- Home

- »

- Agrochemicals & Fertilizers

- »

-

Nitrogenous Fertilizer Market Size & Share Report, 2030GVR Report cover

![Nitrogenous Fertilizer Market Size, Share & Trends Report]()

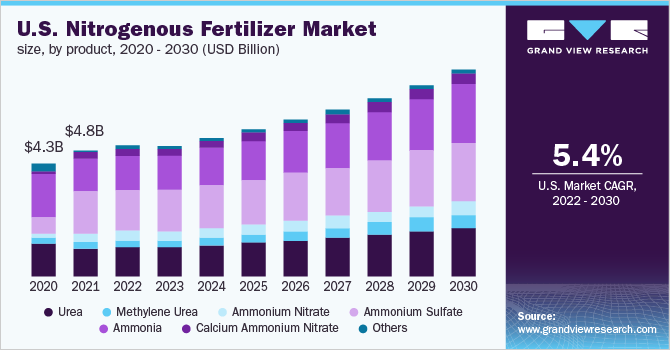

Nitrogenous Fertilizer Market Size, Share & Trends Analysis Report By Product (Ammonium Nitrate, Urea, Methylene Urea), By Application (Cereals & Grains), By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-3-68038-752-0

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2020

- Forecast Period: 2022 - 2030

- Industry: Bulk Chemicals

Report Overview

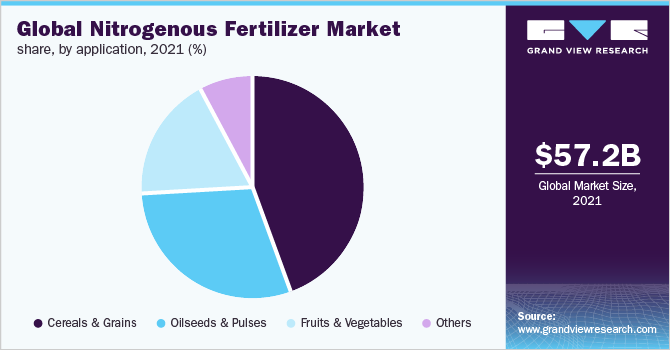

The global nitrogenous fertilizer market size was valued at USD 57.2 billion in 2021 and is projected to register a compound annual growth rate (CAGR) of 5.7% in terms of revenue from 2022 to 2030. The growth is attributed to the increasing popularity of agriculture on a commercial level across the world. There has been a rising demand for nitrogenous fertilizers from the agriculture industry for providing appropriate nutrition to the various food crops, thereby improving their yield. Agricultural commodities including vegetables, fruits, cotton, and cereals are crucial areas of application for these fertilizers. The production capacity of the crops is broadly affected by variations in climatic conditions, thereby changing the supply and demand of crops according to different seasons. The fertilizers are crucial ingredients utilized in agricultural practice for enhancing crop growth. A large number of crops cultivated across the world use fertilizers.

Nitrogen is some of the crucial nutrients necessary for the growth of plants. It is naturally available in the atmosphere, although, very few plants are able to absorb it. Thus, it is synthetically supplied to the plants in the form of nitrogenous fertilizers. The product is offered in the global market in various forms including calcium ammonium nitrate, ammonium sulfate, ammonia, and others, with different proportions of the nutrient values. The aforementioned products help to regulate the growth of the plants for faster yield and also provide a better texture.

Hydrogen and nitrogen are the crucial raw materials utilized in the manufacturing process of the product. The primary nutrient used in the fertilizers is nitrogen, and plants require it in large quantities. It plays a significant role in the photosynthesis process, thereby allowing plants to produce their food by using sunlight. Also, it is necessary for nearly every aspect of plant physiology. Nitrogen deficiency in plants can lead to the development of yellow leaves and poor growth. However, a surplus quantity of nitrogen in the fertilizers can result in enormous vegetative growth in crops, at the expense of fruiting and flowering.

Emerging economies across the globe are now comprehending the significance of using the product in the production of agricultural products. The farmers from the developing countries, including India, China, Rwanda, and Uganda, are receiving knowledge regarding the appropriate usage of chemicals. Furthermore, local manufacturers are involved in giving sales services regarding the technologies as well as crop nutritional requirements. Companies are also involved in educating the users about the potential harm that can be caused by surfeit usage of fertilizers and also their appropriate storage & disposal methods.

Several institutions around the globe are getting involved in spreading awareness concerning the usage of products that are advantageous for improving agricultural yield. They include Global Alliance for Climate-Smart Agriculture (GACSA) and the International Fertilizer Development Center (IFDC). A similar type of initiative is leading to a growth in the consumption of the product across the globe.

Product Insights

The urea product segment accounted for the highest share of over 33% in terms of revenue in 2021. The nitrogenous fertilizer market growth is attributed to the presence of the higher amount of nitrogen and lower costs of urea. Urea is considered the most crucial nitrogenous fertilizer as the nitrogen content in it is very high that is 46%. Significant quantities of ammonia might get lost due to the urea volatilization caused by its rapid hydrolysis thereby forming ammonium carbonate. If large quantities of urea are placed close to seeds, it can lead to ammonia injury to the seedlings due to Rapid hydrolysis of urea. Hence, it is essential to place the urea fertilizers properly with respect to the seeds.

The ammonia product segment stood in the second position in 2021 accounting for around 18% of the revenue share. The growth is attributed to higher leaching loss resistance and excellent solubility. Ammonia is an important pillar of the nitrogen-based fertilizer industry as it has higher nitrogen content as compared to any other commercial counterparts. It can be either applied directly as a plant nutrient to the soil or can be converted to other types of nitrogen fertilizers.

Others segments of the market include ammonium sulfate nitrate, calcium nitrate, and amide fertilizers (diammonium phosphate, calcium cyanamide, etc.). Nitrogen in the calcium nitrate is present in the form of nitrate as it is produced by the reaction of crushed limestone and nitric acid. Amide fertilizers are water-soluble and decompose easily in the soil.

Application Insights

The cereals & grains segment held the highest revenue share of over 44% in 2021. The growth is attributed to the maximum care required by cereals & grains crops for producing higher yields and generating higher profitability for the farmers and the overall agriculture industry. Products such as urea, ammonium nitrate, and anhydrous ammonia are chosen for cereals & grains as the quantity required for these products is lesser to ensure the adequate nitrogen supply needed for optimum growth of the plants.

The oilseeds & pulses held the second position in the application segment and is anticipated to reach a CAGR of 5.6% during the forecast period in terms of revenue. The growth is attributed to the requirement of improving the percentage of germination of seeds and also obtaining dense pulse canopies. Oilseeds & pulses are crucial crops that supply everyday requirements of necessary proteins, vitamins, and minerals in humans. Appropriate application of this product to the farms wherein oilseeds and pulses are grown leads to an improvement in yields of the crop and the proper maintenance of the soil condition.

Other applications include fiber plants and ornamental plants. Nitrogenous fertilizers are applied for promoting the growth of fiber plants and ornamental plants. Overfertilization of these plants can be averted using slow-release formulations of the product so that nitrogen gets released slowly and is utilized by plants at maximum levels.

Regional Insights

Asia Pacific region held the highest share higher than 65% in terms of revenue in 2021. The growth is attributed to a larger available area for cultivation, favorable climate conditions, and a higher rural population. Major multinational manufacturers of nitrogenous fertilizers are establishing their manufacturing units in countries of Asia owing to increasing demand and a growing focus on food security. China is the biggest consumer of the product across the globe and acquires around one-third of the overall global product consumption. These fertilizers play a crucial role to maintain food security in China by allowing a larger growth in both non-grain and grain yields. Barley, rice, soybeans, potatoes, tea, wheat, millets, tomatoes, cotton, and peanuts are some of the key food crops cultivated in the country.

Europe held the third position in the regional segment in 2021 in terms of revenue and is expected to expand with a CAGR of 6.3% in the near future. The growth is attributed to the sizeable landmass occupied by grasslands and agriculture in the region. The region imports nitrate-based fertilizers from Russia, Egypt, and Algeria while phosphate-based products are mainly sourced from Morocco. Compounds of NPK are mostly imported from Norway and Russia.

Key Companies & Market Share Insights

The players in the market are largely focusing on developing advanced nitrogenous fertilizers having sustainable qualities. Various factors having a huge impact on the growth of the market include manufacturing technology, product portfolio, regulatory approvals, and pricing. Local players in the market are majorly focusing on retaining their respective customers by offering customized services to the farmers.

Several manufacturers in the Asia Pacific region are also focusing on expanding their manufacturing capacities owing to the increasing adoption of agrochemicals in some countries including India and China. Players are inclined towards escalating investments for serving the increasing product demand all over the world.

For example, CF Industries Holdings, Inc. has declared a large investment of around USD 41.4 Million for enhancing nitric acid production at the biggest nitrogen fertilizer facility across the globe located in Donaldsonville, Louisiana. Some prominent players in the nitrogenous fertilizer market include

-

Kynoch Fertilizer

-

Sorfert

-

Bunge Ltd.

-

Nutrien Ltd.

-

Yara

-

Omnia Holdings Limited

-

Sasol

-

Aquasol Nutri

-

TriomfSA

-

Rolfes Agri (Pty) Ltd.

-

OCI Nitrogen

-

ICL Fertilizers

-

Eurochem Group AG

-

CF Industries Holdings Inc.

-

Koch Fertilizer, LLC

-

Hellagrolip SA

-

Coromandel International Limited

-

Haifa Group

-

Notore Chemical Industries Plc

Nitrogenous Fertilizer Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 59.40 billion

Revenue forecast in 2030

USD 94.02 billion

Growth Rate

CAGR of 5.7% from 2022 to 2030

Base year for estimation

2021

Historical data

2018 - 2020

Forecast period

2022 - 2030

Quantitative units

Volume in Thousand Tons, Revenue in USD million and CAGR from 2021 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; CSA; MEA

Country scope

U.S.; Canada; Mexico; Germany; U.K.; Italy; France; Spain; Netherlands; China; India; Japan; South Korea; Brazil, Argentina, Saudi Arabia, Qatar, Egypt

Key companies profiled

Kynoch Fertilizer; Sorfert; Bunge Ltd.; Nutrien Ltd.; Yara; Omnia Holdings Limited; Sasol; Aquasol Nutri; TriomfSA; Rolfes Agri (Pty) Ltd.; OCI Nitrogen; ICL Fertilizers; Eurochem Group AG; CF Industries Holdings Inc.; Koch Fertilizer; LLC; Hellagrolip SA; Coromandel International Limited; Haifa Group; Notore Chemical Industries Plc

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global nitrogenous fertilizer market report on the basis of product, application, and region:

-

Product Outlook (Volume, Thousand Tons; Revenue, USD Million, 2018 - 2030)

-

Urea

-

Methylene Urea

-

Ammonium Nitrate

-

Ammonium Sulfate

-

Ammonia

-

Calcium Ammonium Nitrate

-

Others

-

-

Application Outlook (Volume, Thousand Tons; Revenue, USD Million, 2018 - 2030)

-

Cereals & Grains

-

Oilseeds & Pulses

-

Fruits & Vegetables

-

Others

-

-

Regional Outlook (Volume, Thousand Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

Italy

-

France

-

Spain

-

Netherlands

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

Qatar

-

Egypt

-

-

Frequently Asked Questions About This Report

b. The global nitrogenous fertilizers market size was estimated at USD 57.2 billion in 2021 and is expected to reach USD 59.4 billion in 2022.

b. The global nitrogenous fertilizer market is expected to grow at a compound annual growth rate of 5.7% from 2022 to 2030 to reach USD 94.0 billion by 2030.

b. The Asia Pacific dominated the nitrogenous fertilizer market with a share of over 60% in 2021 This is attributable to advancements in farming methods along with the presence of large agricultural lands.

b. Some key players operating in the nitrogenous fertilizer market include Nutrien, Koch Industries, Yara International, OCI Nitrogen, and CF Industries Holdings, Inc. The other manufacturers of nitrogenous fertilizers in the market are ICL Fertilizers, EuroChem Group AG, Sinofert Holdings Limited, and Coromandel International Ltd.

b. Key factors that are driving the nitrogenous fertilizer market growth include technological innovations in the fertilizer industry and growth in commercial agriculture.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."