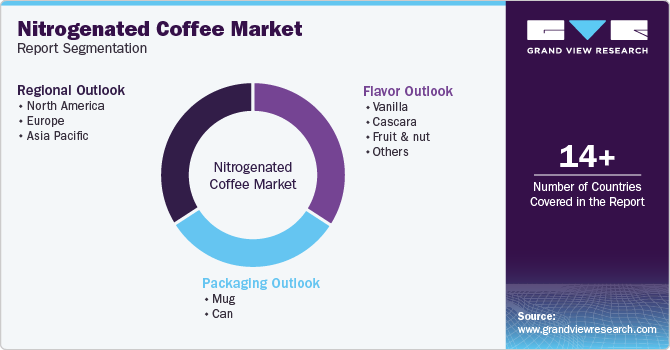

Nitrogenated Coffee Market Summary

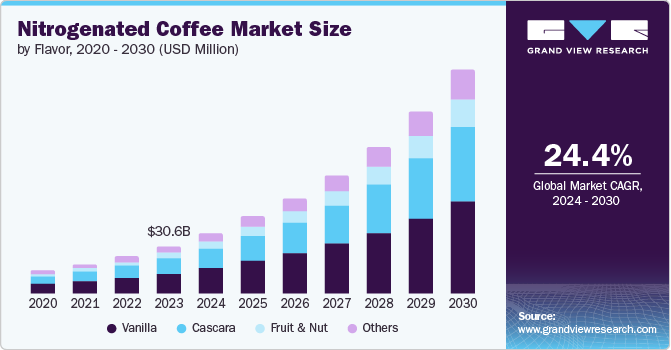

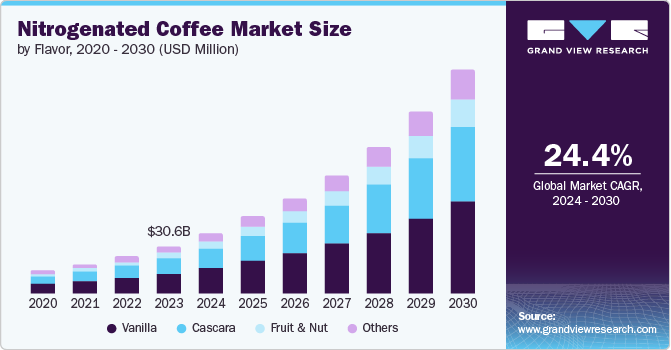

The global nitrogenated coffee market size was estimated at USD 30.6 million in 2023 and is projected to reach USD 144.5 million by 2030, growing at a CAGR of 24.4% from 2024 to 2030. The market surge is attributable to the growing number of health-conscious consumers who prefer nitrogenated or “nitro” coffee for its lower sugar and calorie content as compared to traditional coffee drinks.

Key Market Trends & Insights

- The North America nitrogenated coffee market secured the dominant share with 79.4% in 2023 owing to the well-established coffee culture.

- The Europe nitrogenated coffee market registered 11.4% of the global revenue share in 2023.

- Based on flavor, the vanilla flavor accounted for the dominant share of 42.3% in 2023 as it complements the natural bitterness of coffee.

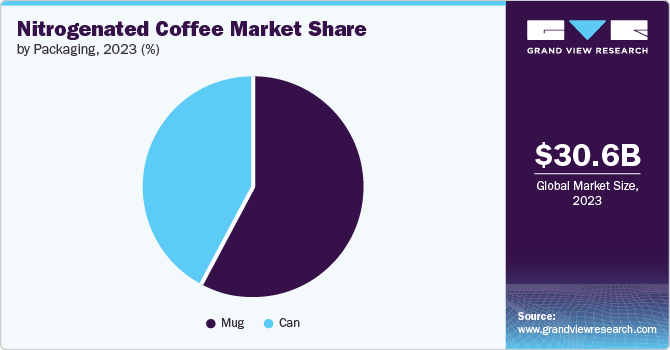

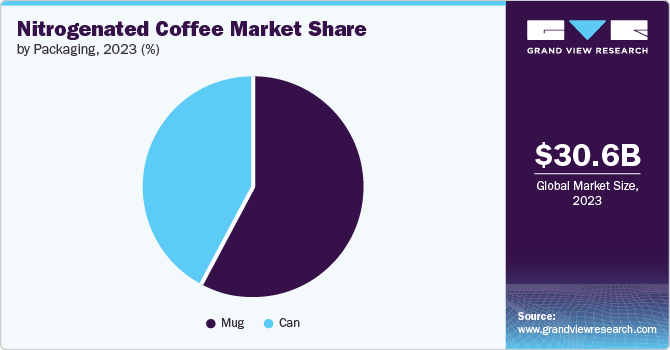

- Based on packaging, the mug packaging held the propellent share of the nitrogenated coffee market in 2023.

Market Size & Forecast

- 2023 Market Size: USD 30.6 Million

- 2030 Projected Market Size: USD 144.5 Million

- CAGR (2024-2030): 24.4%

- North America: Largest market in 2023

The smooth, creamy less bitter taste profile has increasingly appealed to a wide audience, particularly younger demographics and millennials, offering a unique sensory experience.

Consumers have increasingly sought lactose-free dietary options which has led to the rise of non-dairy milk-based beverages influencing the coffee industry. Almond, soy, oat, coconut, and other plant-based milk have gained prominence. Nitrogenated coffee aligns well with this trend as it blends with non-diary alternatives while adding its inherent sweetness in the drink. Additionally, manufacturers have increasingly expanded their product lines to include organic cold brews with organic flavors and ingredients. For instance, Black Nitro, introduced by Byron Beverage Co. in Australia, features a double shot of cold brew without added sugar.

Moreover, ongoing technical advancements in nitrogen infusion and packaging have made production and distribution easy, driving the market demand. Nitro coffees have become increasingly available in cafes, restaurants, and retail outlets. These are also used as ready-to-drink products. Specialty coffee shops have increasingly customized nitrogenated coffee as a base for different flavors and different types of milk, attracting a huge number of consumers.

Flavor Insights

Vanilla flavor accounted for the dominant share of 42.3% in 2023 as it complements the natural bitterness of coffee. Consumers have increasingly favored this harmonious flavor as its smooth, sweet, and comforting taste profile balances the creamy texture and subtle bitterness of nitrogenated coffee. Vanilla’s popularity and widespread acceptance as a flavoring agent make it a safe choice for coffee companies to attract traditional coffee lovers and those who seek new experiences. The flavor’s adaptability allows it to pair well with diverse espresso roasts and other taste additions, offering a blend base for product innovation. Furthermore, as non-dairy milk-based beverages including almond, soy, oat, coconut, and other plant-based milk gain traction in the market, the vanilla flavor enhances the appeal of the nitrogenated coffee.

The fruit & nut flavor is projected to grow at the fastest CAGR over the forecast period owing to the rising consumer demand for healthy products with diverse tastes. Fruits and nuts are healthy and nutritious options that offer a unique taste when blended with coffee. Consumers have increasingly appreciated the unique combination of sweetness and earthy tones from fruits and nuts. Coffee makers use this flavor to blend seamlessly with cold brew coffees to offer a rich and indulgent taste, attracting a large consumer base. Additionally, the flexibility of fruit and nut combinations allows for an extensive range of taste improvements, allowing coffee organizations to create seasonal and limited-edition offerings, significantly propelling the market growth. Moreover, the growing awareness of practical drinks among fitness enthusiasts is expected to contribute to the rise of these flavors.

Packaging Insights

Mug packaging held the propellent share of the nitrogenated coffee market in 2023 owing to easy portability that enables consumers to savor the beverage on the go. Such packaging, commonly used in espresso shops and cafes, offers the correct format for serving nitrogenated espresso, as it allows proper presentation of the drink's signature creamy texture and cascading effect. Moreover, mugs help maintain the freshness and carbonation of nitro coffee. Unlike cans or kegs, which often alter the taste over time, mugs preserve the beverage’s original quality offering a consistent taste to consumers.

Cans are expected to grow exponentially at a CAGR of 25.6% over the forecast period as they maintain the freshness and carbonation of nitrogenated coffees without compromising the taste. Furthermore, the ongoing trend of nitro coffee as a ready-to-drink beverage has made cans more prevalent in the market for easy portability. Furthermore, the sleek design of canned nitro coffee has increasingly attracted consumers with visual appeal. This has encouraged brands to leverage creative labeling and branding to stand out.

Regional Insights

North America nitrogenated coffee market secured the dominant share with 79.4% in 2023 owing to the well-established coffee culture. The market witnessed consumers to be increasingly willing to pay premium prices for tasting innovative beverage options. Furthermore, the presence of robust coffee chains provided an extensive market space for the introduction and rapid adoption of nitrogenated coffee.

U.S. Nitrogenated Coffee Market Trends

The U.S. nitrogenated coffee market dominated in the North America region with the increasing high disposable income which encouraged the consumer preference for premium beverages. Furthermore, the health benefits, including lower sugar and calorie content have fueled the coffee's popularity.

Europe Nitrogenated Coffee Market Trends

The Europe nitrogenated coffee market registered 11.4% of the global revenue share in 2023 owing to the rising popularity of non-dairy milk-based beverages. As nitrogenated coffee pairs well with these alternatives, lactose-intolerant consumers have increasingly sought it for its rich, premium taste. Additionally, manufacturers have increasingly responded to the burgeoning consumer demand by expanding their product lines.

Asia Pacific Nitrogenated Coffee Market Trends

The Asia Pacific nitrogenated coffee market is anticipated to witness significant growth over the forecast period. Such lucrative growth can be attributed to the increasing per capita incomes in the region. The market has witnessed a rapid inclination of consumers toward cold brew coffee. Nitro coffee has seamlessly fit into this trend, appealing to consumers seeking refreshing and less bitter coffee options. In addition, the popularity of ready-to-drink beverages has increased the growth of bottled nitrogenated coffee products.

Key Nitrogenated Coffee Company Insights

Some of the key companies in the nitrogenated coffee market include Starbucks Corporation, International Coffee & Tea, LLC, McDonald's, Blackeye Roasting Co. Organizations, and others that have focused on increasing their customer base to gain a competitive edge in the industry. They have increasingly undertaken several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

Key Nitrogenated Coffee Companies:

The following are the leading companies in the nitrogenated coffee market. These companies collectively hold the largest market share and dictate industry trends.

- Starbucks Corporation

- International Coffee & Tea, LLC

- RISE Brewing Co.

- Dunkin'

- McDonald's

- Stumptown Coffee Roasters

- NITRO Beverage Co.

- Blackeye Roasting Co.

- Bona Fide Nitro Coffee and Tea

- Califia Farms

Recent Developments

- In March 2023, Starbucks announced the launch of a new beverage called as Cinnamon Caramel Cream Nitro Cold Brew.

Nitrogenated Coffee Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2024

|

USD 39.0 million

|

|

Revenue forecast in 2030

|

USD 144.5 million

|

|

Growth Rate

|

CAGR of 24.4% from 2024 to 2030

|

|

Base year for estimation

|

2023

|

|

Historical data

|

2018 - 2022

|

|

Forecast period

|

2024 - 2030

|

|

Quantitative units

|

Revenue in USD million and CAGR from 2024 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Flavor, distribution channel, region

|

|

Regional scope

|

North America, Europe, Asia Pacific, Latin America, MEA

|

|

Country scope

|

U.S., Canada, Mexico, Germany, UK, France, China

|

|

Key companies profiled

|

Starbucks Corporation; International Coffee & Tea, LLC; RISE Brewing Co.; Dunkin'; McDonald's; Stumptown Coffee Roasters; NITRO Beverage Co.; Blackeye Roasting Co.; Bona Fide Nitro Coffee and Tea; Califia Farms

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

Global Nitrogenated Coffee Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global nitrogenated coffee market report based on flavor, packaging, and region.

-

Flavor Outlook (Revenue, USD Million, 2018 - 2030)

-

Vanilla

-

Cascara

-

Fruit & nut

-

Others

-

Packaging Outlook (Revenue, USD Million, 2018 - 2030)

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

Europe

-

Asia Pacific

-

Latin America

-

MEA