- Home

- »

- Pharmaceuticals

- »

-

Non-alcoholic Steatohepatitis Treatment Market Report, 2030GVR Report cover

![Non-alcoholic Steatohepatitis Treatment Market Size, Share & Trends Report]()

Non-alcoholic Steatohepatitis Treatment Market Size, Share & Trends Analysis Report By Drug (Vitamin E & Pioglitazone, Resmetirom), By Disease Stage, By Distribution Channel, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-964-6

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

NASH Treatment Market Size & Trends

The global non-alcoholic steatohepatitis treatment market size was estimated at USD 7.72 billion in 2024 and is projected to grow at a CAGR of 28.1% from 2025 to 2030. The incidence of non-alcoholic steatohepatitis is increasing globally, largely due to lifestyle factors such as poor diet, obesity, and a sedentary lifestyle. Furthermore, the shift towards employing modern dietary habits, eating high in processed foods, and sedentary lifestyles contribute to liver health problems and metabolic conditions, exacerbating the global non-alcoholic steatohepatitis (NASH) burden.

Non-alcoholic fatty liver disease (NAFLD) stands as the leading chronic liver disease in the United States, affecting about one-quarter of the adult population. While most individuals with NAFLD experience liver fat buildup without accompanying inflammation, around 20% of these cases progress to non-alcoholic steatohepatitis, a form that involves liver inflammation and poses a risk for severe liver damage. Globally, more than 115 million adults are estimated to suffer from NASH, according to Pfizer Inc. This condition primarily affects individuals with obesity or Type 2 diabetes. Thus, rising cases of type 2 diabetes are also expected to increase cases of non-alcoholic steatohepatitis over the forecast period.

In 2023, the American Diabetes Association (ADA) stated that individuals with type 2 diabetes mellitus (T2DM) are more likely than the general population to develop non-alcoholic fatty liver disease (NAFLD), placing them at an elevated risk of progressing to non-alcoholic steatohepatitis (NASH) and atrial fibrillation (AF). However, the exact prevalence of NASH and AF among T2DM patients is not yet well established. This association between T2DM and increased risks for NAFLD, and subsequently non-alcoholic steatohepatitis, underscores the growing demand for effective treatment options within the NASH treatment market. Given the worldwide prevalence of T2DM, this overlap of conditions may substantially increase the number of patients needing targeted treatments for both T2DM and NASH.

In Europe, deaths attributed to non-alcoholic fatty liver disease (NAFLD) and non-alcoholic steatohepatitis are particularly high in Ireland, Hungary, Luxembourg, and the United Kingdom. According to the European Association for the Study of the Liver (EASL), the prevalence of NASH across Europe is estimated to reach as high as 5%. The high prevalence and mortality rates of NAFLD and NASH in certain European countries may drive demand for therapeutic development and implementation, including early diagnostic tools and preventive measures over the forecast period.

Drug Insights

Vitamin E and Pioglitazone dominated the market and accounted for 88.31% of the global revenue in 2024. The prevalence of off-label treatments in managing non-alcoholic steatohepatitis primarily arises from the lack of approved therapeutic options. For instance, Vitamin E is widely prescribed to treat NASH but is contraindicated for diabetic patients due to potential complications. Instead, pioglitazone is frequently used for non-alcoholic steatohepatitis treatment in patients with type 2 diabetes. In addition, statins are often recommended for NASH patients who have an elevated risk of cardiovascular disease. This dynamic is expected to drive research, investment, and eventual regulatory efforts to expedite developing and approving dedicated NASH therapies in Europe, potentially reshaping the treatment landscape.

Semaglutide is expected to witness lucrative market growth during the forecast period. The increasing focus on safety and efficacy in clinical trials has yielded promising outcomes for NASH treatments. For example, a 2023 study published by the National Center for Biotechnology Information (NCBI) demonstrates that Semaglutide effectively treats NAFLD with a safety profile that patients can tolerate well. This progress in clinical efficacy and safety strengthens the market growth potential for non-alcoholic steatohepatitis treatments. As effective therapies like Semaglutide show positive results in addressing liver diseases associated with NASH, pharmaceutical companies are more motivated to invest in R&D for related drugs.

Disease Stage Insights

NASH Stage F1 dominated the market with a market share of 34.75% in 2024. Current clinical guidelines may prioritize treatment for patients with at least mild fibrosis (F1), leading healthcare providers to focus their efforts on this group. This focus ensures that resources and treatment options are directed where they can have the most significant impact. In addition, Patients in the F1 stage may have more comorbidities or complications that make treatment more necessary and appealing from a market perspective. The presence of associated conditions, like diabetes or obesity, can also drive the need for intervention in this population.

NASH Stage F0 is projected to experience the fastest growth in the market during the forecast period. According to a study published in the Digestive Diseases Journal in 2021, a significant portion of participants (74.19%) were categorized as having fibrosis stage F0, indicating no fibrosis. In contrast, the prevalence of participants with fibrosis stages F1 through F4 was much lower, with 11.02% at F1, 4.77% at F2, 2.00% at F3, and just 0.77% at F4 (cirrhosis). This high percentage of individuals at the F0 stage suggests a substantial population that may benefit from early intervention and treatment options, highlighting a crucial opportunity for market growth in the F0 segment of NASH treatment.

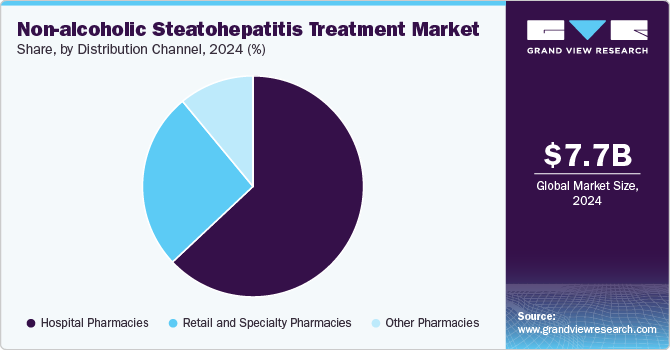

Distribution Channel Insights

Hospital pharmacies dominated the market with a market share of 63.07% in 2024 and is expected to witness a significant growth rate over the forecast period. NASH often requires comprehensive management involving multiple therapies, lifestyle modifications, and close monitoring. Hospital pharmacies are equipped to handle complex medication regimens and can provide personalized care plans for patients. Furthermore, many new treatments for NASH are currently in clinical trials, and hospital pharmacies are often involved in these research efforts. This positions them at the forefront of new therapies and allows them to play a critical role in introducing innovative treatments to the market.

The retail and specialty pharmacies segment is projected to witness a lucrative growth rate over the forecast period. The growing accessibility and convenience of retail and specialty pharmacies have significantly boosted consumer adoption. retail and specialty pharmacies typically offer lower prices than hospital pharmacies, which can be crucial for patients managing long-term conditions like NASH. In addition, Specialty pharmacies often provide tailored medication management services, including counseling and education about NASH treatments, helping patients better understand their therapy. This factor is anticipated to drive segment growth during the forecast period.

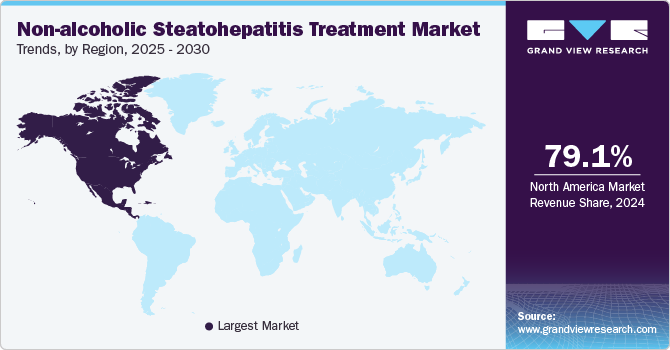

Regional Insights

The North America non-alcoholic steatohepatitis treatment market accounted for a 79.12% share in 2024. This dominance is primarily fueled by an increasing number of NASH diagnoses linked to rising obesity rates and diabetes. The advanced healthcare infrastructure and a wide array of available treatment options, including Vitamin E, Pioglitazone, and Obeticholic Acid (OCA), support effective disease management. However, challenges such as high treatment costs and uneven insurance coverage may hinder broader market expansion.

U.S. Non-alcoholic Steatohepatitis Treatment Market Trends

The non-alcoholic steatohepatitis treatment market in the U.S. is anticipated to dominate North America in 2024. This is fueled by the escalating incidence of NASH, particularly among older adults, which is driving demand for innovative therapies like Lanifibranor and Semaglutide. Moreover, telehealth solutions improve patient access to specialist consultations, while hospital pharmacies and retail outlets remain pivotal distribution channels. Despite these positive trends, barriers such as provider education on emerging treatments and high out-of-pocket expenses for uninsured patients present ongoing challenges.

Europe Non-alcoholic Steatohepatitis Treatment Market Trends

The non-alcoholic steatohepatitis treatment in Europe market is emerging robustly, supported by heightened awareness of liver diseases and improved healthcare access. Countries like Germany and the UK are witnessing advancements in treatment modalities, with clinical therapies such as Resmetirom and Cenicriviroc gaining traction. The regulatory environment is favorable, encouraging the development and introduction of new treatment options. Furthermore, the rising adoption of combination therapies in hospital and homecare settings enhances patient outcomes.

The UK non-alcoholic steatohepatitis treatment market is propelled by a growing patient population experiencing obesity-related liver diseases. Initiatives to integrate digital health technologies with traditional care are enhancing patient management capabilities. The rise of online pharmacies and specialized healthcare apps improves accessibility to treatment options, including generic alternatives for drugs like Vitamin E and Pioglitazone. These advancements, alongside educational campaigns aimed at increasing treatment adherence, are expected to drive market growth.

The non-alcoholic steatohepatitis treatment market in Germany is poised for substantial driven by its aging population, who are more susceptible to chronic liver conditions. The demand for effective new treatments, including Lanifibranor and OCA, is rising, particularly within hospital settings. The shift towards generic drug alternatives is becoming more pronounced as healthcare providers seek cost-effective solutions. Improved accessibility through retail and specialty pharmacies further supports market expansion.

France non-alcoholic steatohepatitis treatment market is set for expansion, bolstered by government-led health initiatives to raise awareness of liver diseases. The focus on patient-centered care is paving the way for enhanced access to therapies, particularly in hospital and outpatient settings. Integrating advanced drug formulations and personalized treatment plans also promotes the research of effective clinical pipeline medications like Semaglutide, ensuring better management of NASH across various stages, from F0 to F4.

Asia Pacific Non-alcoholic Steatohepatitis Treatment Market Trends

The non-alcoholic steatohepatitis treatment market in Asia Pacific is anticipated to experience the fastest growth of 29.31% over the forecast period. Rapid urbanization, increasing obesity rates, and a growing middle class are driving support for effective pipeline therapies, such as Resmetirom and Cenicriviroc. Enhanced healthcare infrastructure and rising disposable incomes are facilitating access to both prescription and over-the-counter medications. The proliferation of online pharmacies further aids market penetration, allowing patients to obtain treatments conveniently.

China non-alcoholic steatohepatitis treatment market is expected to hold a significant share of the Asia-Pacific NASH market in 2024, fueled by growing awareness and government efforts to manage liver diseases. Initiatives to enhance healthcare access, particularly in rural regions, alongside substantial investments in liver disease research, are likely to drive market growth. Retail and specialty pharmacies are critical in distributing effective therapies, ensuring patients can access the needed medications.

The non-alcoholic steatohepatitis treatment market in Japan remains a prominent country in the Asia Pacific for NASH treatment, supported by innovations in treatment delivery systems and personalized care solutions. The government’s focus on improving homecare services and enhancing access to therapies like Vitamin E and Pioglitazone is critical, especially given the country’s aging population. Online pharmacies are gaining popularity, allowing patients easier access to essential medications for disease management.

Latin America Non-alcoholic Steatohepatitis Treatment Market Trends

The non-alcoholic steatohepatitis treatment market in Latin America is expanding as healthcare investments rise and awareness of liver diseases increases. Brazil leads the region in market growth, driven by improvements in healthcare access and rising patient demand for effective treatments, including Obeticholic Acid (OCA). Hospitals and Retail and Specialty Pharmacies play a vital distribution role, ensuring patients can access affordable treatment options.

Brazil non-alcoholic steatohepatitis treatment market is at the forefront, with increasing healthcare expenditures contributing to greater access to therapies. The rising incidence of NASH among adults and children is boosting demand for effective treatments, particularly within hospital and specialty pharmacy settings. Government initiatives to enhance healthcare infrastructure also foster a supportive environment for NASH management.

MEA Non-alcoholic Steatohepatitis Treatment Market Trends

The non-alcoholic steatohepatitis treatment market in the Middle East and Africa (MEA)is witnessing notable growth driven by government efforts to improve healthcare access and manage chronic liver conditions. Increased awareness of liver diseases, particularly among urban populations, fuels demand for effective therapies. Hospital and homecare settings are becoming increasingly important in the treatment landscape, supporting the distribution of essential medications.

The non-alcoholic steatohepatitis treatment market in Saudi Arabia is projected to be one of the fastest-growing markets within the MEA region, driven by a growing population and increased healthcare investments. The focus on managing chronic liver diseases, including NASH, through innovative treatment options, is supporting market expansion. Developing robust pharmacy networks and improved access to generic therapies enhance patient access to essential medications.

Key Non-alcoholic Steatohepatitis Treatment Company Insights

Key players in the market include Intercept Pharmaceuticals, Inc., AbbVie Inc., Galmed Pharmaceuticals Ltd, and Novo Nordisk A/S. These companies are leaders in the global pharmaceutical industry, focusing on developing and producing various pharmaceutical products, including specialized generic medicines for diverse therapeutic areas. Their extensive product portfolios and global presence play a crucial role in healthcare markets, addressing a wide range of medical needs and enhancing patient outcomes.

Key Non-alcoholic Steatohepatitis Treatment Companies:

The following are the leading companies in the Non-alcoholic steatohepatitis treatment market. These companies collectively hold the largest market share and dictate industry trends.

- Intercept Pharmaceuticals, Inc.

- Galmed Pharmaceuticals Ltd

- Inventiva

- AbbVie Inc.

- Galectin Therapeutics Inc.

- Madrigal Pharmaceuticals Inc (Madrigal)

- NGM Biopharmaceuticals, Inc.

- Novo Nordisk A/S

- The Bristol-Myers Squibb Company

- Gilead Sciences, Inc.

Recent Developments

-

In May 2024, the U.S. Food and Drug Administration (FDA) granted approval for Rezdiffra (resmetirom), a treatment developed by Madrigal Pharmaceuticals. This medication is indicated for adults suffering from noncirrhotic, non-alcoholic steatohepatitis (NASH) with moderate to advanced liver fibrosis. It is intended to be used in conjunction with dietary changes and exercise.

-

In August 2024, Shilpa Medicare’s shares jumped over 11 percent to a record high after announcing positive Phase 3 trial results for SMLNUD07 (NorUDCA), a drug targeting Nonalcoholic Fatty Liver Disease (NAFLD). This breakthrough could significantly impact the market by introducing a new option for a condition with few current therapies.

-

In June 2022, Novo Nordisk and Echosens formed a strategic partnership to tackle the issue of underdiagnosis in non-alcoholic steatohepatitis (NASH). By focusing on non-invasive diagnostic solutions, the collaboration aims to enhance early detection and diagnosis rates, to potentially double these rates by 2025. This initiative is expected to open up previously untapped market opportunities and drive revenue growth for the companies involved.

Non-alcoholic Steatohepatitis Treatment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 9.80 billion

Revenue forecast in 2030

USD 33.80 billion

Growth rate

CAGR of 28.1% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Drug, disease stage, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle; East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Brazil; Argentina; South Africa; UAE; Saudi Arabia; Kuwait

Key companies profiled

Intercept Pharmaceuticals, Inc.; Galmed Pharmaceuticals Ltd; Inventiva; AbbVie Inc.; Galectin Therapeutics Inc.; Madrigal Pharmaceuticals Inc.; NGM Biopharmaceuticals, Inc.; Novo Nordisk A/S.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Non-alcoholic Steatohepatitis Treatment Market Report Segmentation

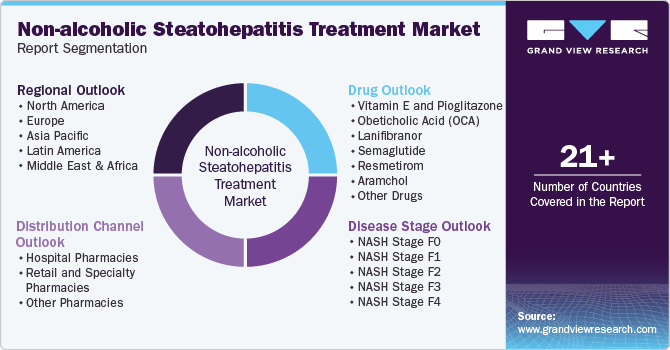

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global non-alcoholic steatohepatitis treatment market report based on drug, disease stage, distribution channel, and region:

-

Drug Outlook (Revenue, USD Million, 2018 - 2030)

-

Vitamin E and Pioglitazone

-

Obeticholic Acid (OCA)

-

Lanifibranor

-

Semaglutide

-

Resmetirom

-

Aramchol

-

Cenicriviroc

-

Other Drugs

-

-

Disease Stage Outlook (Revenue, USD Million, 2018 - 2030)

-

NASH Stage F0

-

NASH Stage F1

-

NASH Stage F2

-

NASH Stage F3

-

NASH Stage F4

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacies

-

Retail and Specialty Pharmacies

-

Other Pharmacies

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

Kuwait

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global non-alcoholic steatohepatitis treatment market size was estimated at USD 7.72 billion in 2024 and is expected to reach USD 9.80 billion in 2025.

b. The global non-alcoholic steatohepatitis treatment market is expected to grow at a compound annual growth rate of 28.10% from 2025 to 2030 to reach USD 33.80 billion by 2030.

b. Based on drug type, the Vitamin E and Pioglitazone (Off-label) segment dominated the NASH treatment market in 2024. This can be attributed to the unavailability of approved drugs in the market.

b. Some key players operating in the NASH treatment market include Intercept Pharmaceuticals; Galmed Pharmaceuticals; Inventiva Pharma; AbbVie Inc.; Galectin Therapeutics Inc.; Madrigal Pharmaceuticals; NGM Biopharmaceuticals Inc.; Novo Nordisk A/S; Bristol Myers Squibb

b. Key factors driving the non-alcoholic steatohepatitis treatment market growth include the launch of new drugs such as Novo Nordisk's Ozempic, Intercept's Ocaliva, and Inventiva's lanifibranor. In addition, the high prevalence of obesity and diabetes is another impact-rendering driver for the market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."