- Home

- »

- Medical Devices

- »

-

Non-alcoholic Steatohepatitis Clinical Trials Market Report, 2030GVR Report cover

![Non-alcoholic Steatohepatitis Clinical Trials Market Size, Share & Trends Report]()

Non-alcoholic Steatohepatitis Clinical Trials Market Size, Share & Trends Analysis Report By Phase (Phase I, II, III, IV), By Study Design (Interventional, Expanded Access), By Region (APAC, Europe), And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-911-4

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2018 - 2020

- Industry: Healthcare

Report Overview

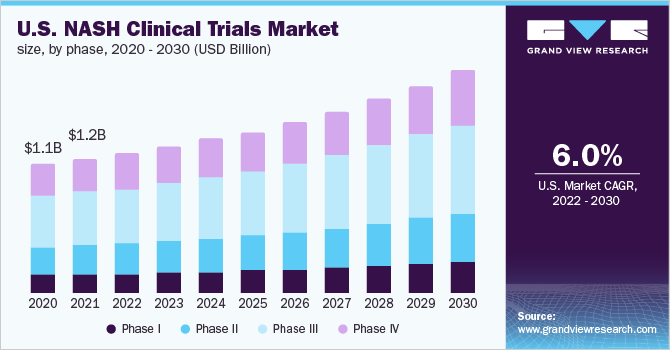

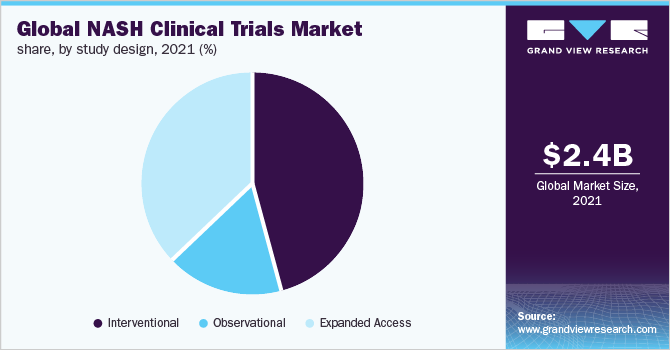

The global non-alcoholic steatohepatitis clinical trials market size was valued at USD 2.42 billion in 2021 and is projected to grow at a compound annual growth rate (CAGR) of 6.5% from 2022 to 2030 The growth can be attributed to factors, such as increased drug R&D, rising prevalence of obesity & diabetes mainly due to sedentary lifestyles, and unmet medical needs. The COVID-19 pandemic and the FDA’s request for further post-interim safety and effectiveness data have slowed the final approval of phase III trial evaluating obeticholic acid for non-alcoholic Steatohepatitis (NASH), drug development. The COVID-19 pandemic in 2020 drew attention to the various vulnerabilities of those living with conditions, such as diabetes and obesity. The largest risk of COVID-19 is associated with NASH.

The pandemic resulted in halts in the trials due to limited patient involvement in the clinical trials and supply chain disruptions. However, some companies managed to complete the trials through virtual participants and screening with proper COVID guidelines. For instance, Novartis successfully finished the phase 2 trial of semaglutide in non-alcoholic steatohepatitis as semaglutide was designated as a breakthrough therapy in the U.S. In 2021, semaglutide will be started in phase 3a in NASH patients. The results of a phase 2 proof-of-concept trial in NASH were given by Novo Nordisk and Gilead Sciences. In the U.S., NASH is the second most common reason for a liver transplant. Recent studies have also emphasized the possibility of developing hepatocellular carcinoma as a result of NASH.

Patients with NAFLD may have it for years before developing NASH. The lack of sensitive, non-invasive diagnostic methods and a limited understanding of the disease mechanism have impeded the development of clinically useful animal models and pharmaceutical therapies for NASH. In NASH trials, categorizing patients into distinct fibrosis stages can be tricky due to pathologist bias. To achieve more consistent biopsy analysis, Sagimet Biosciences is adopting digital pathology in its Phase IIb nonalcoholic steatohepatitis (NASH) trial. Digital pathology in NASH involves histological imaging of biopsy samples, which are ultimately analyzed using Artificial Intelligence (AI) to detect fibrosis alterations. Sagimet is collaborating with HistoIndex, a Singapore-based digital pathology company in the Phase IIb FASCINATE-2 trial (NCT04906421), to investigate TVB-2640.

PathAI and Summit Clinical Research, both based in the U.S., are partnering to develop AI-powered tools for assessing liver pathology. There are 1,000 MR Elastography (MREs) deployed around the world, but the difficulty is that they have not reached the places with the highest number of NASH clinical trial patients. The considerable cost of upgrading MR elastography is its restriction. Finally, the typical cost of upgrading a unit to MR elastography, whether in Europe or the U.S., is around $100,000. The barrier to adoption is not just the cost of the technology, but also the fact that, even though MRE scans are more expensive than regular MRI scans, medical insurers do not currently provide additional reimbursements.

Phase Insights

The segment of phase III accounted for more than 39.5% of the global revenue share in 2021. The phase III trials are associated with high costs. For instance, a single phase 3 study costs around USD 100 million. Hence, the failure of such trials causes a major financial impact on the sponsors. A Phase III trial gathers further data on the drug’s safety and effectiveness by evaluating different populations and dosages, as well as using it in conjunction with other drugs. The most successful and cost-effective way to identify and monitor NASH patients for clinical trials is to use smart, quantitative imaging in combination with other clinical markers for NASH. According to current FDA guidelines, all Phase 3 NASH trials must involve at least two liver biopsies.

One at the start of the study to verify the patient’s eligibility, and another at the end to assess treatment efficacy. The complete cost of a liver biopsy, including the procedure, processing, and pathologist read, is expected to be USD 7,000 or more. In addition to the economic costs of a liver biopsy, the method’s low precision and subjective nature are inherent in the operation. Despite the well-known limitations of liver biopsy, the need that it be included in a NASH study could lead sponsors to be hesitant to add more quantitative measurements in a clinical trial. However, even in Phase 2 and Phase 3 studies that entail liver biopsy, careful use of LiverMultiScan as a screening tool can minimize enrollment costs by avoiding costly, unneeded biopsies.

Study Design Insights

The interventional segment dominated the market with the largest share of more than 45.5% in 2021. In December 2019, there were 84 ongoing interventional studies with patients enrolled to evaluate the therapeutic efficacy of therapies for NASH. The majority of these trials are investigating novel drugs as monotherapies, with some exploring into combination therapy for NASH. The FDA and the EMA recognized that the reliable way to diagnose NASH is through a histopathological analysis of a tissue sample obtained from a liver biopsy. Biomarkers are a point of contention between the EMA and the FDA.

In phase 2 of a trial, the FDA strongly recommends the use of a biomarker signature method. The EMA does not forbid such a strategy from being used in phase 2, but it also does not necessitate it to be used in phase 2. As a result, interventional trialists are in high demand. Expanded access trials, also known as compassionate use trials, are expected to grow at the fastest CAGR of 6.9% during the forecast period. As no satisfactory therapies are available, it could be a viable option for patients with significant disease conditions to receive treatment outside of a clinical trial. The expanded access trials market is expected to be driven by increasing innovation in NASH clinical trial approaches.

Regional Insights

Asia Pacific region is anticipated to register the fastest growth rate of 7.6% over the forecast period. The high prevalence of diabetes and obesity, as well as the growing number of people affected by these disorders (which is anticipated to rise by 30-fold by 2030), are driving the region’s growth. NASH cases are projected to account for 20 to 25% of all NAFLD cases in 2019, with prevalence ranging from 5.9% (4.8%-7.3%) in Singapore in the general population (all ages). During the 2019-2030 timeframe, the number of prevalent NASH cases is expected to rise 20% in Hong Kong and South Korea, 25% in Taiwan, and 35% in Singapore. In India, the incidence and prevalence of NAFLD are comparable to global estimates, with the majority of cases occurring in people aged 30 to 50 years.

Around 5% of patients with NAFLD are likely to have NASH. In India, there are no standardized NAFLD screening guidelines. Because the majority of noncirrhotic NAFLD and NASH patients are asymptomatic, fatty liver is usually diagnosed based on an ultrasound finding and/or increased liver enzymes. Newer and better imaging modalities for assessing fatty liver and fibrosis, such as magnetic resonance imaging derived proton density fat fraction and MR elastography, have been developed in recent technological advances and are being used in early-phase NASH trials to assess liver fat content and fibrosis stage. These are accessible in a few specialized centers; but, expensive costs and a lack of reimbursements may limit their use, especially when clinically necessary trials.

Key Companies & Market Share Insights

Market players are undertaking various strategic initiatives, such as the signing of the new partnership agreement, collaborations, mergers & acquisitions, geographic expansion, aiming to strengthen their services, & manufacturing capacities, thus providing a competitive advantage. In March 2021, Gilead Sciences, Inc. and Novo Nordisk announced that their trial partnership in non-alcoholic steatohepatitis has been expanded. In people with compensated cirrhosis (F4) due to NASH, the companies would perform a Phase 2b double-blind, placebo-controlled study to assess the safety and efficacy of Novo Nordisk’s semaglutide, a GLP-1 receptor agonist.

In November 2021, GlaxoSmithKline announced it is making its first massive effort into treating the fatty liver disease known as nonalcoholic steatohepatitis (NASH) with a USD 1 billion asset deal with Arrowhead Pharmaceuticals. In October 2019, Novartis added another non-alcoholic steatohepatitis therapeutic candidate to its pipeline with a USD 80 million license agreement with Pliant Therapeutics.

The deal focuses on PLN-1474, a preclinical drug that acts as a small-molecule inhibitor of integrin V1, a target suspected to be implicated in the development of fibrotic (scar) tissue in the livers of persons with NASH. In January 2021, Terns Pharmaceuticals introduced two NASH candidates in clinical trials. The company received USD 87 million in investment from Eli Lilly and Deerfield Management after leasing three NASH candidates. Some of the prominent players in the global non-alcoholic steatohepatitis clinical trials market are:

-

Pfizer Inc.

-

Novartis AG

-

Icon Plc

-

LabCorp

-

Allergan Plc

-

Cadila Healthcare Ltd.

-

Shire Plc (Takeda Pharmaceuticals)

-

Eli Lilly

-

Novo Nordisk

-

Gilead Sciences Inc.

-

Glaxosmith Kline

-

Arrowhead Pharmaceuticals

Non-alcoholic Steatohepatitis Clinical Trials Market Report Scope

Report Attribute

Details

Market Size value in 2022

USD 2.53 billion

Revenue forecast in 2030

USD 4.2 billion

Growth Rate

CAGR of 6.5% from 2022 to 2030

Base year for estimation

2021

Historical data

2018 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Phase, study design, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Japan; China; India; Australia; South Korea; Brazil; Mexico; Argentina; Colombia; South Africa; Saudi Arabia; UAE

Key companies profiled

Pfizer Inc.; Novartis AG; Icon Plc; LabCorp; Allergan Plc; Cadila Healthcare Ltd.; Shire Plc (Takeda Pharmaceuticals); Eli Lilly; Novo Nordisk; Glaxo Smith Kline; Gilead Sciences Inc.; Arrowhead Pharmaceuticals

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030 For the purpose of this study, Grand View Research has segmented the global non-alcoholic steatohepatitis clinical trials market report on the basis of phase, study design, and region:

-

Phase Outlook (Revenue, USD Million, 2018 - 2030)

-

Phase I

-

Phase II

-

Phase III

-

Phase IV

-

-

Study Design Outlook (Revenue, USD Million, 2018 - 2030)

-

Interventional

-

Observational

-

Expanded Access

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Colombia

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global non-alcoholic steatohepatitis clinical trials market size was estimated at USD 2.42 billion in 2021 and is expected to reach USD 2.53 billion in 2022.

b. The global non-alcoholic steatohepatitis clinical trials market is expected to grow at a compound annual growth rate of 6.5% from 2021 to 2028 to reach USD 4.2 billion by 2030.

b. North America dominated the market for NASH clinical trials and accounted for the largest revenue share of 50.7% in 2021.

b. Some key players operating in the NASH clinical trials market include Pfizer Inc.; Novartis AG; Icon Plc; LabCorp; Allergan Plc; Cadila Healthcare Ltd.; Shire Plc (Takeda Pharmaceuticals); Eli Lilly; Novo Nordisk; Glaxo Smith Kline; Gilead Sciences Inc.; Arrowhead Pharmaceuticals

b. Key factors that are driving the non-alcoholic steatohepatitis clinical trials market growth include rising healthcare expenditure, increasing prevalence of obesity & diabetes mainly due to sedentary lifestyles, and unmet medical needs.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."