Classification

Age Restrictions & Sales

Packaging & Labelling

Potential Future Regulations

U.S.

- Food and Drug Administration (FDA)

-Federal Trade Commission (FTC)

Tobacco-derived products

21+ for purchase and use

Must have health warnings, ingredient disclosures, and be child-resistant

Stricter guidelines on flavor restrictions and product safety

UK

-General Consumer Protection Laws

-Regulated under the General Product Safety Regulations (GPSR)

General product

-18+ for purchase and use

Products must carry health warnings, clear ingredient lists, and child-resistant packaging

Increasing regulation around flavored products

Canada

Health Canada, Canadian Tobacco, and Nicotine Regulation Office

Tobacco product

18+ (19+ in some provinces) for purchase; restricted sales in some areas

Must include health warnings, detailed ingredient information, and child-resistant packaging

Prohibiting certain flavors and further limiting sales to behind-the-counter at pharmacies

France

French Agency for the Safety of Health Products (ANSM)

Tobacco product

18+ for purchase and use

Must display health warnings and adhere to strict packaging requirements

Outright ban

Austria

Federal Ministry of Health

Austrian Agency for Health and Food Safety (AGES)

Tobacco-derived products

18+ for purchase and use

Health warnings required; packages must be child-resistant

Stricter Marketing Restrictions and enhanced taxation

Sweden

Swedish National Board of Health and Welfare (Socialstyrelsen)

Regulated as a tobacco product

18+ for purchase and use

Must include health warnings and detailed labeling; child-resistant packaging required

Stricter packaging regulations and potential flavor bans

Denmark

Danish Health Authority (Sundhedsstyrelsen)

Classified as a tobacco product under Danish law

18+ for purchase and use

Health warnings and ingredients must be clearly listed; packaging must be child-resistant

Future regulations may focus on flavor restrictions and health-related regulations

Switzerland

Swiss Federal Office of Public Health (FOPH)

Tobacco product

18+ for purchase and use

Must include nicotine content, health warnings, and clear instructions for use

Stricter advertising restrictions, higher taxes on nicotine products,

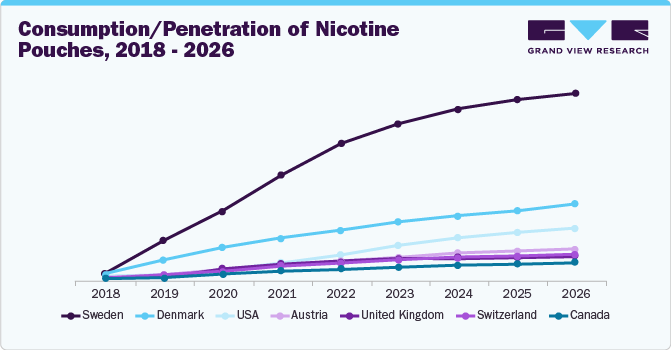

The consumption of nicotine pouches globally has been steadily growing over the past few years. These tobacco-free products, which provide a discreet and clean way to consume nicotine, have seen a rise in adoption among various demographics.

Initially, nicotine pouches were a niche product, but as consumer awareness and acceptance have increased, they have gained a foothold in the market.

Looking ahead, it is expected that the market for nicotine pouches will continue to expand, though at a gradual pace. This trend reflects a broader shift in the way people consume nicotine, with newer, potentially less harmful alternatives emerging as the dominant options.

Product Type Insights

The Tobacco-derived segment led the market with the largest revenue share of 95.7% in 2024. The preference for tobacco-derived nicotine pouches stems from various factors and trends within the industry. These pouches offer users a familiar taste and aroma akin to traditional tobacco products, appealing to those seeking a recognizable experience. With typically higher nicotine content compared to synthetic alternatives, tobacco-derived pouches attract individuals desiring a stronger nicotine hit. In addition, some consumers perceive these products as potentially less harmful than combustible tobacco, driving interest in harm reduction alternatives. Market trends indicate a growing demand for innovative nicotine products, with manufacturers focusing on developing tobacco-derived options to cater to consumer preferences.

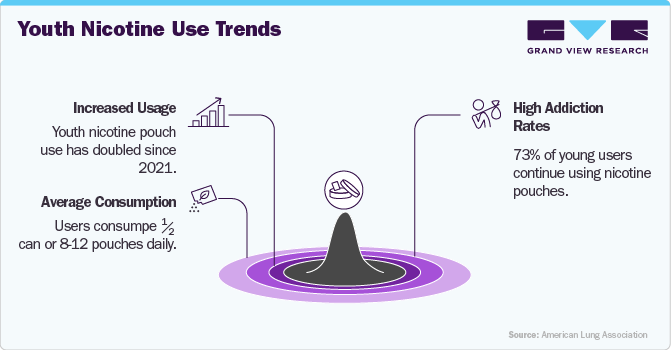

The synthetic segment is expected to grow at a CAGR of 48.5% from 2025 to 2030. Some consumers view synthetic nicotine pouches as a potentially safer alternative, as they do not contain tobacco leaves or combustion byproducts. This aligns with a broader trend of health-conscious consumer behavior, where individuals seek products perceived as less harmful. Furthermore, the wide range of flavors available in synthetic nicotine pouches appeals to consumers looking for novel and enjoyable experiences, particularly younger demographics. The convenience and discretion offered by nicotine pouches, whether synthetic or traditional, also contribute to their popularity, as they can be used discreetly in various settings where smoking is prohibited.

Flavor Insights

Based on flavor, the flavored segment led the market with the largest revenue share of 89.92% in 2024. Nicotine pouches come in many varieties, from those with lower nicotine levels to those with higher levels. They also come in different flavors, including mint, coffee, lemon, and berry. In 2020, 82.9% of youth used flavored nicotine pouches, including 84.7% of high school users (2.53 million) and 73.9% of middle school users (400,000) in the U.S. This variety allows users to explore different options, finding ones that they find enjoyable and satisfying. In addition, flavored pouches often mask the harshness or bitterness associated with tobacco, making the experience more pleasant, particularly for those new to nicotine products or seeking alternatives to traditional smoking.

The original/unflavored segment is expected to grow at the fastest CAGR of 33.8% from 2025 to 2030. Increased demand for reduced-risk alternatives that are both tobacco-free and smoke-free with a taste of tobacco is propelling the sales of unflavored/original products. Unflavored pouches resonate with minimalist lifestyles, offering simplicity and authenticity. A high preference for pure nicotine among U.S. consumers is driving sales of unflavored nicotine pouches in North America. Unflavored pouches offer flexibility, allowing users to tailor their experience by mixing them with other flavors or additives according to their preferences. Some consumers find flavored pouches overwhelming and opt for unflavored options to avoid sensory overload.

Strength Insights

Based on strength, the strong (4-6 mg/pouch) segment led the market with the largest revenue share of 43.3% in 2024. Higher levels of nicotine dependency often prompt individuals to opt for stronger doses, as they provide a more effective means of satisfying cravings and staving off withdrawal symptoms. Particularly for those endeavoring to quit smoking, the stronger nicotine content closely mirrors the intake experienced with cigarettes, facilitating the transition to nicotine pouches. Some users prefer the intensified sensation offered by these higher nicotine levels. Beyond personal preference, stronger pouches offer efficiency by delivering nicotine more promptly and effectively, appealing to individuals seeking a rapid onset of effects. Numerous factors can influence the effect of a nicotine pouch on individual users. Factors such as individual differences, moisture content, pH levels, and even flavoring can influence the strength of the product.

The normal (3 mg/pouch) segment is expected to grow at the fastest CAGR of 30.6% from 2025 to 2030. Moderate tobacco users and those with a lower tolerance to the effects of nicotine prefer tobacco pouches with a regular strength type. However, the availability of various flavors and strength levels that allow customers to choose products tailored to their individual needs will drive industry’s growth. For instance, Swedish Match AB brand ZYN offers a tobacco-flavored nicotine pouch that contains no tobacco in a normal strength range of 3mg. Such factors are likely to bode well for segment growth.

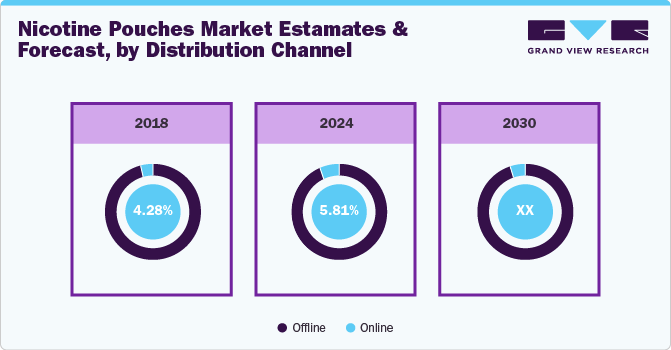

Distribution Channel Insights

Based on distribution channel, the offline segment led the market with the largest revenue share of 94.2% in 2024. The increasing availability of nicotine pouches in various flavors through offline stores such as pharmacies, drug stores, supermarkets/hypermarkets, and convenience stores is likely to drive the segment. Key players/brands in the market majorly opt for offline distribution channels to make products easily available and accessible at nearby stores. For instance, Walmart U.S. offers nicotine pouches in various strengths and flavors of brands-2ONE, NicoDerm CQ, Nicorette, Habitrol, Grinds, Baccoff, Jake’s Mint Chew, Ground Coffee, Smokey Mountain, TeaZa Energy, PrimeScreen, and Herbion.

The online segment is expected to grow at the fastest CAGR of 27.2% from 2025 to 2030. Increasing third-party retailer platforms and the availability of products directly from brands’ websites are some of the key factors determining segment growth. New entrants in the industry prefer online channels for product distribution. For instance, in March 2021, synthetic nicotine pouch brand NIIN launched the online retail store NIINPouches.com, which would provide consumers with a better user experience, educational information, and a convenient online platform to purchase high-quality, 100% tobacco-free products easily.

Regional Insights

North America nicotine pouches market dominated with the largest revenue share of 78.4% in 2024. The North American market is anticipated to grow at a significant CAGR during the forecast period, due to increasing investments in the development of alternative products for tobacco, coupled with shifting consumer preference toward tobacco-free substitutes such as nicotine patches, gums, and lozenges. The rising consumption of nicotine pouches by adult smokers in the U.S. and Canada is a key factor driving the demand for nicotine pouches in the region. The use of nicotine pouches is also prevalent among lower annual income groups and younger populations. Consumers believe that nicotine patches are less harmful compared to other forms, which increases their demand in the region.

U.S. Nicotine Pouches Market Trends

The U.S. nicotine pouches market accounted for the largest market revenue share in North America in 2024. The market for nicotine pouches in the U.S. is expected to witness significant growth over the forecast period owing to the presence of large-scale companies, including Altria Group, Inc., Reynolds American Inc., and Imperial Brands Plc, and their extensive strategic initiatives like product launches and innovation.

Europe Nicotine Pouches Market Trends

The nicotine pouches market in Europe is expected to grow at a significant CAGR during the forecast period, due to the increasing consumption of tobacco-free oral products over cigarettes. The region has numerous limitations on the production and sale of oral tobacco products, which has given new opportunities for the growth of non-tobacco oral products such as nicotine pouches and chewable gums and lozenges.

The Scandinavia nicotine pouches market is expected to grow at a significant CAGR of 35.8% from 2025 to 2030. Nicotine pouches have gained widespread popularity in the Scandinavian region among youth due to the large-scale production of flavored nicotine pouches in Sweden, Norway, Denmark, and Finland. Sweden is considered to be the biggest producer and consumer of nicotine pouches worldwide. Nicotine pouches like Snus have originated from Sweden and have gained immense popularity in the entire region further driving the market growth.

The nicotine pouches market in the UK is expected to grow at a substantial CAGR of 7.6% from 2025 to 2030. Also, growing awareness among the UK population regarding tobacco-free products will stimulate the demand for nicotine pouches in the country. For example, buynicotinepouches.co.uk is a website based in the UK, that creates awareness regarding the ill effects of tobacco consumption and works directly with leading tobacco manufacturers to sell the best and fresh products available in the category of tobacco-free oral products.

Asia Pacific Nicotine Pouches Market Trends

The nicotine pouches market in Asia Pacific is expected to grow at a significant CAGR of 46.2% from 2025 to 2030. Rapid urbanization, per capita income, and attractive marketing strategies adopted by global players are set to propel market growth in Asia Pacific. Key manufacturers present in the region continued to expand their geographic and store footprint for their oral smokeless product portfolios, often accompanied by promotional discount activities. For instance, SHIRO, a Japan-based brand, offers nicotine pouches in seven flavors, including Tingling Mint, Sour Red Berry, Fresh Mint, Cooling Mint, and more.

The China nicotine pouches market is expected to grow at the fastest CAGR of 48.1% from 2025 to 2030. The demand for nicotine pouches in China has surged in recent years, driven by a combination of factors. With the Chinese government tightening regulations on traditional tobacco products like cigarettes, consumers are seeking alternative options. In response to these regulatory measures, the sales volume of alternative tobacco products, including nicotine pouches, has been rising.

The nicotine pouches market in India is expected to grow at a substantial CAGR of 47.1% from 2025 to 2030. Nicotine pouches are widely accepted by consumers, and retailers have predicted significant market expansion for the category of tobacco-free products in India, majorly due to growing health concerns in light of COVID-19 risk factors. There is an increasing demand among consumers for goods that are safer as well as free from the negative effects of smoke or inhalation.

Central & South America Nicotine Pouches Market Trends

The nicotine pouches market in Central & South America is expected to grow at a significant CAGR from 2025 to 2030. Smoking prevalence in Central & South America has reduced in the last few decades as a result of regional tobacco control efforts. Tobacco use and smoking prevalence of 15.6% has been observed among adults in Central or South America, which is expected to boost nicotine pouches usage. For now, people are quitting smoking and using tobacco-derived products to reduce tobacco usage.

Middle East & Africa Nicotine Pouches Market Trends

The nicotine pouches market in the Middle East & Africa is expected to grow at a substantial CAGR from 2025 to 2030. Nicotine pouches are popular in various Middle East & African countries, including Egypt, Nigeria, and Qatar, and are consumed on a large scale in these countries. Egypt has the largest population of tobacco users in the region. Across the six Middle Eastern and African markets under review, a range of reduced-risk products are legal in most countries. Some products are legal in other countries, but there are notable restrictions. For instance, In Kenya, regulatory uncertainty led to British American Tobacco (BAT) launching and subsequently withdrawing its tobacco-free nicotine pouch brand Lyft from the market following a regulatory dispute in late 2020.

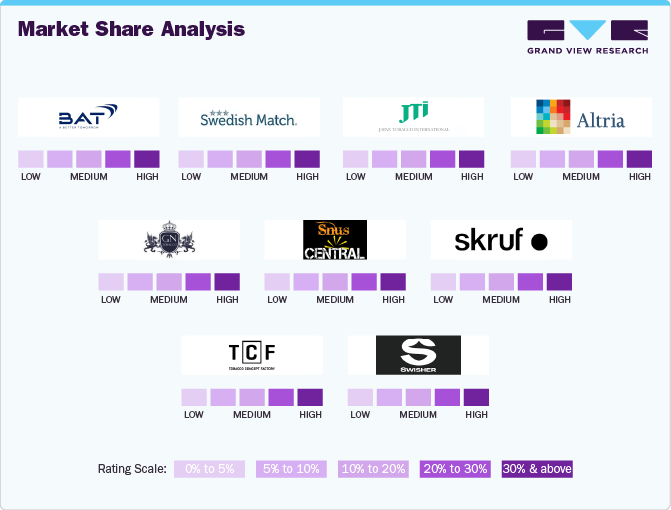

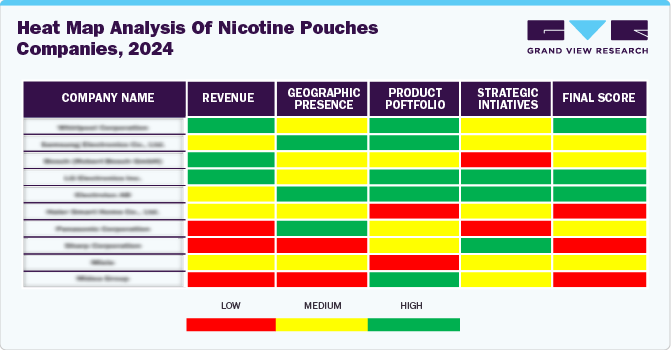

Key Nicotine Pouches Company Insights

The global nicotine pouches industry is characterized by the presence of numerous well-established players such as British American Tobacco PLCO, Altria Group, Inc., NIQO Co. (Swedish Match AB), Nicopods ehf., SnusCentral, Japan Tobacco International, Swisher, GN Tobacco Sweden AB, Skruf Snus AB, and Tobacco Concept Factory, among others.

The market players face intense competition from each other as some of them are among the top nicotine pouches manufacturers with diverse product portfolios for nicotine pouches. These companies have a large customer base due to the presence of established and vast distribution networks to reach out to both regional and international consumers.

Key Nicotine Pouches Companies:

The following are the leading companies in the nicotine pouches market. These companies collectively hold the largest market share and dictate industry trends.

- British American Tobacco PLCO

- Altria Group, Inc.

- NIQO Co. (Swedish Match AB)

- Nicopods ehf.

- SnusCentral

- Japan Tobacco International

- Swisher

- GN Tobacco Sweden AB

- Skruf Snus AB

- Tobacco Concept Factory

Recent Developments

-

In October 2024, British American Tobacco announced plans to introduce a new version of its Velo nicotine pouches in the U.S., utilizing synthetic nicotine.

-

In April 2024, Scandinavian Tobacco Group UK (STG) launched a new range of nicotine pouches called XQS in the UK. XQS pouches are made in Sweden and are available to retailers at a competitive price of £5.50. The XQS range includes four flavors: Blueberry Mint, Tropical, Cool Ice, and Arctic Freeze. These pouches are designed with a smaller size to fit comfortably under the lip and come in fully recyclable packaging.

-

In March 2024, British American Tobacco unveiled a new center in Southampton, UK, featuring a pilot plant for nicotine pouches. This facility will enable the company's research team to transform ideas into test products in just an hour rapidly.

-

In March 2023, Nordic Spirit introduced a more potent variation of its Spearmint-flavored nicotine pouches. The introduction of the product at a retail price of £6.50 aimed to cater to the high demand for extra-strong and strong variants, which collectively hold an 83.1% market share within the category.

Nicotine Pouches Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6.96 billion

Revenue forecast in 2030

USD 25.40 billion

Growth rate

CAGR of 29.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, flavor, strength, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S; Canada; Mexico; UK; Germany; France; Scandinavia; Spain; China; Japan; India; Indonesia; Brazil; Saudi Arabia

Key companies profiled

British American Tobacco PLCO; Altria Group, Inc.; NIQO co.(Swedish Match AB); Nicopods ehf.; SnusCentral; Japan Tobacco International; Swisher; GN Tobacco Sweden AB; Skruf Snus AB; Tobacco Concept Factory

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Nicotine Pouches Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global nicotine pouches market report based on the product type, flavor, strength, distribution channel, and region.

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Tobacco-derived Nicotine

-

Synthetic Nicotine

-

-

Flavor Outlook (Revenue, USD Million, 2018 - 2030)

-

Original/Unflavored

-

Flavored

-

-

Strength Outlook (Revenue, USD Million, 2018 - 2030)

-

Light (2 mg/pouch)

-

Normal (3 mg/pouch)

-

Strong (4-6 mg/pouch)

-

Extra Strong (More than 8 mg/pouch)

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Scandinavia

-

Denmark

-

Sweden

-

Norway

-

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Indonesia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global nicotine pouches market size was estimated at USD 5.39 billion in 2024 and is expected to reach USD 6.96 billion in 2025.

b. The global nicotine pouches market is expected to grow at a compounded growth rate of 29.6% from 2025 to 2030 to reach USD 25.40 billion by 2030.

b. Tobacco-derived nicotine pouches dominated the nicotine pouches market with a share of 95.7% in 2025. Consumers perceive these products as potentially less harmful than combustible tobacco, driving interest in harm reduction alternatives.

b. Some key players operating in the nicotine pouches market include British American Tobacco PLCO, Altria Group, Inc., NIQO co. (Swedish Match AB), Nicopods ehf., SnusCentral, Japan Tobacco International, Swisher, GN Tobacco Sweden AB, Skruf Snus AB, and Tobacco Concept Factory.

b. Growing interest in nicotine pouches among younger consumers who are trying to quit smoking, coupled with the rising demand for alternative products that do not involve lung exposure, will drive the market during the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.