- Home

- »

- Agrochemicals & Fertilizers

- »

-

Nitric Acid Market Size, Share, Growth & Trends Report, 2030GVR Report cover

![Nitric Acid Market Size, Share & Trends Report]()

Nitric Acid Market Size, Share & Trends Analysis Report By Application (Fertilizers, Nitrobenzene, Adipic Acid, Toluene Di-isocyanate, Nitoroclorobenzene), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-441-3

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

Report Overview

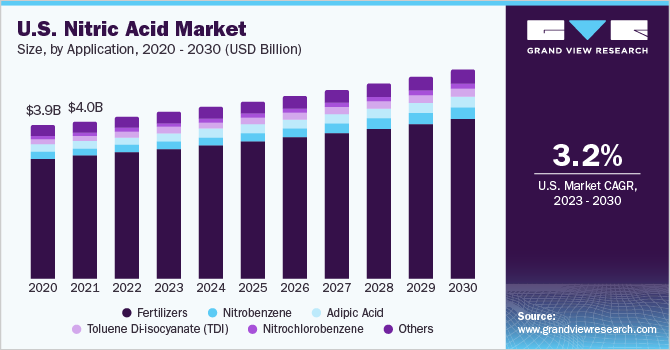

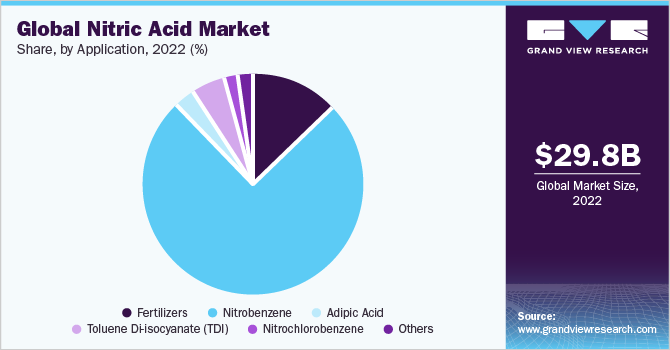

The global nitric acid market size was valued at USD 29.8 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 2.4% from 2023 to 2030. The growth for the product is expected to be driven by increasing demand for the product from fertilizers formulators and by rising consumption of fertilizers in agrarian economies of the world. Growing demand for food has propelled the expansion of various fertilizers and agricultural units globally to optimize crop yield, lower cultivation time, attain healthy crop growth, and more. Nitric acid is one of the key components of producing nitrogen fertilizers which are highly demanded by the agricultural world.

The global product market is highly competitive, especially in the presence of multinationals that are constantly innovating to capture a broader share of the market. Companies like BASF SE, Dow Chemicals, Nutrient, CF Industries are the major players and dominate the market with a wide range of products for each application and a strong global presence.

Development of the cutting-edge technologies such as the mono-medium pressure process, mono-high pressure process, and dual pressure process for producing the product moreefficiently are poised to increase awareness and enhance market growth over the coming years. Increasing demand of the product from nylon production sector is poised to pave new avenues in the global marketspace

The product is consumed in the production of TDI and adipic acid, which are widely used in the development of Nylon 6, 6. Nylon 6, 6 is further used across multiple applications such as the manufacturing of plastics and industrial carpeting. Nitric acid is a vital raw material in the making of Nitrobenzene which is excessively utilized in the construction industry. The growth in the construction industry is anticipated to trigger the demand for Nitrobenzene in the forecast period.

Moreover, ammonia and nitric acid are the two crucial components of producing nitrogen fertilizers which are widely demanded by the agricultural sector. Rapid innovations in the farming ecosystem have further boosted demand for various innovative solutions in the global market space which is projected to pave way for increased consumption of nitrogen fertilizers worldwide. Further, a growing number of industry participants in the global competitive market is poised to provide further opportunities for nitric acid development in terms of product development, market positioning, and process innovations among others.

Applications Insights

Fertilizer manufacturing dominated the nitric acid application with a share of 80.53% in 2022. Its high share is attributable to the increasing demand for food which has led to the development of fertilizers units globally. Farmers are adopting techniques that maximize the crop yield in minimum time with the help of fertilizers.

Adipic acid is produced by the use of the product as an important raw material. It is considered one of the key components for the production of Nylon 6, 6 which is used widely in the development of plastics and industrial carpets. Nylon 6, 6 is expected to stagnate over the forecast period resulting in a reduced margin in Adipic acid manufacturing owing to which the consumption of nitric acid for the production of Adipic is anticipated to be on the lower side.

Nitrobenzene is one of the key applications of nitric acid and is used in the construction industry. The future scenario of nitrobenzene totally depends on how the construction industry grows after the industry was slowed down in emerging economies due to an unexpected strike of coronavirus which has affected the demand for nitrobenzene. However, the demand is expected to pick up over the forecast period.

Toluene di-isocyanate is widely used in the production of soft foam that is used in mattresses, and automotive seats. The demand for TDI was disrupted due to the unforeseeable situation of the pandemic. The margin in TDI is also facing a downfall and is expected to grow at a slower rate which is putting pressure on the TDI value chain.

Other applications of the product include its use as a rocket propellant, analytical reagent in metalworking, cleaning agent, and in woodworking applications. Among these aforementioned application sectors of the product, its utility in cleaning products is substantial. However, as per the assessments made in the cleaning & hygiene sector, the use of nitric acid in cleaning products is deemed harmful to humans. Multiple household cleaning products used across various Latin American countries contain nitric acid in their formulations, excessive use of which can lead to serious consequences on the health of humans.

Regional Insights

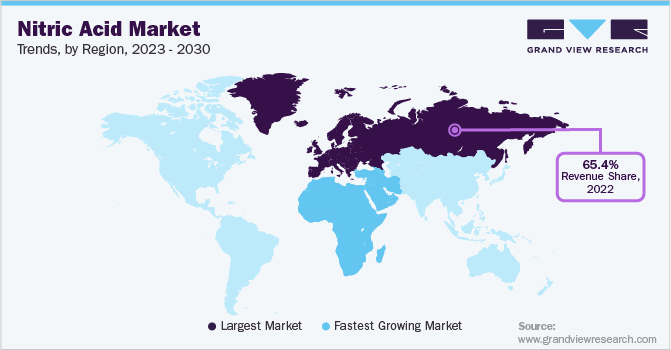

Europe dominated the market with a share of 65.40% in 2022. This is attributed to the presence of a robust value chain and significant domestic consumption in the region. The growth in Central Europe is steady and moderate. However, the majority of the demand comes from Eastern Europe which shows huge potential for expansion. The automotive and chemical industries are the major pillars and driving forces for the product in the region.

France which has a highly specialized chemical industry provides adequate opportunities for the market growth of nitric acid. Nitric acid consumption is expected to take a leap due to the presence of specialty chemical manufacturers such as Arkema, Air Liquide, Solvay, SEQENS, L’Oréal, BASF, DowDuPont, Henkel, Bayer. With the government initiation in developing a sustainable economy for the chemical industry, the demand is expected to witness steady growth.

North America accounted for the second largest revenue contributor globally in 2022. This is attributed to the fact that fertilizers are the major application segment in the region owing to the high demand for nitrogenous fertilizers and the presence of a favorable industrial environment. The growing population and rising income are expected to continue accelerating the demand for agricultural commodities.

Key Companies & Market Share Insights

The presence of multinationals has increased the competition in the global nitric acid market. Multinationals conduct constant research and development activities to formulate new innovations and increase their market.

Companies operational in the global market are focusing on increasing their exposure in the regional market. BASF, for instance, has multiple distributors in the region, which enables them to place products across all countries within the stipulated time efficiently. Also, companies such as Yara International are acquiring established distributors in the region based on their channel and presence in the market. This strategically helped Yara to enhance its product placement and well as cater to a broader market in the region. Some prominent players in the global nitric acid market include:

-

BASF SE

-

Dupont

-

Nutrien Ltd.

-

Omnia Holding Limited

-

Apache Nitrogen Products Inc.

-

CF Industry Holdings, Inc

-

Rashtriya Chemicals & Fertilizers Ltd.

-

Dyno Nobel

-

Sasol

-

Angus Chemical Company

-

Enaex S.A.

-

LSB Industries

-

Thyssenkrupp AG

-

Yara International ASA

-

Ixom

Nitric Acid Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 30.39 billion

Revenue forecast in 2030

USD 35.9 billion

Growth Rate

CAGR of 2.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million, Volume in kilotons and CAGR from 2023 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Russia; Poland; Ukraine; France; China; Uzbekistan; Kazakhstan; Thailand; Brazil; Egypt

Key companies profiled

BASF SE; Dupont; Nutrien Ltd.; Omnia Holdings Limited; Apache Nitrogen Products Inc.; CF Industries Holdings, Inc.; Rashtriya Chemicals & Fertilizers Ltd.; Dyno Nobel; Sasol; Angus Chemical Company; Enaex S.A.; LSB Industries; Thyssenkrupp AG; Yara International ASA; J.R. Simplet Company; Ixom

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Nitric Acid Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global nitric acid market report based on application and region:

-

Application Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

Fertilizers

-

Ammonium Nitrate

-

Calcium Ammonium Nitrate

-

Others

-

-

Nitrobenzene

-

Adipic Acid

-

Toluene Di-isocyanate (TDI)

-

Nitrochlorobenzene

-

-

Regional Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Russia

-

France

-

Poland

-

Ukraine

-

-

Asia Pacific

-

China

-

Uzbekistan

-

Kazakhstan

-

Thailand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Egypt

-

-

Frequently Asked Questions About This Report

b. The global nitric acid market size was estimated at USD 29.8 billion in 2022 and is expected to reach USD 30.39 billion in 2023.

b. The global nitric acid market is expected to grow at a compound annual growth rate of 2.4% from 2023 to 2030 to reach USD 35.9 billion by 2030.

b. Europe dominated the nitric acid market with a share of over 65.40% in 2022. This is attributable to robust manufacturing base for fertilizers in economies including Russia and the abundant availability of raw materials such as ammonia.

b. Some key players operating in the nitric acid market include DuPont, BASF, Dow, Nutrien, Omnia Holdings, Apache Nitrogen Products Inc., CF Industries, Dyno Nobel, Sasol, Angus Chemical Company, Enaex S.A., and J R Simplot.

b. Key factors that are driving the nitric acid market growth include increasing demand for adipic acid in lightweight automotive materials and the growing application of polyurethane foam.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."