- Home

- »

- Consumer F&B

- »

-

Non-Alcoholic Concentrated Syrup Market Size Report, 2030GVR Report cover

![Non-Alcoholic Concentrated Syrup Market Size, Share & Trends Report]()

Non-Alcoholic Concentrated Syrup Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Fruit Syrups, Vegetable Syrups, Herbs & Spices Syrup), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-491-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

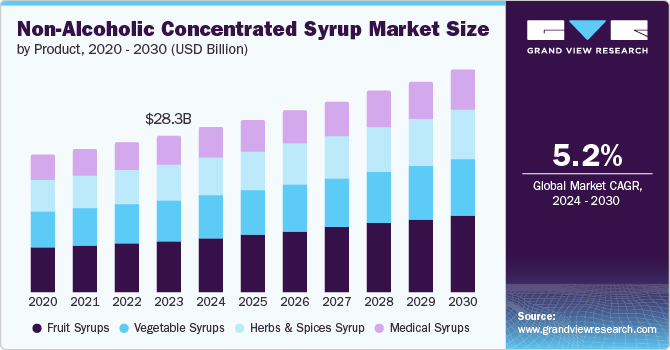

The global non-alcoholic concentrated syrup market size was valued at USD 28.33 billion in 2023 and is projected to grow at a CAGR of 5.2% from 2024 to 2030. The significant shift in consumer preferences towards healthier and more versatile beverage options drives the market growth. As people become increasingly health-conscious, they are seeking alternatives to sugary soft drinks and alcoholic beverages. Non-alcoholic syrups offer a way to create a wide variety of flavorful drinks without the high sugar content or the adverse health effects associated with alcohol consumption. This trend is particularly pronounced among younger demographics, driving the demand for innovative and customizable beverage experiences.

Another key driver of this demand is the growing popularity of at-home mixology and DIY beverage crafting. With more people spending time at home, there has been a surge in interest in creating restaurant-quality drinks in a home setting. Non-alcoholic syrups are a crucial ingredient in this trend, as they provide the base for an endless array of cocktails, mocktails, and flavored beverages. This versatility allows consumers to experiment with different tastes and combinations without needing a fully stocked bar.

Furthermore, the expansion of the global café culture has significantly contributed to the rising demand for these syrups. Coffee shops and specialty cafes worldwide increasingly use non-alcoholic syrups to enhance their drink menus, offering unique and seasonal flavors that attract a wide range of customers. The ability to customize drinks with various syrups allows these establishments to cater to diverse tastes and preferences, thereby boosting their appeal and sales.

Lastly, the growing awareness and preference for natural and organic ingredients have also played a role. Many producers of non-alcoholic concentrated syrups now focus on using high-quality, natural ingredients, which aligns with the broader consumer trend toward clean-label products. This shift not only appeals to health-conscious consumers but also aligns with the values of environmentally conscious ones, further driving the market for these syrups.

Product Insights

The fruit syrup segment held the largest market revenue share of 32.5% in 2023. Health-conscious consumers are increasingly seeking natural and healthier alternatives to traditional sweeteners. Additionally, the versatility of fruit syrups, which can be used in a variety of beverages and culinary applications, increases their popularity. The growing trend of at-home beverage preparation, fueled by the rise of DIY culture and the convenience of creating customized drinks, also drives demand. Moreover, innovations in flavor combinations and the availability of exotic and unique fruit syrups are attracting adventurous consumers looking for novel taste experiences.

The herbs and spices segment is projected to witness a significant CAGR over the forecast period. The growing trend toward global cuisine has heightened consumer appreciation for the diverse and exotic tastes that herbs and spices provide. Furthermore, the wellness movement has amplified the popularity of ingredients with perceived medicinal properties, such as ginger, turmeric, and basil, commonly used in traditional medicine. This convergence of health consciousness, flavor exploration, and cultural culinary influences fuels the demand for herb- and spice-infused non-alcoholic concentrated syrups.

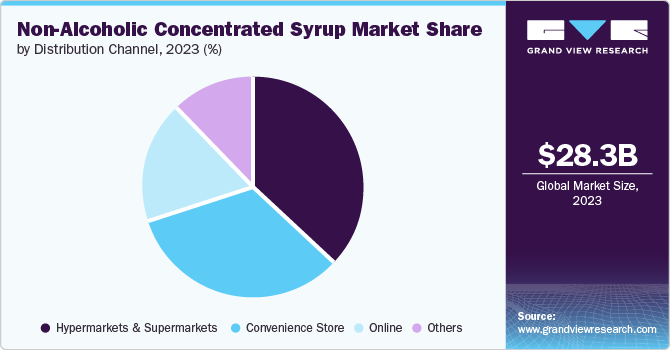

Distribution Channel Insights

Hypermarkets & supermarkets segment held the largest market revenue share in 2023. These large retail outlets offer a broad range of products, providing consumers with a one-stop shopping experience that is highly convenient. Additionally, hypermarkets and supermarkets often feature competitive pricing strategies, including discounts and promotional deals, which price-sensitive customers prefer. Moreover, these stores often invest in advanced logistics and supply chain management, ensuring a steady and reliable supply of products. Lastly, the growing trend of urbanization and the increase in disposable incomes have led more consumers to shop at hypermarkets and supermarkets, further driving the demand for non-alcoholic concentrated syrups in these retail formats.

The online segment is projected to grow at the fastest CAGR over the forecast period. Consumers prefer the convenience of ordering syrups online, especially given the wide range of flavors and brands available that are not found in local stores. Additionally, e-commerce sites frequently offer subscription services for regular users, making it economically attractive. The ability to compare prices and read customer feedback online also plays a significant role. Finally, the improved logistics and reliable delivery services have made online purchases more appealing, ensuring that consumers receive their products promptly and in good condition.

Regional Insights

North America non-alcoholic concentrated syrup market held the largest market revenue share of 34.2% in 2023. Health-conscious consumers seek alternatives to traditional sugary sodas and alcoholic beverages, and these syrups offer a customizable and often healthier option. The versatility of concentrated syrups, which can be mixed with water, soda, or other beverages to create a variety of drinks, attracts consumers looking for personalized and unique flavors. Additionally, the rise of the craft beverage movement has increased interest in artisanal and gourmet syrups that can be used in home and commercial settings. The convenience of these syrups, which are easy to store and use, also contributes to their growing popularity in the region.

U.S. Non-Alcoholic Concentrated Syrup Market

U.S. non-alcoholic concentrated syrup market is projected to grow with a significant CAGR over the forecast period. The increasing emphasis on health and wellness among American consumers drives market growth. As people become more aware of the negative health impacts of sugary sodas and alcoholic beverages, they are turning to healthier alternatives. Moreover, the cost-effectiveness of making drinks at home compared to purchasing ready-made beverages has further contributed to the rising popularity of non-alcoholic concentrated syrups in the U.S.

Europe Non-Alcoholic Concentrated Syrup Market

Europe market is expected to witness prominent growth in this industry. The European Union's stringent regulations on food and beverage additives encourage manufacturers to innovate with healthier syrup formulations. The rise of the café culture in Europe, especially in countries like France, Italy, and the UK, has also played a significant role. Cafés and restaurants incorporate flavored syrups into their menus to cater to diverse consumer tastes. Moreover, the popularity of the DIY beverage trend has driven retail sales of these syrups as consumers seek to recreate their favorite café-style drinks at home. Lastly, the increasing number of festivals, fairs, and events promoting non-alcoholic beverages, particularly in Scandinavian countries, highlights the cultural shift towards healthier, alcohol-free socializing, further boosting demand in the market.

The UK non-alcoholic concentrated syrup market is projected to grow rapidly in the coming years. The UK's vibrant café culture, with an increasing number of artisanal coffee shops and tea houses, uses these syrups to offer diverse, customizable drink options. There is a growing market for non-alcoholic beverages driven by the "sober curious" movement, where individuals are more inclined to explore alcohol-free lifestyle choices.

Asia Pacific Non-Alcoholic Concentrated Syrup Market

Asia Pacific is projected to grow at the fastest CAGR over the forecast period. The demand for non-alcoholic concentrated syrup in the Asia Pacific region is increasing due to a combination of cultural, economic, and lifestyle factors unique to this area. Countries such as Japan, South Korea, and China have a long-standing tradition of tea and fruit-based beverages, which has seamlessly integrated concentrated syrups. Moreover, the rising middle class and increasing disposable incomes in countries such as India, Indonesia, and Vietnam have increased willingness to spend on premium and novel beverage products. Additionally, the rising awareness and emphasis on pediatric healthcare in countries like Japan and South Korea have boosted the demand for child-friendly medicinal syrups, which are easier for children to consume compared to pills.

India non-alcoholic concentrated syrup market is projected to grow rapidly in the coming years. The Indian beverage market has seen a surge in homegrown brands offering innovative flavors that cater to local tastes, such as mango, tamarind, and rose, which resonate well with Indian consumers. The increasing popularity of homemade beverages like mocktails and flavored sodas, especially among younger consumers and urban households, is boosting the demand for these syrups.

Key Non-Alcoholic Concentrated Syrup Company Insights

Some of the key companies in the non-alcoholic concentrated syrup market include MONIN INCORPORATED.; Amoretti; Torani; SUNTORY HOLDINGS LIMITED.; and others

-

MONIN INCORPORATED. Provide non-alcoholic concentrated syrups made from natural ingredients with a variety of options, such as spicy, savory, fruity, and herbal, for a completely customizable flavor experience. Consumers can combine different juices to create a mix of flavors according to their personal preferences.

-

Amoretti provides sugar-free syrups which is prepared with blend of sucralose and are preserved to maintain optimal freshness to allow for varying applications. These syrups are available in several premium flavors such as premium caramel syrup, French vanilla syrup, raspberry syrup, coconut cream syrup, and many more.

Key Non-Alcoholic Concentrated Syrup Companies:

The following are the leading companies in the non-alcoholic concentrated syrup market. These companies collectively hold the largest market share and dictate industry trends.

- Rasna Private Limited

- Britvic plc.

- NICHOLAS PLC

- SUNTORY HOLDINGS LIMITED.

- Unilever PLC

- MONIN INCORPORATED.

- Grapette International

- Bickford’s Australia

- Torani

- Amoretti

Recent Developments

-

In May 2024, Monin announced the launch of a new, innovative solution for preparing matcha. This new method aims to simplify the traditionally complex process of making matcha, making it more accessible and convenient for both consumers and professionals. Monin's approach ensures a consistent and high-quality matcha experience, enhancing this popular beverage's flavor and overall enjoyment.

-

In June 2024, SUNTORY HOLDINGS LIMITED. announced the establishment of Suntory India Private Limited to cover corporate functions necessary to build a firm business foundation in India, expand its existing spirits business, and cater to the demand for soft drinks and health and wellness products in the Indian market. This strategic move aims to leverage India's large population and growing economy.

Non-Alcoholic Concentrated Syrup Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 29.69 billion

Revenue forecast in 2030

USD 40.16 billion

Growth Rate

CAGR of 5.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

September 2024

Quantitative units

Revenue in USD billion/million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy Spain, China, India, Japan, Australia, South Korea, Brazil, South Africa.

Key companies profiled

Rasna Private Limited; Britvic plc.; NICHOLAS PLC.; SUNTORY HOLDINGS LIMITED.; Unilever PLC; MONIN INCORPORATED.; Grapette International; Bickford’s Australia; Torani; Amoretti

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Non-Alcoholic Concentrated Syrup Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the non-alcoholic concentrated syrup market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Fruit Syrups

-

Vegetable Syrups

-

Herbs & Spices Syrup

-

Medical Syrups

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarkets & Supermarkets

-

Convenience Store

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.