- Home

- »

- Consumer F&B

- »

-

Non-Dairy Frozen Dessert Market Size Report, 2022-2030GVR Report cover

![Non-Dairy Frozen Dessert Market Size, Share & Trends Report]()

Non-Dairy Frozen Dessert Market Size, Share & Trends Analysis Report By Type (Ice Cream, Sorbet, Custard, Yogurt, Gelato, Sherbet, Frozen Novelties), By Distribution Channel (Food Service, Retail), By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-959-7

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Consumer Goods

Report Overview

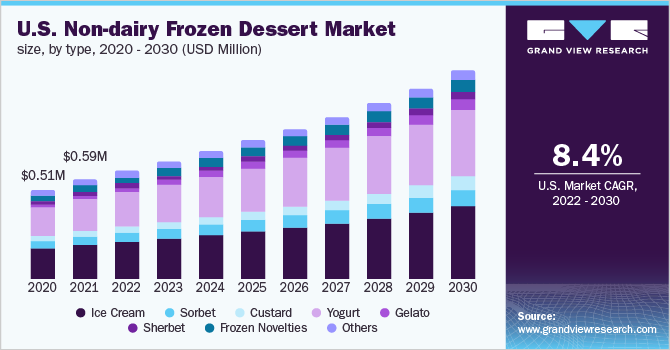

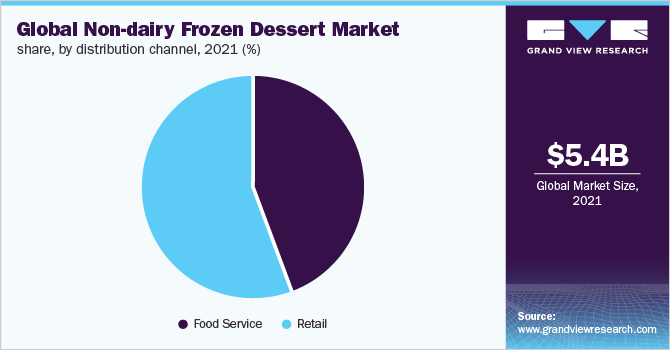

The global non-dairy frozen dessert market size was valued at USD 5.43 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 8.7% from 2022 to 2030. The gradual shift of consumers from dairy-based to non-dairy-based frozen products is propelling the product demand.Consumers are significantly following more plant-based diets as they are loaded with proteins, contain lower calories, and support healthier cholesterol levels. Socialization trends, growing awareness about health, and the rising prevalence of lactose intolerance and other dairy-related health issues are anticipated to further boost the growth of the industry over the forecast period.

The COVID-19 pandemic positively impacted the non-dairy frozen dessert market as vegetarian, flexitarian, and vegan diets were on the rise. Concerns about environment, personal health, ethical treatment of animals, and planetary sustainability fueled the demand for non-dairy and plant-based diets. The pandemic, further accelerated the trend of non-dairy dessert products as consumers became conscious about the importance of health and healthy eating. According to the International Food Information Council’s (IFIC) Food & Health Survey 2020, 85% of U.S. citizens have made at least some change in their eating habits due to the pandemic.

The adoption of the non-dairy frozen dessert product among consumers in the U.S., especially millennials has gradually increased in recent years and is likely to continue over the forecast period. Rising commercialization, along with the growing inclination of consumers toward plant-based milk is a major factor driving the demand for the non-dairy frozen dessert market. Rapid innovation in products for enhancing taste, advancement in technology, new raw material sources, and evolving taste & texture challenges in the industry will provide a positive market outlook.

Several product launches with different tastes will act as a stimulant for the non-dairy frozen dessert market over the forecast timeline. For instance, in April 2022, Bruster’s Real Ice Cream relaunched a non-dairy ice cream line with 14 different flavors, made with oat milk. The company aims to serve a superior, and creamier product, with enhanced taste and quality. The growing number of distribution channels due to the increasing penetration of new entrants will boost the overall sales volume of the product.

Many consumers are still unaware of the potential benefits of non-dairy frozen desserts for overall well-being and the immune system. However, in the coming years, there is a massive opportunity for non-dairy frozen dessert brands, to educate consumers in the space of gut health. As per the report published by the National Library of Medicine in 2017, a plant-based diet is beneficial for human health as it promotes the development of more stable and diverse microbial systems. Market players are improving their marketing strategies, understanding the specific health outcomes of non-dairy frozen desserts as well as engaging with customers to develop new products with enhanced taste and texture.

Type Insights

Non-dairy ice cream accounted for the largest revenue share of more than 30% in 2021 and is expected to maintain dominance over the forecast period. The rise of health-conscious consumers and planetary concerns are major factors driving the demand for this segment. Dairy-free ice cream is made from plant-based milk, such as soy, coconut, and almonds. It is rich in fiber, which has a positive effect on body mass index.

Soy-milk-based ice creams are also rich in isoflavones, which have anti-cancer properties. It also improves heart health, promotes hair growth, and maintains cholesterol levels. Ideal vegan ice cream is rich in vitamin B6, vitamin B complex, and magnesium, which acts as an antidepressant. The growing popularity and availability of a variety of flavors have escalated the segment growth.

Non-dairy yogurt is anticipated to grow at a CAGR of 9.4% over the forecast period. Non-dairy yogurts provide nutrients that even dairy-based yogurts fail to offer. For instance, hemp yogurt and flax milk yogurt are rich in fiber and natural omega-3 fatty acids. Plant-based yogurt is fortified with minerals and vitamins to make them healthier. Makers of vegan yogurt have been focused on their R&D activities to innovate and experiment with unique flavors to meet the increasing demand of consumers.

According to the Plant Based Foods Association (PBFA), the sales of non-dairy yogurt in the U.S. grew at seven times the rate of its dairy-based counterparts in 2020. Non-dairy yogurt is made from milk derived from soy, hemp, almonds, and cashews to achieve the perfect texture, and taste. Further, it is rich in probiotics, calcium, fiber, and protein which aid in improving digestive health.

Companies emphasize on delivering a creamy taste and a thick textured product similar to dairy yogurt. For instance, in August 2021, Silk, a dairy-free brand, launched vegan Greek-style yogurts made with pea protein coconut milk. This, in turn, will aid the company in strengthening its brand presence and expanding its conscious consumer base.

Distribution Channel Insights

The retail segment is anticipated to grow at a high CAGR of 9.2% over the forecast period. These non-dairy frozen desserts are readily available through several retail distribution channels, such as hypermarkets, supermarkets, convenience stores, online retailers, and grocery stores. Hypermarkets/supermarkets and convenience stores are the most preferred distribution channel owing to the easy product availability under one roof.

Furthermore, the varied range of innovative flavors like blueberry, avocado, strawberry, raspberry, and ice cream is offered by key brands including Baskin & Robins, Ben & Jerry, and Dairy Queen, through several off-trade platforms such as Walmart, Costco, Tesco PLC, and other regional retail stores.

Foodservice accounted for a share of 44.4% in 2021. Recently, the growing inclination toward premium flavored non-dairy frozen desserts has increased their consumption in pubs, cafés, restaurants, and other food service outlets. These food service outlets are offering dairy-free and gut-supporting frozen desserts with different ingredients and novel tastes, which has increased their consumption through these channels.

Companies offering non-dairy frozen desserts are working closely with restaurants to expand their customer base. For instance, Coconut Bliss’s distribution is generally available in retail stores, including Albertsons, Sprouts Farmers Market, Kroger, and Wegmans. In May 2019, Coconut Bliss collaborated with Burgerville to create a plant-based ice cream shake for their customers. Similarly, in September 2021, KFC announced the launch of Oatly, vegan ice cream in China.

Regional Insights

North America made the largest contribution to the global market of over 38% in 2021. The non-dairy frozen dessert market in the region has expanded rapidly, as customers are seeking, a quality, healthier alternative. Consumers in this region are seeking a sustainable, ethical, and low-calorie lifestyle, which has driven the product demand.

Furthermore, the majority of companies offer non-dairy frozen desserts that are USDA and non-GMO certified making them safer for consumers, hence propelling the demand among American consumers. According to a ProCon.org report, 36% of the population in the U.S. are lactose intolerant. The growing number of lactose intolerant adults and children will support the market growth of non-dairy frozen desserts in the region.

Europe is expected to grow with a CAGR of 9.5% during the forecast period. Consumers are looking for non-dairy options that suit their lifestyle and put a lot more emphasis on what they are consuming, which has driven the demand for non-dairy frozen desserts in the region. Due to the steadily increasing number of vegans in the U.K, market players are introducing dairy-free product lines.

According to a plant-based news organization 2021 report, 34% of U.K citizens are interested in trying a plant-based diet. Several brands are educating consumers by highlighting their properties, as well as wellness-friendly ingredients including probiotics, vitamins, minerals, and organic acids that are typically low in calories, sugar, and carbohydrates.

Key Companies & Market Share Insights

The market is characterized by the presence of a few well-established players and several small and medium players. These manufacturers are adopting various strategies, including new product launches, expansion of product portfolios, and mergers & acquisitions. For instance:

-

In March 2022, So Delicious, launched a new line of non-dairy frozen desserts, Wondermilk, that are rich and creamy in texture. Wondermilk Frozen Desserts are available in two cone flavors and five pint flavors and two cone flavors all of which are Non-GMO and Vegan Certified

-

In October 2021, Ripple Foods raised USD 60 million in Series E funding to expand its non-dairy product line. The non-dairy brand raised funds from Ajax Strategies, S2G Ventures, and Ajax Strategies to innovate new products and plans to enter into dairy-free soft serve ice cream and vegan cheese categories

-

In March 2019, JENI’s Splendid Ice Creams launched its first dairy-free ice cream line in four different flavors. The four different flavors include roasted peanut butter & strawberry jam, cold brew with coconut cream, dark ice-cream truffle, and Texas sheet cake

Some prominent participants in the global non-dairy frozen dessert market include:

-

Yoga-urt

-

JENI'S SPLENDID ICE CREAMS, LLC.

-

Coolhaus

-

Miyoko's Creamery

-

NADAMOO

-

Ripple Foods

-

Dinoci Dairy Free

-

NOONA’S ICE CREAM, LLC.

-

So Delicious Dairy Free

-

Breyers (Unilever)

Non-Dairy Frozen Dessert Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 5.90 billion

Revenue forecast in 2030

USD 11.50 billion

Growth rate

CAGR of 8.7% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Poland; Switzerland; China; India; Japan; South Korea; Australia; Brazil; UAE; South Africa

Key companies profiled

Yoga-urt; JENI’S SPLENDID ICE CREAMS, LLC., Coolhaus; Miyoko’s Creamery; NADAMOO; Ripple Foods; NOONA’s ICE CREAM, LLC; So Delicious Dairy Free; Unilever (Breyers), Dinoci Dairy Free

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Non-Dairy Frozen Dessert Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global non-dairy frozen dessert market report based on type, distribution channel, and region:

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Ice Cream

-

Sorbet

-

Custard

-

Yogurt

-

Gelato

-

Sherbet

-

Frozen Novelties

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Food Service

-

Retail

-

Hypermarkets/Supermarkets

-

Online

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Poland

-

Switzerland

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global non-dairy frozen dessert market size was estimated at USD 5.43 billion in 2021 and is expected to reach USD 5.90 billion in 2022.

b. The global non-dairy frozen dessert market is expected to grow at a compound annual growth rate of 8.7% from 2022 to 2030 to reach USD 11.50 billion by 2030.

b. North America dominated the non-dairy frozen dessert market with a share of more than 38.8% in 2021. Consumers in this region are seeking sustainable, ethical, and low-calorie lifestyle, which has driven the product demand.

b. Some of the key players in the non-dairy frozen dessert market are Yoga-urt, JENI’S SPLENDID ICE CREAMS, LLC., Coolhaus, Miyoko’s Creamery, NADAMOO, Ripple Foods, NOONA’s ICE CREAM, LLC, So Delicious Dairy Free, Unilever (Breyers ), and Dinoci Dairy Free.

b. Key factors that are driving the non-dairy frozen dessert market growth include growing awareness about health, and the rising prevalence of lactose intolerance and other dairy-related health issues.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."